Since Bitcoin began to steadily rise around $98,000 on June 22, BTC today broke through $112,000, reaching a high of $112,052.24, surpassing the previous high of $111,999 set on May 22, and increasing over 14% from the June low.

Source: TradingView

Under the resonance of multiple macroeconomic and industry internal factors, the driving force behind this round of market activity cannot be explained by a single event. From the surge in corporate purchases, policy games, tech stock correlations, to changes in investor structure and market sentiment evolution, this round of Bitcoin's rise is not only a price increase but also a reflection of the re-evaluation of crypto assets' status.

Institutional Buying Frenzy, Bitcoin Price Momentum Unabated

The continuous accumulation by institutions has become one of the core driving forces behind this price surge. According to ARK Invest's June report "Bitcoin Monthly," the proportion of Bitcoin held by long-term holders has risen to 74%, the highest level in 15 years. This indicator shows that although the activity of new buyers has declined in the short term, "diamond hands" are still firmly holding and continuously accumulating in low volatility ranges.

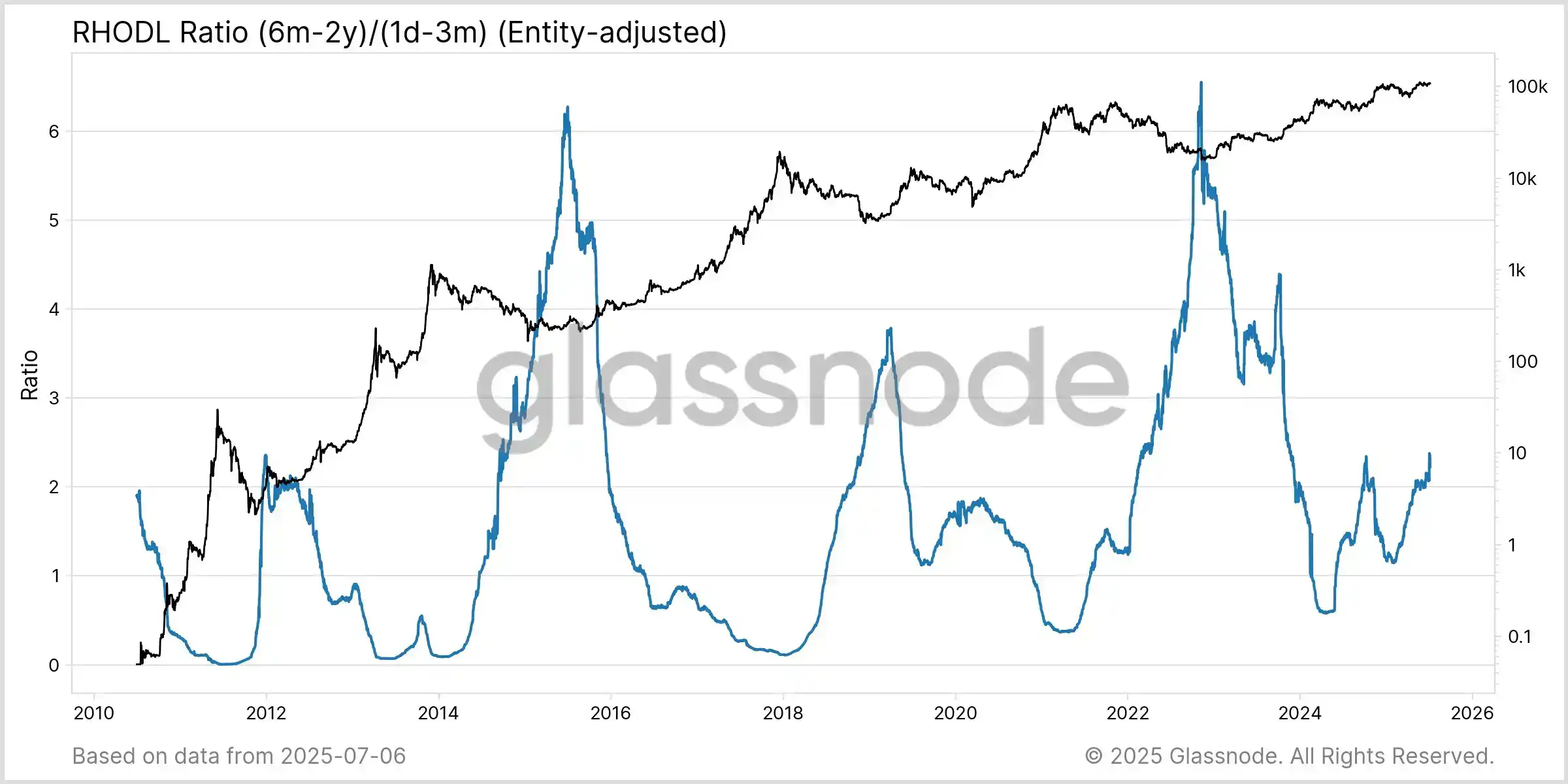

On July 9, Glassnode posted on social media that the Bitcoin RHODL ratio has begun to rise, reaching the highest level of this cycle. This signal indicates that the market structure is changing, with more wealth controlled by single-cycle holders, while short-term activities of 1 day to 3 months remain low. Historically, such turning points often signal a transition in market cycles and a cooling of speculative momentum.

The RHODL ratio is an on-chain metric for Bitcoin that measures the difference in holding proportions between short-term and long-term holders, thus analyzing market cycles and investor behavior.

Source: Glassnode

At the same time, BlackRock's iShares Bitcoin Trust (IBIT) has accumulated over 700,000 BTC, accounting for about 3.33%. Bloomberg data shows that the annual management fee income of this ETF has surpassed that of BlackRock's flagship product—the S&P 500 ETF (IVV), becoming a profitable example for traditional financial institutions entering the Bitcoin market.

Since July, a trend led by U.S. publicly listed companies to adopt "Bitcoin reserves" has rapidly spread, particularly among traditional industry transformers such as hotels, real estate, and food sectors. Mexican hotel and real estate operator Murano (NASDAQ: MRNO) announced the launch of a Bitcoin reserve strategy, signing a standby equity purchase agreement (SEPA) worth up to $500 million, and has purchased 21 BTC, planning to enhance asset liquidity and convert it into long-term crypto reserves through real estate sales and introducing Bitcoin payments. Meanwhile, Japanese hotel chain operator Metaplanet has increased its Bitcoin holdings twice in just a few days from late June to early July, with total holdings surpassing 2,200 BTC, clearly transforming into a treasury-type company centered on BTC as a core reserve.

In addition to the hotel industry, more diverse companies are reconstructing their balance sheets with Bitcoin. The food and culture group DDC (NYSE: DDC), headquartered in the Cayman Islands and operating across Hong Kong, the U.S., and mainland China, announced the purchase of an additional 230 BTC, incorporating it into its long-term strategic asset allocation. U.S. medical technology company Semler Scientific and Swedish quantitative trading firm Hilbert Group also completed Bitcoin purchases or secured financing for this purpose during the same period. Additionally, chip and Web3 infrastructure provider Nano Labs, traditional manufacturer Addentax Group from Shenzhen, mobility tech company Webus, and established crypto custody platform Bakkt have all announced or advanced reserve strategies centered on Bitcoin, BNB, XRP, and other digital assets, with amounts ranging from millions to billions of dollars.

These companies come from diverse backgrounds and span various industries, yet they have come together under the trend of Bitcoin assetization—collectively viewing digital assets as key levers for liquidity management, inflation hedging, and capital appreciation, confirming that the trend of Bitcoin as an "enterprise-level reserve asset" is accelerating from the tech finance circle to a broader real economy.

The logic behind this is not hard to understand. Against the backdrop of cooling global inflation expectations and the nearing end of the Federal Reserve's interest rate hike cycle, some companies and institutional investors are reassessing their asset allocation models, with Bitcoin's value being emphasized once again. Especially as traditional safe-haven tools—such as gold and long-term U.S. Treasuries—no longer offer attractive yields, Bitcoin, with its high liquidity and global pricing mechanism, is being endowed with more imaginative space beyond its digital gold function.

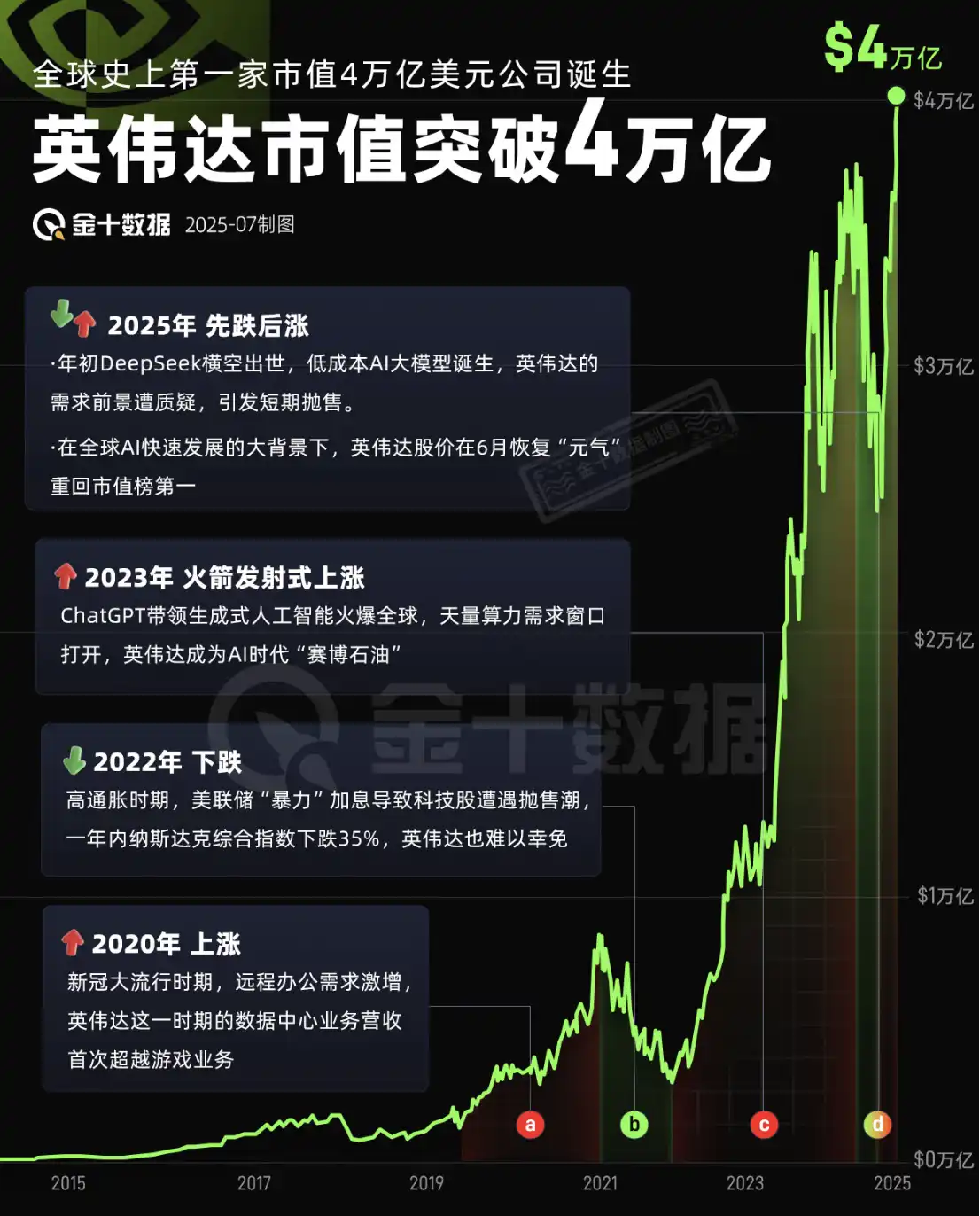

Currently, the rise of Bitcoin is closely related to the simultaneous strength of the U.S. tech sector. Companies like Nvidia, representing AI and semiconductors, have driven the Nasdaq index to new highs, indirectly reinforcing the market's risk appetite. Yesterday, Nvidia's market capitalization briefly surpassed $4 trillion, creating a strong spillover effect in the stock market. In this context, Bitcoin and tech stocks have shown a highly positive correlation, further strengthening its role as a risk asset.

Source: Jinshi Data

This linkage is not coincidental but a result of changes in investor structure. In recent years, traditional stock investors have been migrating to the crypto market, projecting their risk appetite and growth expectations onto Bitcoin through ETFs, futures, and compliant exchanges. Stocks closely related to Bitcoin, such as Coinbase and MicroStrategy (MSTR), have also seen significant price increases recently, indicating that investors are placing Bitcoin alongside tech stocks as "future-driven assets."

It is noteworthy that policy expectations have also played a key role in market expectation management. Although the likelihood of the U.S. government establishing a "strategic Bitcoin reserve" has significantly decreased in prediction markets, the ongoing fermentation of related topics in public opinion still creates psychological hints for investors. With the "Crypto Week" set to take place in Washington in 2025, the market generally expects that crypto assets will receive more positive guidance within a regulatory framework, especially regarding topics such as Bitcoin being included in corporate financial statements and state-level government purchase plans, with the policy's gray areas gradually being clarified.

Additionally, on-chain data shows that the funding structure of the Bitcoin market is exhibiting more institutional characteristics. According to Coinglass data, approximately $340 million in short positions were liquidated within just four hours before and after Bitcoin reached a new high. This phenomenon has occurred multiple times during the 2021 bull market, indicating that a large number of highly leveraged speculative positions were quickly flushed out in a strong market, creating a technical short squeeze. Although the price push caused by such leverage liquidation has short-term characteristics, the market signals released are very clear: the short forces are weakening, and the upward trend is established.

At the same time, although overall liquidity has not fully recovered to the peak levels of 2021, on-chain indicators such as MVRV (Market Value to Realized Value ratio) show that the current market is still in a structurally rising channel. ARK's report points out that although capital flows have cooled compared to the beginning of the second quarter, long-term capital is still entering at a stable pace.

Policy Support, Crypto Week Approaching

Not only is the capital market boosting Bitcoin prices, but U.S. policy is also welcoming Crypto Week. On July 4, the White House's cryptocurrency and AI director, "Crypto King" David Sacks, stated that the week of July 14 will be House Cryptocurrency Week: the "GENIUS Act" is about to be delivered to the president. The "CLARITY Act" (U.S. Digital Asset Market Clarity Act) is also set to be delivered to the Senate.

From a macro perspective, the strong dollar should have suppressed crypto assets, but Bitcoin has shown significant counter-cyclical resilience. The Federal Reserve's "Nominal Broad Trade-Weighted Dollar Index" continues to rise, challenging the mainstream logic that "dollar depreciation drives Bitcoin up." However, Bitcoin still achieved an upward movement during this period, indicating that its trend has gradually detached from reliance on a single macro factor, exhibiting characteristics driven by multiple factors interwoven. This trend may suggest that Bitcoin is transitioning from a "narrative asset" to a "fundamental asset."

It is worth mentioning that although inflation levels are gradually declining, investors' traditional perception of Bitcoin as an "inflation hedge" is weakening. However, the warming of risk appetite brought about by expectations of a federal funds rate cut has become a real driving force for the new round of increases. In traditional markets, tech stocks, growth assets, and startup equity have all performed strongly, and Bitcoin naturally benefits from this.

The weakness in the real estate market has also indirectly pushed capital towards liquidity assets. ARK's report notes that there is currently a serious divergence between expectations and transactions in the U.S. housing market, with homeowners' psychological expectations being too high while actual transaction volumes continue to decline. This "price rigidity" under liquidity shortages has led some funds originally allocated to real estate to seek assets with greater price elasticity. Bitcoin's around-the-clock trading and cross-border pricing mechanism have become the preferred outlet for such funds.

In summary, this round of Bitcoin breaking historical highs is the result of multiple intertwined factors. It benefits from macro trends such as the surge in tech stocks, liquidity easing, and corporate asset reallocation, while also reflecting Bitcoin's own structural advantages of being "institutionally neutral, supply certain, and highly liquid." In this complex structure, market trends can no longer be explained by a single narrative framework but require a comprehensive analysis from multiple dimensions, including funding structure, policy expectations, and investor behavior.

Looking ahead, although there is a risk of price correction in the short term, especially in the context of a lack of new buying support after short liquidations, the market may enter a technical consolidation phase. However, from a medium to long-term perspective, under the multiple trends of corporate purchases becoming mainstream, crypto regulation gradually clarifying, and risk asset sentiment warming, Bitcoin is still expected to welcome a new rising cycle in the second half of 2025, further solidifying its position as a global digital value anchor.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。