Original | Odaily Planet Daily (@OdailyChina)

Who would have thought that the traditionally antagonistic traditional finance and crypto industries would enter a phase of intertwining honeymoon over the past two months? On one hand, the tokenization process of traditional financial stocks has accelerated, with compliant platforms like Robinhood and Coinbase joining in, and on-chain US stock platforms emerging like mushrooms after rain. Crypto investors may also need to transition from "speculating on altcoins" to "speculating on US stocks" in the future.

On the other hand, a crypto bull market is also unfolding in the US stock market, with announcements from US-listed companies regarding crypto asset treasury strategies, crypto companies going public in the US, and traditional companies transitioning to crypto all triggering stock price increases. “The US stock market is willing to pay more than $2 for a $1 crypto asset,” Bloomberg columnist Matt Levine described the frenzy of US stock investors towards crypto concept stocks.

However, for both crypto investors and US stock investors, one thing is now common: finding high-potential value crypto US stocks. This round of structural bull market for crypto US stocks has just begun, with market attention still focused on topics with short-term popularity such as “well-known US stocks” and “crypto asset treasury listed companies,” while those truly compliant companies engaging in crypto business and rising in the US stock market remain relatively unknown.

Odaily Planet Daily will introduce a US-listed company that has transformed from an automotive service provider to the world's second-largest Bitcoin mining company—Cango (Cango Inc.). As Robinhood CEO Vlad Tenev stated at a press conference held in the film capital of the world, Cannes, “It’s time to shift from Bitcoin and meme coins to real-world assets with actual utility.”

Cango Inc. is that hidden gem beneath the surface; let’s dig it out.

### 1. Despite the Large Transformation, Cango is Serious

Cango Inc. (NYSE: CANG) was established in 2010 and successfully listed on the New York Stock Exchange in 2018. Cango had been deeply involved in the automotive industry for many years, exploring various areas from automotive finance to vehicle trading and even new energy vehicle manufacturing, and had even strategically invested in Li Auto. However, this well-established automotive company announced in November 2024 that it would fully enter the crypto industry to engage in Bitcoin mining, retaining only its operation of the online international used car export platform AutoCango.com from its past automotive business.

Nowadays, it is not uncommon for Web2 companies to enter the crypto industry or announce crypto asset treasury strategies; for most of these companies, it is merely a “market value management behavior” to boost stock prices before facing bankruptcy. However, when Cango announced its entry into the crypto industry, the crypto market was still in the frenzy of meme coins, and crypto concept US stocks were not as favored by investors as they are today.

“Due to the deterioration of the credit environment caused by the pandemic and economic downturn, Cango began systematically considering business transformation as early as 2022. We have thoroughly researched many directions, from automotive finance to vehicle trading to new energy vehicle manufacturing, and finally entered the field of computing power mining. From the outside, the scale of transformation seems enormous, but the path we are on is still clear, step by step,” said Juliet Ye, Cango's IR head, when discussing the company's transformation.

Entering the Global Second Largest Mining Company, Aiming for Global First by Year-End

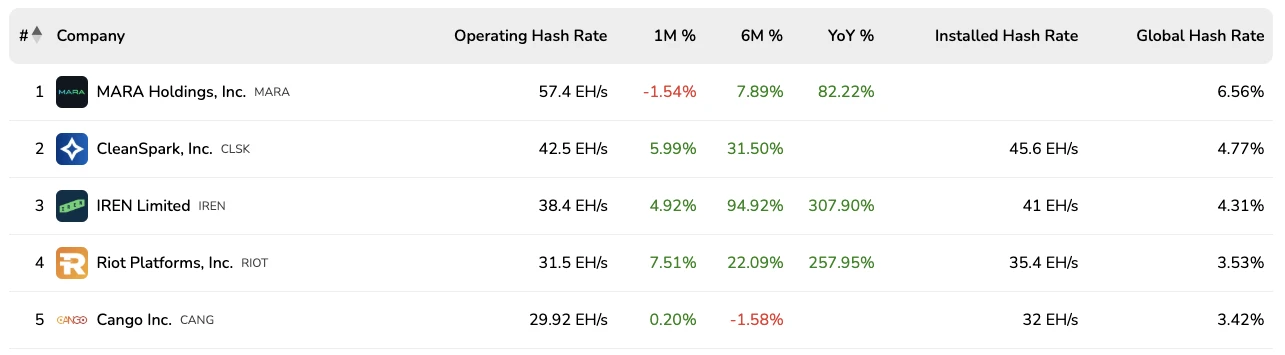

Cango's approach to entering the Bitcoin mining business is “cutting off the hand,” which is the biggest difference between it and those US-listed companies that only want to invest a small amount of capital to claim a transformation to crypto. On November 15, 2024, Cango acquired rack-mounted Bitcoin mining machines with a total computing power of 32EH/s from Bitmain for $256 million; on June 27, 2025, Cango acquired rack-mounted Bitcoin mining machines with a total computing power of 18EH/s from Golden TechGen for $144 million in equity. This acquisition brought Cango's computing power to 50EH/s, making it the second-largest mining company in the world, second only to MARA Holdings (57.4EH/s).

Before the acquisition was completed, Cango ranked fifth globally in computing power (data source: BitcoinMiningStock)

“Our plan is to increase another 10-15 EH/s by the end of 2025 to become the global leader,” Juliet Ye revealed Cango's future plans in mining to Odaily.

To better integrate into the Web3 industry and lead the company's strategic development, Cango also made significant changes at the management level. On May 27, Cango announced that it had sold its Chinese business for approximately $351.94 million to Ursalpha Digital Limited and underwent a major board restructuring, with four out of the original seven members leaving and two new directors added, namely Lin Yanjun, founding partner of blockchain and AI investment consulting firm IN Capital, and Lu Haitan, a professor of accounting and finance at the Hong Kong Polytechnic University.

In terms of equity, after the completion of the 18EH/s equity transaction, Cango founders Zhang Xiaojun and Lin Jiayuan's combined shareholding ratio dropped to 18.54%, and their voting rights fell to 12.07%; Golden GenTech holds 19.85% of Cango's shares and 12.92% of voting rights; while another key stakeholder, Enduring Wealth, holds 2.82% of Cango's shares but has a staggering 36.74% voting rights, thus truly controlling the company. Enduring Wealth Capital is a financial planning and investment management service company based in Singapore, and its partner Andrea Dal Mas has been deeply involved in blockchain for many years.

From spending high costs to quickly establish advantages in the mining industry to significantly introducing Web3 professionals into the company's decision-making, Cango has completed a comprehensive transformation into a Bitcoin mining company in less than a year, reflecting both Cango's determination to transform and a sense of urgency.

“We are currently in this halving cycle, and time is money. We hope to acquire as much Bitcoin as possible with the lowest initial capital investment during this cycle to prepare for expanding into the upstream and downstream of the digital economy ecosystem in the next cycle,” Juliet Ye explained the strategic considerations behind the company's rapid transformation without building its own mining sites.

A New Type of Bitcoin Treasury Company: Implementing a Bitcoin "Mine and Hold" Strategy

A Bitcoin mining company publicly stating that “it will acquire as much Bitcoin as possible” is also a fresh concept for the market.

Bitcoin mining companies have historically been in a position of being “loved and hated” by investors. On one hand, miners play a crucial role in maintaining the security and operation of the Bitcoin network, but on the other hand, miners also represent a significant potential selling pressure in the market. The strategy of “mine, withdraw, and sell” has been the norm for most mining companies, especially when Bitcoin is in a downward cycle or when prices approach the “shutdown price” for mining companies, leading to further downward pressure on Bitcoin prices.

However, unlike these “going with the flow” mining companies, Cango has explicitly stated that it will implement a Bitcoin “mine and hold” strategy similar to a Bitcoin treasury strategy, meaning Cango will not choose to sell the Bitcoin mined from its mining machines on the market but will hold it long-term.

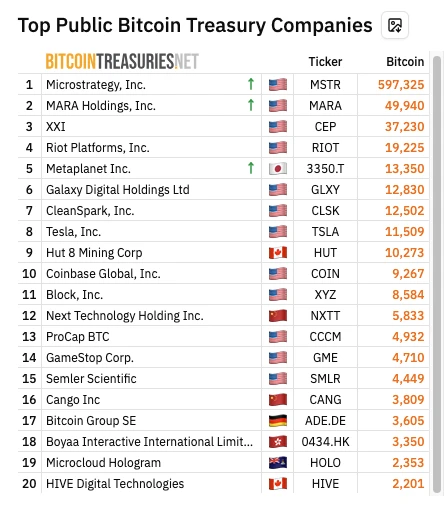

According to Cango's Q1 2025 earnings report, total revenue for the first quarter was $145.2 million, of which the BTC mining business generated $144.2 million in revenue. Given that Cango implements a “mine and hold” strategy, it also reduced the selling pressure of Bitcoin worth $144.2 million in the first quarter. As disclosed by Cango on June 27, it holds a total of 3,809.1 Bitcoins, valued at over $416 million. According to data from BitcoinTreasuries.net, Cango's Bitcoin holdings rank 16th among publicly listed companies.

Ranking of publicly listed companies by Bitcoin holdings

The “mine and hold” strategy makes Cango a new type of Bitcoin treasury company, not only supported by actual crypto business but also continuously increasing its Bitcoin holdings daily. Although Cango does not create buying pressure for Bitcoin in the public market, it reduces market selling pressure from the “supply side.” Based on Cango's current computing power of 50EH/s, if the total network computing power is 900EH/s, Cango could produce approximately 9,125 BTC in a year, valued at over $912 million. It is believed that as Cango's computing power and industry position improve, this strategy will also be adopted by other mining companies.

Of course, the “mine and hold” strategy does not mean never selling. “We do not mechanically execute ‘never sell’; instead, we have established a three-tiered selling trigger mechanism. First, when the Bitcoin price exceeds $150,000, we may gradually reduce our holdings to lock in some profits for our shareholders and investors; second, to address liquidity needs, such as for computing power expansion or debt repayment, but we will prioritize financing through collateralized holdings; third, in the event of a black swan event. All contingency plans have been incorporated into a dynamic risk control model,” Juliet Ye stated when discussing whether Cango would sell Bitcoin.

At the same time, because Cango is increasing its Bitcoin holdings through mining, its Bitcoin cost is also sufficiently low. According to Cango's Q1 2025 earnings report, its average Bitcoin mining cost is $70,602.1, lower than Strategy's average of $70,982 per coin. Additionally, with Cango's current cash and cash equivalents reserve valued at $347 million and the $351.94 million revenue from the divestment of traditional business, the company has ample cash flow without needing to maintain operations by selling coins like other mining companies.

### 2. Competitive Mining Business, Entering Green Energy

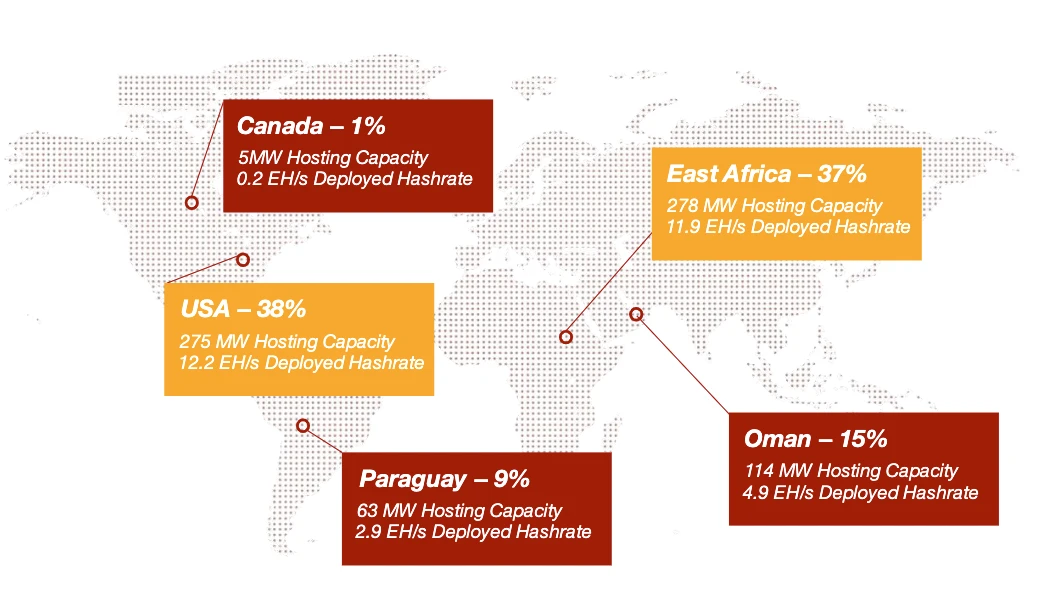

As a Web2 company, Cango is no longer young, but as a Bitcoin mining company that just entered the industry in November 2024, it is like a newborn compared to other listed mining companies. Currently, Cango primarily deploys its mining operations in North America, the Middle East, South America, and East Africa. Although Cango has only recently started its Bitcoin mining business, it has already become the second largest in the world in terms of computing power, and in other aspects, it is not inferior to well-known mining companies.

In terms of Bitcoin holdings, Cango ranks sixth with 3,809.1 Bitcoins, while MARA Holdings ranks first with 49,940 Bitcoins. However, since Cango only began mining in November 2024, it is not reasonable to compare total holdings alone. Before completing the acquisition of 18EH/s computing power in Q1 2025, Cango had over 136,000 rack-mounted mining machines, with a total computing power of 32EH/s, ranking behind MARA Holdings (54.3EH/s), CleanSpark (42.4EH/s), and Riot Platforms (33.7EH/s), but ahead of Core Scientific (18EH/s).

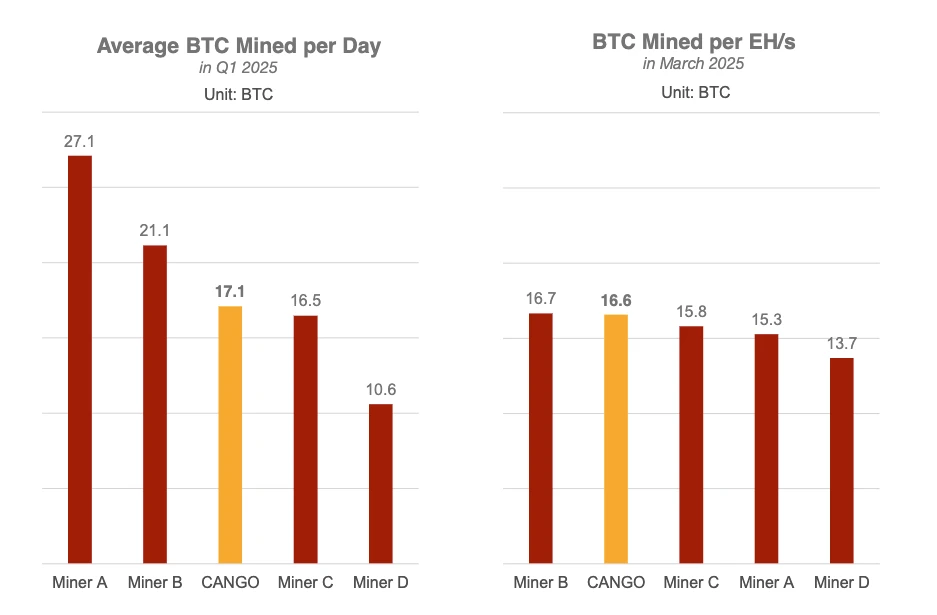

As shown in the figure below, in Q1 2025, Cango's average daily Bitcoin production ranked third, and its Bitcoin production per EH/s ranked second, placing it among the top in efficiency among Bitcoin mining companies. With the completion of the 18EH/s computing power acquisition and the improvement of infrastructure, Cango's various indicators will also improve in Q2 2025.

Average daily Bitcoin production and Bitcoin production per EH/s comparison for Q1 2025 (A, B, C, D represent MARA Holding, CleanSpark, Riot Platforms, and Core Scientific respectively)

In mining, beyond improvements in efficiency and computing power, Cango has even greater ambitions. “In fact, ‘energy + computing power’ is our true transformation direction. Striving to become the world's number one mining company is one aspect; on the other hand, from an energy perspective, Cango will deepen its green energy transformation, promoting the upgrade of Bitcoin mining from a high-energy consumption model to a sustainable paradigm. Through self-built green electricity and energy storage integrated projects, the company plans to achieve 100% green electricity mining and ‘zero-cost’ mining in the future,” Juliet Ye explained Cango's core competitiveness in mining and energy to Odaily.

In 2021, the domestic Bitcoin mining business was completely halted, partly due to its huge energy consumption, which was inconsistent with carbon reduction goals. In the future, if Cango successfully achieves pure green electricity mining, it may have the opportunity to restart this core Bitcoin industry domestically against the backdrop of accelerating global regulatory acceptance of the crypto industry.

Cango's global computing power distribution

The Undervalued CANG

CANG is Cango's stock code on the New York Stock Exchange. According to TradingView data, CANG's historical highest price was $14.2, and its current market capitalization is $540 million, ranking 14th among Bitcoin mining companies (excluding Galaxy).

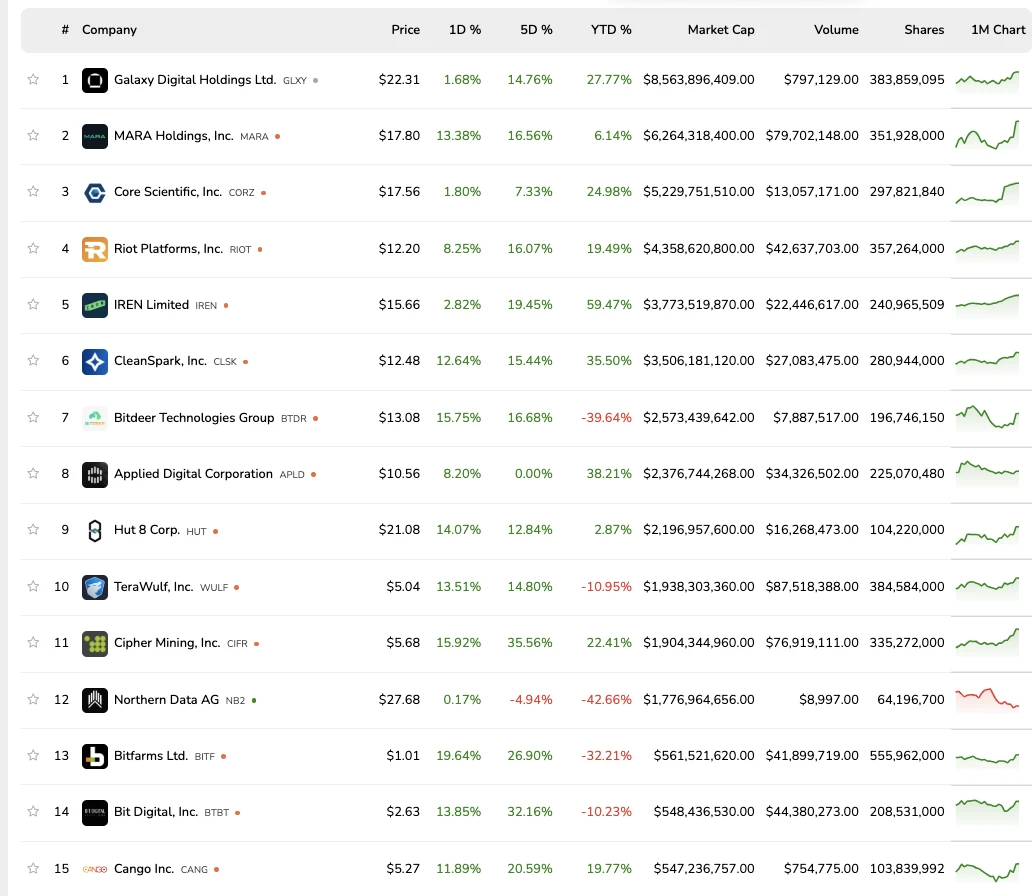

Data source: BitcoinMiningStock

Since Cango announced its entry into the Bitcoin mining business in November 2024, its stock price has indeed been in a fluctuating upward trend, peaking at $8 in December 2024, after which the price began to oscillate. In June, influenced by management changes, equity sales, and the acquisition of 18EH/s computing power, Cango's stock price rose, with CANG increasing by over 14.32% in the past month. However, compared to other listed mining companies, CANG is still undervalued.

As shown in the figure above, MARA Holding has a market capitalization of $6.2 billion and ranks first globally with a computing power of 57.4EH/s; listed mining company Core Scientific has a market capitalization of $5.22 billion but only 18.1EH/s of computing power; Riot Platforms has a market capitalization of $4.358 billion with 31.5EH/s of computing power. Although there is no absolute relationship between computing power and company market capitalization, for Cango, which ranks second in computing power and sixth in Bitcoin holdings, a market capitalization of $540 million is indeed undervalued. Even after completing a stock issuance, the company's total market capitalization remains in the $800-900 million range.

However, as Cango's mining capacity continues to rise and its Bitcoin holdings increase, along with the return of the “value investment” concept brought by this wave of crypto US stock bull market, CANG may become a dark horse in the stock market.

### Will Cango Become the Next Strategy?

Thanks to the integration of crypto and US stocks, Bitcoin treasury listed companies and various altcoin treasury listed companies have emerged like mushrooms after rain, creating a mixed market where investors who lack time for research fall into the strange loop of “watching what it really does rather than what it says” and “looking for who is the next Strategy,” ultimately resulting in a liquidity exit window for capital.

The noisy market environment has also brought new problems for companies that are genuinely transforming to engage in crypto business, namely how to capture investors' attention. “If we take November of last year as a dividing point, before that, the biggest difficulty we faced was: where exactly to turn? After that, the major pain point is: telling my story to you.” Juliet Ye expressed the concerns faced by most Web2 companies transitioning to the crypto industry at this time.

Although Cango's transformation scale is large, it is important to note that before Strategy became the first Bitcoin treasury stock, its core business was commercial data analysis. Since announcing its “Bitcoin treasury” strategy, its stock price has increased by approximately 2,600%. So, under the guidance of the “energy + computing power” strategy, how will Cango, which is continuously expanding the possibilities of green electricity mining and also achieving the “Bitcoin treasury” strategy, perform in the future? We will wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。