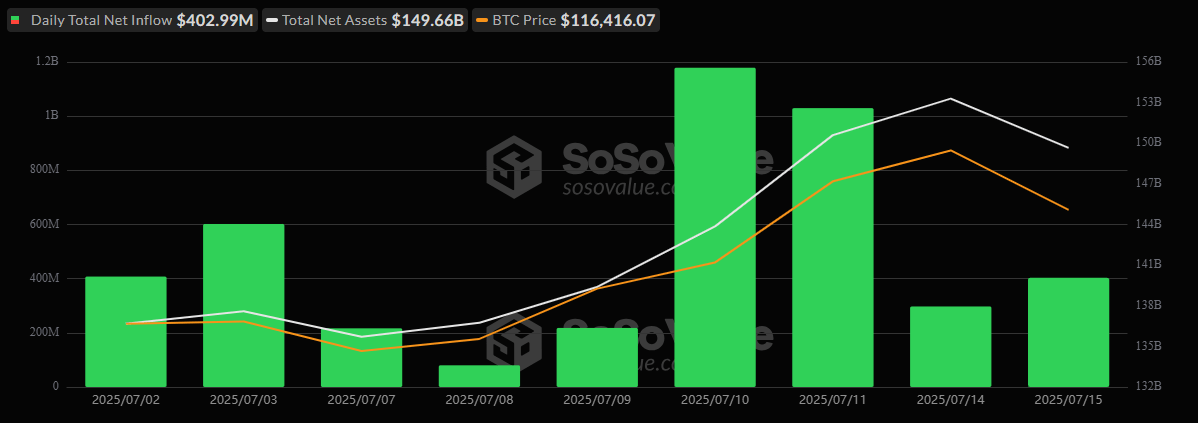

Bitcoin ETFs Record $403 Million in Inflows for 9th Consecutive Day, While Ether ETFs Set New Record

The momentum refuses to break. Institutional interest in crypto exchange-traded funds (ETFs) stayed red-hot as bitcoin ETFs logged a 9th consecutive day of inflows, pulling in $402.99 million. The heavy lifter once again? Blackrock’s IBIT, which absorbed $416.35 million, effectively powering the entire segment on its own.

Smaller gains followed: Vaneck’s HODL and Grayscale’s Bitcoin Mini Trust pulled in $18.99 million and $18.56 million, while Bitwise’s BITB and Franklin’s EZBC brought in $12.70 million and $6.76 million, respectively.

Not everything was green, though. Grayscale’s GBTC shed $41.22 million, with Fidelity’s FBTC and ARK 21Shares’ ARKB losing $22.93 million and $6.21 million, respectively. Still, the market remained firmly in the green, with total trading volume hitting $6.70 billion and net assets closing at $149.66 billion.

Source: Sosovalue

Meanwhile, ether ETFs continued their impressive streak with an 8th straight day of inflows, totaling $192.33 million. Blackrock’s ETHA was again the dominant player, raking in $171.52 million. Fidelity’s FETH added $12.22 million, and Grayscale’s Ether Mini Trust chipped in $8.59 million.

Perhaps more striking than the capital was the activity: total trading volume hit an all-time high of $1.62 billion, and net assets rose to $14.22 billion. For both bitcoin and ether ETFs, it’s not just consistency, it’s acceleration.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。