Bitcoin ETFs Extend Inflow Streak to 7 Days Despite Heavy Outflows in Key Funds

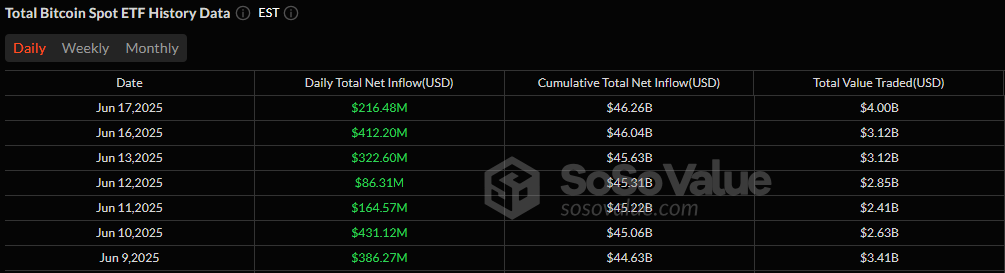

Bitcoin ETFs defied heavy selling pressure on Tuesday, June 18, extending their inflow streak to a seventh day as investor demand remained solid.

The market’s bullish mood was anchored by Blackrock’s IBIT, which pulled an impressive $639.19 million inflow, easily offsetting significant withdrawals across other major funds. While Fidelity’s FBTC suffered a $208.46 million outflow and Ark 21shares’ ARKB lost $191.40 million, Blackrock’s strength ensured the sector stayed in positive territory.

Source: Sosovalue

Bitwise’s BITB also posted a $22.84 million outflow, but the day still closed with a net inflow of $216.48 million. Total trading activity surged to $4 billion, with net assets holding firm at $128.18 billion.

Ether ETFs mirrored this resilience. Although Fidelity’s FETH lost $20.22 million and Grayscale’s ETHE saw a $9.02 million outflow, fresh capital flowed into Blackrock’s ETHA ($36.71 million) and Bitwise’s BITB ($3.62 million), pushing the day’s net inflow to $11.09 million. Ether ETF trading volumes hit $528.36 million, with total net assets steady at $10.05 billion.

Despite mixed flows across various funds, the overall market remains firmly in accumulation mode, suggesting investor confidence is still high.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。