Content Editor: Peter_Techub News

U.S. President Trump announced that starting August 1, 2025, he will impose tariffs ranging from 10% to 70% on 10 to 12 countries, officially notifying the relevant countries through a letter on July 4. This move aligns with Trump's consistent trade protection policy and may have far-reaching effects on global trade, capital markets, and the cryptocurrency sector.

Tariff Policy Triggers Market Uncertainty

Trump's tariff measures target countries that have failed to reach trade agreements with the U.S., with rates varying from 10% to 70%, although the specific list of countries has yet to be released. These countries will learn more about Trump's tariff policy details in April 2025. This action could exacerbate global market volatility, affect currency valuations, and put pressure on international trade relations.

Market uncertainty often stimulates speculative behavior, especially in the cryptocurrency market. For instance, digital currencies like Bitcoin and Ethereum have frequently experienced price fluctuations during past trade tensions. According to a June 2025 study on tariffs across U.S. states, similar policies could lead to turmoil in financial markets, which would, in turn, impact cryptocurrency trading.

Trump has stated, "If the U.S. cannot reach an agreement with any company or country, we will impose tariffs." This statement further underscores his hardline trade stance.

Potential Connection Between Cryptocurrency Market and Tariffs

Historically, trade tensions have had an indirect impact on the cryptocurrency market. For example, during the U.S.-China trade war from 2018 to 2020, the prices of Bitcoin and Ethereum fluctuated frequently due to market uncertainty, with investors often using digital currencies as a hedge against risks in traditional financial markets.

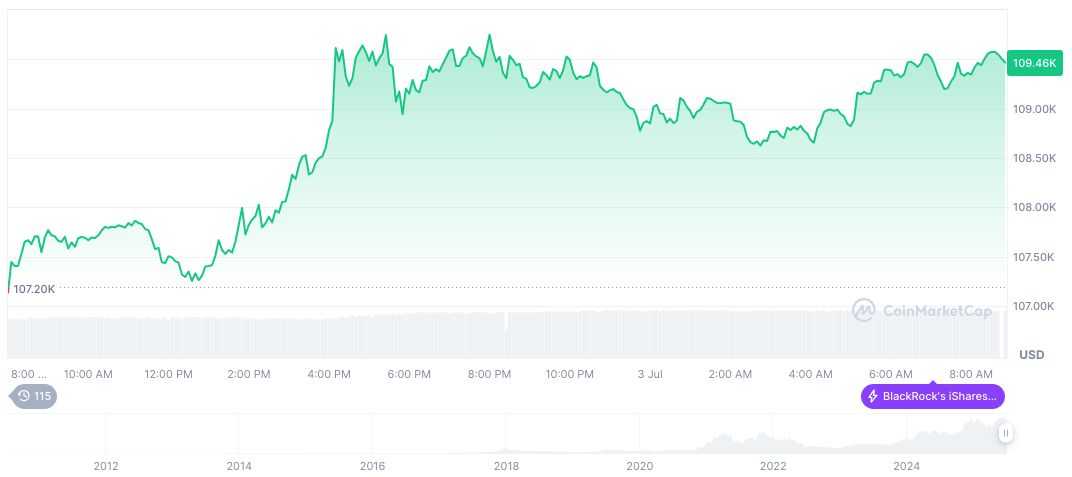

According to CoinMarketCap data, as of July 4, 2025, 05:20 (UTC), the price of Bitcoin (BTC) is $109,175.02, with a total market capitalization of $2.17 trillion, maintaining a market share of 64.47%. The trading volume in the past 24 hours has decreased by 11.14%, to $48.77 billion.

The Coincu research team analyzed that the tariff policy may indirectly affect the cryptocurrency market through pressure on traditional financial markets. Historical experience indicates that during macroeconomic turmoil, digital currencies are often used as a hedging strategy, potentially intensifying trading volume and price fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。