1小时BTC/USD图表显示出明显的下行趋势,起源于最近的$108,800峰值,标志着持续的低高点和低低点。成交量确认了这一趋势,卖出活动在红色蜡烛上加剧,指向持续的看跌压力。交易者关注$107,500和$108,000之间的弱反弹作为潜在的短线入场点,同时将$106,000视为近期的支撑阈值以制定退出策略。逐渐的下跌缺乏恐慌性抛售的速度,但信号显示出稳定的分配。除非动量指标发生显著变化,短期前景仍然看跌。

2025年7月1日通过Bitstamp提供的BTC/USD 1小时图表。

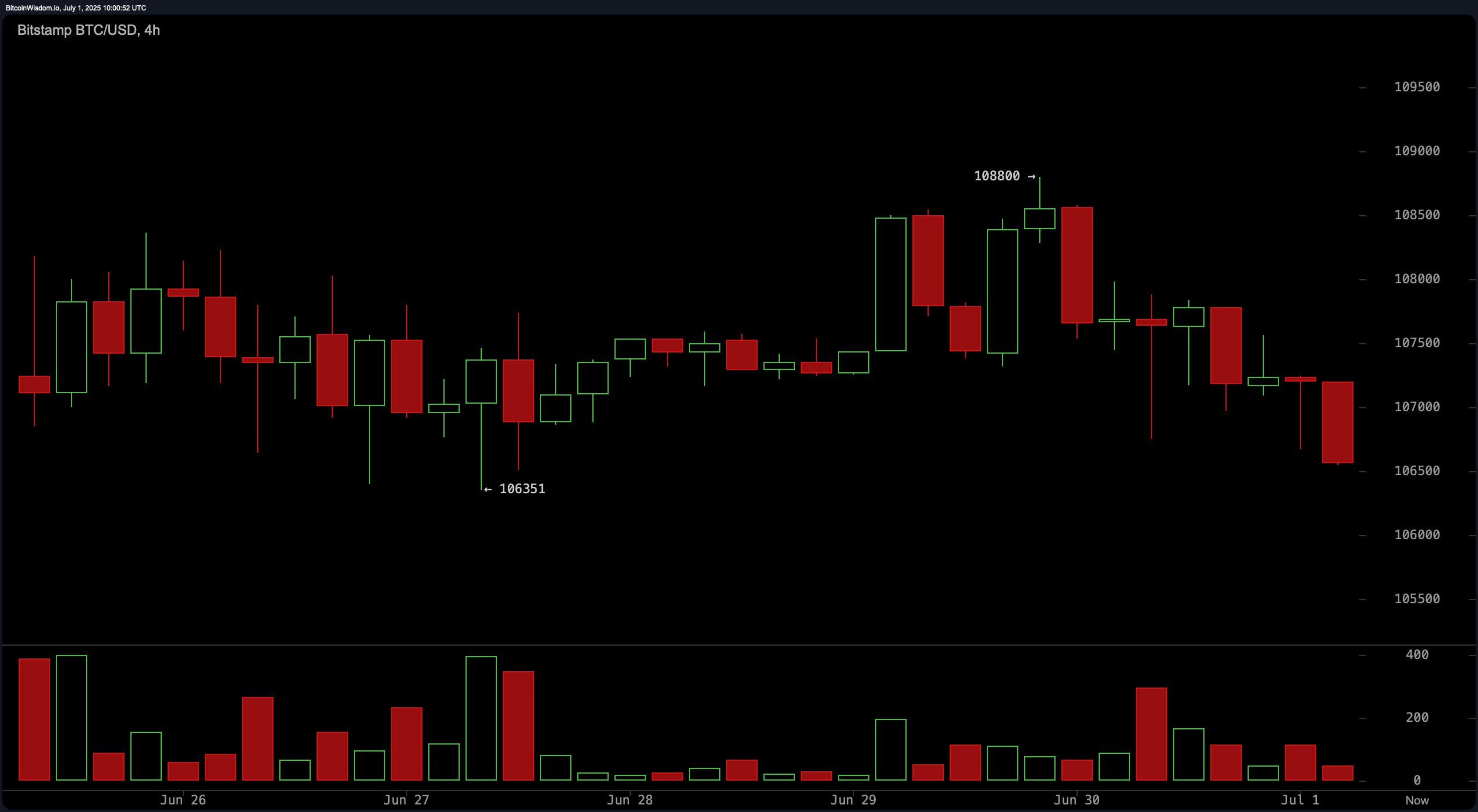

在4小时图表上,比特币在未能维持$108,800的突破后似乎处于区间震荡。支撑位形成在$106,300附近,但整体结构表明犹豫不决,突破后小蜡烛和成交量下降的迹象明显。除非动量显著改善,否则这一冷却阶段可能会持续。对于短线交易者来说,$106,000附近可能出现入场机会,获利了结可能在$108,000的阻力位附近受到限制。若跌破支撑位,将会重新吸引看跌目标指向$105,000以下的水平。

2025年7月1日通过Bitstamp提供的BTC/USD 4小时图表。

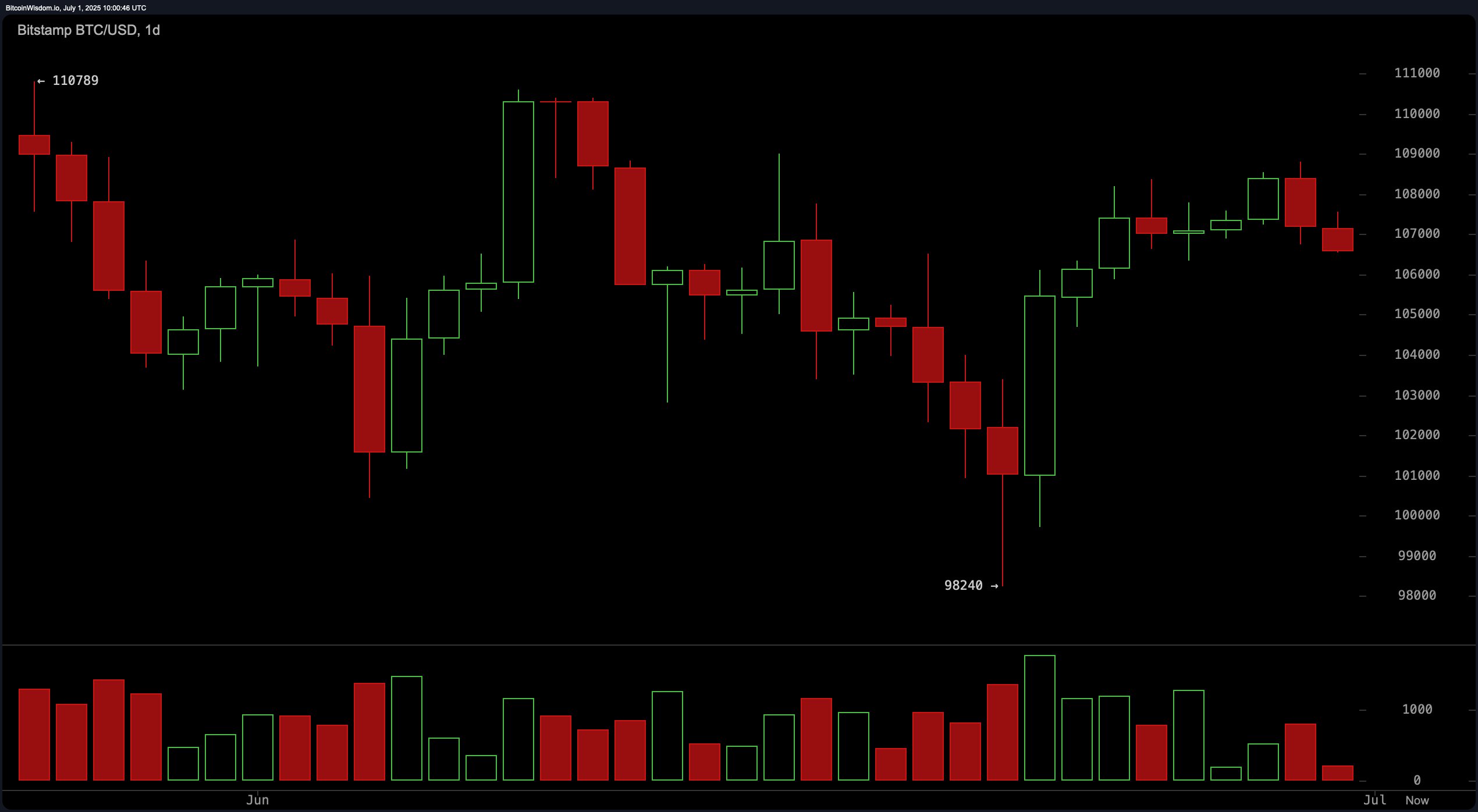

比特币的日线图描绘了在接近$110,789的反弹高峰后,经历了更广泛的整合阶段,随后回调至最近的低点$98,240。从该水平的反弹表明了买入兴趣,但卖方在$108,000附近持续出现。形成了看跌吞没形态,若动量未能重新夺回上方阻力,可能预示着未来的下行。交易者正在关注$102,000–$103,000区间的入场机会,同时关注$108,000–$110,000的退出点。若果断跌破$98,000,可能会加速卖压。

2025年7月1日通过Bitstamp提供的BTC/USD 1日图表。

振荡器读数呈现中性到混合的图景。相对强弱指数(RSI)为52,表明平衡,而随机指标%K(14, 3, 3)为86,暗示超买状态并发出卖出信号。商品通道指数(CCI)为58,平均方向指数(ADX)为12,均表明中性。同时,动量指标为4,462,MACD水平(12, 26)为557,指向残余的看涨情绪。这种对比突显了市场的犹豫,倾向于短期交易而非方向性押注。

尽管短期疲软,移动平均线(MAs)支持谨慎看涨的长期立场。10期指数移动平均线(EMA)在$106,607发出卖出信号,而10期简单移动平均线(SMA)在$106,367则发出买入信号。所有较长期的移动平均线——包括20、30、50、100和200期的EMA和SMA——均发出买入信号,反映出更广泛趋势中的持续强劲。这些平均线作为动态支撑位,可能会限制比特币进一步下跌的空间。总体而言,短期看跌行为与长期看涨结构的汇聚表明交易者应具备战术灵活性。

看涨判决:

如果比特币维持在$106,000的支撑位,且买家在$102,000–$103,000区间重新入场,受看涨移动平均线支持的长期上行趋势可能会恢复。若突破$108,000,可能会打开重新测试$110,000,最终达到$111,000的路径,进一步强化在更高时间框架上显现的看涨结构。

看跌判决:

如果$106,000的支撑位未能维持,技术指标暗示可能会下跌至$103,000–$100,000区间。持续的卖压,加上振荡器的疲软和看跌的日内结构确认,可能会加速下行动量,特别是如果$98,000被突破,将使比特币近期的看涨布局失效。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。