#RWA 赛道一直是我们重点投资的领域,近两年美债代币化如火如荼,现如今美股代币化正在成为新的风口。

我们投研团队最近又挖掘到一个新RWA机会:#xStocks( @xStocksFi) 正式上线 #Bybit( @Bybit_Official)。简单说,它就是把我们平时熟悉的美股(比如苹果、特斯拉、英伟达这些大蓝筹)给“搬”到链上来了,变成可以像普通加密货币使用USD交易的代币。这将是一场巨大的变革,它是传统股票和加密世界之间的一座桥。

为什么我看好这个?

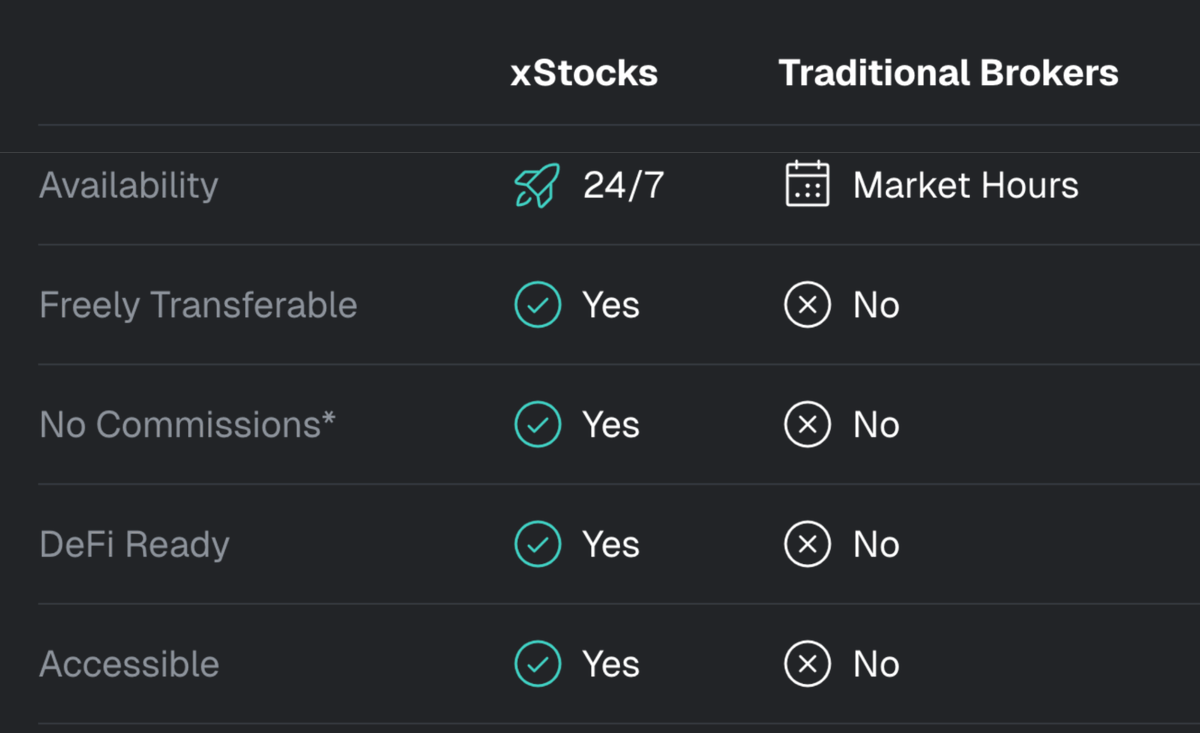

1️⃣传统股票 + 区块链的优势,组合拳打出来了

以前我们买美股,要开美股账户、转外汇、看时差、交手续费、还得担心被查税(最近富途封口、境外账户被盯得越来越紧)。但是 #xStocks 不一样,它是代币化的股票,直接用 USDT 就能买,24 小时全天候交易,不怕错过任何一个新闻行情。

而且它是有真股托底的,不是那种期货或者合成资产,而是真正 1:1 有股票抵押在后面的代币,背后是 Backed Finance 公司做发行、合规也过了欧洲 MiFID II 招股要求,还托管在瑞士/美国监管机构那边,底子很硬。

2️⃣可以链上玩,还能接入 #DeFi

买了这些 #xStocks,不光能囤着等涨(像买正股那样长线投资),还可以用在 #DeFi 场景里去抵押、借贷、套利、做收益策略。这点对我们 Web3 老玩家太友好了,相当于一份资产,两头赚——又有正股的基本面,又能链上搞玩法。

举个例子,我可以把手里的 #AAPL(APPLX)借出去拿利息,或者抵押去借稳定币出来做其他投资,流动性和资金效率高多了。

3️⃣ #Bybit 作为交易平台,十分靠谱

#Bybit 本身就有不错的流动性和用户界面,现在引入 #xStocks 后,直接变成我们链上交易美股的新入口。不用走券商开户,不用担心外汇限制,你有 USDT 就能上车,跟传统加密货币交易相同的交易界面,完全降低了门槛。

对于加密圈的用户来说,终于可以在熟悉的环境里“炒美股”了。而且是 7x24 小时无休交易,比起传统股市那种每天只开6.5小时的节奏,简直太爽了。

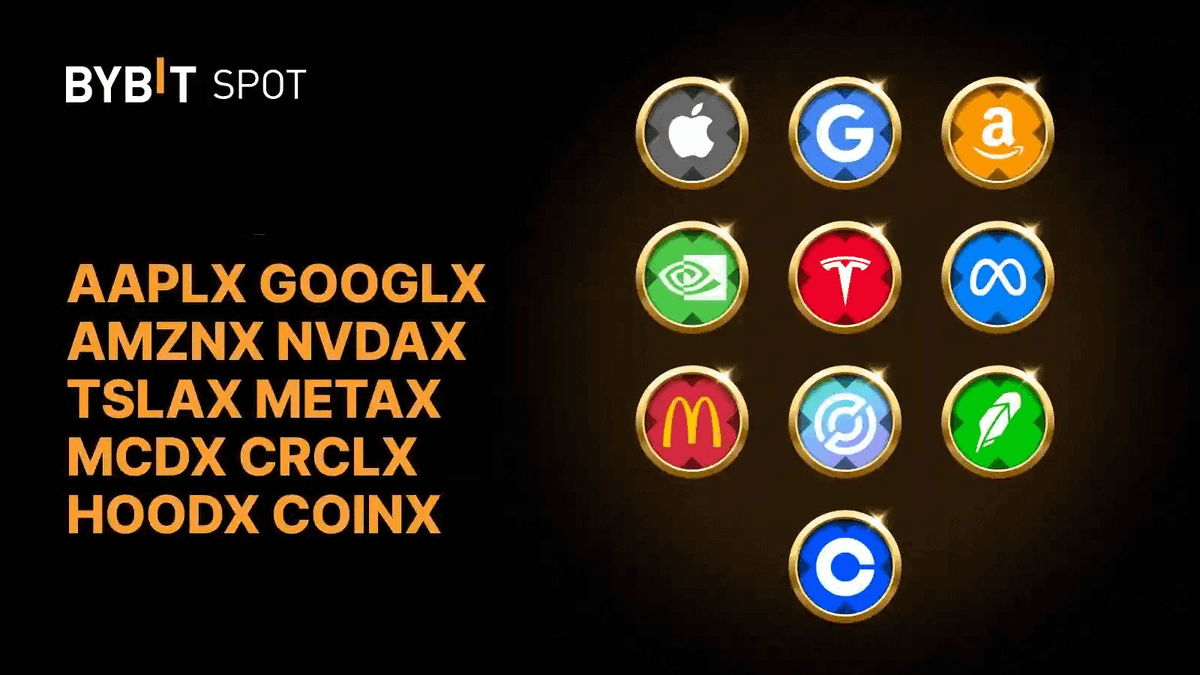

4️⃣潜力远远不止美股

现在上线的是“七朵金花”(#AAPL、#TSLA、#NVDA、#META、#AMZN 等)加上一些跟加密相关的公司(#MSTR、#HOOD、#CRCL)。这只是个开始。未来 #RWA代币化是大趋势,地产、债券、大宗商品都有可能变成链上的资产。

根据数据,今年 RWA 市场已经超过 240 亿美金,年底目标是 500 亿。黑石的 CEO 拉里·芬克也亲自站台,说代币化是“未来的金融基建”。这就相当于告诉我们:这条赛道,不只是风口,是浪潮。

5️⃣如何参与 #Bybit 美股购买

1.登录或创建 #Bybit 账户,并完成必要的KYC验证,注册链接🔗:https://partner.bybit.com/b/84410

2.点击 #Bybit 现货交易。使用其代码搜索所需的 #xStock 代币(首批上市的十只股票为:COINX、NVDAX、CRCLX、APPLX、HOODX、METAX、GOOGLX、AMZNX、TSLAX、MCDX)。

3.跟传统加密货币交易模式,一摸一样,操作逻辑不变。

总的来说,这次 #Bybit 与 #xStocks 的合作,是RWA发展的一次大跃进,让普通加密货币投资者,更容易更方便且毫无门槛的进入到美股投资的浪潮。让加密alpha机会与美股beta机会,充分融合,充分实现组合配置,有效对冲风险并获得可观回报,这将是金融工具的一次巨大升级——谁先上车,谁就有先发优势。🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。