原文标题:《 EigenLayer、Ether.fi 双双转型,再质押叙事黄了?》

原文作者:Fairy,ChainCatcher

2024 年上半年,二次收益的概念掀起市场沸腾,「再质押」一度成为席卷加密生态的核心话题。EigenLayer 崛起,Ether.fi、Renzo 等项目接连涌现,再质押代币(LRT)遍地开花。

然而,如今赛道的两大龙头项目均选择了转型:

Ether.fi 宣布转型为加密新型银行(neobank),计划推出现金卡及面向美国用户的质押服务;

Eigen Labs 宣布裁员约 25%,将资源重组,全面聚焦新产品 EigenCloud。

曾经火热的「再质押」,如今迎来转折点。两大龙头的战略调整,是否预示着这条赛道正在走向失效?

涌现、热潮与出清

过去几年,再质押赛道经历了从概念试水到资本密集涌入的周期。

据 RootData 数据,目前再质押赛道已累计诞生 70 余个项目。以太坊生态的 EigenLayer 是首个将 ReStaking 模型推向市场的项目,并催生出 Ether.fi、Renzo、Kelp DAO 等流动性再质押协议的集体爆发。随后,Symbiotic、Karak 等新架构项目也接连登场。

2024 年,融资事件激增至 27 起,全年吸金近 2.3 亿美元,成为加密市场最炙手可热的赛道之一。进入 2025 年,融资节奏开始放缓,赛道整体热度逐步降温。

与此同时,赛道洗牌加速推进。现已有包括 Moebius Finance、goTAO、FortLayer 在内的 11 个项目相继停运,早期泡沫逐渐被清理。

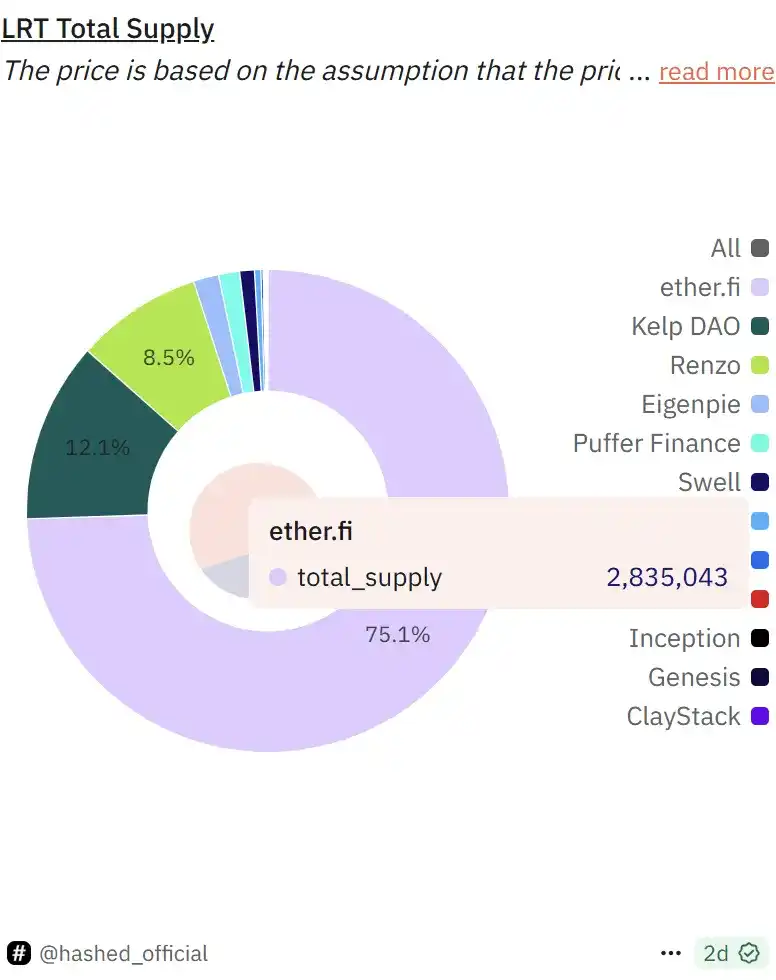

目前,EigenLayer 仍是赛道的主导者,TVL 约为 142 亿美元,占据全行业超 63% 的市场份额。在其生态中,Ether.fi 占据约 75% 份额,Kelp DAO 和 Renzo 分别为 12% 和 8.5%。

叙事失重:数据背后的冷却信号

截至当前,再质押协议的总 TVL 约为 224 亿美元,相较 2024 年 12 月的历史峰值(约 290 亿美元)已下降 22.7%。尽管整体锁仓体量仍高,再质押增长动能已出现放缓迹象。

图源:Defillama

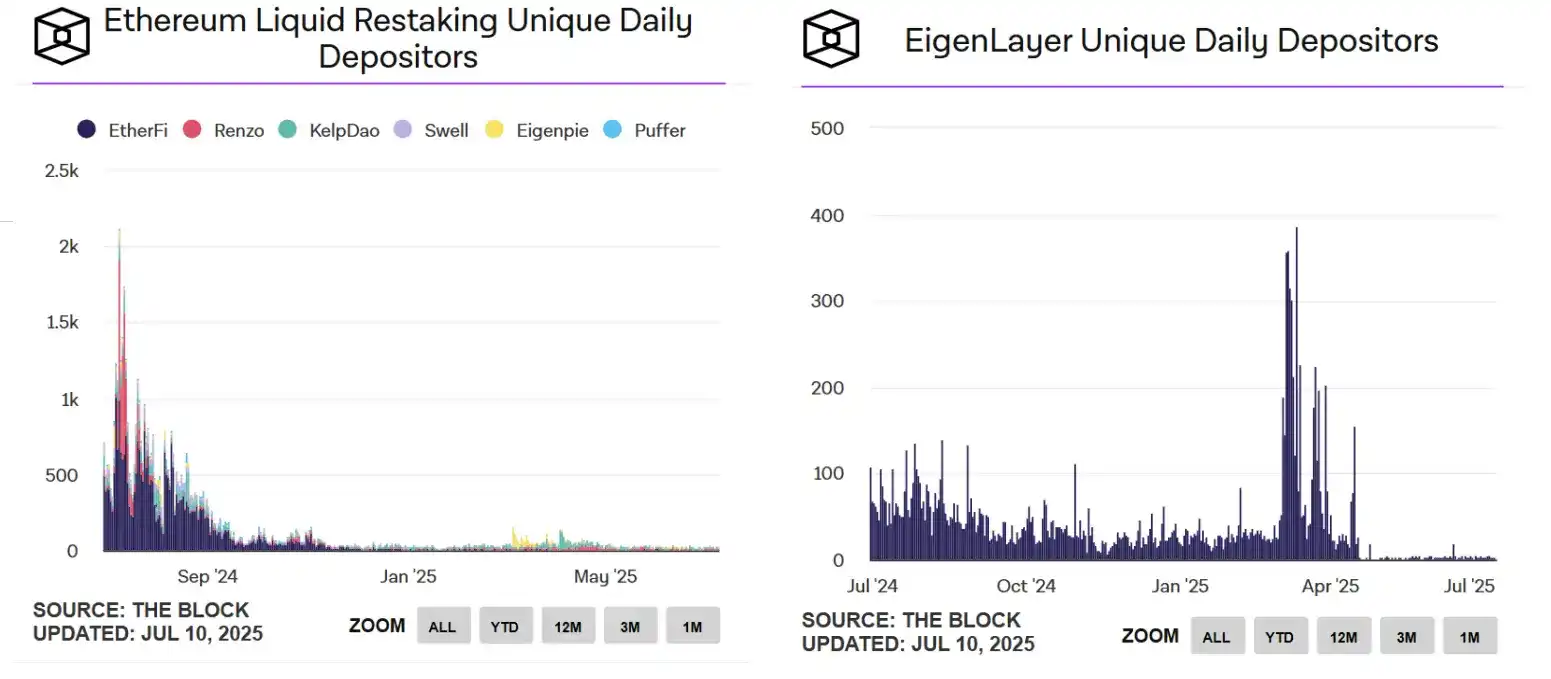

用户活跃度的下滑更加显著。根据 The Block 数据,以太坊流动性再质押的日活跃存款用户数已从 2024 年 7 月的高峰(上千人)骤降至当前仅三十余人,而 EigenLayer 的每日独立存款地址数量甚至跌至个位数。

图源:The Block

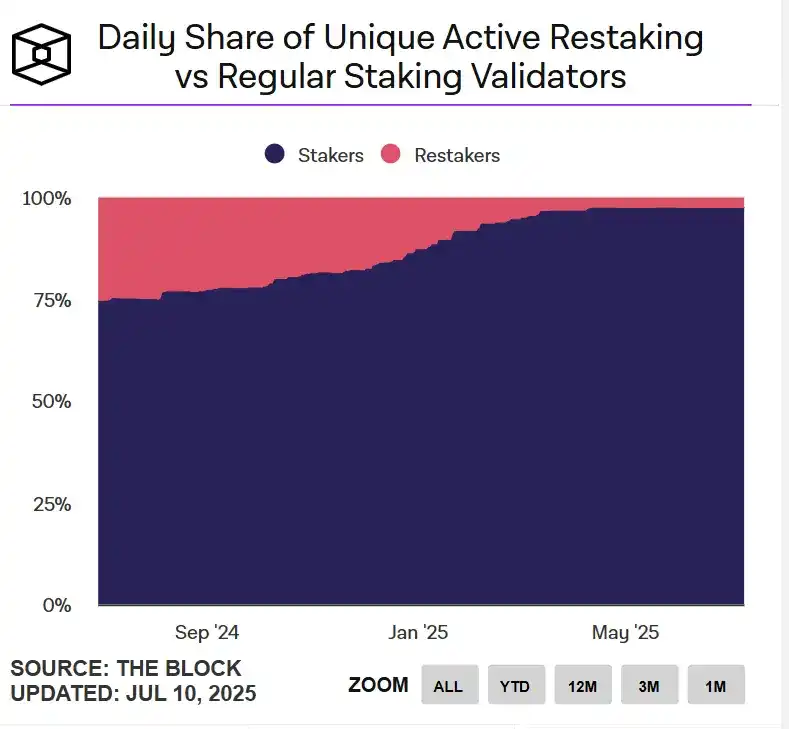

从验证者角度看,再质押的吸引力也在减弱。当前以太坊每日活跃的再质押验证者,与常规质押验证者相比已不足 3%。

此外,Ether.fi、EigenLayer、Puffer 等项目的代币价格均较高点回调超过 70%。整体来看,尽管再质押赛道仍保有一定体量,但用户活跃度与参与热情已显著下滑,生态正陷入「失重」状态。叙事驱动效应减弱,赛道增长进入瓶颈期。

头部项目转型:再质押生意做不下去了?

当「空投期红利」褪去、赛道热度消退,可预期收益曲线趋于平滑,再质押项目开始不得不面对拷问:平台如何才能实现长期增长?

以 Ether.fi 为例,其在 2024 年底连续两月实现超 350 万美元的收入,到了 2025 年 4 月,收入回落至 240 万美元。在增长动能放缓的现实下,单一的再质押功能,或许很难撑起一个完整的商业故事了。

也正是在 4 月,Ether.fi 开始扩展产品边界,转型为「加密新型银行」,通过「账单支付、工资发放、储蓄与消费」这些真实世界场景,构建金融操作的闭环。「现金卡 + 再质押」的双轨组合,成为其试图激活用户粘性与留存的新引擎。

与 Ether.fi 的「应用层突围」不同,EigenLayer 选择的是更偏向基础设施战略层面的重构。

7 月 9 日,Eigen Labs 宣布裁员约 25%,并将资源集中投入新产品开发者平台 EigenCloud,其也因此吸引了 a16z 新一轮 7000 万美元的投资。EigenCloud 集成了 EigenDA、EigenVerify、EigenCompute,试图为链上与链下的应用提供通用信任基础设施。

Ether.fi 和 EigenLayer 的转型,虽路径各异,却本质上指向同一逻辑的两种解法:让「再质押」从终点叙事变为「起始模块」,从目的本身变成构建更复杂应用系统的手段。

再质押未死,但其「单线程增长模式」或难再续。只有当它被嵌入更具规模效应的应用叙事中,才具备持续吸引用户与资本的能力。

再质押赛道以「二次收益」点燃市场热情的机制设计,如今正在更复杂的应用图谱中,寻找新的落点与生命力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。