撰文:Jose Antonio Lanz,Guillermo Jimenez

编译即整理:BitpushNews

比特币继续强势突破关键阻力,站上 11.6 万美元历史高位,这波破位行情正为市场注入新动能,接下来会冲击多少价位成为交易员热议焦点,本文将从技术图表角度进行拆解。

宏观背景铺垫

当标普 500 与纳斯达克综合指数在四个交易日内第三次收于历史高点,黄金期货站上每盎司 3370 美元之际,随着美联储维持货币政策耐心立场,风险资产正全线获得买盘支撑。

比特币的上涨动能同样与爆表的美国就业数据形成共振——6 月非农就业人数增长 14.7 万(预期 11 万)。尽管强劲的就业数据最初因加息担忧令比特币跌破 10.9 万美元,但市场迅速消化抛压并推升至局部新高。

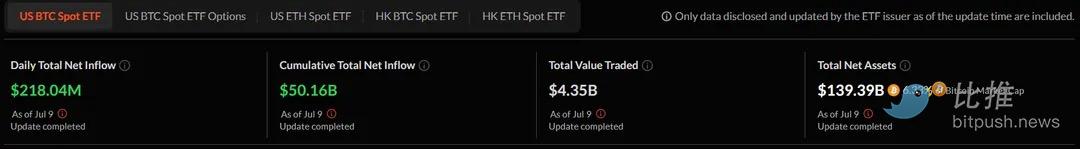

机构采用仍是核心驱动力。7 月比特币 ETF 累计资金流入已突破 500 亿美元大关。这种持续的机构买单为任何回调提供关键支撑,并验证着比特币从投机资产向组合配置资产的进化。

技术突破与机构积累的协同效应,令交易者不禁揣测:在跨越通往未知领域的最后障碍后,比特币将何去何从?

比特币图表:双重突破瞄准最后阻力

比特币日前冲高至 11.3 万美元,标志着全新历史高位区域的开启,这也是对压制价格数周的两大形态的决定性技术突破。

4 小时图显示比特币干净利落地突破了一个对称三角形形态,而日线图则显示出较小的波动,看涨势头略显不足,在这种类型的模式中,这是预料之中的,但如此长的烛台几乎没有留下任何疑问。突破确认是清晰的——足以使几乎所有关键指标在日内时间框架内转为看涨。

图源 TradingView

在 4 小时图上,平均趋向指数(ADX)为 27。这通常确认了一个趋势市场。ADX 衡量趋势强度,不考虑方向,当它突破 25 时,它向动量交易者发出信号,表明一个可持续的趋势正在形成,通常会触发趋势跟踪策略的系统性买盘。

但相对强弱指数(RSI)达 75 显示比特币已进入超买区域。不妨将 RSI 视作市场温度计——当读数过高时,往往预示降温需求。当前情形可能暗示在大涨后即将迎来调整。不过需注意,比特币曾多次在更高 RSI 水平下维持看涨动能。

日线图的挤压动量指标显示「关闭」状态,表明近期压缩行情释放的波动性符合先前分析预期。这暗示初始突破行情已兑现,交易者应准备迎接延续上涨或当前水平的整固。

整体而言,价格正释放看涨信号。尽管上涨趋势延续概率较大,但鉴于回调蜡烛图普遍呈现微小波动,调整对趋势料不构成威胁。

日线图同样展示看涨结构:比特币挣脱了自 5 月高点以来压制价格的下降看跌通道(上图黄线标注)。当前似乎正在形成看涨支撑线(上图白线),以 4 月回调低点和 6 月末低点为参照。若确认有效,比特币可能在该支撑线附近震荡,维持看涨动能并使 11 万美元在月底前成为新支撑。

日线图上 RSI 报 67,显示健康动能且未触及 70 以上的超买区域——暗示进一步上行空间。该读数告知交易者:买压保持强劲,但尚未达到通常预示调整的极端水平。

日线 ADX 报 12 表明趋势仍在发展,尚未达到可界定为明确形态的支配程度——短期图表往往包含大量噪音。虽然低于确认强劲定向运动的关键阈值 25,但突破后的低读数常预示加速前的平静。交易者将此解读为下一波冲动上涨前的积累阶段。

均线分析显示,比特币在多个时段稳稳站在 50 周期与 200 周期指数均线(EMA)上方。这些均线间不断扩大的缺口(称为均线背离)通常表征强劲趋势状态,并在回调时充当动态支撑。

关键价位

- 即时支撑:110,197 美元(突破回测位)

- 强支撑区间:105,000-108,700 美元(支撑线)

- 预期阻力:115,000 美元(基于三角形突破量度目标及斐波那契扩展位)

比特币后市展望

技术突破、机构资金流与有利宏观环境的协同作用,推动比特币有望延续突破历史阻力后的看涨趋势。但偏好技术分析的交易者应监控日线 ADX 能否突破 25 以确认趋势强度,同时警惕创新高失败时的 RSI 顶背离现象。

放眼更广维度,7 月对比特币仍可能波动剧烈:特朗普政府「大美丽法案」等政策或将使美国赤字扩大 3.3 万亿美元——历史上这对 BTC 等稀缺资产构成利好。此外,白宫 7 月 22 日加密货币行政令报告截止期限临近,其中可能涉及美国战略比特币储备的更新,将成为潜在催化剂。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。