原文标题:《速览 Hyperion:Binance 新玩法首期项目是何来头?》

原文作者:Alex Liu,Foresight News

7 月 16 日 16:00,Binance 钱包将举办首期 Bonding-Curve 版 TGE,上线 Aptos 生态 DEX 项目 Hyperion 的原生代币 RION。本次活动要求符合条件的用户使用 Binance Alpha 积分参与认购,通过「Bonding-Curve」算法为 RION 动态定价以及交易提供流动性。

以此为契机,我们全面梳理一下 Hyperion 的项目定位、技术特色、融资历史、数据指标、代币经济、空投方案等,同时介绍一下 Aptos 生态其他热门项目和整体活跃度。

协议特点:混合订单簿 + AMM + 聚合

Hyperion 是原生部署在 Aptos 链上的混合型去中心化交易所(DEX),集成订单簿撮合和高级自动做市两种机制。核心设计基于集中流动性模型(类似 Uniswap V3),允许流动性提供者在指定价格区间布资,提升资本效率。

Hyperion 还具有方向性流动性做市商(DLMM)机制,通过动态调整 x+y=k 曲线内的资金分布,实现高波动资产的零滑点交易。如此一来,Hyperion 能在高效服务稳定币对时兼顾长尾资产的交易需求,是 Aptos 上首个同时满足该场景的 DEX。

2025 年 6 月,Hyperion 上线聚合路由功能,使其从单一 DEX 向全链路流动性枢纽的定位转向。该功能会智能拆分交易路径,聚合 Aptos 上所有 DEX 的流动性,为用户提供最优价格和最低滑点。

Hyperion 官方文档称,其「完全 on-chain 的混合订单簿 -AMM DEX」原生利用 Aptos 并行执行引擎,兼顾专业交易者与散户的需求。此外,Hyperion 还在开发限价挂单功能,并具有收益金库(Vault)、Drips 激励,形成一个完整的交易基础设施层。

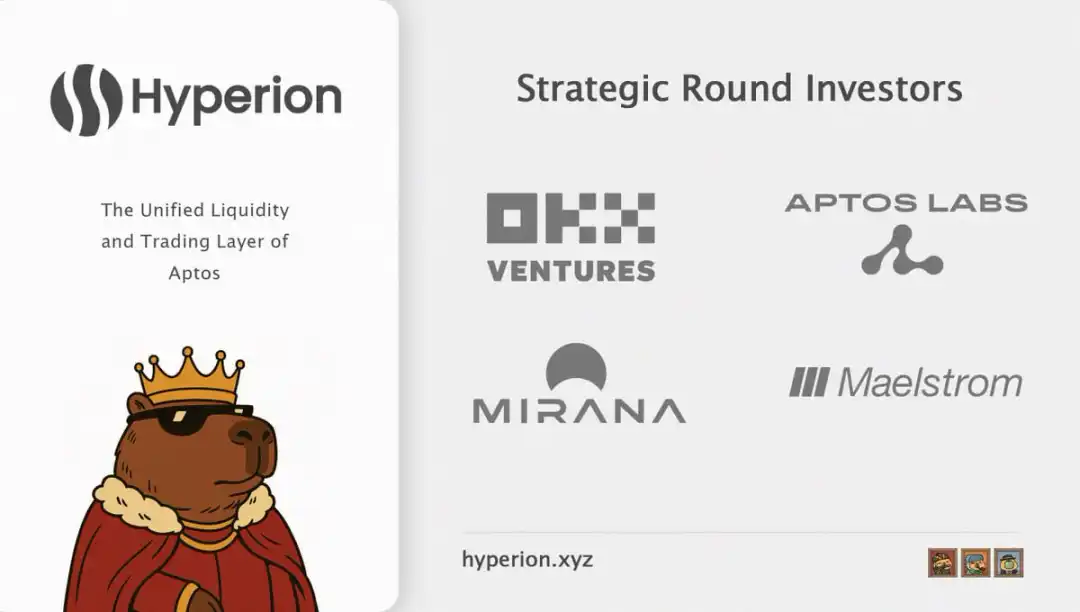

融资情况:OKX、Maelstrom 等机构入局

Hyperion 诞生不久即获得多家机构支持。今年 4 月,Hyperion 完成一轮战略融资,OKX Ventures 领投,Aptos Labs(Aptos 创始团队支持方)跟投。后续还有 Maelstrom(BitMEX 创始人 Arthur Hayes 的家族办公室)、Mirana Ventures 等资本参与,但具体金额均未披露。

项目数据:高交易量与活跃用户

短短数月,Hyperion 已迅速成为 Aptos 生态的流动性中心。Hyperion 目前是 Aptos 上交易量最大的协议,累计链上成交额已突破 65 亿美元。截至 7 月,Hyperion TVL(总锁仓价值)超过 1.3 亿美元。日均交易额在 1.25 -1.5 亿美元间波动,7 月初甚至一度达到 1.74 亿美元。

根据 DefiLlama 数据,Hyperion 过去 30 天总交易量超 40 亿美元,在所有 DEX 中排名第 12。

它同时联合主流钱包和平台开展了许多用户激励活动。例如,与 OKX Wallet 联动的 USDC DeFi 活动、与 Bitget Wallet、Gate Wallet 联动的交易挖矿和空投活动,为协议引入用户和流动性。

Hyperion 推出 Drips 积分系统,让交易者、LP 和社区贡献者通过链上交互积累积分,与空投和治理挂钩。种种举措共同促进了用户增长:截至目前,Hyperion 链上交互总参与者已近 94 万。

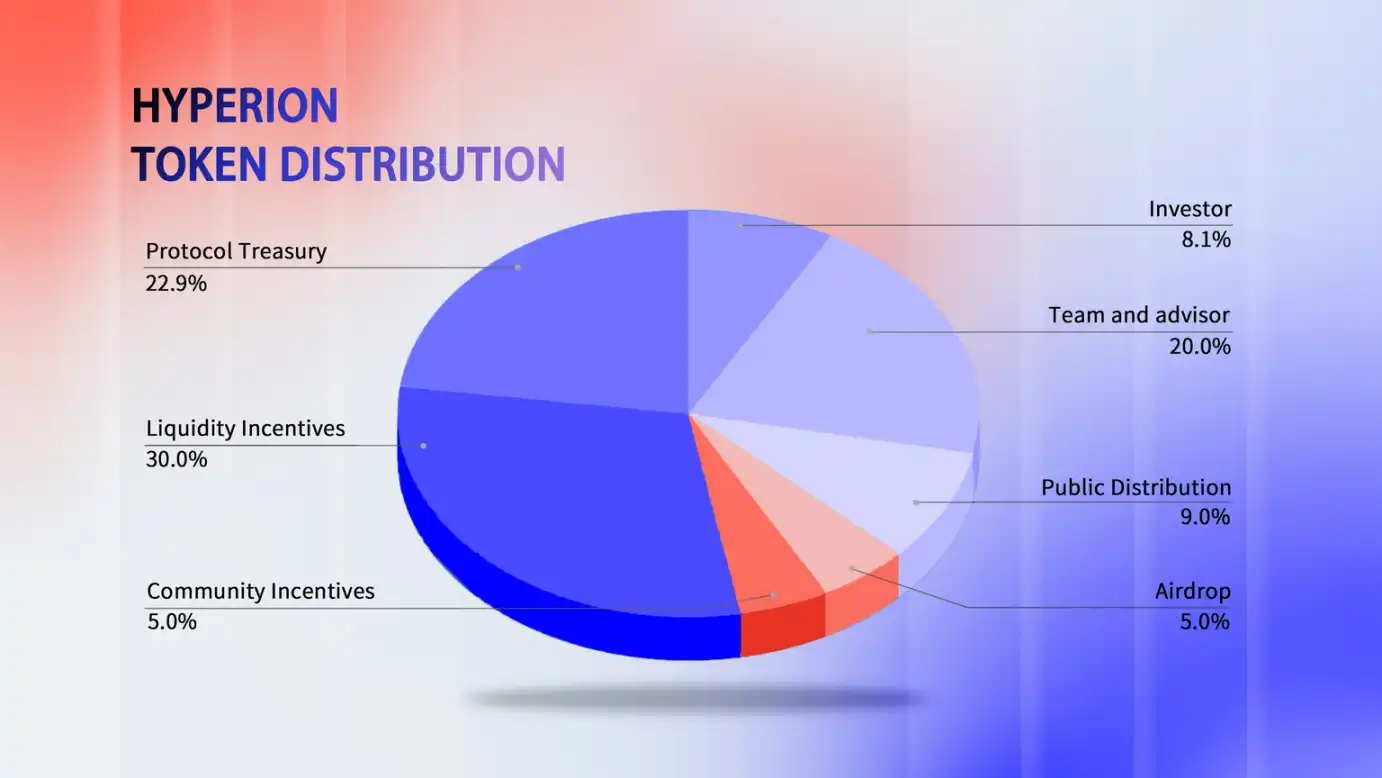

代币经济学:双代币模型与分配

Hyperion 采用双代币模型:可交易的原生代币 RION(总供应量 1 亿枚)和通过质押产生的治理代币 xRION。RION 是 Hyperion 平台的功能型代币,用于支付手续费、结算交易并发放奖励。xRION 是不可转让的治理凭证,用户可将 RION 锁仓(最长 52 周)换取 xRION,用于平台治理和新项目启动池配额。xRION 权重随时间线性递减设计,旨在鼓励长期持有和持续参与。

Hyperion 已公布创世空投安排:共 5% 的 RION 用于回馈协议早期参与者。其中 3% 在代币生成时释放,余下 2% 在 TGE 一个月后线性解锁。RION 的用途还包括平台运营、生态发展奖励等(官方文档指出,RION 会作为平台参与激励,只会根据实际链上活动分发,未活跃的用户不额外获得代币)。RION 将通过 Binance 钱包的 Bonding Curve 机制发行时,其价格由供需决定,活动结束后转为普通交易资产。

空投详情与参与方式

Hyperion 设置了社区激励和空投机制来拉动用户。正如前述,其创世空投覆盖协议的交易者、流动性提供者和社区贡献者,总量占 RION 的 5%。获取空投资格的关键是参与 Hyperion 生态:用户在交易、提供流动性或者完成社区任务时,可以获得 Drips 积分。积分与后续代币空投和治理权重直接挂钩,可用于兑换未来的空投奖励或获得 Launchpad 白名单资格。

Hyperion 空投中设置了针对 2022 年 Aptos 空投地址的幸运抽奖,约 800 个地址被随机抽取具备资格申领 RION。

参与 Binance 钱包 Bonding Curve 版 TGE

此次 RION TGE 由 Binance 钱包的 Bonding-Curve 版 TGE 独家发行,是 Binance Alpha 的首个此类活动。认购时间定于 2025 年 7 月 16 日 16:00–18:00,参与需 Binance Alpha 积分。

活动规则是:每位用户最多可投入 3 枚 BNB 参与认购,智能合约会根据已售出的 RION 总量动态计算当前价格。当用户确认投入后,BNB 被锁定,等量的 RION 分配到其 Alpha 账户内;此阶段 RION 不能提到链外,只能在活动页面内与其他用户挂单交易。订单一旦提交不可撤销,只要有其他用户挂单匹配就会成交。活动结束后,所有未成交的 BNB 自动退回钱包,而用户持有的 RION 将被解锁,成为可自由交易的资产。

简单来说,就是「早买便宜、晚买贵」,活动结束前只能「内盘交易」,结束后可自由交易。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。