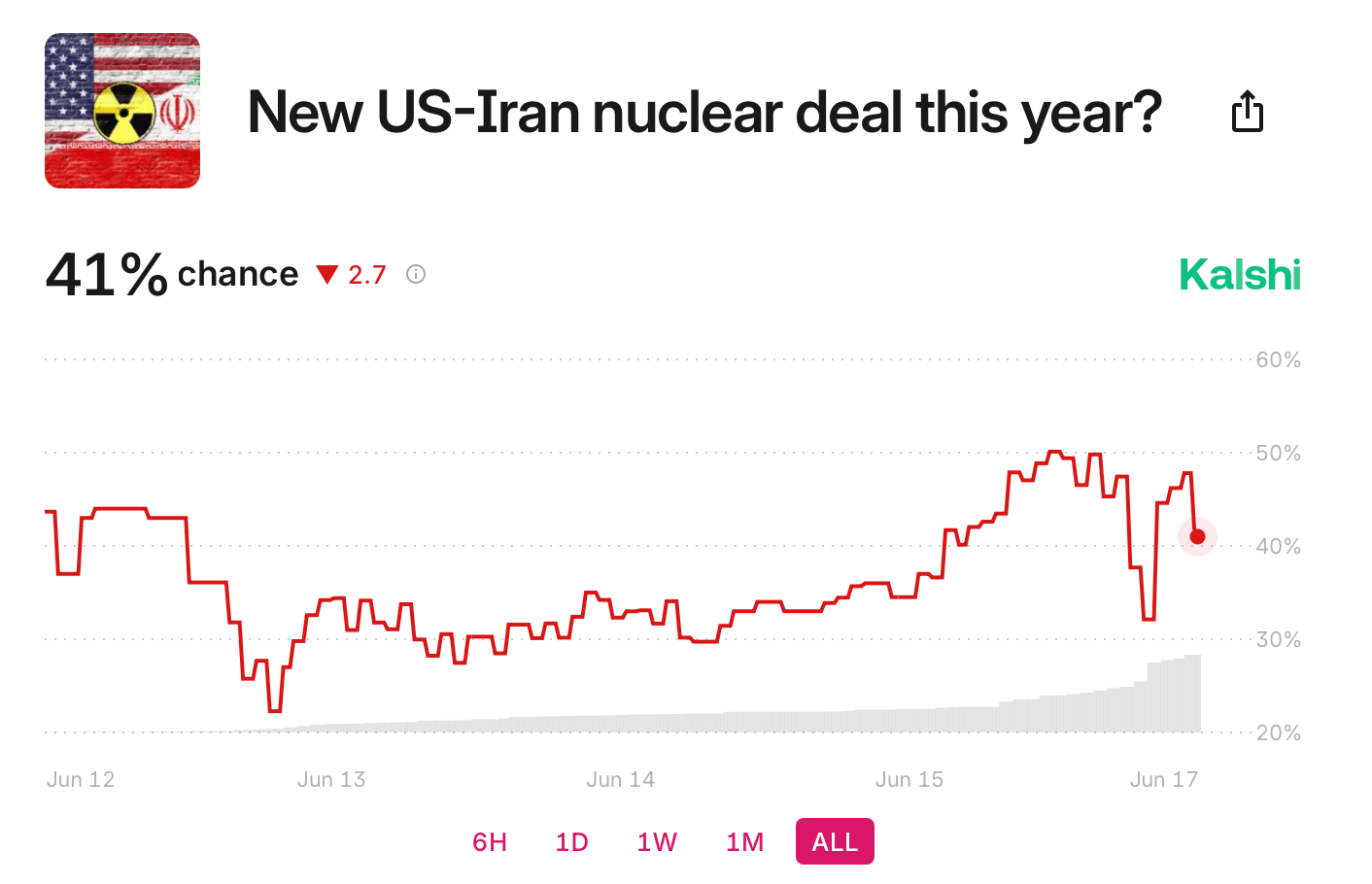

与此同时,中东的紧张局势加剧,预测市场充满了投机。在美国监管的交易所Kalshi上,一笔总额为52,999美元的赌注表明,今年美国与伊朗达成核协议的可能性为41%。同一市场预计在7月之前,美国代表团与伊朗官员会面的概率为42%。

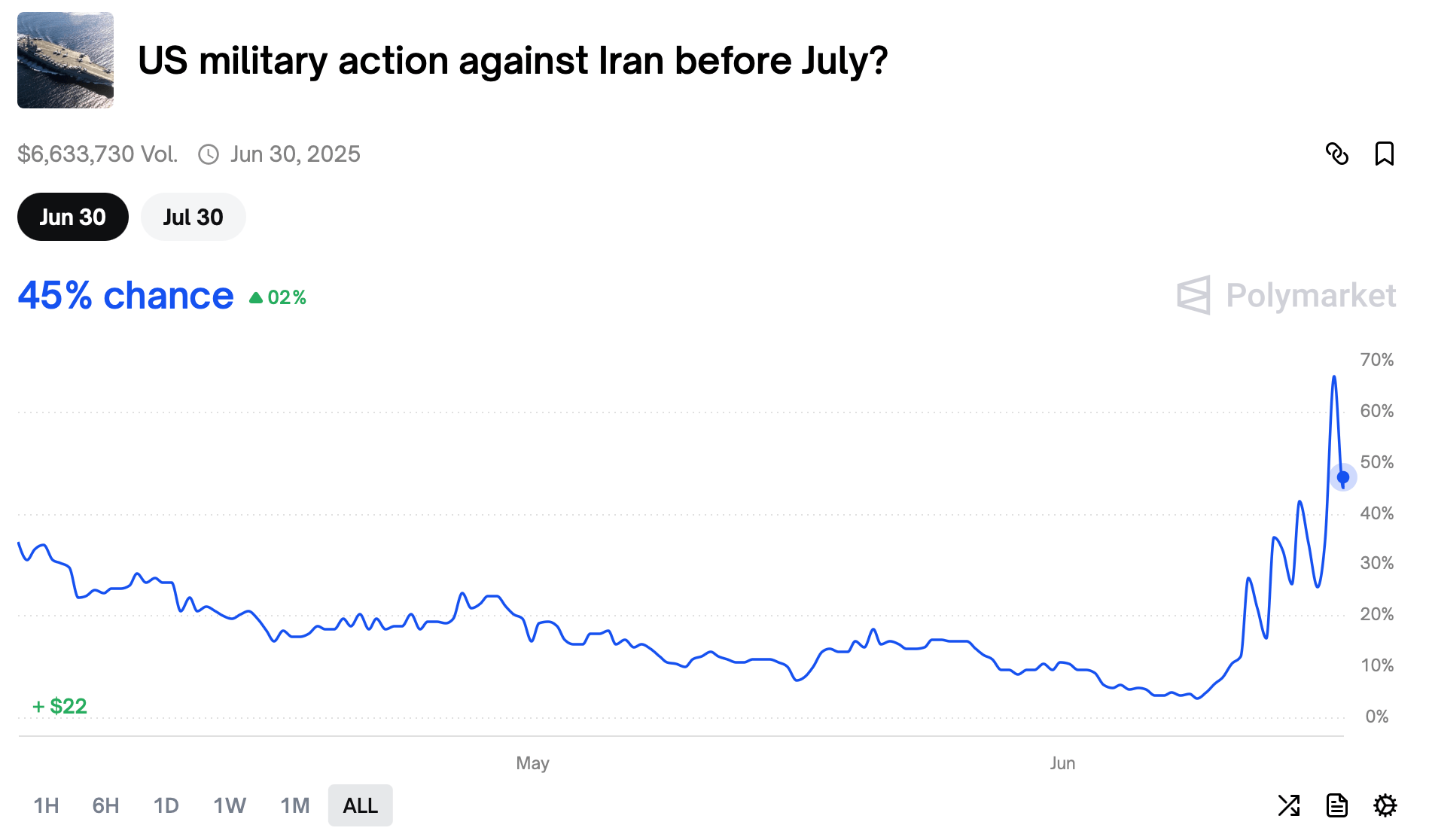

在基于区块链的Polymarket上,投注者关注美国是否会在7月之前对伊朗采取武力。这笔赌注的交易量达到了659万美元,概率为45%。就在昨天,6月16日东部时间晚上8点,这一概率达到了66.9%的峰值。

另一项在Polymarket上的赌注,交易量为162万美元,给出了美国在年底前达成核协议的51%概率。其条款规定:“如果在2025年2月4日至12月31日期间,美国与伊朗之间达成关于伊朗核研究和/或核武器开发的正式协议(定义为公开宣布的相互协议),则该市场将判定为‘是’。”

报道称,特朗普总统在G7峰会期间突然离开,以应对危机,敦促立即撤离德黑兰,并暗示有一个比单纯停火更为广泛的计划。与此同时,中国驻特拉维夫大使馆已建议中国公民立即离开以色列。人们越来越担心,这场对抗可能升级为更广泛的地区战争,特别是如果美国直接介入的话。

随着外交渠道的缩小和市场对地缘政治风险的定价,接下来的几周可能成为美国在压力下外交政策的试金石。当军事行动与概率赌注相碰撞时,真正的风险远远超出百分比——涉及全球稳定、经济后果以及在核武器阴影下政治对抗的不可预测后果。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。