The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on July 3, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

Talks of CoreWeave acquiring Core Scientific have been circling for a while even though the first attempt failed. With multi billion-dollar contracts in place and overlapping infrastructure footprints, many figured it was only a matter of time. Now it’s official: CoreWeave (CRWV) is acquiring Core Scientific (CORZ)in an all-stock deal valued at ~$9B.

On paper, that sounds bullish, but investors hit the sell button. The following are my 2-cents about the pullback.

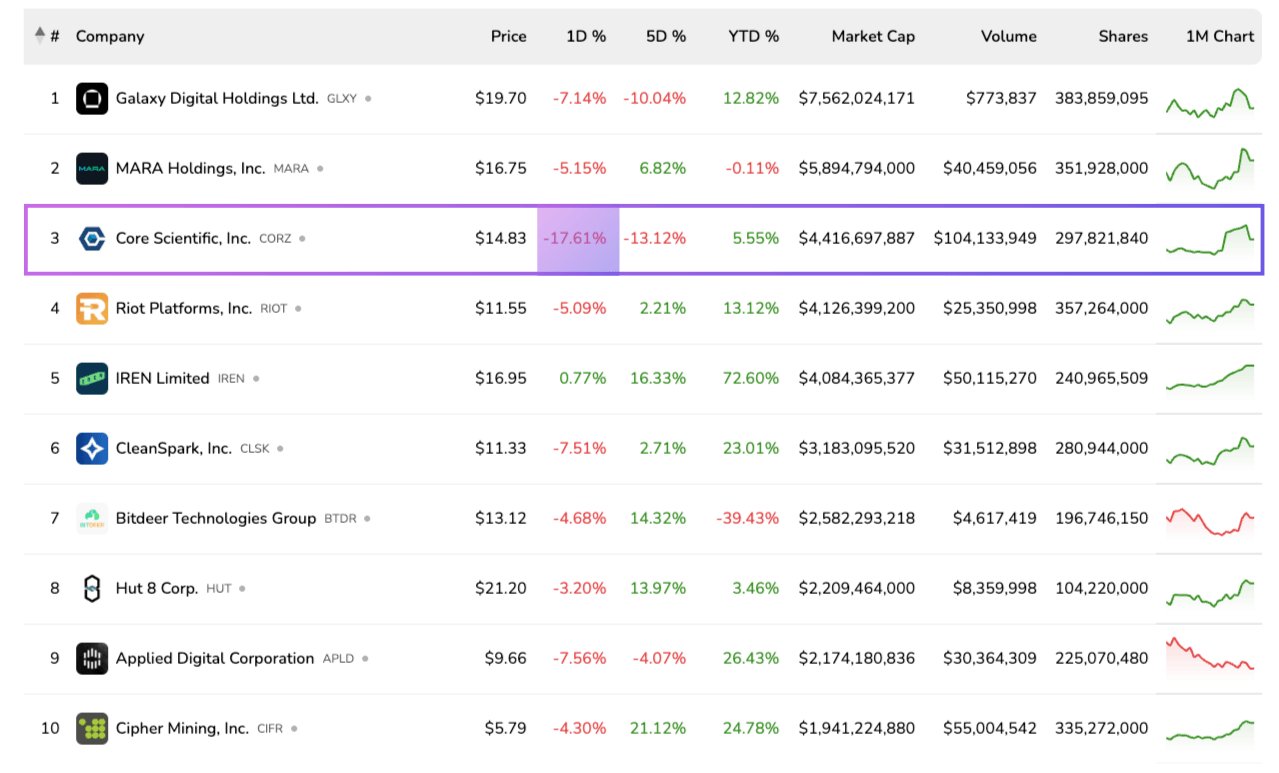

CORZ dropped notably after the acquisition news, as of the July 7, 2025 market close.

What’s the Deal?

Core Scientific shareholders will receive 0.1235 newly issued shares of CRWVfor each CORZ share. At CoreWeave’s closing price of on July 3, the deal implies a total equity value of approximately $9.0 billion, which values CORZ at $20.40 per share-a 13.14% premium to CORZ’s pre-announcement price of $18.03.

At face value, a 13% spread might seem reasonable. However, several underlying concerns appear to have driven the negative reaction.

1. All-Stock Structure Brings Uncertainty

The deal is tied to CoreWeave’s stock price. If CRWV falls before the deal closes (expected in Q4), CORZ holders take the hit. That 13% premium could vanish-or flip to a discount.

On the flip side, if CRWV rallies, CORZ investors benefit. But betting on that is speculative, especially given CoreWeave’s current financials.

2. CoreWeave Might Be Overvalued

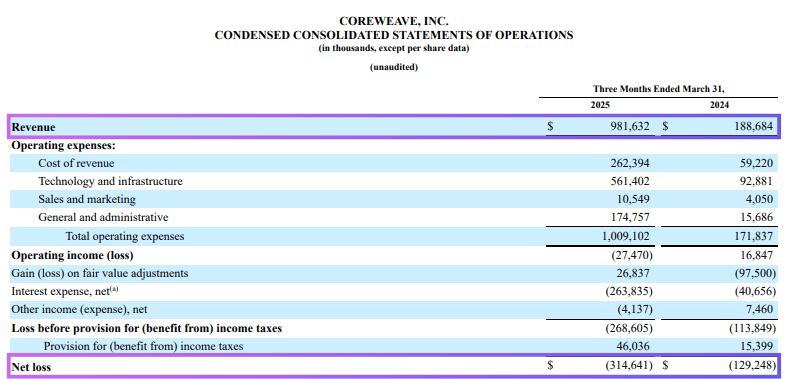

CoreWeave posted $981.6M in Q1 revenue, up nearly 5x YoY. However, despite explosive top-line growth, the company posted a net loss of $314.6M in Q1.

Screenshot of CoreWeave’ Q1 2025 SEC Filing

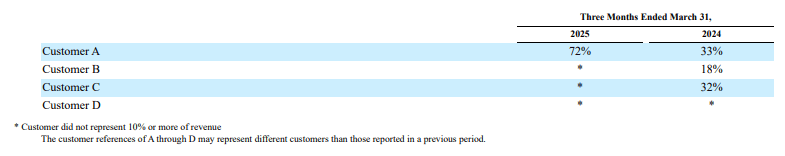

Moreover, Customer A made up 72% of revenue for the quarter – customer concentration is pretty high.

Significant Customers of CoreWeave (source: SEC Filing)

Its adjusted annualized run-rate loss is >$1B, and the business is heavily leveraged – $8.7B in net debt and over $3B in lease liabilities. The sharp increase in valuation since IPO (+299.25% YTD) seems to reflect AI market hype more than sustainable fundamentals.

If that momentum slows, so could CRWV’s stock-and with it, CORZ’s value in the deal.

3. Lack of Bitcoin Exposure

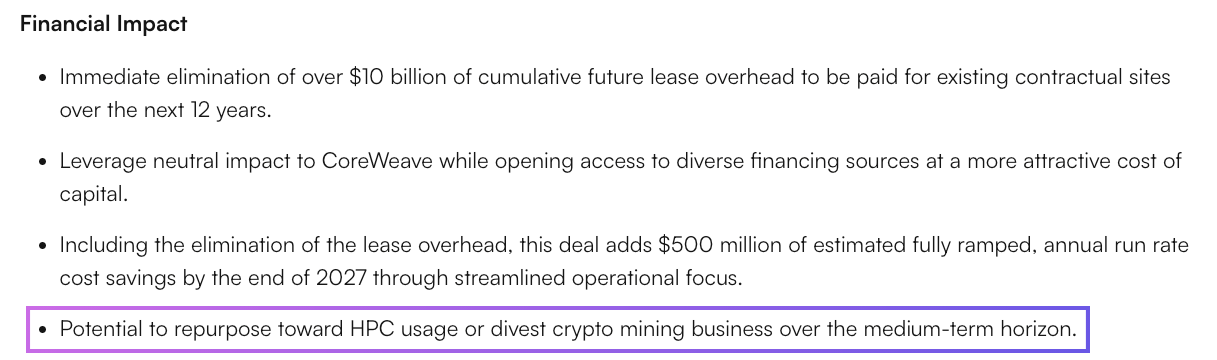

The biggest red flag for some investors: CoreWeave may pivot Core Scientificaway from Bitcoin mining. The press release hints at “repurposing” data centers for AI and HPC. For those wanting Bitcoin exposure, this deal feels more like an exit than a growth opportunity.

Screenshot from the Press Release

4. Is 13% Premium Enough?

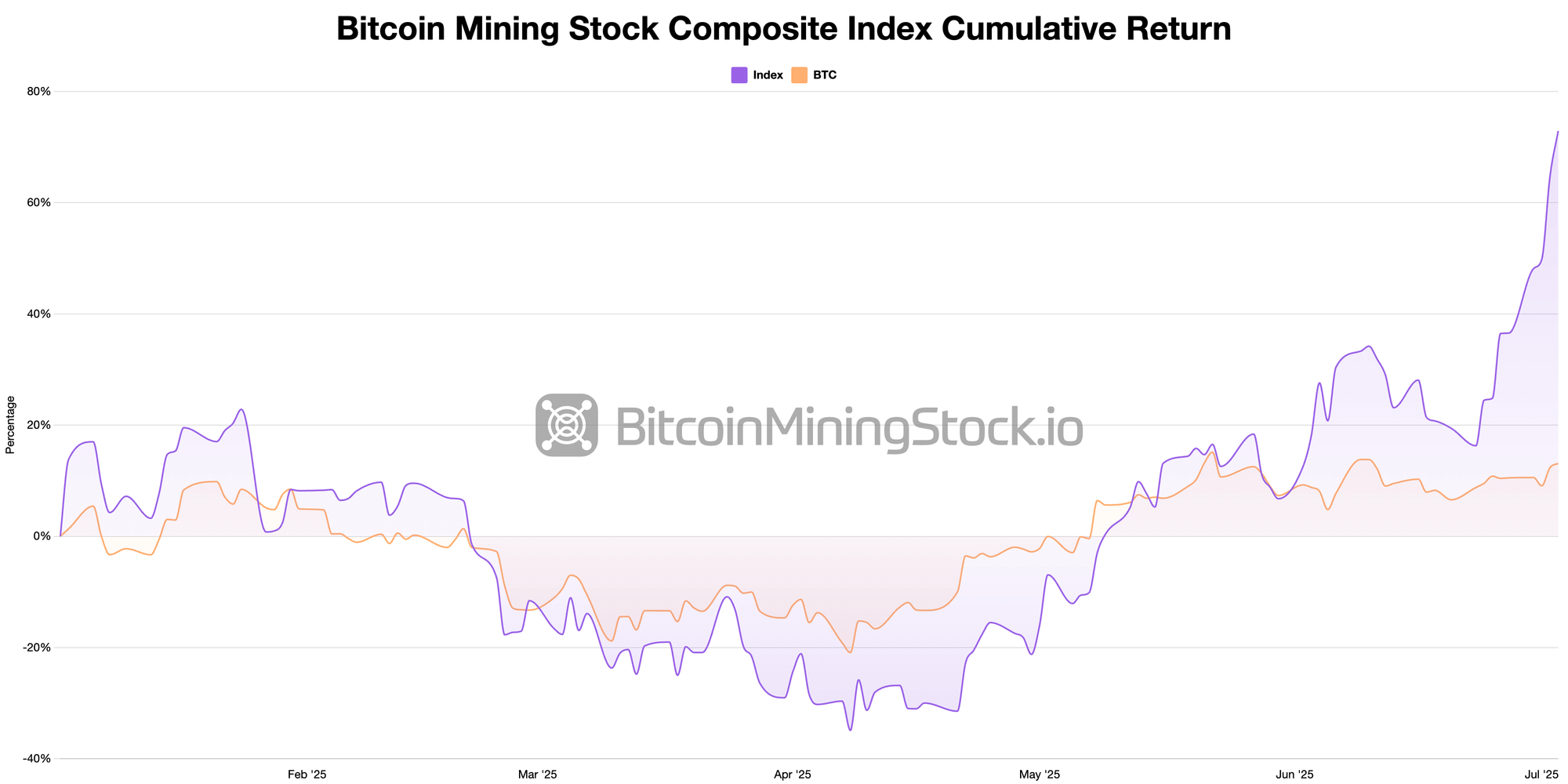

Recently the Bitcoin mining stock sector has been outperforming Bitcoin itself, with many mining stocks are gaining momentum. CORZ, one of the Industry leaders, may have more upside on its own than what this deal offers.

Bitcoin mining stocks (as a sector) have outperformed Bitcoin YTD. Source: Bitcoin Mining Stock Index

A 13.14% fixed upside over several months-while taking on CRWV’s volatility-just isn’t compelling enough for many.

Final Thoughts

From a business standpoint, the deal is logical – CoreWeave gains 1.3 GW of total gross power, deep operational expertise, and eliminates $10B in future lease obligations. It vertically integrates data center control, unlocking an estimated $500M in annual run-rate cost savings by 2027.

But the deal serves CoreWeave’s AI ambitions – not necessarily CORZ shareholders’ interest in Bitcoin mining.

With both boards approving and the strategic logic aligning for CoreWeave, the merger is likely to close in Q4 2025 pending regulatory and shareholder approvals. However, the all-stock structure, valuation dependency, and potential pivot away from Bitcoin mining likely explain the sell-the-newsreaction.

If the deal closes as structured, Core Scientific may become yet another crypto-native infrastructure player absorbed into the broader AI trend – reducing pure-play exposure in the public mining stock sector.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。