GMX Exchange Hack: $42M Stolen, Token Plunges as Users Panic

GMX exchange hack: $42 million gone in a flash

In a shocking incident, popular decentralized trading platform has reportedly become the latest victim of a major breach. The GMX exchange hack has suffered them with financial loss, the marketplace which runs on Arbitrum(GMX VI) and Avalanche has suffered a massive loss of over $42 million from its GLP pool. This announcement has been shared on X platform recently, which creates tension and buzz all over the crypto world.

Source: X

The GMX exchange hack was confirmed on July 9 by DeBank. It sparked panic among the investors and a steep fall in its token price.

Suspicious outflow sparks concerns

The very first signal of trouble came when blockchain trackers noticed a sudden and suspicious outflow of funds from their wallets. A large amount of digital assets including WETH, WBTC, USDC, DAI, LINK, FRAX and more were moved to a suspicious wallet starting with “0xdf3340a4…”.

This wallet showed an 800%+ increase in value that confirms that something is seriously happening wrong. Security companies like ExVul and data providers like DeBank suddenly flagged the activity as a potential breach. Later on it was confirmed by the marketplace about GMX exchange hack .

Source: X.

Later, GMX exchange hack was discovered that the attacker had funded their wallet via Tornado cash days in advance which suggests that it was a pre planned and well executed.

Marketplace shared some immediate taken steps by them that are:

-

The platform disabled the trading and GLP mint/redeem functions on Arbitrum and Avalanche.

-

Confirmed that GMX V2, tokens and other trading pools will remain unaffected.

-

It promised to the investors that the full details of the incident will be disclosed soon, as soon as all findings are validated.

What all was stolen?

The hacker didn’t just steal platform’s one coin but they hacked a mix of major visual assets like $9.6M in USDC, $8.5M in WETH, $10.4 in Frax Dollar , $9.6M in WBTC and smaller amounts of UNI, LINK, DAI and other tokens.

Exchange speaks out after silence

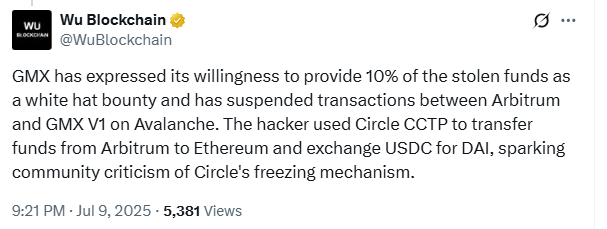

To prevent further losses , because of GMX exchange hack, the platform immediately disabled GLP trading, minting and redeeming on both Avalanche and Arbitrum. In a new move, the platform has now offered a 10% of stolen funds as white hat bounty.

Source: X

It was also discovered that the attacker used Circle’s CCTP(Cross- Chain Transfer Protocol) to move USEDC from Arbitrum to Ethereum(ETH) and later converted to DAI. This has triggered criticism among the people involved with the community and are questioning why Circle didn’t freeze the stolen USDC in time.

Token price drops, Users panic

As expected the panic set in fast. The platform’s token price dropped by more than 10% falling to around $12.50 within 24 hours. This news caused a quick sell-off as many users rushed to exit

Crypto breach continue to be a feature of the digital asset landscape

In the first half of the year 2025, losses from virtual hacks reached $2.5 billion and approximately $1.4 billion in stolen funds resulting from the Bybit hack in the month of February.

Also, Iranian crypto exchange Nobitex has recently fallen victim of cyber attacks too. It was done by a pro-Israeli hacker group called Gonjeshke Darande. This hack caused a loss of over $81 million, forced to stop services temporarily to mitigate the effect of the breach.

A wake up call for DeFi

The GMX exchange hack is a wake-up call for the DeFi world. Despite strong audits and active security partners and top marketplaces can be vulnerable. The platform’s quick response, offersand transparency will be a key in restoring people’s trust. For now everyone is waiting for a deep investigation to take place and waiting for the next move of attackers.

Also read: Thumzup Crypto Investment Plans: Bitcoin, ETH, XRP, and More Coming免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。