Metaplanet Bitcoin Collateral Leverage Powers Digital Bank Plans

Strategic Asset for Growth

Japanese trading company Metaplanet is making headlines again as it took its entry in the second phase of its strong driven strategy.

Originally a Hotel operator, this Tokyo listed firm now plans to leverage its increasing its holdings to acquire revenue generating ventures.

Source: X

In an interview with Financial Times, Simon Gerovich, CEO has revealed the firm’s strategy to eventually Metaplanet virtual asset holdings into areas such as digital bankings.

From inflation hedge to acquisition tool

Metaplanet has started accumulating virtual asset in 2024 to hedge against inflation. Metaplanet began as a protective financial move that has now evolved into a long term growth strategy.

Yesterday the company added more virtual currency to reserve of around 2,204 for $237 million that means each Bitcoin was brought around $107,000. Currently, the firm holds 15,555 BTC and Gerovich aims to increase his current hold to 210,000 BTC by 2027 and roughly 1% of all, that will ever be in circulation.

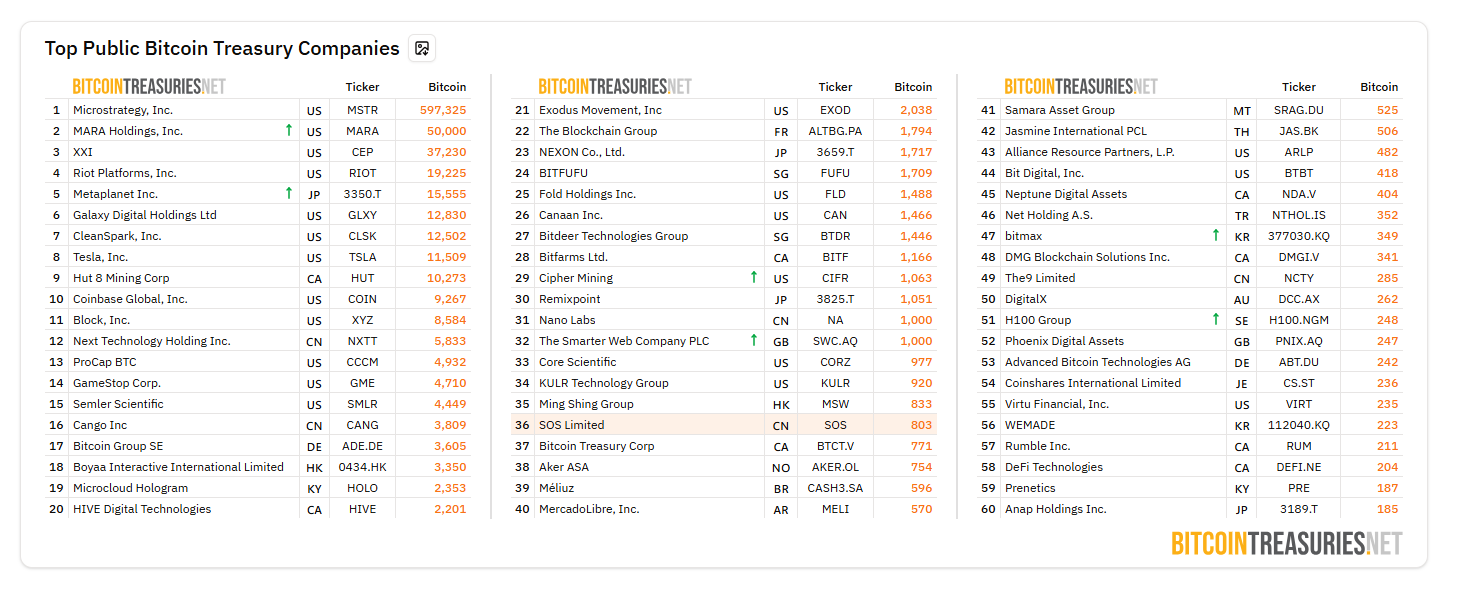

Source: Bitcoin Treasuries

Metaplanet stock has grown over 378% this year which raised the market cap above $7.08 billion. The firm goal is to use this digital gold as collateral to access funding, enabling the acquisition for gaining profits in businesses.

Metaplanet approach echoes Saylor’s model that owns 597,325 BTC with a market value topping $64.83billion.

Digital banking on the Radar

Metaplanet Bitcoin collateral leverage targets to acquire a digital bank in Japan , Gerovich believes such an acquisition would align perfectly with the company’s vision. He said “Maybe it is acquiring a digital bank in Japan and providing digital banking services that are superior to the services that retail can retail now is getting”.

While crypto backed loans are still a rarity in traditional financing and some global institutions like Standard Chartered and OKX are experimenting with using virtual assets as collateral which is marking a move in how the financial world perceives crypto.

Funding the future without debt pressure

Metaplanet is not planning to issue convertible debt to fund ambitions. Instead, Gerovich prefers issuing preferred shares as they offer flexibility without the burden of repayments tied to fluctuating share prices.

This move indicates the company’s cautious yet ambitious approach to growth that is using BTC not only as an asset but also as a financial tool to secure long term value.

Conclusion

Metaplanet Bitcoin collateral leverage latest acquisition of 2,204 BTC for $237 milli0n underscores its commitment to become a powerhouse of Bitcoin. Now, its BTC holding is around 15,555 and the company is drawing comparisons to MicroStrategy’s Bitcoin strategy .

As the market cap soars past $7 billion, the company’s antique path blends traditional business growth with a crypto foundation.

Also read: Ethereum Treasury Holdings Rise as Firms Embrace ETH免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。