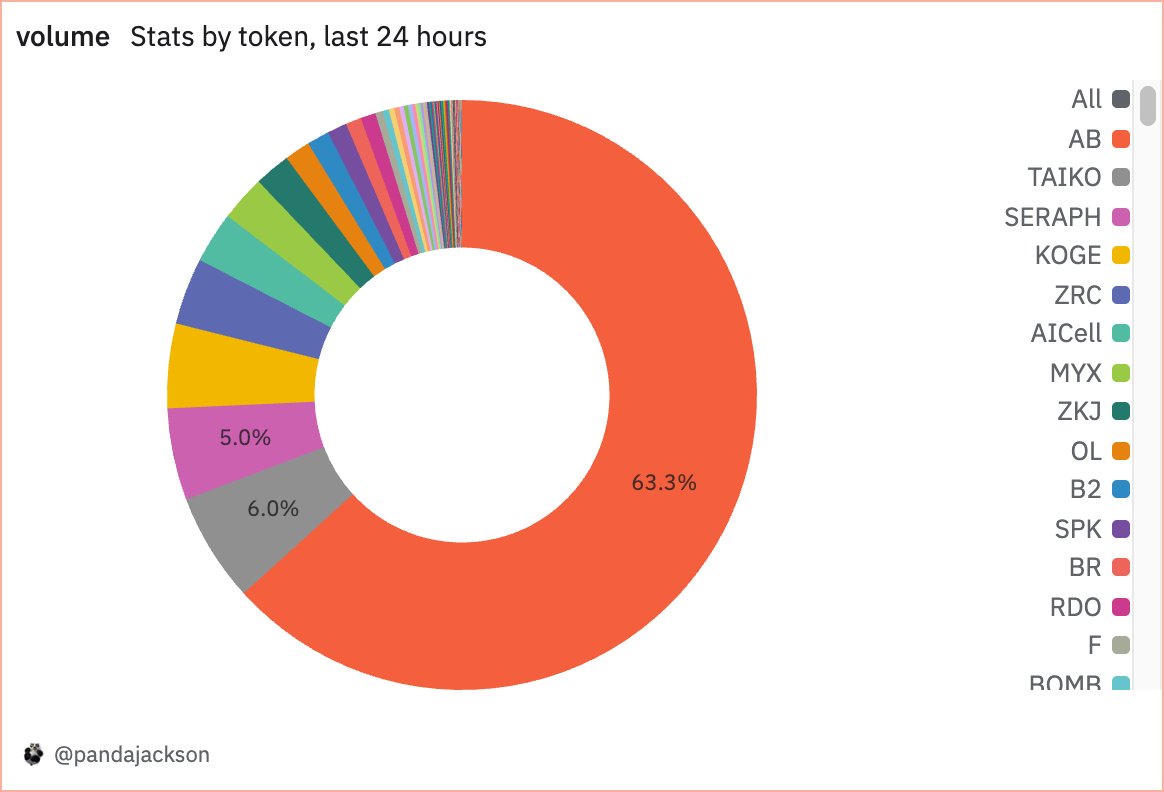

⚡️据 @pandajackson42 追踪数据,6 月 17 日 Binance Alpha 日交易量为 7.32 亿美元——

相比 5 月底曾突破 20 亿美元的高峰,已连续 9 天下降,Alpha进入显著的降温周期。

从平台角度来看,币安的Alpha绝对是个天才设计,真的做到了很多平台想做却做不到的事:

在没有明确收益预期的情况下,调动了大量用户的时间、注意力、流动性,甚至情绪。

更重要的是,Alpha 为币安带来了前所未有的一级定价影响力——

通过「用户行为 × 平台引导」的机制,让项目早期热度、关注度、资金流动性直接与币安用户挂钩,直接在 CEX 层面就完成了定价预演。

这本质上是一种用户行为驱动的定价新秩序,是把 VC 手中的一级估值权,部分转化成了平台内部流动性博弈的结果。

所以,提出这个系统的产品经理,真应该发50个月的年终奖!

明天 Alpha 新规即将上线,我现在还没有离职在刷保底观察;如果二段分发效果好,感觉会有第二波小高峰~

数据看板:https://dune.com/pandajackson42/binance-alpha-20-purchase-dex-tokens-directly-on-binance-cex

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。