Today's homework is difficult to write. Let's write less about the geopolitical conflict part; the information I can obtain is basically similar to what everyone else has. Overall, although the U.S. has not yet intervened, the preparations should be nearly complete. I don't know if Trump's words will be effective with Iran. Currently, several regions in Iran cannot access the internet. However, Iran has also stated that it has never requested to bow down in front of the White House. This conflict is very different from the Russia-Ukraine conflict; it resembles a war of annihilation.

The main impact of the geopolitical conflict is still reflected in oil prices, especially the $USOIL price, which can better reflect the direction of the war. Moreover, the rise in oil prices has also driven domestic inflation in the U.S. During today's Federal Reserve meeting, Powell discussed this topic. Geopolitical conflicts and tariffs are among the reasons hindering the Fed from cutting interest rates. Powell still insists on looking at the data, which is, of course, expected.

The expectation that there will be no interest rate cuts in June has been fully anticipated. The focus is on the dot plot, which still indicates two rate cuts in 2025. This is considered good, as it is much better than the one or zero cuts that many market investors expected. Therefore, the probability of a rate cut in September has increased again. Although the expectation for a rate cut in 2026 is only once, it is still very early, and the Fed can adjust at any time. Thus, for the market, this dot plot is relatively neutral.

During Powell's speech, he also emphasized the impact of tariffs and geopolitical conflicts on interest rate adjustments. Powell believes that tariffs still need to be assessed based on final data, but he thinks that the war's impact on energy prices is short-term, meaning that the inflation increase is also short-term. He believes that the U.S. economy is still healthy, with a low unemployment rate and no demand for interest rate cuts in the labor market. Overall, Powell's remarks today can also be considered neutral, and now we will see the market's reaction.

Looking at Bitcoin's data, the turnover rate has slightly increased, but not significantly. The turnover factors are still largely related to geopolitical conflicts. However, Powell has stated that the conflict's impact on inflation is short-term. It remains to be seen whether this can alleviate investors' concerns about rising oil prices. The $BTC involved in the turnover is still mainly short-term investors.

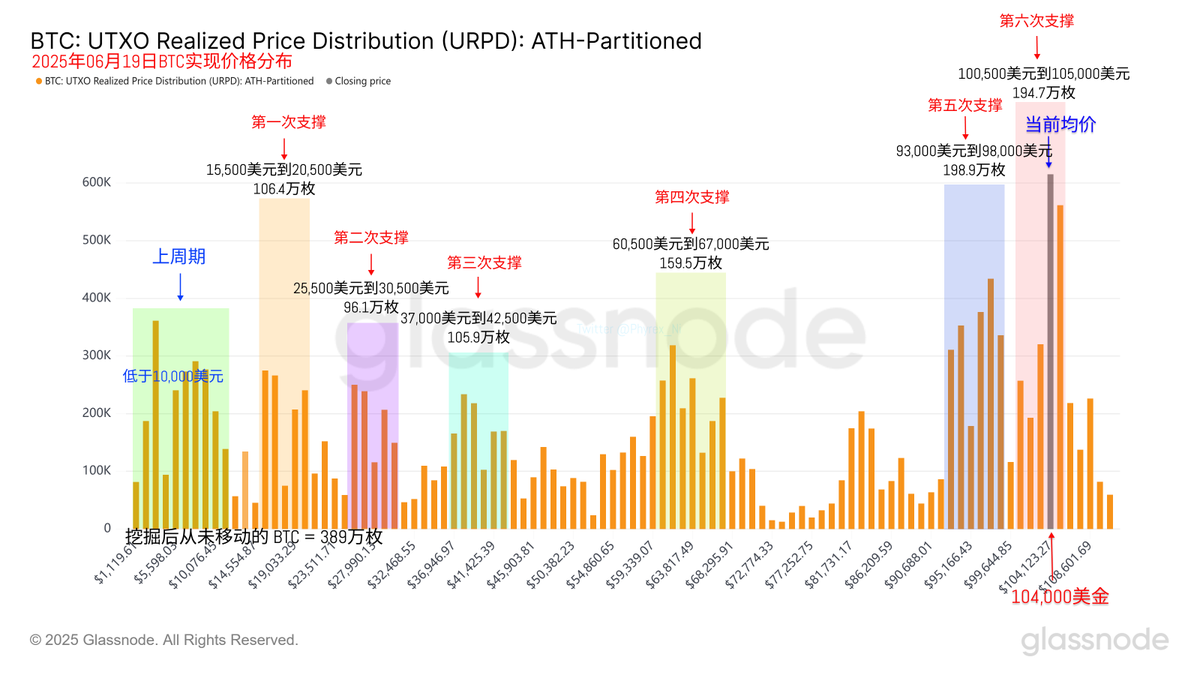

From the supporting data, the best support remains between $93,000 and $98,000. Even though there have been significant price fluctuations recently, investors in this range have not shown signs of panic selling; instead, they remain very stable. Investors in the $100,500 to $105,000 range are continuing to accumulate. Currently, this looks good, but if accumulation continues, the risk factor will increase.

There are no significant macro data releases on Thursday and Friday, so the market's focus temporarily returns to geopolitical conflicts.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。