According to Glassnode, long-term holders (LTHs) are defined as investors who have held bitcoin (BTC) for at least 155 days. CoinDesk Research indicates that one reason bitcoin has ye to reach new all-time highs has been selling pressure from these long-term holders.

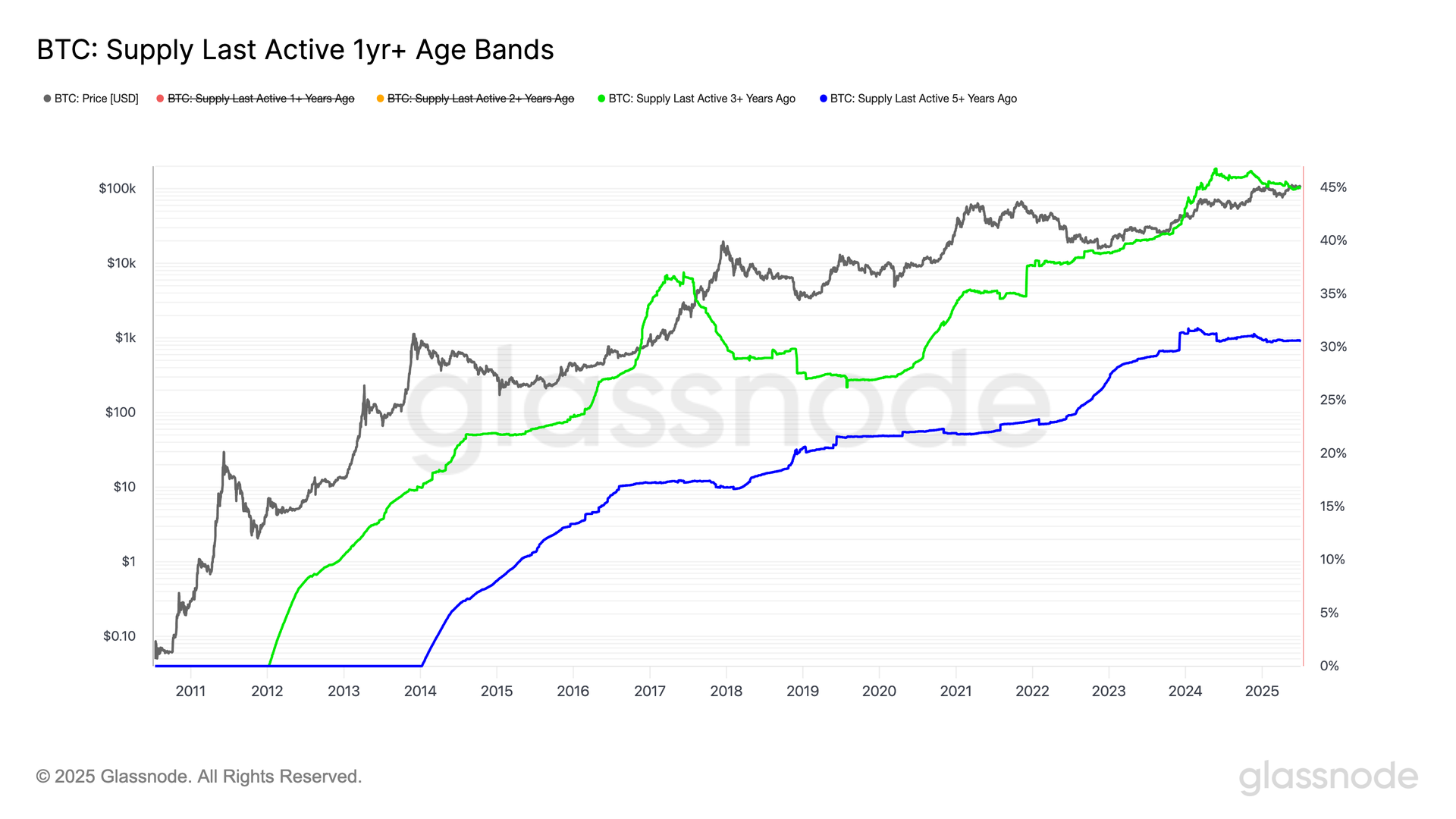

However, zooming out, Glassnode data shows that the percentage of bitcoin’s circulating supply that has not moved in at least three years currently stands at 45%, which is the same level observed in February 2024, one month after the launch of the US exchange-traded fund.

Three years ago, in July 2022, the market was in the midst of the leverage crisis triggered by the collapse of 3AC and Celsius during the last bear market, when bitcoin was priced at $20,000, which shows the conviction of LTHs.

Meanwhile, the share of circulating supply that has not moved in at least five years is at 30% and has remained flat since May 2024.

So, even though long-term holders are selling, as they typically do when prices climb higher, these data points suggest that the broader cohort has not significantly changed its aggregate behavior for over a year now, implying that many are waiting for higher prices before making further moves.

Read more: Bitcoin Whales Wake Up From 14-Year Slumber to Move Over $2B of BTC

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。