Strategy and Metaplanet, two of the most prominent bitcoin treasury companies, bought a combined 11,212 BTC in the past 24 hours, taking advantage of the cryptocurrency’s momentary decline in price, following the unfolding conflict in the Middle East.

Israel launched a pre-emptive missile attack on nuclear sites in Iran last week Thursday, citing concerns over an alleged secret nuclear weapons program that would pose an existential threat to Israel. Iran retaliated with its own counterstrikes, and the conflict has continued to escalate. Both stock and crypto markets tanked last week Friday as a result, creating an opportunity for firms like Strategy and Metaplanet to swoop in and pick up bitcoin at discounted prices.

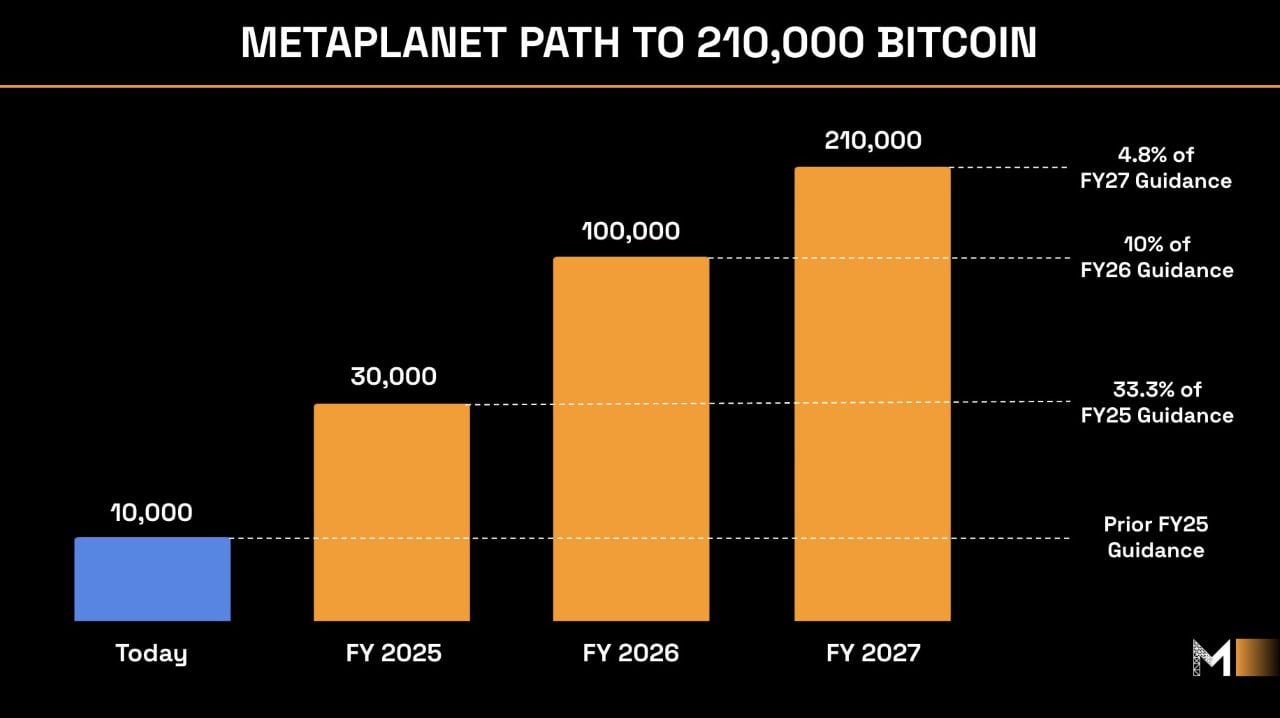

Strategy shelled out more than a billion dollars and purchased 10,100 BTC while Metaplanet bought 1,112 BTC for roughly $117.2 million. Strategy now owns a total of 592,100 bitcoin and Metaplanet has reached its 10,000 BTC target for 2025 earlier than planned. Metaplanet previously announced a “21 Million Plan” where it planned on acquiring 21,000 BTC by 2026. The company has now upped the ante and announced a new “Metaplanet Path to 210,000 Bitcoin” roadmap. The cryptocurrency jumped above $107K on the news, making a full recovery after falling to $103K last week when the Israel-Iran conflict began.

(Metaplanet’s new ambitious roadmap for acquiring 210,000 BTC by 2027 / Simon Gerovich on X)

“This era will be divided between those who bought bitcoin and those who were left behind,” said Metaplanet CEO Simon Gerovich in a post on X.

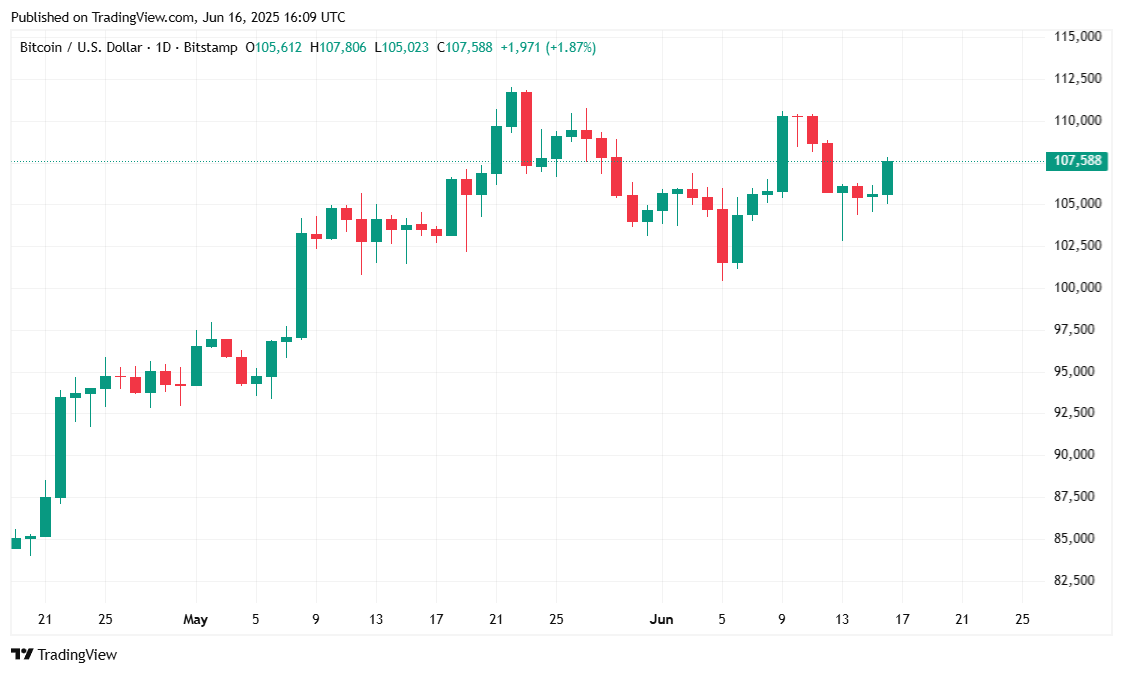

Bitcoin climbed 1.79% over the past 24 hours and was trading at $107,534.32 at the time of reporting, after a tough weekend in the wake of the Israel-Iran conflict. The cryptocurrency remains slightly down by 0.36% over the past seven days. It traded within a relatively narrow range between $104,519.88 and $107,819.09, reflecting modest volatility as investors and traders assessed the impact of the situation in the Middle East.

( BTC price / Trading View)

Trading volume jumped 29.18% to $46.23 billion, largely attributed to the expected surge in activity following the weekend slowdown. Bitcoin’s market capitalization rose to $2.13 trillion, an increase of 1.81% from the previous day, although BTC dominance slipped by 0.38% to 64.46%.

( BTC dominance / Trading View)

In derivatives markets, BTC futures open interest surged by 4.82% to $73.06 billion. Coinglass data showed minimal and balanced liquidations totaling just $106,380. Liquidations were split between $63,800 in longs and $42,580 in shorts, once again illustrating a wait-and-see attitude from investors as they assess the current geopolitical climate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。