机构动能增强,比特币和以太坊ETF累计收益达6.08亿美元

比特币ETF显示出没有减速的迹象。在连续第12天的净流入中,投资者信心持续涌入,5只ETF共吸引了5.48亿美元的资金。

黑石的IBIT再次领跑,锁定了3.4028亿美元的新资本。富达的FBTC紧随其后,获得了1.1519亿美元,而Ark 21Shares的ARKB吸引了7020万美元。

Bitwise的BITB(1290万美元)和Vaneck的HODL(914万美元)也贡献了流入。交易总值达31.7亿美元,使比特币ETF的总净资产达到1335.6亿美元,创下新里程碑。

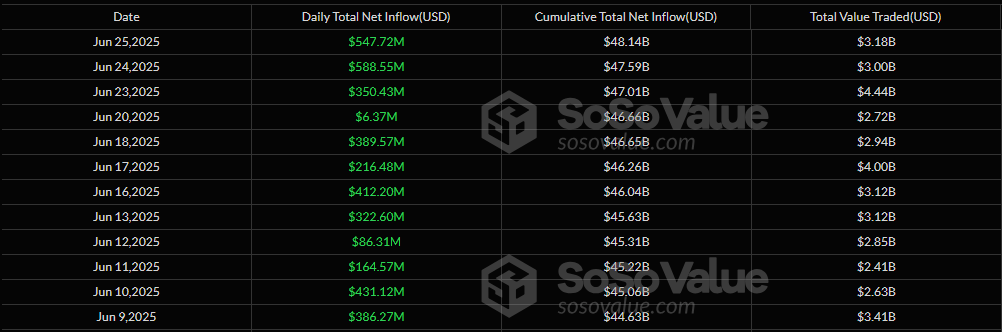

来源:Sosovalue

以太坊ETF也保持了上升势头,净流入为6041万美元。黑石的ETHA再次成为焦点,带来了5518万美元,而Bitwise的ETHW增加了523万美元。

尽管与比特币ETF相比,交易量较为平淡,但以太坊基金的日交易额仍达3.4595亿美元,净资产上升至99.1亿美元。

随着最大的资产管理公司持续强劲的表现,比特币和以太坊ETF都在乘着机构需求的浪潮,显示出没有减弱的迹象。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。