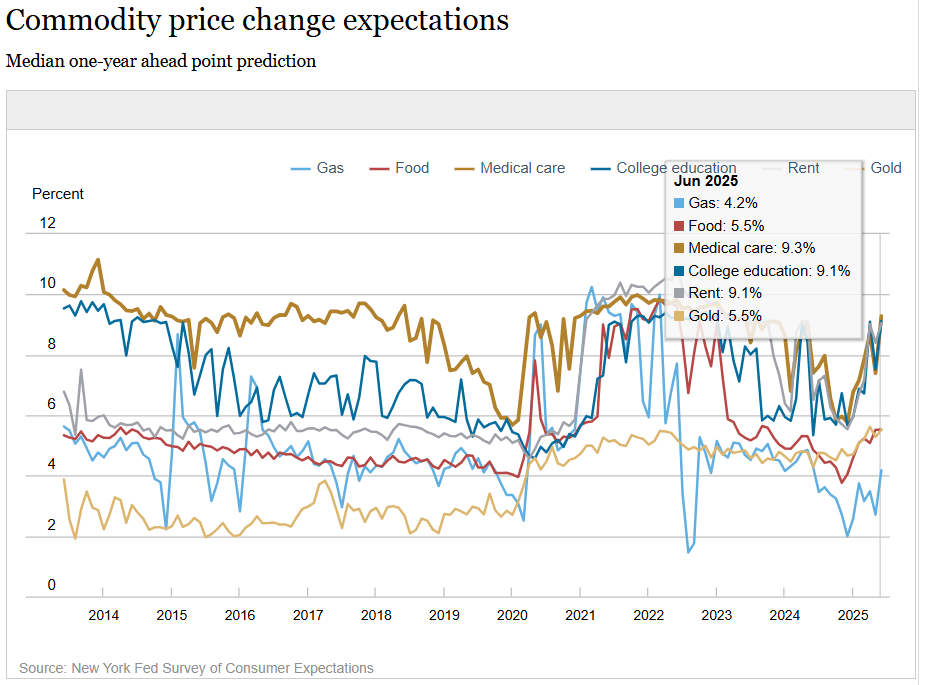

纽约联邦储备银行于周二发布的6月份消费者预期调查显示,美国人预计一年后的通胀率将约为3%,比5月份的调查预期低0.2%。在这一消息的影响下,比特币上涨了0.44%,整个上午都徘徊在10.8万美元左右。

3%的数字意味着美国人对通胀的预期已回到特朗普总统就职前的关税水平。根据消费者物价指数(CPI)测得的实际通胀率在5月份低于预期,为2.4%,但仍高于联邦储备目标的2%水平。

(美国人预计一年后的通胀率为3% / 纽约联邦储备)

特朗普的有争议的关税策略受到经济学家的强烈批评,他们预计在总统实际上发起全球贸易战后,价格将随之飙升。就在昨天,特朗普分享了发送给多个国家的信件副本,说明他们的进口税将于8月1日生效。这些信件在总统的社交媒体平台Truth Social上发布。

“我很高兴地宣布,来自世界各国的美国关税信件和/或交易将于7月7日(星期一)东部时间中午12:00开始发送,”总统写道。“感谢您对此事的关注!”

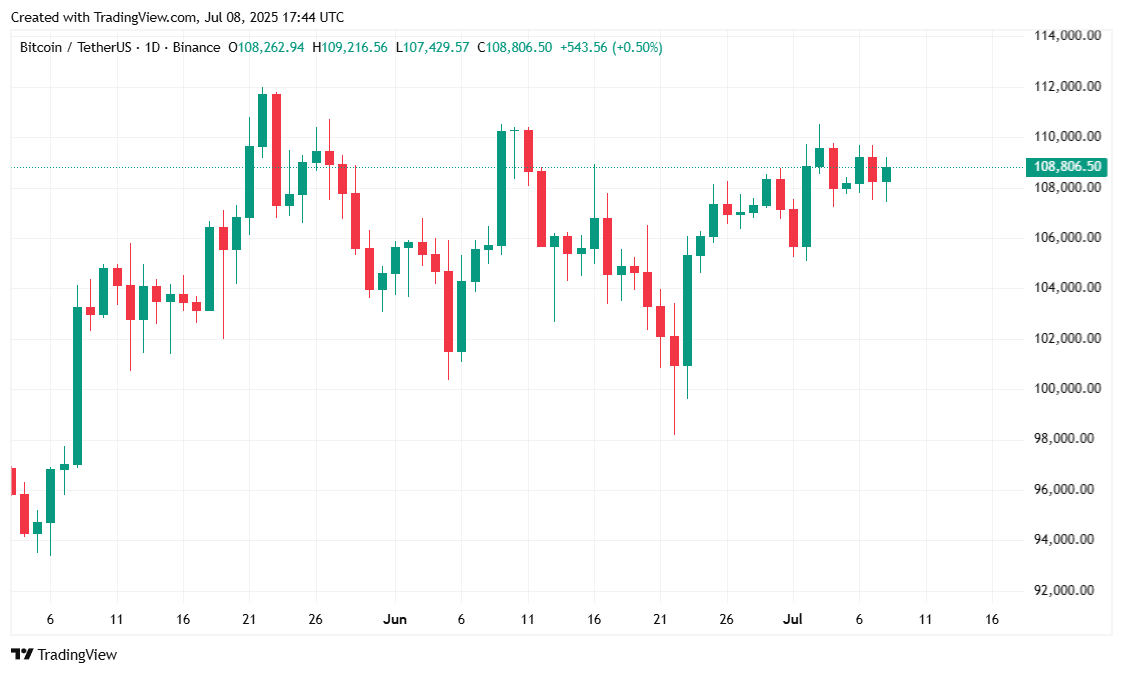

自昨天以来,比特币的价格在107,499.56美元和109,198.97美元之间波动,截至报道时交易价格为108,788.74美元。报价反映出24小时内约0.74%的温和升值,但根据Coinmarketcap,周价格上涨幅度显著更大,达2.41%。

(BTC价格 / Trading View)

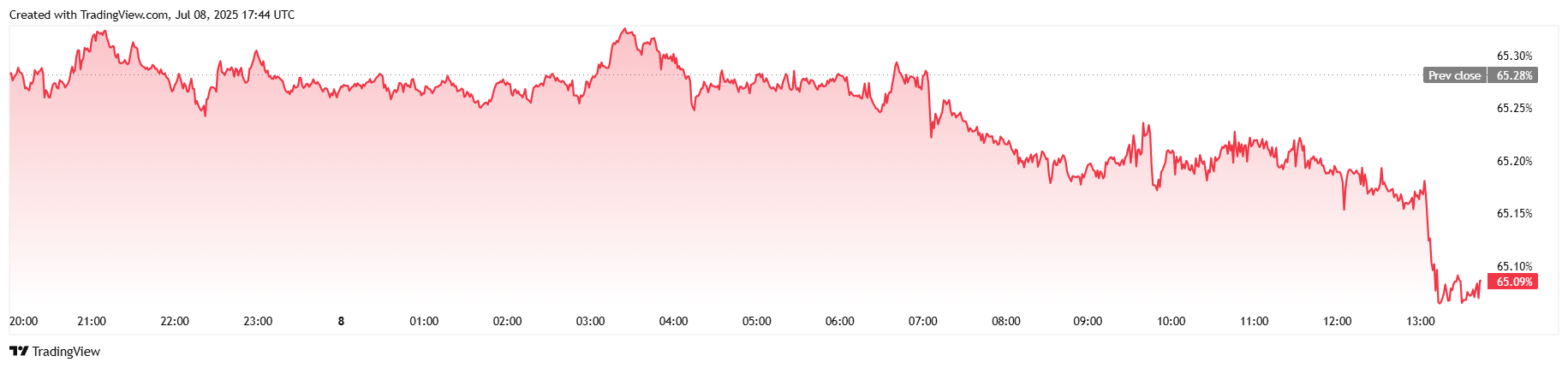

交易量基本持平,增加了0.50%,达到452亿美元。比特币的市值上涨了0.74%,达到2.16万亿美元,而BTC的主导地位下降了0.01%,降至65.09%。

(BTC主导地位 / Trading View)

开放的BTC期货合约总数也基本保持不变,自昨天以来下降了0.11%,降至739.7亿美元。24小时内的清算总额为3620万美元,多头遭受了约2023万美元的清算。持有空头头寸的空头被清算的金额为1597万美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。