Author: Prathik Desai

Translation: Block unicorn

Preface

In the late 1980s, Nathan Most worked at the American Stock Exchange. However, he was neither a banker nor a trader. He was a physicist who had spent many years in the logistics industry, responsible for transporting metals and commodities. Financial instruments were not his starting point; practical systems were.

At that time, mutual funds were a popular way to gain broad market exposure. They provided diversification for investors but also came with delays. You couldn't buy and sell at any time during the trading day. You placed an order and then waited until the market closed to know the execution price (by the way, they still trade this way today). This experience felt outdated, especially for those accustomed to real-time trading of individual stocks.

Nathan proposed a workaround: to create a product that tracked the S&P 500 index but traded like a single stock. Package the entire index into a new form and list it on an exchange. The proposal was met with skepticism. Mutual funds were not designed to be traded like stocks. The relevant legal framework did not exist at the time, and the market did not seem to need it.

He still pushed forward.

Tokenized Stocks

In 1993, the S&P Depository Receipts (SPDR) debuted under the ticker SPY. This was essentially the first exchange-traded fund (ETF). A tool representing hundreds of stocks. Initially seen as a niche product, it gradually became one of the most traded securities globally. On many trading days, SPY's trading volume exceeded that of the stocks it tracked. A synthetic structure gained higher liquidity than its underlying assets.

Today, this story is relevant again. Not because of the launch of another fund, but because of what is happening on-chain.

Platforms like Robinhood, Backed Finance, Dinari, and investment platforms like Republic have begun offering tokenized stocks—blockchain-based assets designed to reflect the prices of private companies like Tesla, Nvidia, and even OpenAI.

These tokens are marketed as a way to gain exposure rather than ownership. No shareholder status, no voting rights. You are not purchasing equity in the traditional sense. What you hold is a token related to the equity.

This distinction is important because it has sparked controversy.

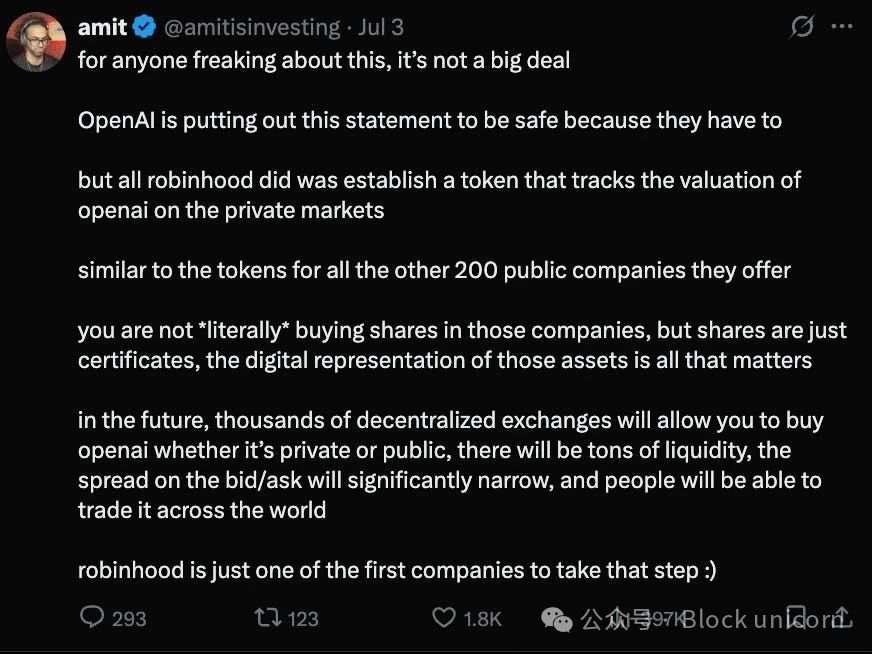

OpenAI and even Elon Musk have expressed concerns about the tokenized stocks offered by Robinhood.

Robinhood's CEO, Vlad Tenev, later had to clarify that these tokens actually give retail investors access to these private assets.

Unlike traditional stocks issued by the company itself, these tokens are created by third parties. Some claim to hold real stocks in custody, providing a 1:1 backing. Others are completely synthetic. The experience feels familiar: prices fluctuate like stocks, the interface resembles a brokerage app, although the legal and financial substance behind it is often weaker.

Nevertheless, they still attract a specific type of investor. Especially those outside the U.S. who cannot invest directly in U.S. stocks. If you live in Lagos, Manila, or Mumbai and want to invest in Nvidia, you typically need a foreign brokerage account, a higher minimum balance, and longer settlement periods.

On-chain traded tokens track the underlying stocks' movements on the exchange. Tokenized stocks eliminate friction in the trading process. Think about it: no wire transfers, no forms, no barriers. Just a wallet and a market.

This method of access feels novel, even though its mechanics are similar to older systems.

But there is a practical issue. Many of these platforms—Robinhood, Kraken, and Dinari—cannot operate in many emerging economies outside the U.S. For example, it is currently unclear whether an Indian user can legally or practically purchase tokenized stocks through these means.

If tokenized stocks are to truly expand global market access, the friction will not only be technical but also regulatory, geographical, and infrastructural.

How Derivatives Work

Futures contracts have long provided a way to trade without touching the underlying asset. Options allow investors to express views on volatility, timing, or direction, often without needing to purchase the stock itself. In each case, options products became another avenue for investing in the underlying asset.

The emergence of tokenized stocks carries similar intent. They do not claim to be better than the stock market. They simply offer another investment avenue, especially for those long excluded from public investment.

New derivatives typically follow a recognizable trajectory.

At first, the market is chaotic. Investors are unsure how to price, traders hesitate on risk, and regulators step back to observe. Then, speculators rush in. They test the boundaries, expand the product range, and exploit inefficient arbitrage. Over time, if the product proves effective, it will be adopted by more mainstream participants. Eventually, it becomes infrastructure.

This is the development path of index futures, ETFs, and even Bitcoin derivatives on CME and Binance. They were not initially designed as tools for everyone. They began in the playground of speculation: faster, riskier, but more flexible.

Tokenized stocks may follow the same path. Initially used by retail traders chasing exposure to elusive assets like OpenAI or pre-IPO companies. Then adopted by arbitrageurs, exploiting price differences between the tokens and their underlying stocks. If trading volume continues to grow and infrastructure matures, institutional investors may also begin to use them, especially in jurisdictions where compliance frameworks emerge.

Early activity may appear noisy, with insufficient liquidity and wide spreads, and noticeable weekend price gaps. But this is often how derivative markets start. They are by no means perfect replicas. They are stress tests. A way for the market to discover demand before the assets themselves adjust.

This structure has an interesting feature or flaw, depending on how you view it.

Time lag.

Traditional stock markets have opening and closing times. Even most derivatives based on stocks trade during market hours. But tokenized stocks do not always follow these rhythms. If a U.S. stock closes at $130 on Friday and a significant event occurs on Saturday—like an earnings report leak or a geopolitical event—the token may begin to react to this, even though the stock itself is static.

This allows investors and traders to consider news that comes in when the stock market is closed.

The time lag only becomes an issue when the trading volume of tokenized stocks significantly exceeds that of the stocks themselves.

Futures markets address this challenge through funding rates and margin adjustments. ETFs rely on authorized participants and arbitrage mechanisms to maintain price consistency. So far, tokenized stocks have not had these systems. Prices may fluctuate. Liquidity may be insufficient. The connection between tokens and their reference assets still relies on trust in the issuer.

However, this level of trust varies. When Robinhood launched tokenized stocks for OpenAI and SpaceX in the EU, both companies denied any involvement. No coordination, no formal relationship.

This is not to say that tokenized stocks themselves are problematic. But it raises the question: what are you buying in these cases? Exposure to price, or synthetic derivatives with unclear rights and recourse?

The infrastructure behind these products also varies significantly. Some are issued under European frameworks. Others rely on smart contracts and offshore custodians. A few platforms, like Dinari, are attempting a more regulated approach. Most are still testing the legal boundaries of what is possible.

In the U.S., securities regulators have not made a clear statement. The SEC's stance on token sales and digital assets is clear, but the representation of tokenized traditional stocks remains a gray area. Platforms are cautious. For example, Robinhood chose to launch its products in the EU rather than its home market.

Even so, demand is evident.

Republic has provided synthetic access to private companies like SpaceX. Backed Finance packages public stocks and issues them on Solana. These attempts are still in their infancy but are ongoing, and the supporting models behind them promise to address friction rather than funding issues. The issuance of tokenized stocks may not improve the economics of ownership, as that is not their intended goal. They simply aim to simplify the participation experience. Perhaps so.

For retail investors, participation is often the most important aspect.

In this sense, tokenized stocks do not compete with stocks but compete with the effort required to acquire stocks. If investors can gain targeted exposure to Nvidia with just a few taps through an app that also holds their stablecoins, they may not care whether the product is synthetic.

However, this preference is not new. Research on SPY shows that packaged products can become major markets. Contracts for difference (CFDs), futures, options, and other derivatives are similar; they were initially tools for traders but ultimately served a broader audience.

These derivatives often even lead the underlying assets. At the same time, they absorb market sentiment, reflecting fear or greed faster than the slower markets below.

Tokenized stocks may follow a similar path.

The infrastructure is still in its infancy. Liquidity is uneven. Regulatory transparency is lacking. But the potential momentum is clear: to build a system that can reflect assets, is more accessible, and is good enough for people to participate. If this representation can maintain its form, then more trading volume will flow through it. Ultimately, it will no longer be a shadow but a signal.

Nathan Most's original intent was not to redefine the stock market. He saw inefficiencies and sought a smoother interface. Today's token issuers are doing the same. Only this time, the wrapper is a smart contract rather than a fund structure.

It remains to be seen whether these new wrappers can stand firm when the market becomes challenging.

They are not stocks. They are not regulated products. They are proximate tools. For many users, especially those far from traditional finance or in remote areas, this proximity may be sufficient.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。