$429 Million in Combined Inflows on Breakout Trading Day for Bitcoin and Ether ETFs

The crypto ETF market came alive on Wednesday, July 9, with strong investor participation and inflows that echoed bullish conviction across the board. Bitcoin and ether ETFs both delivered impressive performances, lifting total net assets to new highs.

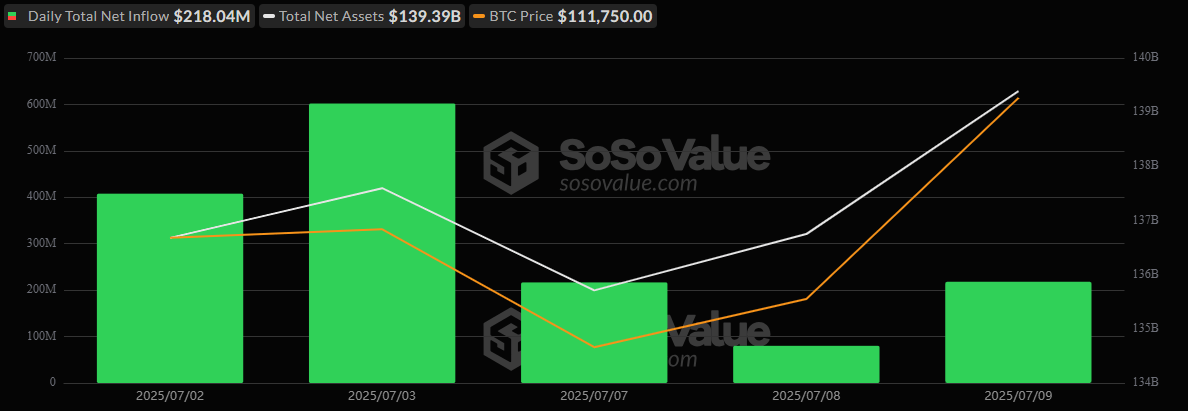

Bitcoin ETFs locked in $218.04 million in inflows, marking the 5th consecutive day of gains. Blackrock’s IBIT absorbed the largest share with $125.58 million, while Ark 21shares’ ARKB followed closely with $56.96 million.

Source: Sosovalue

Additional support came from Grayscale’s Bitcoin Mini Trust at $15.83 million, and Invesco’s BTCO with $9.48 million. Minor but meaningful contributions also came from Fidelity’s FBTC ($4.84 million), Bitwise’s BITB ($3.01 million), and Valkyrie’s BRRR ($2.34 million). There were no outflows, and total trading surged to $4.35 billion, driving net assets to a record $139.39 billion.

Ether ETFs were just as impressive, with a $211.32 million net inflow, fueled by a surge in investor interest. Blackrock’s ETHA led the way with $158.62 million, followed by Fidelity’s FETH ($29.53 million), Grayscale’s Ether Mini Trust ($17.96 million), and Franklin’s EZET ($5.21 million). Trading activity shattered previous records with $1.26 billion in volume, and net assets rose to $11.84 billion.

Momentum is clearly building again in crypto ETF markets, and both bitcoin and ether continue to draw strong institutional flows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。