On the 1-hour chart, XRP exhibits a sideways trend with a slight bullish inclination, oscillating between support at approximately $2.26 and resistance at $2.40. The recent price action reveals a bounce from the $2.26 level, with consolidation signaling indecision among short-term traders. A brief push towards $2.35 encountered seller resistance, while diminishing volume suggests a potential breakout is nearing. Key trading levels include a buy zone near $2.26 with a tight stop-loss around $2.24, and a profit target at $2.40, extending up to $2.50 should bullish momentum continue.

XRP/ USDT 1-hour chart via Binance on July 7, 2025.

The 4-hour chart indicates a medium-term recovery trend characterized by higher lows and periodic pullbacks. XRP has climbed from a recent low of $2.147 after peaking at $2.35, with the current price nearing previous highs amid a sequence of green candlesticks. A bullish engulfing pattern observed on July 6 signals renewed short-term buying pressure. Entry opportunities appear favorable around $2.24 to $2.26, with exit targets positioned near the $2.35 to $2.40 resistance band. Traders should monitor the $2.24 level closely, as a breakdown on volume could push the price back toward $2.20.

XRP/ USDT 4-hour chart via Binance on July 7, 2025.

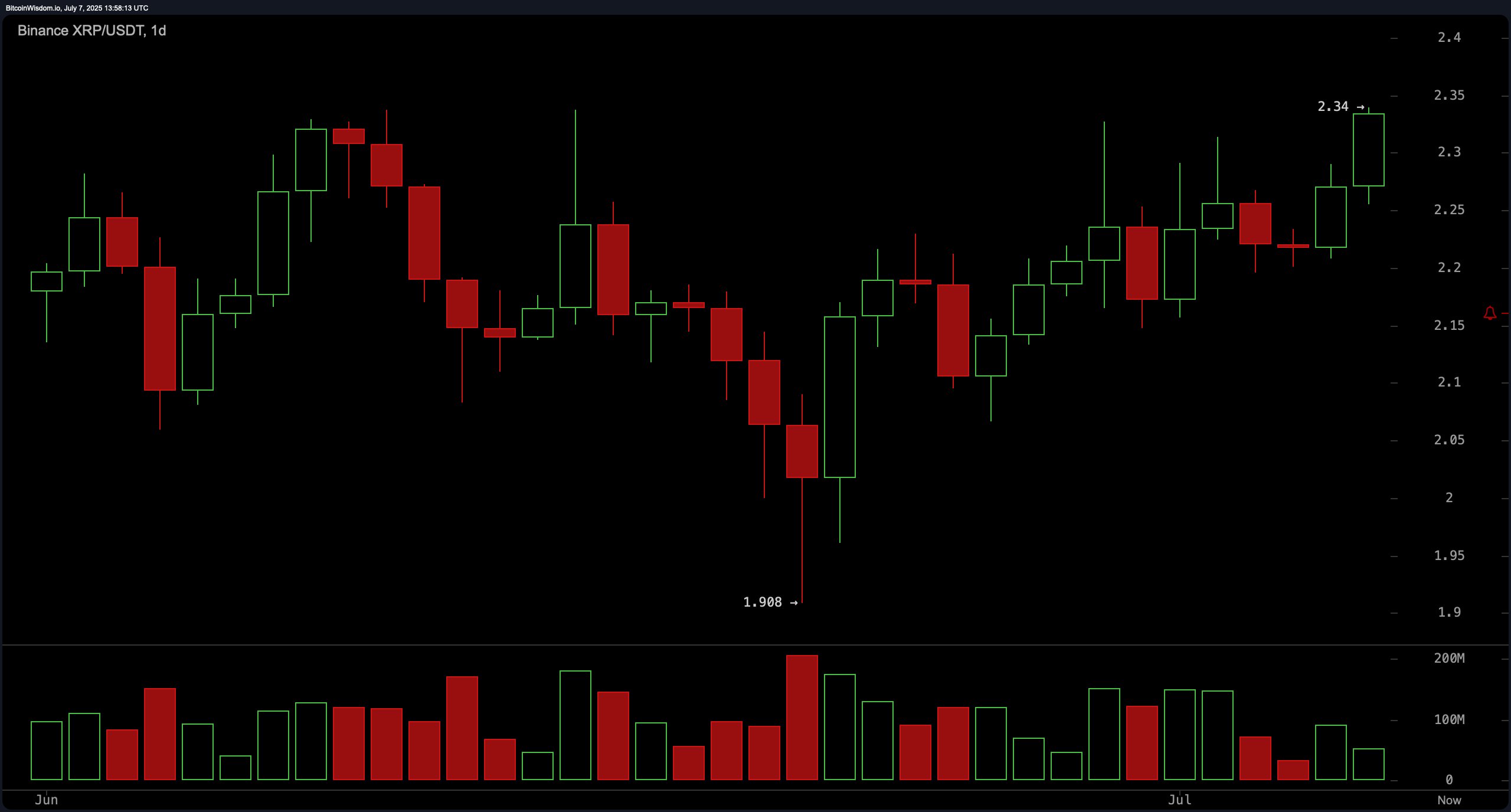

From a daily chart perspective, the longer-term outlook remains bullish following a rebound from a $1.908 low. XRP continues to form higher highs and higher lows, with price action pressing against the resistance band of $2.30 to $2.35. The support zone between $2.15 and $2.20 has held firm, offering a reliable base for potential accumulation. Bullish momentum persists, although traders are advised to be cautious as the price approaches the upper bounds of this resistance area. Pullbacks to the $2.20 to $2.22 zone are considered strong entry opportunities, with potential exits near $2.35 to $2.40.

XRP/ USDT daily chart via Binance on July 7, 2025.

Technical oscillators provide a neutral to cautiously optimistic view. The relative strength index (RSI) stands at 57.83, signaling neither overbought nor oversold conditions. The Stochastic oscillator is elevated at 81.80 but remains fairly neutral. The commodity channel index (CCI, 20) reads 129.03, reflecting modest bullish momentum without reaching extremes. The average directional index (ADX, 14) at 13.14 suggests that the current trend lacks strong directional strength. The Awesome oscillator at 0.06116 also indicates a neutral bias, while the momentum indicator has turned bearish with a value of 0.15075, contrasting the moving average convergence divergence (MACD, 12, 26), which signals positivity with a positive divergence of 0.01602.

Moving averages (MAs) strongly support a bullish bias across the board. All short- to mid-term averages signal buying strength: the exponential moving averages (EMAs) for 10, 20, 30, 50, 100, and 200 periods range from $2.23151 to $2.11108 and all reflect a bullish signal. Similarly, the simple moving averages (SMAs) across those same periods, ranging from $2.23007 to $2.20334, also signal positive reinforcement—except for the 200-period SMA, which is at $2.36083 and currently highlights bearishness. The overall moving average structure affirms sustained upward momentum, reinforcing the current bullish trend unless disrupted by significant market catalysts.

Bull Verdict:

XRP remains in a constructive bullish posture across all major timeframes, supported by a favorable alignment of moving averages and a continuation of higher highs and higher lows. Provided that support levels hold and volume increases on upward moves, a breakout above $2.30 could catalyze a push toward $2.35 or higher.

Bear Verdict:

Despite recent gains, XRP’s rally shows signs of exhaustion with resistance intensifying near $2.30 and momentum indicators revealing early weakness. If critical support at $2.24 fails, the price may revert to the $2.20–$2.15 range, threatening the bullish structure and exposing the market to a deeper correction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。