Author: Deep Tide TechFlow

In July, the sun blazed, and the summer crypto scene welcomed the wave of U.S. stock tokenization.

Robinhood announced with fanfare that European users could trade U.S. stocks on the Arbitrum chain around the clock; xStocks partnered with Kraken and Solana to launch on-chain tokens for 60 popular U.S. stocks, and Coinbase also applied to the SEC to launch tokenized securities…

In an instant, U.S. stock tokenization became one of the few narratives that resonated in the otherwise dull crypto space, and this wave has taken over everyone's timeline.

But this is not the first time for U.S. stock tokenization.

Memories of the past began to resurface, reminding me of that summer five years ago.

In August 2020, the summer of DeFi swept through the crypto world like a raging fire, with Uniswap's liquidity mining igniting fervor, and Terra's Luna chain and UST soaring. On-chain finance had already made many innovations, including the tokenization of U.S. stocks.

At that time, there was a protocol on Luna called Mirror, where I minted mAAPL (the token corresponding to Apple stock) using a few dollars of UST on Terra Station, without KYC, without opening an account, for the first time bypassing brokers to touch the pulse of Apple's stock price.

But there is a lyric that perfectly describes the feelings of seasoned investors after experiencing all this:

"You left a clamor in my life, but after you left, it was terrifyingly quiet."

Luna eventually collapsed, and Mirror was crushed by the SEC's lawsuit, shattering the dreams of 2020. Aside from transaction hashes, it seems there is nothing to prove that U.S. stock tokenization existed five years ago.

Now, xStocks and Robinhood are making a comeback, reigniting hope for on-chain U.S. stocks. Will this time be successful? How is it different from five years ago?

That Summer, the Free Utopia of Mirror

If you don't remember Mirror Protocol, or if you weren't in the space at that time, let me help you recall those distant memories.

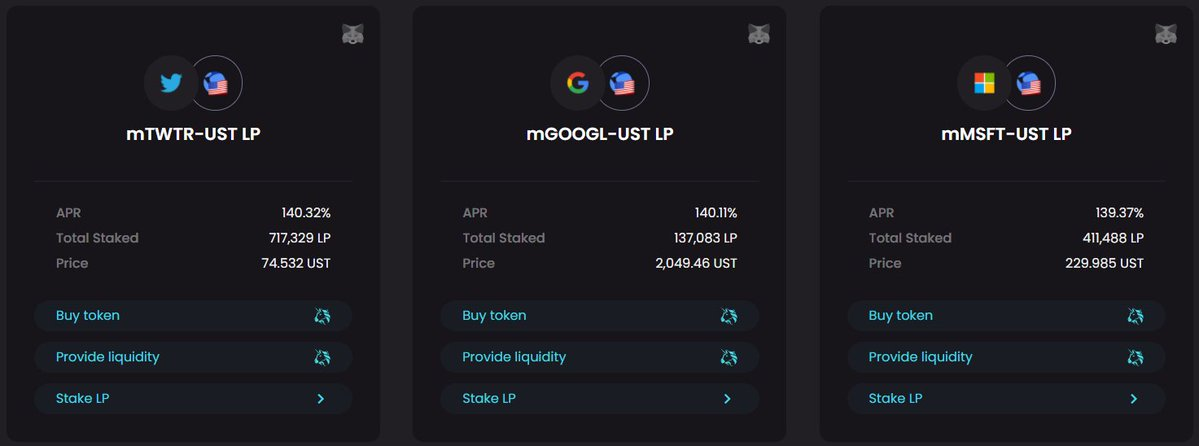

The core idea of Mirror Protocol was: to use on-chain synthetic assets to track the stock prices of real-world U.S. stocks. This gave birth to a class of assets called mAssets.

The so-called "synthetic assets" mAssets are tokens that simulate stock prices through smart contracts and oracles. Holders do not own actual stocks; they merely act as "shadows on the chain" to track price fluctuations.

For example, mAAPL (Apple), mTSLA (Tesla), mSPY (S&P 500 ETF) rely on Band Protocol's decentralized oracle to obtain real-time U.S. stock data.

Although this differs from directly buying U.S. stocks, it excels in convenience:

Minting mAssets was simple; using the stablecoin UST on the Terra chain, you could over-collateralize 150%-200%, and obtain the corresponding tokenized stocks through Terra Station, without KYC, with transaction fees of only about $0.1.

These tokens could not only be traded 24/7 on Terraswap (then Terra's DEX), as flexible as Uniswap's token pairs, but could also be used as collateral in another lending protocol within its ecosystem, Anchor Protocol, for borrowing or earning interest.

You could enjoy the growth benefits of U.S. publicly traded companies while leveraging the flexibility of on-chain finance; it seemed that DeFi five years ago had already figured out U.S. stock tokenization.

But the good times didn't last long; that summer's dream shattered unexpectedly.

In May 2022, a notorious black swan event hit the crypto space. Terra's algorithmic stablecoin UST depegged, Luna plummeted from $80 to mere cents, mAssets were wiped out overnight, and Mirror nearly came to a halt.

To make matters worse, the U.S. SEC intervened, accusing mAssets of being unregistered securities, and Terraform Labs and its founder Do Kwon became mired in lawsuits.

From "Hold on tight, folks" to "Sorry, we failed," the collapse of the Terra ecosystem made U.S. stock tokenization disappear from the chain, and while reflecting and reminiscing, one could also see its fatal weaknesses:

Synthetic assets severely relied on oracles and the stability of UST, with no actual stocks backing them; the collapse of the underlying would render the upper-layer assets illusory. Moreover, while anonymous trading attracted users, it inevitably touched regulatory red lines; the regulations and policies at that time were far from as open and lenient as they are today.

The fragility of synthetic assets, the risks of stablecoins, and the lack of regulation led to a painful price for this experiment.

What’s Different This Time?

Just because it didn't succeed back then doesn't mean it won't succeed now.

The summer of 2020 has passed, and this time Kraken, Robinhood, and Coinbase, armed with more mature technology and compliance stances, are attempting to rewrite the story.

As a veteran who witnessed the summer of DeFi, I can't help but compare: what exactly is different this time compared to Mirror five years ago?

We might look at it from three aspects: products, participants, and market environment.

- Products: From On-Chain Shadows to Real Anchors

As mentioned earlier, tokens like mAAPL and mTSLA were merely "on-chain shadows" simulated by smart contracts, without holding actual stocks, only simulating price fluctuations.

Now, xStocks has taken a different path. xStocks is managed by regulated brokers, ensuring the cash value of stocks purchased can be redeemed.

The process of U.S. stock tokenization is operated by Backed Assets, a token issuer registered in Switzerland, responsible for purchasing and tokenizing assets.

It buys stocks, such as Apple or Tesla, through Interactive Brokers' IBKR Prime channel (a professional brokerage service connecting to the U.S. stock market), then transfers the assets to Clearstream (the custodian of Deutsche Börse) for isolated storage, ensuring that each token corresponds 1:1 to actual holdings and undergoes legal audits.

In short, every on-chain purchase you make is anchored by a real stock purchase behind it.

(Image source: X user @_FORAB)

Additionally, xStocks allows token holders to redeem actual stocks through Backed Assets, a feature that enables it to escape the purely speculative framework of Mirror, connecting on-chain and off-chain.

- Participants: From DeFi Natives to TradFi Integration

The stage of Mirror belonged to DeFi native players. Retail investors and developers from the Terra community were the main force, and discussions on Discord and Twitter drove the popularity of mAssets. The success of Mirror was inseparable from the Luna and UST craze within the Terra ecosystem, and the community's experimental spirit made it shine like a comet.

This also makes one sigh; the era of adults has changed.

This wave of U.S. stock tokenization is primarily led by traditional financial giants and compliant enterprises within the space.

For instance, xStocks is provided by Kraken as a compliant platform, Robinhood brings traditional brokerage experience on-chain, and BlackRock's tokenization pilot further signifies institutional entry.

The DeFi ecosystem of Solana (such as Raydium and Jupiter) indeed adds vitality to xStocks, allowing retail investors to use tokens for liquidity mining or lending, retaining some DeFi genes.

But compared to the community-driven nature of Mirror, xStocks feels more like a grand production directed by exchanges and TradFi giants: larger in scale, less wild.

- Market and Regulatory Environment: From Gray Areas to Compliance as King

Mirror in 2020 was born in a regulatory gray area. The summer of DeFi was almost indifferent to compliance, and anonymous trading was the community's default rule. In 2022, the SEC deemed mAssets as unregistered securities, and Terraform Labs became embroiled in lawsuits, with anonymity becoming a fatal flaw.

The market at that time was small, and DeFi felt more like a testing ground for a group of geeks.

The market and regulatory environment in 2025 are entirely different. Projects like xStocks prioritize compliance, enforcing KYC/AML, and adhering to EU MiCA regulations and U.S. securities laws.

After the Trump administration took office in January 2025, SEC's new chairman Paul Atkins referred to tokenization as "the digital revolution in finance," and lenient policies are loosening the reins on innovation. In June 2025, Dinari obtained the first U.S. brokerage license for tokenized stocks, further paving the way for Kraken and Coinbase.

The embrace of mainstream finance and changes in the market environment have allowed xStocks and Robinhood to navigate the legal pitfalls that Mirror faced with a compliant stance, but it also seems to have stripped on-chain U.S. stocks of the grassroots flavor of the past.

The Echoes of Summer

The crypto space has changed over the years, yet it seems unchanged.

Five years ago, U.S. stock tokenization in DeFi felt like an unrefined carnival, full of passion but lacking stability. Today, crypto has donned the cloak of compliance, walking a steadier path, yet losing some of its spontaneity and wild spirit.

Similar products, different scenes.

As more people view BTC as digital gold, as institutions gear up, and as crypto gradually becomes a tool for boosting traditional capital market stock prices, two groups of people, both inside and outside the space, may have inadvertently completed a transformation of questions:

Those who used to trade U.S. stocks didn't understand why the crypto market was so hot; now, those trading cryptocurrencies are beginning to wonder why U.S. stocks with a crypto label keep rising.

Only that summer, the FOMO frenzy that everyone rushed to join, that ubiquitous wildness and geek spirit, may have long since faded away.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。