In the fluctuating world of cryptocurrency, we have witnessed too many ups and downs, and often transparent promises are just slogans, with the community merely pawns caught in the ambitions of price.

On July 1, in Cannes, France.

At the ongoing EthCC stage, Ethereum developer Zak Cole made a shocking declaration:

“ETH to $10k isn’t a meme, it’s a requirement!”

Translated, this means that ETH rising to $10,000 is not a meme, but a requirement.

As soon as he finished speaking, he announced the establishment of the Ethereum Community Foundation (ECF), a self-proclaimed Ethereum community foundation that is community-based and vows to push ETH to new heights.

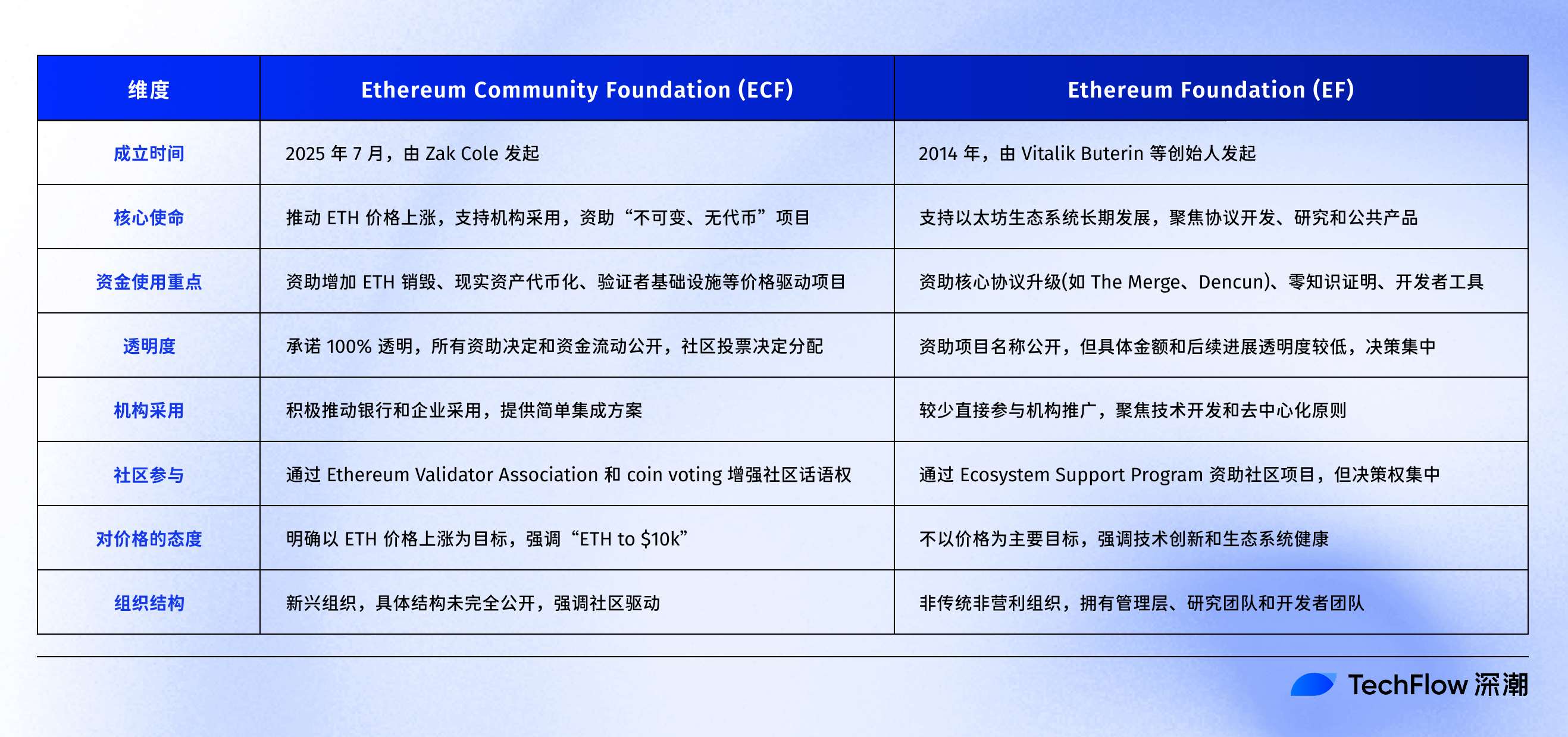

The name of this soon-to-be-established organization easily brings to mind the Ethereum Foundation (EF), which is only one word different but more official.

Subsequently, Zak Cole stated in his speech that:

“We say what the Ethereum Foundation (hereinafter referred to as EF) is unwilling to say and do what they are unwilling to do. We serve ETH holders because you deserve better. Our North Star, our token Ticker, is ETH.”

Applause and skepticism erupted simultaneously on the X platform; some cheered for this community awakening, while others mocked it as just another speculative gimmick.

Ethereum, the king that has nurtured DeFi, NFTs, and Layer 2 innovations, is facing a downturn in prices and pressure from competitors like Solana.

The Ethereum Foundation (EF), established 11 years ago, has promoted Ethereum's The Merge and Dencun technology upgrades but has also been criticized for high expenditures and alienating the community.

At this moment, shouting to serve the community and ETH holders, ECF's slogan is indeed timely, but saying and doing are completely different concepts.

What are the specific plans to push ETH to $10,000? What differences does it bring compared to EF?

Transparency and Empowerment

From the content of the on-site speech, ECF's goals are clear and aggressive: to raise ETH prices, accelerate institutional adoption, and empower the community.

In broad terms, it will first increase ETH burn through funding high-volume projects (such as tokenization of real assets), reducing circulating supply, and pushing ETH prices towards $10,000.

Secondly, ECF plans to provide easy Ethereum integration solutions for banks and enterprises, promoting Ethereum as a global settlement layer to attract traditional finance. Finally, it promises to give validators and the community more say in protocol development and funding allocation through the Ethereum Validator Association (EVA) and coin voting mechanisms.

In terms of specific strategies, ECF's execution revolves around those "immutable, non-token" projects.

It will prioritize funding high ETH consumption applications such as on-chain financial derivatives and real estate tokenization, ensuring that the EIP-1559 burn mechanism achieves maximum effect.

To attract institutions, ECF plans to collaborate with regulators to develop compliant on-chain solutions while investing in validator infrastructure, such as staking tools and node optimization, to enhance network security.

Moreover, transparency is its core selling point: all funding decisions will be made through community voting, and the flow of funds will be 100% public, striving to distinguish itself from the "black box operations" of the Ethereum Foundation (EF).

If he is incompetent, take his place

In "Romance of the Three Kingdoms," Liu Bei entrusted his son to Zhuge Liang at the White Emperor City, saying, “If my son is capable, then assist him; if he is incompetent, you may take his place.”

This means that if my son is not capable, you can directly take his place.

Ethereum in 2025 also stands at such a historical juncture.

The Ethereum Foundation (EF) seems like the incapable Liu Shan; will the Ethereum Community Foundation (ECF) be the loyal Zhuge Liang?

The combination of strategies mentioned above clearly targets the official Ethereum Foundation — Zak Cole's speech also hit on EF's pain points: price stagnation, community alienation, and competitive losses.

The Ethereum Foundation (EF) was once a beacon for Ethereum, but this year we have seen more negative discussions about it. EF is indeed mired in internal and external troubles, with high expenditures, centralized decision-making, and market failures leading to community grievances.

EF's expenditures in 2023 reached $134.9 million, funding mainnet upgrades, zero-knowledge proofs, and other projects, but it has been criticized for a lack of transparency.

The community has also questioned the Ecosystem Support Program for its lack of details on fund allocation and project progress, with decision-making concentrated in the hands of a few management members, contrary to the decentralized ethos.

In 2024, EF researchers Justin Drake and Dankrad Feist resigned due to controversies surrounding EigenLayer, further exposing issues of conflict of interest, with calls of "EF out of control" echoing on the X platform.

Internal restructuring and layoffs further highlight management difficulties.

In 2024, Ethereum's mainnet revenue significantly declined, with Layer 2 solutions (such as Arbitrum and Optimism) diverting transaction volume, and the burn effect of EIP-1559 weakened due to reduced mainnet activity.

ETH prices failed to outperform Solana in the 2024-2025 bull market, as the latter excelled in transaction speed and low fees, while Binance Smart Chain also diverted some DeFi traffic.

In terms of institutional adoption, EF's neutral stance has slowed Ethereum's expansion in traditional finance, far behind Solana's collaborations with enterprises.

The community's disappointment has also paved the way for ECF's emergence today.

The Serial Entrepreneur Zak

While human efforts are important, whether ECF can bring ETH to $10,000 ultimately depends on the people involved.

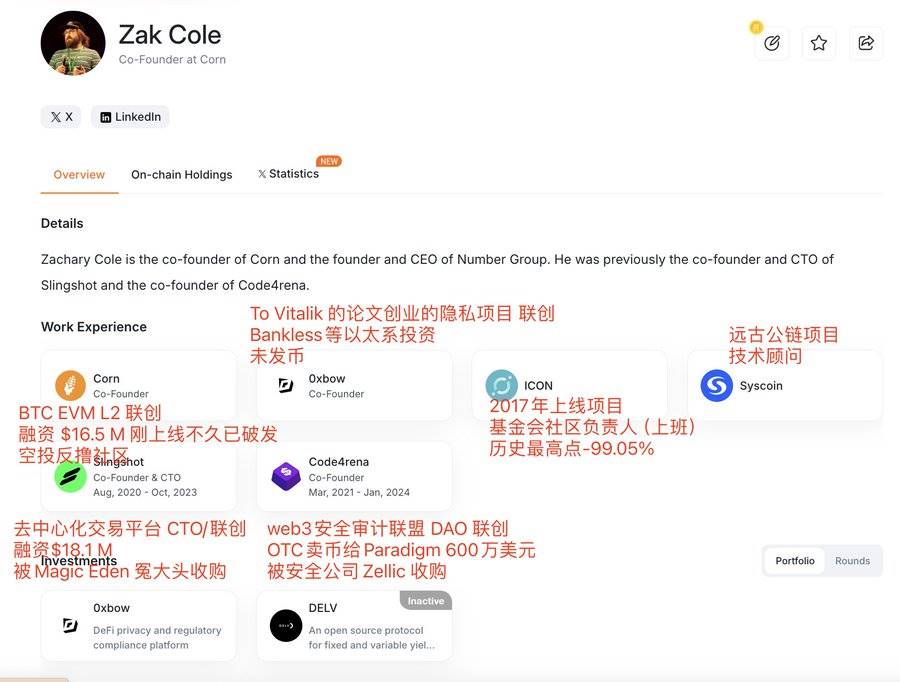

However, the past of Zak Cole, the core developer, is like a double-edged sword, adding luster to his ambition while casting a shadow over ECF's credibility.

He is a well-known serial entrepreneur in the industry, having co-founded several projects. However, the results of these ventures seem to contradict his current slogan of empowering the Ethereum community.

The community often ends up being the injured party.

According to a well-known leaker on X, Crypto Brave, several larger projects Zak participated in have not performed well in the market.

For example, BTC L2 Corn, which quickly fell below its launch price, and its airdrop strategy backfired on the community; while the ancient project ICON, which he participated in in 2017, saw its token nearly go to zero.

(Source: X user Crypto Brave @cryptobraveHQ)

Of course, there are environmental issues such as the overall downturn in the cryptocurrency market and various narratives and projects being debunked, but it is hard to believe that a serial entrepreneur who keeps starting over will inject lasting effort into the Ethereum community.

The ambition of ECF to achieve “ETH to $10k” still raises questions.

Its price-driven strategies, such as funding high-burn projects and institutional adoption plans (like collaborating with banks), may temporarily boost ETH value, but they also face speculative risks and centralization concerns.

After all, you never know if the next crypto project will be just a rebranded version of the last rug pull.

In the fluctuating world of cryptocurrency, we have witnessed too many ups and downs, and often transparent promises are just slogans, with the community merely pawns caught in the ambitions of price.

Will this time be different?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。