美国如果参战会发生什么 – 比特币价格影响

世界屏息以待。以色列与伊朗之间的战争迅速升级,现在美国可能会介入。但这对比特币和其他加密货币市场有什么影响呢?

在以色列上周袭击伊朗核设施时,BTC已经跌破了$103,000。几天前,德黑兰也遭到了以色列的攻击。以太坊和其他加密货币随之下跌。每个人都感到恐惧,市场不稳定,问题简单却令人恐惧。

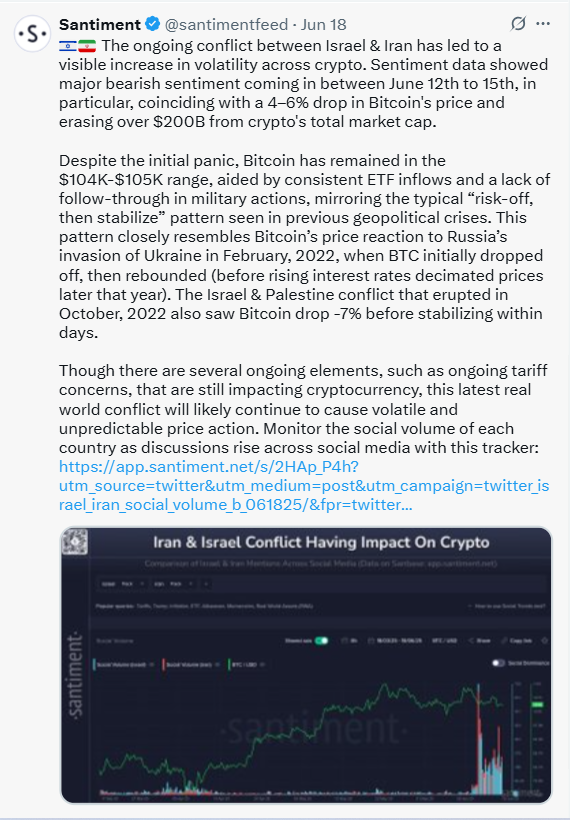

来源:Santiment on X

如果美国参战会发生什么?

让我们分析一下现在发生的事情,未来可能发生的事情,以及这一切对加密货币的意义。

当前情况:比特币已经受损:

6月13日,以色列轰炸了伊朗。

BTC立即暴跌,总加密市场价值损失超过$2000亿。

以太坊跌至$2400,狗狗币和佩佩币等模因币也大幅下跌。

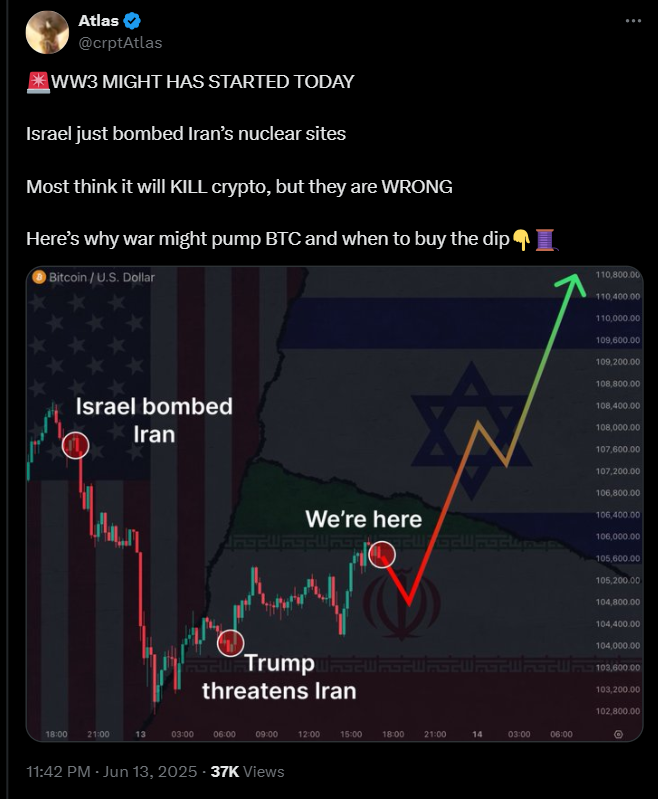

加密分析师Atlas在X上警告WW3恐慌,但也暗示在下跌后可能会反弹。

来源:Atlas on X

尽管价格从$104k到$105k的范围内有所回升,但恐惧并未消失。人们在等待美国接下来会发生什么。白宫报告称将在两周内决定是否参战。如果参战,可能会导致另一轮崩盘。

短期影响:如果美国参战

如果美国介入冲突,根据专家的说法,BTC可能在几分钟内下跌10%至20%。

为什么这么快?

投资者会恐慌并迅速抛售。

资金将转移到更安全的地方,如黄金或美元。

大型投资公司可能会撤回资金。

更糟糕的是,唐纳德·特朗普最近的推文引发了争论。他的话简短却可能加剧投资者的焦虑,加速加密货币的抛售。

来源:Donald J. Trump on X

可能发生的情况:

比特币可能跌至$85K–$95K。

Solana、ADA和XRP等山寨币可能会更严重崩溃。

波动性(疯狂的价格波动)将迅速增加。

交易者可能会平仓风险较大的赌注,加密货币价格可能在数小时内迅速变化。

长期展望:比特币能否恢复?

好消息是,历史证明比特币可以反弹——即使在战争期间。

2022年2月,俄罗斯入侵乌克兰后,BTC跌了一周……然后飙升了16%。

在2023年以色列-加沙战争期间,BTC在50天内上涨。

目前,即使在伊朗紧张局势中,数字资产仍保持在$104K以上。

此外:

大型投资者如迈克尔·塞勒的MicroStrategy本月购买了价值$10亿的比特币。

美国比特币ETF上周迎来了$3亿的资金流入,就在空袭之前。

因此,市场可能在短期内崩溃,但如果局势平稳,可能在接下来的4-6周内恢复。

目前影响加密货币的其他因素:

不仅仅是战争。其他重大问题也在动摇加密市场:

美联储利率:美联储本月没有降息,因此加密货币没有获得所需的动力。

油价上涨:战争导致油价在袭击后上涨7-11%,这引发了更多的通胀担忧。

伊朗交易所黑客攻击:亲以色列的黑客 reportedly 从伊朗的Nobitex交易所盗取了9000万至1亿美元。

美国关税政策:新的贸易关税的截止日期即将到来,定于7月9日。这让投资者感到紧张。

投资者应该怎么做?

如果你在加密货币领域,这里有一些准备建议:

在下跌时保持冷静。

监测指标:油价、ETF资金流入、美联储声明和战争新闻。

不要因恐慌而盲目跟风或抛售——加密货币在恐惧消退后会反弹。

监测比特币与黄金和美元的相关性作为风险指标。

最后的思考:

数字货币可能会受到冲击,但不会崩溃。如果美国被卷入以色列-伊朗战争:

短期内,准备应对恐慌和价格崩溃。

长期来看,加密货币可能会再次反弹,就像在之前的冲突中一样。

现在,比以往任何时候都更重要的是,聪明的投资者正在转变为战争开发者,广泛的经济信号如通胀、油价和美联储政策都在影响比特币的未来。

世界在关注数字货币重新回到聚光灯下——不仅作为一种货币,还作为避风港、赌博和生存的故事。

另请阅读: Dropee Daily Combo And Question of the Day 21 June 2025

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。