加密市场对特朗普关税升级的反应

特朗普对100个国家征收10%的关税

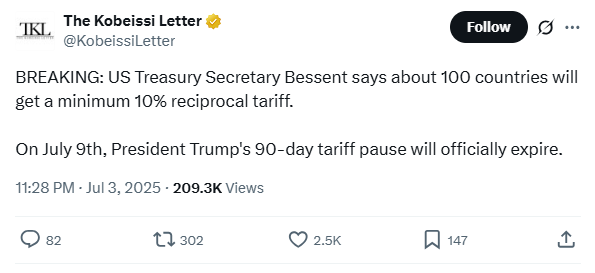

根据科贝西信的消息,美国财政部长贝森特确认,约100个国家将很快面临至少10%的对等税。

来源:X

这一公告将在7月9日特朗普总统的90天税收暂停正式到期之前发布。这一强硬举措不仅引发了全球的关注,还推动了一波新的贸易关税新闻,使市场保持紧张。

随着截止日期的临近,专家认为许多交易将无法完成,为未来几天的不确定决策和激烈竞争奠定了基础。

对加密货币的影响?

特朗普提议对近100个国家征收10%的税,不仅仅是另一项进口关税,它对加密市场也有深远的影响。

地缘政治紧张局势和贸易关税新闻造成了经济不确定性,这促使投资者转向比特币(BTC)或稳定币等替代品。专家建议,如果税收扰乱传统市场,加密货币可能会成为对抗疲软法定货币的对冲工具。

然而,加密货币也可能面临逆风,作为对特朗普强硬立场的回应,一些政府可能会加强金融监管,特别是在跨境数字资产流动方面。这可能导致加密公司面临更慢的增长。

依赖全球硬件或国际人才的区块链公司可能会看到成本上升。贸易关税新闻的任何干扰都可能延迟基础设施的发展。因此,尽管加密货币在短期内可能受益,但它仍然与未来几周这一进口关税的演变紧密相关。

限制与责任:专家指导

根据Coin Gabbar分析师的说法,在截止日期之前只会取得有限的进展。他们的报告建议,一些快速交易可能有助于避免美国的尴尬,但不会减少通过持续新闻上升的整体僵化。

最可能的结果似乎是一些非常有限的协议组合,他们指出:“这将允许美国在不失面子的情况下授予进一步的延期。”但由于特朗普的不确定性,新的贸易关税新闻可能随时爆发,重塑全球市场格局。

欧盟坚守立场

欧盟没有表现出退缩的迹象。作为一个主要的交易参与者,代表着25%的美国出口,欧盟拒绝受到紧迫截止日期的影响。他们的立场只增加了近期税收头条的分量。

欧盟领导人专注于长期政策,而不是短期政治策略。他们的坚定立场反映了全球交易动态的更广泛变化,各国保持自己的权力,而不是对最新的贸易关税新闻做出反应。欧洲人的这种抵抗可能会影响其他国家也保持坚定,从而减缓当前交易僵局的快速解决。

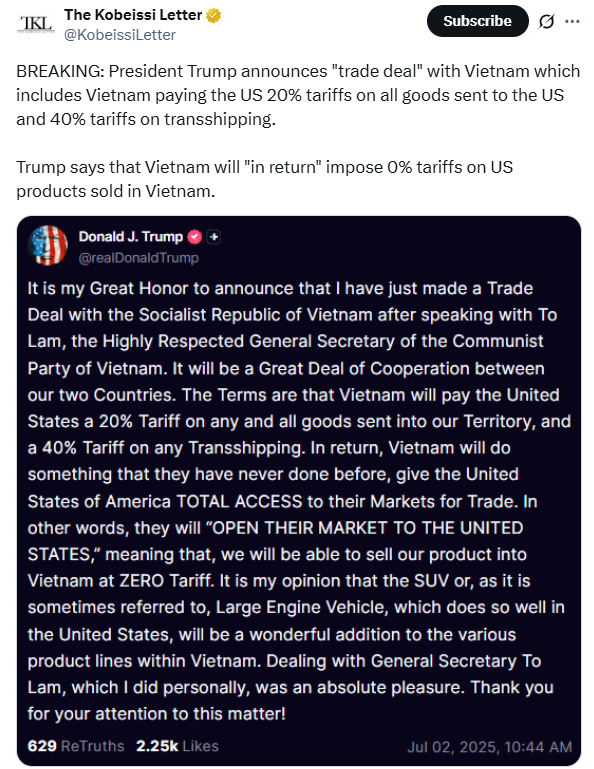

此外,特朗普宣布与美国-越南达成协议,关税设定在20%-40%,对通过其他国家运输到达美国的任何商品征收关税。

来源:X

法律挑战动摇特朗普的关税策略

在5月,美国国际贸易法院裁定特朗普的大部分税收是非法的。虽然联邦上诉法院暂时恢复了这些税收,但此案引发了更多的贸易关税新闻和法律复杂性。这些法律冲突为已经紧张的环境增添了新的不确定性。

企业不确定是应该为新的税收做准备,还是希望有裁决推翻最近的政策,这使得贸易关税新闻成为全球市场的日常关注。

企业和投资者 - 等待观察

从进口商到出口商,全球各地的公司现在都在因尚未解决的贸易关税新闻而暂停计划。成本上升、发货延迟和不可预测的关税迫使企业重新考虑战略。

加密公司也在密切关注。从矿机设备到远程工作的软件条款,任何来自此的干扰都可能影响运营、融资和全球扩展计划。发展中市场的公司尤其脆弱,缺乏快速适应的资源。这使得税收相关决策迫在眉睫,全球商业气候变得更加脆弱。

结论

随着7月9日截止日期的临近和10%税收威胁的确认,全球市场依然紧张。最新的贸易关税新闻正在重塑各国、企业甚至加密用户为未来做准备的方式。显然,这只是全球交易的初始阶段。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。