On July 3, multiple mainstream financial media confirmed that Peter Thiel is co-founding a new bank named Erebor with tech moguls Palmer Luckey and Joe Lonsdale, and has officially applied for a national bank charter with the Office of the Comptroller of the Currency (OCC). This bank aims to serve "cryptocurrency, AI, defense, and manufacturing startups that mainstream banks are unwilling to serve," attempting to become an alternative following the collapse of Silicon Valley Bank.

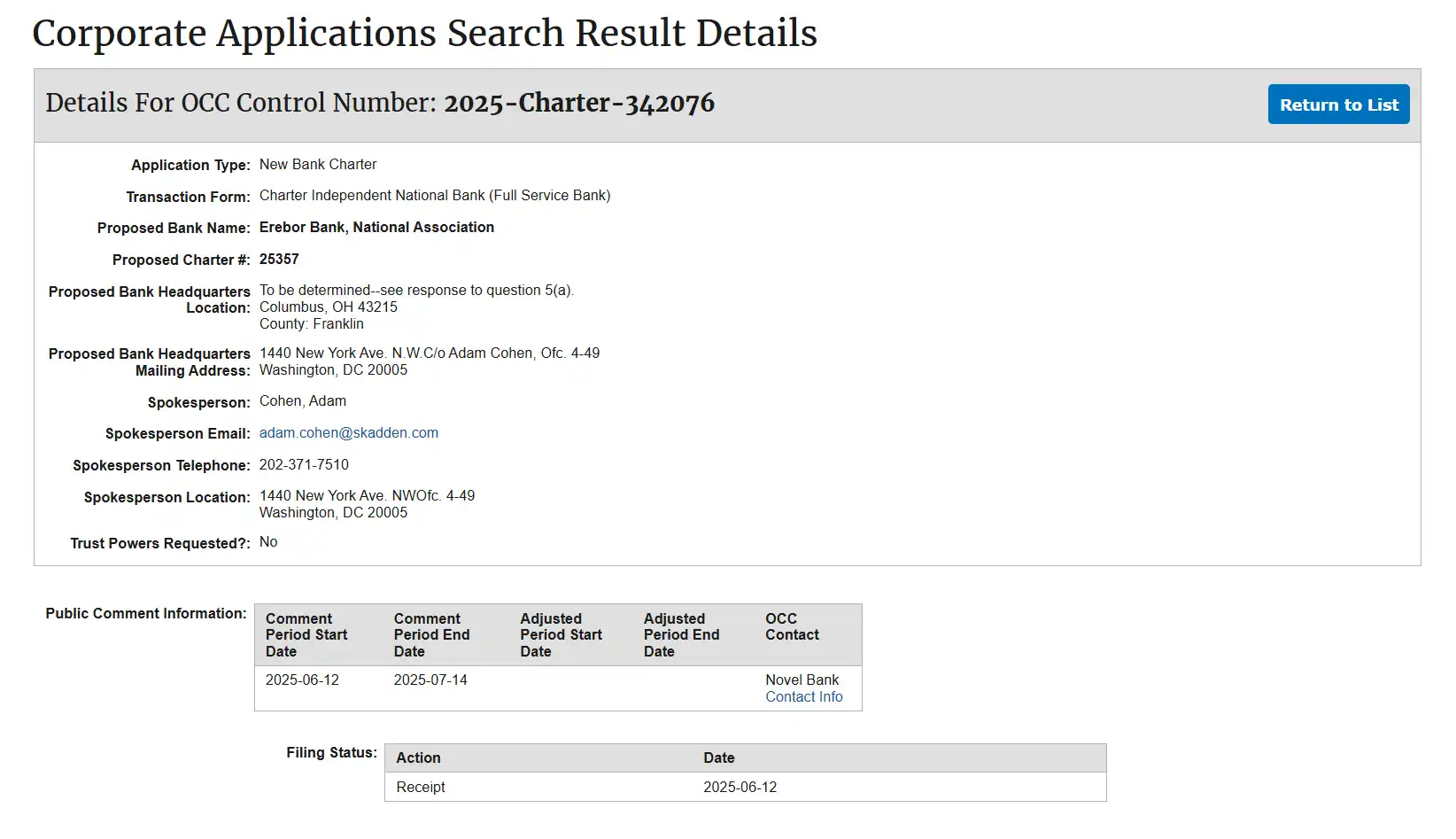

OCC discloses Erebor's application for a new bank charter

Who is behind "Lonely Mountain"?

In Tolkien's lore, Erebor, or "Lonely Mountain," is an underground kingdom established by dwarves, containing vast amounts of gold and treasure, later occupied by the dragon Smaug. Throughout the story of "The Hobbit," the Lonely Mountain symbolizes not only wealth but also the struggle for order, sovereignty, and reconstruction.

The image of the seeing stone from the movie "The Lord of the Rings," and the Palantir logo

The name "Erebor" was chosen for this new bank not by chance. It continues Peter Thiel's consistent naming preference: his investment company Palantir, meaning "seeing stone," comes from "The Lord of the Rings," and includes Valar Ventures, corresponding to the "Valar," and Rivendell Capital, both references from Middle-earth.

The founders of this bank also exhibit a distinct "Silicon Valley political capital crossover" characteristic:

Peter Thiel (co-founder of PayPal and Palantir, leader of Founders Fund)

Palmer Luckey (founder of Oculus, co-founder of Anduril)

Joe Lonsdale (co-founder of Palantir, founder of 8VC)

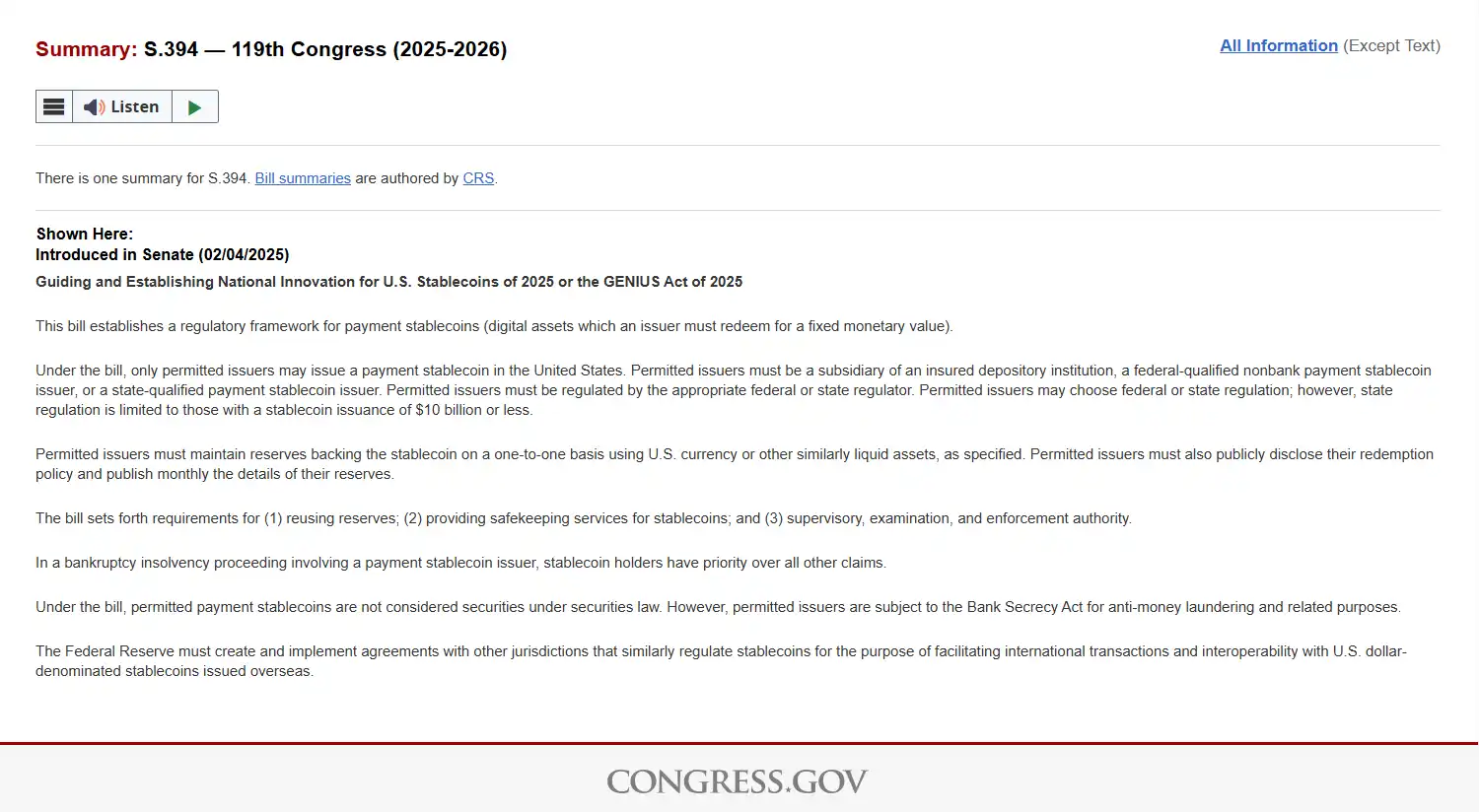

All three are significant political donors to Trump in the 2024 U.S. presidential election and are closely linked to the current Congress's advancing "GENIUS Act."

According to the application documents submitted by Erebor to the OCC, Founders Fund will participate as the main capital supporter, while the three founders will not engage in daily management but will intervene in the governance structure as board members. The bank's management will be led by former Circle advisors and the CEO of compliance software company Aer Compliance, aiming to clearly delineate the boundaries between politics and operations, highlighting its application as a institutionalized financial entity.

Under this multi-layered naming, capital, and political embedding, Erebor's establishment is not only a cultural symbol choice but also a signal—it hopes to be seen as a central asset in the new financial order, aligning with mainstream regulatory systems while retaining the independence of technological capital within institutional boundaries.

Related reading: "Silicon Valley Turns Right: Peter Thiel, A16Z, and the Political Ambitions of Cryptocurrency"

After SVB, Erebor rises again as Lonely Mountain

In March 2023, Silicon Valley Bank (SVB) declared bankruptcy due to asset mismatches and liquidity crises, becoming the second-largest bank failure in U.S. financial history. Following the incident, deposits from several crypto companies, including Circle, BlockFi, and Avalanche, were frozen, triggering systemic panic, with Bitcoin's price briefly falling below $20,000. The SVB incident marked a turning point in the fracture of Silicon Valley's financial ecosystem and prompted several founders of Erebor to initiate the independent bank plan.

SVB's assets were subsequently acquired by First Citizens, with some executives moving to HSBC USA, partially continuing their service capabilities. However, for many early-stage tech companies, the original account services, credit support, and risk tolerance mechanisms were difficult to replicate. Erebor's bank application documents clearly state that its target clients include "tech companies rejected by mainstream banks due to SVB's collapse," covering cryptocurrency companies (including trading, custody, and settlement), AI startups, defense tech companies, mid-to-high-end manufacturing startups, as well as their employees, investors, and foreign legal entities.

Unlike the SVB model, Erebor proposes to adopt a 1:1 reserve system and limit the loan-to-deposit ratio to below 50%, avoiding maturity mismatches and credit expansion risks. Its documents indicate that stablecoins will be one of its core businesses, with USDC, DAI, RLUSD, and others potentially within its custody scope, aiming to become "the most regulated stablecoin trading institution," providing fiat entry and exit channels and asset custody services under compliance.

Additionally, Erebor's three main founders—Palmer Luckey, Joe Lonsdale, and Peter Thiel—are all significant financial backers of Trump's 2024 campaign, having donated to various Republican political action committees. They have direct political connections with the core promoters of the "GENIUS Act," which gives the Erebor project clear institutional backing as the policy window opens. This "financial gap + policy expectations + high-risk clients" triad provides Erebor's application with realistic motivations and pathway designs.

S.394 - 2025 GENIUS Act

Crypto bank, Thiel's long-term plan

One of the most noteworthy forces behind Erebor is Founders Fund—a veteran venture capital firm led by Peter Thiel and one of the direct investors in this bank plan.

Peter Thiel and Founders Fund

Founded in 2005 by Peter Thiel, Ken Howery, and Luke Nosek, Founders Fund is one of the earliest venture capital firms in Silicon Valley to adopt "non-consensus investing" as a strategic direction. The fund's early investments include Facebook, SpaceX, Palantir, Stripe, Airbnb, and Lyft, leaving a significant mark in the Web2 and deep tech sectors.

Unlike most mainstream venture capital firms, Founders Fund explicitly advocates for "dystopian technological idealism," preferring to invest in areas where policies are not yet established and institutions are not yet formed, particularly in regulatory gray areas such as defense technology, artificial intelligence, biotechnology, and crypto assets.

In the crypto space, the fund has invested in Anchorage Digital (the first digital asset custody institution to receive a national bank charter), LayerZero, BitGo, Ramp Network, EigenLabs, and other infrastructure projects, representing a typical "institutional crossover" in the path of U.S. crypto financialization.

Founders Fund is also noted for its strong political stance. Founder Peter Thiel has long supported American conservatism, being a significant financial backer for Trump's 2016 and 2024 campaigns, while actively participating in anti-regulatory and anti-mainstream central bank discourse. The fund is not only a direct investor in Erebor but also a key intermediary facilitating its connection with the political groups behind the "GENIUS Act."

Erebor's emergence is seen as a financial hub extension of this network: it not only provides digital asset settlement and custody services but also seeks to legally onboard a batch of "emerging enterprise clients rejected by mainstream banks" under the federal institutional framework—many of which have long been supported by the Founders Fund system, including AI, defense, biotechnology, and the highly volatile crypto industry. Looking deeper, under the backdrop of the "GENIUS Act" and the new SEC chair's push for "stablecoin re-regulation," Erebor is likely to strive to become one of the first "dollar relay banks" to legally custody mainstream stablecoins like USDC and RLUSD, providing a federal clearing path for stablecoins.

This is not just the birth of a new bank; it resembles a "systemic construction" led by venture capital logic: Founders Fund is not betting on a financial institution but is establishing a controllable financial order interface, creating an independent, stable pivot that can traverse existing financial structures for its dominant technological empire system. If Erebor is granted a charter and operates smoothly, it could become the first financial platform built by venture capital, leveraging policy windows to serve "enterprises inside and outside institutional boundaries."

The competitive landscape and future challenges of crypto banks

Erebor faces significant competition. As the U.S. regulatory environment becomes clearer, the crypto industry is entering a new window of "compliance banking," with a variety of players accelerating their layouts:

Anchorage Digital is the first crypto custody institution to receive a national bank charter, focusing on government collaboration and institutional-level asset services;

Circle has applied for a trust bank charter, concentrating on USDC reserve custody and circulation clearing;

Ripple plans to leverage the RLUSD stablecoin to create a new cross-border settlement network while simultaneously applying for a federal bank charter;

Additionally, state-chartered trust banks like Custodia Bank and Paxos Trust are exploring stablecoin financial services linked to the dollar through different paths.

In contrast, Erebor's differentiation lies in its application for a full-function national bank charter, explicitly including "stablecoin trading and custody" in its main business scope. This inherently qualifies it for interstate operations and comprehensive compliance, expanding its client base beyond the digital asset industry to include AI, defense, biotechnology, and other "high-risk" customer groups viewed as such by traditional banks. Compared to Anchorage's focus on institutional custody, Erebor aims to create a "commercial banking platform" supporting crypto and high-tech enterprises; and compared to Circle and Ripple's B2B circulation market roles, Erebor seeks to establish a financial node with higher regulatory levels and entry barriers within the federal system.

In short, Erebor is not merely a "filler" in the crypto bank landscape; it is a "system-level sprint" striving to be distinct in license selection, asset structure, and target clients. In the future, it may not only compete for customer resources with other crypto banks but also deeply intertwine with the Federal Reserve-led payment system and stablecoin legislative processes, becoming one of the most symbolic attempts in this round of "digital dollar" institutional evolution.

Thiel's Erebor aims not just to help AI companies manage money; it seeks to become the "interface" of future finance—bridging traditional banks and crypto assets, as well as national regulation and technological autonomy.

If it succeeds, it will not only custody stablecoins—it will custody a portion of the future "digital power" pathways.

After all, in Middle-earth, dwarves can indeed forge their own kingdoms.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。