The summer of 2025 is the summer of crypto and U.S. stocks.

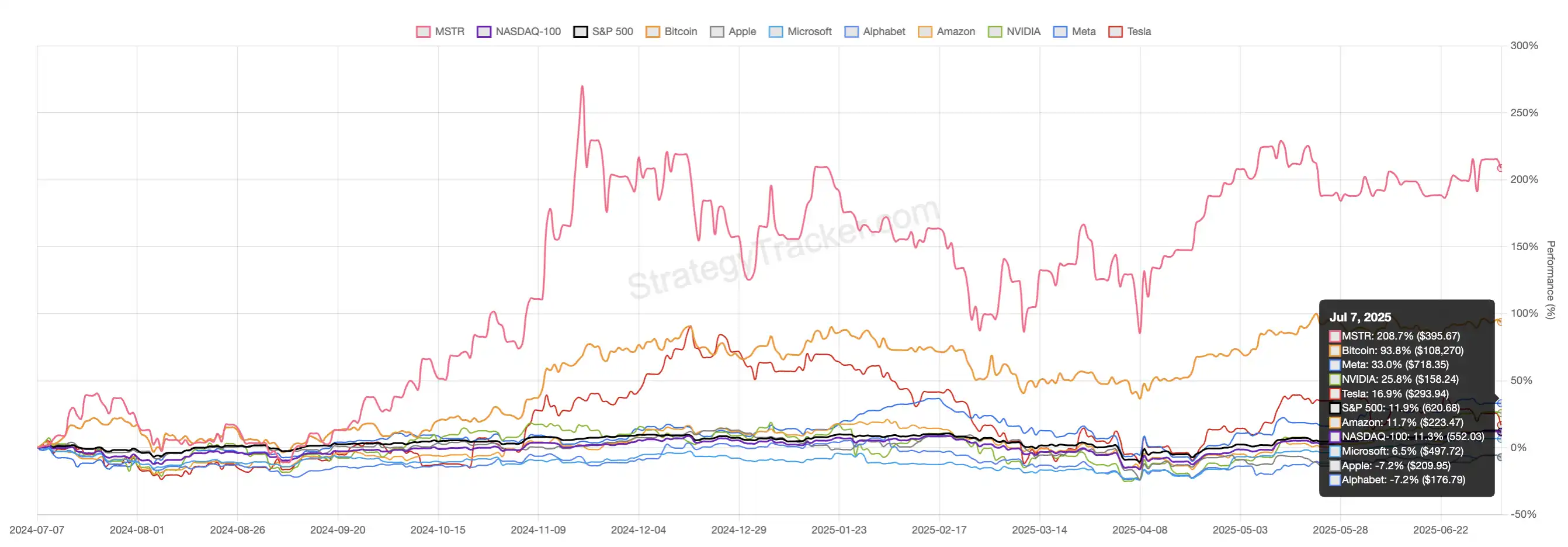

Looking at the capital markets, the true protagonists this year are not Meta, nor NVIDIA, and certainly not those traditional tech giants, but rather the U.S. stocks that have moved Bitcoin onto their balance sheets through "strategic holding." This chart clearly shows the madness of MicroStrategy.

In the past year, Bitcoin has risen nearly 94%, outperforming the vast majority of traditional assets. In comparison, the gains of tech giants like Meta, NVIDIA, and Tesla are at most around 30%, while companies like Microsoft, Apple, and the S&P 500 index have basically hovered around 0, even experiencing pullbacks.

However, MicroStrategy's stock price soared by 208.7%.

Behind MSTR, a large number of crypto-holding U.S. stocks and Japanese stocks are playing out their own valuation myths. The premium of market cap/net asset value (mNAV), borrowing rates, short positions, convertible bond arbitrage, and even GameStop-style short squeezes are all brewing and colliding in the undercurrents of the capital markets. Faith and structural games intertwine, with institutions and retail investors having different mindsets—how do traders navigate this new battlefield of "coin stocks"? What hidden logics are dominating the market?

This article from BlockBeats will dissect the frenzy and games of "strategic holding" U.S. stocks from the perspectives of three professional traders: from the premium fluctuations of MSTR to the covert battles of arbitrage among new companies, from the fantasies of retail investors to the calculations of institutions, progressively unfolding this new capital narrative cycle.

The Truth of "Strategic Holding" U.S. Stocks

Going long on BTC and shorting MicroStrategy seems to be the view of many traditional financial institutions and traders.

The first trader interviewed by BlockBeats, Longxin Yan, adopts this strategy: "The implied volatility (IV) differences for these companies are huge. I buy Bitcoin options off-exchange using SignalPlus software while selling call options for this company, like MSTR, when the U.S. stock market opens."

In Longxin Yan's own words, this is the "long BTC + short MSTR" volatility spread strategy, which is a way to achieve stable returns.

"This strategy is actually a judgment on the 'premium regression range'," says another trader with a more conservative style, Hikari: "For example, if the current premium is 2 times, and you expect it to fall back to 1.5 times, then when the premium declines to that point, you can lock in the price difference for profit. But if market sentiment becomes overly exuberant, pushing the premium to 2.5 times or 3 times, then you will incur a floating loss."

"Premium" seems to be a term that all traders cannot avoid when discussing "strategic holding" U.S. stocks.

The so-called mNAV (Market Net Asset Value) is simply the multiple of a company's market cap to its actual net value of held crypto assets.

The popularity of this metric is almost entirely due to the Bitcoin buying frenzy initiated by MicroStrategy (MSTR) in 2020. Since then, MSTR's stock price has been almost tied to the rise and fall of Bitcoin, but the market has consistently priced it significantly higher than the company's actual "net asset value." Today, this mNAV "premium phenomenon" has also been replicated in more and more crypto asset U.S. stocks and Japanese stocks, such as Metaplanet and SRM. In other words, the capital market is willing to pay far more for these companies than the sum of "coin-based + core business assets," with the remaining portion being a bet on holding, leverage, future financing capabilities, and imaginative potential.

mNAV Premium Index: The Mirror for MicroStrategy

Looking back at the trend of the MicroStrategy mNAV premium index. From 2021 to early 2024, the mNAV premium fluctuated between 1.0 and 2.0 times, with a historical average of about 1.3 times—meaning the market was willing to pay an average of 30% more for the Bitcoin on MSTR's balance sheet.

However, starting in the second half of 2024, MicroStrategy's mNAV premium hovered around 1.8 times. By the end of 2024, it became even more exaggerated, as Bitcoin continuously approached the $100,000 mark, the mNAV premium of MSTR also rose, breaking the multiple and reaching a historical peak of 3.3 times on certain extreme trading days.

By the first half of 2025, the mNAV index fluctuated in the range of 1.6 to 1.9 times. It is clear that each change in the premium range corresponds to rounds of capital expectations and fluctuations in speculative sentiment.

In Longxin Yan's words, this is actually similar to the concept of operating leverage in traditional businesses; the market's assessment of these companies' future leverage will affect their premium: "MSTR has already gone through multiple rounds of financing, with creditors spread across Wall Street. This ability to raise funds and issue shares is the core competitiveness. The market expects you to continuously raise money, which is why they dare to give you a higher premium." In contrast, newly established, smaller "coin-holding U.S. stocks" find it very difficult to gain the same level of trust and premium from the capital market, no matter how loudly they shout.

What Premium is Considered Reasonable?

Butter is a typical believer in quantitative analysis and data, with all decisions based on historical percentiles and volatility.

"The market's premium for MicroStrategy being in the range of 2-3 times is reasonable." After calculating the changes in Bitcoin and MicroStrategy's stock prices over the past year, Butter stated.

From early to March 2024, when Bitcoin rose from about $40,000 to $70,000, an increase of about 75%, MSTR surged from $55 to nearly $180, an increase of over 220%. In this round of increases, MSTR was about three times that of Bitcoin.

From November to December 2024, when Bitcoin tested the $100,000 mark again, it rose about 33%, while MSTR jumped from $280 to around $520, an increase of about 86%, more than double that of Bitcoin.

However, during the subsequent pullback period from December 2024 to February 2025, when Bitcoin fell from $100,000 to $80,000, a drop of about 20%, MSTR's decline was also 2 times, with a cumulative drop of about 50%.

Similarly, from March to May this year, when Bitcoin rebounded to about $108,000 with a 35% increase, MSTR rose nearly 70%, still about 2 times.

In addition to the premium index, Butter also pays attention to annualized volatility. According to his calculations, the standard deviation of Bitcoin's daily returns in 2024 was about 4.0%, corresponding to an annualized volatility of about 76.4% for all-weather trading; during the same period, MSTR's daily return standard deviation was about 6.4%, with an annualized volatility of up to 101.6% on U.S. stock trading days. Entering 2025, BTC's annualized volatility fell to about 57.3%, while MSTR remained around 76%.

Therefore, Butter's core viewpoint is very clear: "A premium fluctuating in the range of 1.5-3 times is a very clear trading signal." By combining volatility with mNAV premium, Butter distilled a "simplest trading logic"—go long when the market is low volatility + low premium, and conversely, short when high volatility + high premium.

Hikari's approach is similar to Butter's, but he also incorporates options strategies for assistance: selling put options to earn premiums in low premium ranges, and selling call options in high premium situations to collect time value. He reminds ordinary investors: "The margin accounts on both sides should be independent; if both sides are leveraged, it is easy to be liquidated in extreme market conditions."

Convertible Bond Arbitrage: A Mature Strategy for MSTR on Wall Street

If premium arbitrage and options operations are essential courses for retail and quantitative players in the "coin stock" world, then the real big funds and institutional players focus more on the arbitrage space of convertible bonds.

On October 30, 2024, Michael Saylor officially launched the "21/21 Plan" during an investor conference call: over the next three years, he plans to phase in the issuance of $21 billion in common stock through ATM (At-The-Market) to continuously buy Bitcoin. In fact, within just two months, MicroStrategy completed its first round target—issuing a total of 150 million shares, raising $2.24 billion, and acquiring an additional 27,200 BTC; shortly after, in the first quarter of 2025, the company again raised $21 billion through ATM and simultaneously launched $21 billion in perpetual preferred stock and $21 billion in convertible bonds, with a total financing tool scale reaching $63 billion within six months.

Butter observed that this "overtime" issuance put heavy pressure on MSTR's stock price. In November 2024, although the stock price once surged to a high of $520, as the market's expectations for a new round of dilution fell short, the stock price fell all the way down, dropping below $240 in February 2025, approaching the low point of the premium during Bitcoin's pullback period. Even occasional rebounds were often suppressed by the issuance of preferred stock and convertible bonds. In his view, this is also an important logic behind MSTR's stock price being extremely volatile in the short term while maintaining sustained volatility in the long term.

However, for many more institutional hedge funds, the focus is not on betting on the direction of "up" or "down," but on capturing volatility through convertible bond arbitrage.

"Convertible bonds usually have higher implied volatility than options of the same maturity, making them an ideal tool for 'volatility arbitrage.' The specific approach is to buy MSTR convertible bonds while borrowing an equivalent amount of common stock in the market to short, locking in a net delta exposure of approximately 0. Whenever the stock price experiences significant fluctuations, adjusting the short ratio and buying low and selling high can harvest volatility as profit," Butter explained: "This is one of Wall Street's most mature arbitrage games."

Behind this, a group of hedge funds is quietly engaging in one of Wall Street's most mature arbitrage games using convertible bonds—"Delta neutral, Gamma long."

He added that MSTR's short interest once reached 14.4%, but many of the shorts were not "bearish on the company's fundamentals," but rather funds engaging in convertible bond arbitrage, using continuous shorting to dynamically hedge their positions. "They don't care whether Bitcoin goes up or down; as long as the volatility is large enough, they can repeatedly buy low and sell high to realize arbitrage profits," Butter summarized.

In a sense, MSTR's convertible bonds are also a type of bullish option derivative.

Hikari has his own experience with the combination of options and convertible bond strategies. He described buying options as akin to buying a lottery ticket, where you occasionally hit the jackpot, but most of the time you are paying "tuition fees" in premiums to the market; selling options is like being a lottery store owner, relying on collecting premiums for a steady income. In his actual trading, both options and convertible bonds are powerful tools for diversifying risk and averaging costs.

"Unlike traditional spot or leveraged contracts, the greatest significance of options lies in the 'time dimension.' You can choose different expiration dates of 1 month, 3 months, or 6 months, each with its own implied volatility, creating countless combinations and making strategies into three-dimensional portfolios. This way, no matter how the market moves, you can always keep risks and returns within your acceptable range."

This line of thinking represents the underlying logic of the most mainstream derivative arbitrage on Wall Street. In the case of MSTR, this type of structured arbitrage is becoming the main battlefield for smart money.

Can You Short MicroStrategy?

However, for ordinary investors and retail traders, this seemingly lively arbitrage feast may not be something to celebrate. As more and more hedge funds and institutions continuously extract liquidity from the market through "issuance + arbitrage," ordinary shareholders often become the last ones holding the bag: they may not be able to dynamically hedge like professional institutions, nor can they timely identify the risks of premium regression and dilution—once the company issues shares on a large scale or encounters extreme market conditions, paper profits can quickly evaporate.

For this reason, in recent years, "shorting MicroStrategy" has become a hedging choice for many traders and structured funds. Even if you are a staunch bull on Bitcoin, during periods of high premium and high volatility, simply holding MSTR stock can lead to greater net value drawdowns than holding Bitcoin alone. How to hedge risks or capture the "regression trend" of MSTR's premium in reverse has become a pressing question for every trader in the "coin stock" market.

When discussing the topic of shorting MicroStrategy, Hikari's attitude became noticeably cautious.

He admitted that he had "suffered losses" from shorting MicroStrategy. He candidly stated that he had even written a review on his public account—last year, he started shorting MSTR at around $320, only for the market to surge to $550, putting immense pressure on his position.

Although he eventually "struggled to break even" when MSTR pulled back to the $300 range, he described the pressure of holding through high premiums and drawdowns as something "difficult for outsiders to understand."

This trade led Hikari to completely revise his style. He stated that if he were to short now, he would never sell the underlying stock naked or directly sell calls; instead, he would prioritize buying put options or other limited-risk combinations—even if the cost is higher, he would no longer recklessly confront the market head-on. "You still have to lock risks firmly within a range you can accept," he concluded.

However, as mentioned earlier and pointed out by Butter, MicroStrategy has significantly expanded its authorization for common and preferred stock in recent years, directly increasing from 330 million shares to over 10 billion shares, while frequently issuing preferred stock, convertible bonds, and continuing ATM offerings. "These operations lay the groundwork for future limitless dilution. Especially with ongoing ATM issuances and premium arbitrage, as long as the stock price is above net assets, the company's management can 'risk-free' buy Bitcoin, but it puts continuous dilution pressure on the common stock price."

Especially if Bitcoin experiences a significant pullback, this "high premium financing + continuous Bitcoin buying" model will face even greater pressure. After all, MicroStrategy's model fundamentally relies on the market's sustained high premium and confidence in Bitcoin.

To this end, Butter also mentioned two double inverse ETFs specifically designed to short MicroStrategy: SMST and MSTZ, with expense ratios of 1.29% and 1.05%, respectively: "But this is more suitable for experienced short-term traders or investors looking to hedge existing positions. It is not suitable for long-term investors because leveraged ETFs have a 'leverage decay' effect, and long-term holding often yields returns below expectations."

Will "Coin-Holding U.S. Stocks" Experience a GameStop-like Short Squeeze?

If shorting MSTR is a risk hedging tool for institutions and veterans, then "short squeezes" are the ultimate narrative that inevitably arises during every peak in the capital markets. Over the past year, there has been no shortage of institutions publicly bearish on MicroStrategy and Metaplanet, such "coin-holding companies." Many investors cannot help but recall the sensational GameStop short squeeze event on Wall Street—so, do these crypto U.S. stocks also have the potential to ignite a short squeeze?

On this question, while the analytical perspectives differ, the three traders share some similarities in their views.

Longxin Yan believes that from the perspective of implied volatility (IV), there are currently no obvious signals of "over-leverage" in targets like MSTR. The greater risk, he argues, comes from variables such as policy or tax changes that disturb the core logic of the premium. He joked, "The current shorts should all go to CRCL."

Hikari's analysis is more direct. He believes that it is difficult for a giant like MicroStrategy, with a market cap of hundreds of billions of dollars, to experience a GameStop-style extreme short squeeze. The reason is simple: the float is too large and the liquidity too strong, making it hard for retail investors or speculative funds to collectively move the overall market cap. "In contrast, small companies like SBET, which initially had a market cap of only a few tens of millions of dollars, are more likely to experience a squeeze." He added that SBET's performance in May this year is a typical example—its stock price surged from two or three dollars to $124 in just a few weeks, with its market cap skyrocketing nearly forty times. Low market cap stocks with insufficient liquidity and scarce borrowable shares are the most likely to become breeding grounds for "short squeeze" scenarios.

Butter agrees with this view and explained to BlockBeats the two core signals of a "short squeeze": first, the stock price experiences an extreme single-day surge, with the increase entering the top 0.5% of historical percentiles; second, the available shares for borrowing in the market drop sharply, making it nearly impossible to borrow shares, forcing shorts to cover.

"If you notice a stock suddenly surging in volume while the number of borrowable shares is low, short positions are high, and borrowing rates are skyrocketing, that is basically a signal that a short squeeze is brewing."

Taking MSTR as an example, in June this year, its total short volume was about 23.82 million shares, accounting for 9.5% of the float. Historically, in mid-May, it even climbed to 27.4 million shares, with shorts accounting for as much as 12-13%. However, from the perspective of financing and borrowing supply, the short squeeze risk for MSTR is not extreme. The current annualized borrowing rate is only 0.36%, and there are still 3.9 to 4.4 million shares available to borrow. In other words, although there is considerable short pressure, there is still a significant distance from a true "short squeeze."

In stark contrast is the U.S. stock SBET (SharpLink Gaming), which holds ETH. As of now, SBET's annualized borrowing rate is as high as 54.8%, making it extremely difficult and costly to borrow shares. About 8.7% of the float is short positions, and all short positions could be covered with just one day's trading volume. The high cost combined with a high short ratio means that if the market reverses, SBET is likely to experience a typical "rolling short squeeze" effect.

Looking at SRM Entertainment (SRM), which holds TRX, the situation seems even more extreme. Recent data shows that SRM's borrowing cost has reached 108-129%, with the number of borrowable shares hovering between 600,000 and 1.2 million, and the short ratio roughly between 4.7% and 5.1%. Although the short ratio is only moderate, the extremely high financing cost directly compresses the shorting space, and if market conditions change, the funding side will face immense pressure.

As for DeFi Development Corp. (DFDV), which strategically holds SOL, its borrowing cost once reached as high as 230%, with a short ratio of 14%, meaning nearly one-third of the float is being shorted. Therefore, overall, while the coin stock market has the potential for a short squeeze, the stocks that truly have the potential to ignite a "long-short battle" singularity are often those with smaller market caps, poorer liquidity, and higher levels of capital control.

There is Only One MicroStrategy in the World

"For example, if you have a market cap of $10 billion and the market believes you can refinance $20 billion to do business, then a 2x premium is not considered expensive. But if you just went public and your market cap is still small, even if you shout 'I want to raise $500 million' to the heavens, the capital market may not truly believe you," Longxin Yan pointed out the current dividing line for crypto-holding companies—only those that truly grow strong and have the ability to continuously refinance and expand their balance sheets are qualified to enjoy high premiums in the market. Those limited in scale and newly listed "small players" find it difficult to replicate MSTR's valuation myth in the market.

Looking back over the past two years, "strategic holding companies" have gradually clustered in the U.S. stock market—some heavily invested in Bitcoin, some laying out Ethereum, SOL, BNB, and even HLP and other mainstream assets, and some imitating MSTR's strategy, simply looking to ride the wave of "holding premium."

How should we view the investment logic and market positioning of these companies? Longxin Yan's perspective remains calm: "This sector is now too crowded. Just having a 'shell' or gimmick, lacking real business and operational support, makes these companies fundamentally too 'young.' Public companies are not QQ groups; they cannot just be a few people coming together to play the capital game." He emphasized that the capital market has a set of mature rules and bottom lines, and relying solely on the rough qualities of Web3 and the enthusiasm of circles makes it difficult to establish a long-term foothold in the U.S. stock market.

Moreover, the pricing differences for these companies vary greatly across different countries and regions. For example, Japan's Metaplanet is essentially a publicly listed company that originated in the hotel industry and is now the ninth-largest holder of Bitcoin globally. Due to Japan's domestic tax policies favoring the holding of crypto assets, along with many Asian investors being unable to buy coins, companies like MSTR and Metaplanet have even become "crypto ETFs" in the minds of many. In contrast, some Hong Kong-listed companies are also trying to allocate crypto assets, but due to dispersed liquidity and insufficient market depth, they do not enjoy the same benefits as U.S. stocks. Longxin Yan candidly stated, "I am not very optimistic about Hong Kong stocks doing this."

It is undeniable that putting a large amount of Bitcoin on a company's balance sheet is indeed a symbol of strength. However, the "rules of the game" in the market have not changed—high-quality companies are few and far between, and most companies are merely chasing a wave of hype and valuation premium. Once Bitcoin experiences a significant drop, those companies that have leveraged their balance sheets and lack real business may easily find themselves in trouble due to exhausted refinancing capabilities, forced to sell their held Bitcoin at the bottom of a bear market, which in turn exacerbates the downward pressure on the entire market, triggering a chain reaction and forming a vicious cycle similar to a "death spiral."

In a bull market, these companies often exhibit a "left foot stepping on the right foot" self-reinforcing structure—coin prices rise, holdings appreciate, market caps soar, and the market chases them, leading to smooth refinancing. However, in a bear market, everything can reverse, and the valuation system may collapse at any time. Longxin Yan's experience is very direct: "I absolutely do not buy high premiums, I don't buy those recently transformed, and I definitely avoid those that have not gone through more than two rounds of financing—fearing that the creditors in front are actually insiders, just like playing dollar bonds with real estate developers."

During the interview, Hikari's views were also similar to Longxin Yan's. He stated that many newly emerged "strategic holding companies" are essentially replicating MicroStrategy's script—buying coins, refinancing, telling stories, and relying on "holding premiums" to boost their market caps. Some are even transitioning from being crypto VCs or project parties. Hikari candidly admitted, "In fact, many of these companies are just here to scam money."

"The reason MSTR has come this far is fundamentally because its size is large enough and the amount of Bitcoin it holds is substantial. Moving forward, it still has many potential plays, such as using these Bitcoins for large-scale staking or engaging in some complex options strategies to activate its assets. As long as the company is willing to distribute dividends and return these profits to shareholders, this path can actually continue indefinitely."

He added that apart from MicroStrategy, he is currently only focusing on a few truly transparent asset-disclosing companies with legitimate core businesses, such as Japan's Metaplanet and the medical device company SMLR (Semler Scientific). "As long as the asset structure is clear enough and the core business is reasonable, these companies are still worth paying attention to."

As for how the market changes and how strategies evolve, Longxin Yan, Hikari, and Butter all unanimously agree on one point: regardless of how the narrative develops, the most scarce and widely recognized asset in the crypto market remains Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。