为什么需要 Hyperion?

Aptos 作为高性能公链,正努力构建“全球链上交易引擎”的愿景,依托并行执行、秒级最终确认、强扩展性的技术优势,成为新一代基础设施的重要候选者。但事实是,Aptos 早期生态仍面临典型的 DeFi 痛点:

-

流动性碎片化,资金部署效率低

-

交易路径分散,用户体验割裂

-

缺乏可持续、结构化的收益产品,资金沉淀意愿不足

链上金融的成熟,离不开高效的交易、稳定的流动性与完善的收益体系。而 Hyperion 的出现,正是为了解决这些现实痛点,搭建 Aptos 生态真正可用、可持续的 DeFi 基础设施。

Hyperion 如何重塑 Aptos 流动性?

-

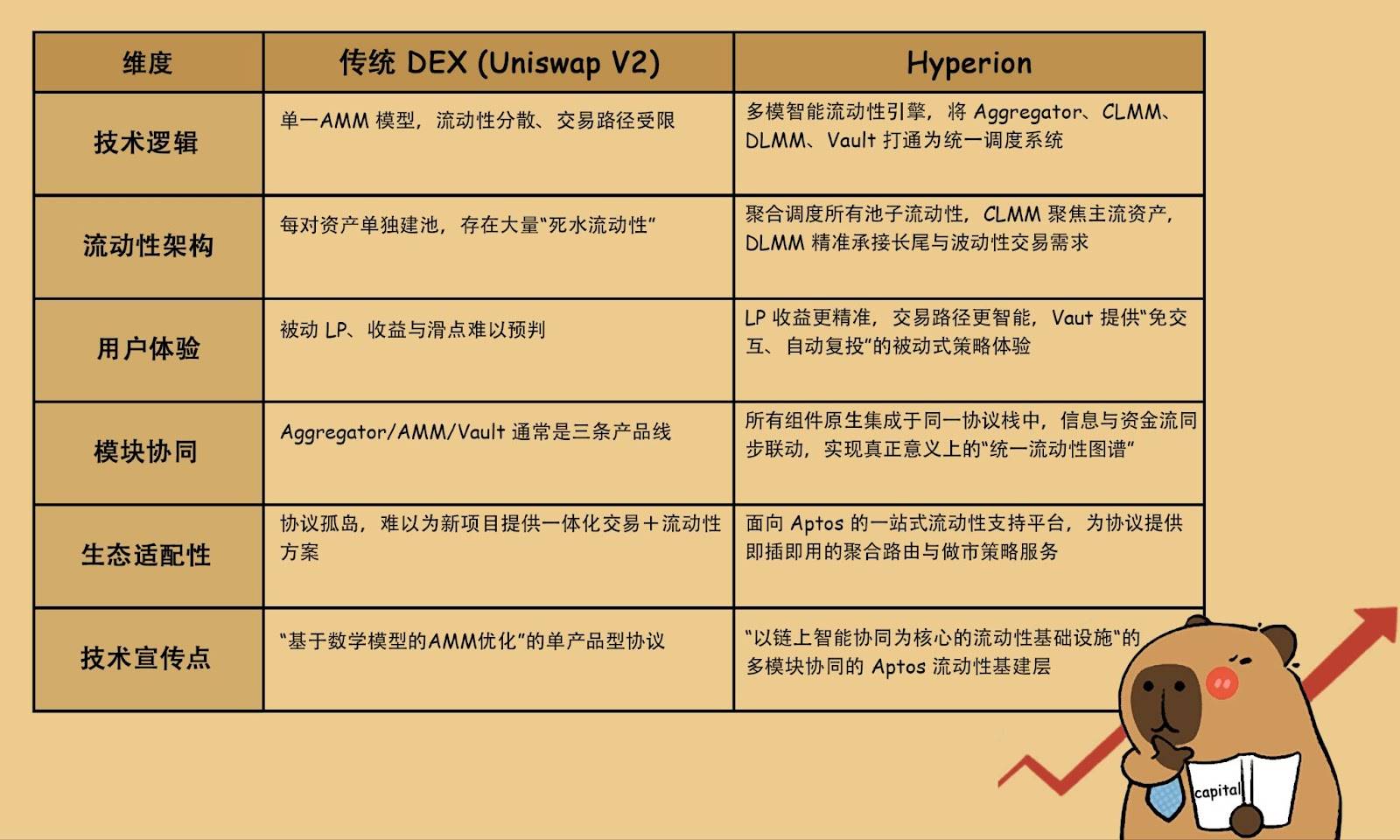

Hyperion 构建了一套统一、高效、可组合的链上金融引擎,整合了:

-

智能聚合交易(Aggregator):跨全链流动性智能路由,支持多跳拆单,优化交易价格与滑点体验。

-

集中式流动性市场(CLMM):基于 Uniswap v3 模型,LP 可在特定价格区间提供流动性,提升资本效率与交易深度。

-

定向式流动性市场(DLMM):支持非对称、方向性策略,灵活应对波动资产与动态市场。

-

开放式 Vault 平台:策略提供者可自由部署自动化流动性策略,普通用户无需繁琐操作,即可参与高效生息。

-

-

这套模块化架构,打破了传统 DEX 孤立池模式下的资金碎片问题:

-

主流资产通过 CLMM 增强交易深度

-

波动性资产由 DLMM 动态适配流动性

-

智能路由打通全链交易路径,降低滑点与操作成本

-

Vault 平台降低策略参与门槛,实现收益自动化

-

最终,Hyperion 构建了一张全链共享的“统一流动性图谱”,既为交易者提供最优执行路径,也为 LP 带来可持续、高效率的资本利用。

Hyperion 做了什么?

过去短短 5 个月,在 Aptos 社区的共同见证下,Hyperion 用数据与产品,证明了自身作为 Aptos 核心流动性与金融入口的价值:

-

71 亿美元累计交易量,构建 Aptos 交易主场:自上线以来,Hyperion 累计交易额突破 71 亿美元,稳居 Aptos 网络最活跃 DEX,并成为全网前十大的DEX(按交易量计)。其中,单日交易量峰值屡创新高,当前日均交易量稳定在 1.25 亿至 1.5 亿美元区间,展现出强劲的用户活跃度与市场需求。

-

1.3 亿美元 TVL,资金效率与链上收益并行:Hyperion 当前总锁仓量(TVL)突破 1.3 亿美元,通过主动流动性策略、自动复投 Vault 系统与高效 LP 方案,打造出高收益、低门槛、资金利用率最优的链上资产管理体验。更重要的是,Hyperion 将交易量与 TVL 规模有效协同,持续提升单位资金的实际使用效率,确保每一份流动性都真正服务于链上交易与生态增长,避免资金闲置与低效沉淀。

-

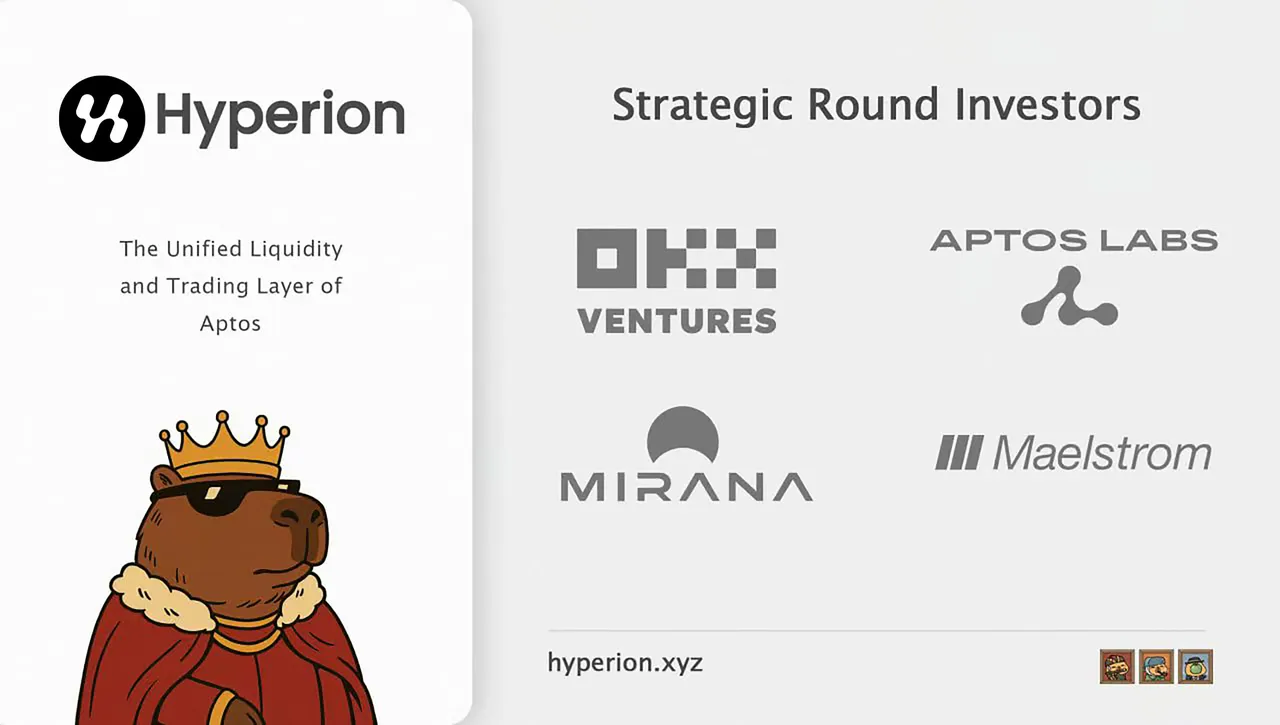

顶级资本背书,生态基础稳健:Hyperion 已完成战略融资,由 OKX Ventures 领投,Aptos Foundation、Maelstrom(Arthur Hayes)、Mirana Ventures 等头部机构联合投资。这不仅是对团队能力的认可,更是对 Hyperion 模块化 DeFi 基础设施愿景的高度信任。

Vault 系统正式上线,用户收益体验全面升级。Hyperion Vault 已覆盖:

-

自动复投机制,降低操作门槛

-

高度可控的集中式 LP 策略,提升资本利用效率

-

多资产收益组合,丰富投资配置空间。帮助用户轻松获取稳定收益,降低链上操作复杂度。

构建 BTC 资产流动性枢纽,拓展 Aptos 生态边界:Hyperion 已通过与 OKX、ECHO 等合作,成为 Aptos 链上 BTC 合成资产(如 xBTC、aBTC)交易的主要流动性中心。优质的市场深度与流畅的交易体验,进一步推动 Aptos 生态与 BTC 资产的深度融合。

社区是 Hyperion 生态的主角。我们正通过 DRIPs 等机制,持续强化 Aptos 原生用户的参与粘性,Hyperion 社区现已形成稳定用户网络:

-

超 3 万名Discord 社区成员

-

超 13 万名Twitter 关注者

-

累计近 95 万名DRIPs 活跃用户

其中,DRIPs 作为链上激励系统,有效提升了用户参与度与生态正向循环。

RION 与下一步布局

Hyperion 已完成从 0 到 1 的产品建设,用户网络与交易生态初具规模。我们相信,真正的基础设施不止于功能,更属于所有推动它成长的人。

为此,RION 和 xRION 将作为关键枢纽,引导更多建设者、交易者和社区成员深度参与、共建未来,同时进一步推动 Hyperion 进入下一阶段:

- RION:Hyperion 平台的原生、加密安全、可流通代币,承担生态内的多重实用功能,主要用于支持交易、去中心化结算、与xRION 锚定获得生态参与资格等场景;

- xRION:Hyperion 生态的治理权载体,用户可通过锁定 RION 获取 xRION,代表治理参与与时间承诺,绑定用户长期价值

TGE(代币生成事件)将于 7 月正式启动,随后 Hyperion 将陆续上线:

-

进阶版 Vault 策略,提升收益体验

-

AMM 升级,优化交易效率与资本利用

-

BTC 市场拓展,深度连接 Aptos 与主流资产网络

-

Launchpool 计划与多链合作,激励生态共建

-

新一轮交易竞赛、推荐激励与社区扩张活动

Hyperion,将成为 Aptos 的金融底层

5 个月,71 亿美元交易额,1.3 亿美元 TVL,顶级机构支持。Hyperion 已经用数据与产品,证明了自己是 Aptos 上最具韧性与生命力的金融基础设施构建者。

下一阶段,随着 RION 的推出,我们将继续完善产品矩阵,连接更多链上资产,释放更丰富的收益场景,让每一位参与者都能从 Hyperion 的发展中受益。

真正的金融底层,将是一个持续进化的开放网络。Hyperion 希望成为这个网络的连接器、放大器和共同体。如果你是 Aptos 的建设者、开发者、长期用户或社区贡献者,我们不仅欢迎你的加入,更期待与你一起构建一个高效、透明、可持续的链上金融世界。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。