Author: Bright, Foresight News

On the morning of July 16, Beijing time, according to a report by Politico, the procedural vote on cryptocurrency-related legislation in the U.S. House of Representatives failed to pass. According to Fox News, the House plans to attempt another vote on the rules for cryptocurrency-related legislation around 5:00 PM Eastern Time (5:00 AM Beijing time) on the same day.

Reports indicate that President Trump was very "angry" after being embarrassed. Following the House's failed vote, Trump immediately posted that the GENIUS Act would pass tomorrow, stating that he had met with 11 dissenting congressmen in the Oval Office today to discuss passing the "GENIUS Act" and received unanimous agreement to support the rules the following morning.

However, the House Democratic Whip later stated that there were no additional plans for a vote on cryptocurrency legislation today. The vote concluded with 196 votes in favor vs. 222 votes against, preventing three cryptocurrency bills, including stablecoin regulations, and the defense spending bill from entering the formal review stage. The main cryptocurrency bills included:

GENIUS Act (Stablecoin Regulations)

CLARITY Act (Digital Asset Market Structure Regulation)

Anti-CBDC Surveillance State Act (Anti-CBDC Surveillance State Act)

House Speaker Johnson could only awkwardly express hope that the House would attempt a procedural vote on cryptocurrency legislation again on Wednesday.

The Aggressive Trump Administration

Since the GENIUS Act passed the Senate on June 18, Trump immediately expressed his hope to see the bill on his desk before Congress adjourns in August. Market news also unanimously believed that the House's vote on the GENIUS Act was merely a "formality," and its formal passage was a foregone conclusion.

Before the House's "procedural vote" on the GENIUS Act, Trump had already posted on social media to "pop the champagne," stating: "Happy Crypto Week. The House is about to vote on a significant bill, the GENIUS Act, aimed at making the U.S. the undisputed number one leader in the digital asset space. Digital assets represent the future, and the U.S. is far ahead. Let's complete the first vote this afternoon (all Republicans should vote in favor). This is our moment. It's all about making America great again, stronger and more exceptional than ever. We are leading the world and will work with the Senate and House to push for more relevant legislation to be passed."

Why the "Embarrassment"? CBDC is the Original Sin

However, the reason the House did not follow the script to complete a series of cryptocurrency bill votes may not be solely due to the GENIUS stablecoin bill. Before the meeting, David Sacks, the White House's AI and cryptocurrency director, made a sudden statement that was quite thought-provoking. He explicitly stated that the Trump administration intends to ban the issuance of central bank digital currencies (CBDCs).

It can be seen that the Anti-CBDC Surveillance State Act may be the real battleground for both parties.

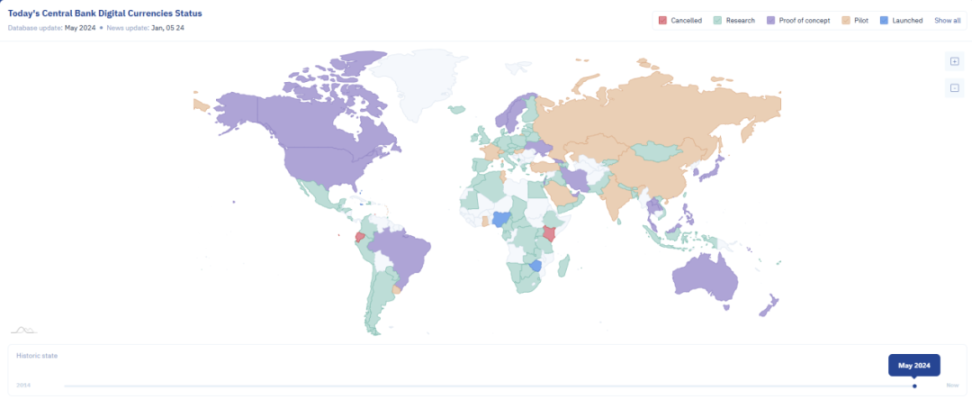

The Republican and Democratic parties have long been at odds over the issue of CBDCs, with the Biden administration very committed to promoting them. In March 2022, Biden signed Executive Order 14067: "Ensuring Responsible Development of Digital Assets," prioritizing the design and deployment of CBDC research. In March 2023, Nellie Liang, the Deputy Secretary of the Treasury for Domestic Finance, announced during a speech at the Atlantic Council that the Treasury would convene a cross-departmental working group to explore the development of CBDCs, aiming to "move forward quickly in determining that CBDCs align with national interests."

To elevate the status of CBDCs, the Biden administration has not hesitated to suppress cryptocurrencies. In March of the same year, the White House Council of Economic Advisers released its annual report, devoting an entire chapter to discussing digital assets. The report presented CBDCs and the FedNow payment system launched by the Federal Reserve as more promising avenues for enhancing currency and finance, expressing the view that cryptocurrencies are nearly worthless aside from speculative risks. This report subsequently became the ideological foundation for the Biden administration's ongoing pressure on the cryptocurrency industry.

The camp opposing CBDCs is filled with mainstream Republicans, Silicon Valley libertarians, anti-establishment leftists, and cryptocurrency practitioners, all of whom uniformly oppose CBDCs on the grounds of privacy and government control concerns. By the end of the Biden administration, the Democratic-led vision for CBDCs had essentially collapsed. The Anti-CBDC Surveillance State Act was passed in the House in May 2024, while the Senate had yet to vote. The bill explicitly prohibits the Federal Reserve from issuing retail central bank digital currencies (CBDCs) directly or indirectly to the public, using them for open market operations or any monetary policy tools, and bans any form of CBDC testing.

As expected, on January 23, 2025, newly inaugurated President Trump immediately signed an executive order banning any institution from issuing or using central bank digital currencies (CBDCs) within or outside the United States, while relaxing regulations on privately issued digital currencies and establishing a digital asset market working group led by the President, which later became the White House AI and Cryptocurrency Working Group chaired by David Sacks.

Thus, the Anti-CBDC Act is essentially the pre-legal basis for the Trump administration's promotion of the GENIUS and other cryptocurrency bills. The failure of these three substantial cryptocurrency bills to pass is fundamentally a struggle between the mainstream CBDC establishment of the Democrats and the mainstream cryptocurrency faction of the Republicans.

However, from a societal perspective, there is a lack of actual public support for CBDCs in the U.S. Previous polls showed that only about 16% of Americans expressed support for CBDCs, while 78% indicated they were "unlikely to use" them, with more than half stating they were "extremely unlikely to use" them.

In this regard, CICC previously published a research report indicating that the Anti-CBDC Surveillance State Act, along with the CLARITY Act and the GENIUS Act, forms a logical closed loop for the regulatory path of digital currencies in the U.S. It reflects America's strategic choice: to abandon government-led CBDCs in favor of supporting privately issued dollar stablecoins, while implementing policy guidance and regulation. Amid the global wave of central banks exploring CBDCs, this move also highlights the differentiated path of traditional Republicans based on the "small government, big market" philosophy. In the long run, dollar stablecoins and CBDCs issued by various countries' central banks will form a competitive relationship, and to some extent, this path difference represents another competition between the market and the government in the innovation arena.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。