撰文:曼昆

在当今全球化浪潮中,Web3 项目正以前所未有的速度走向国际舞台,中国企业更是一支不可忽视的力量。但是中国对行业政策的不确定性、法律的缺失以及监管态度的模糊性,使得 Web3 企业的发展有所踌躇。这些因素共同作用,使得 Web3 项目在国内发展面临合规挑战,许多从业者不得不转向海外或在有限的合规框架内寻求突破。然而,通过密切关注政策动向并结合各国的优惠政策,合理构建企业合规框架,Web3 行业仍有可能再找到适合的发展模式。

企业出海目的

(一)市场机会

全球市场为 Web3 项目提供了更广阔的用户基础和增长潜力。尤其是在亚洲和欧洲等地区,用户对区块链技术和加密货币的接受度较高,这为项目带来了更多的商业机会和发展空间。

(二)监管环境

不同国家对区块链和加密货币的监管政策差异显著。一些国家,如新加坡和香港,拥有相对宽松和友好的监管环境,这为 Web3 项目的运营和发展提供了更大的灵活性和安全性。相比之下,某些国家的严格监管可能限制项目的发展。在一些国家,Web3 项目可能面临法律和合规方面的挑战。出海到法律环境更友好的国家,可以有效降低这些风险,确保项目的长期稳定运营。

(三)人才获取

Web3 是一个技术密集型领域,吸引顶尖的开发者和专家对项目的成功至关重要。通过出海,项目可以在全球范围内寻找和招募优秀人才,从而加速技术和产品的创新与开发。

(四)资金和投资

出海使 Web3 项目能够接触到更多潜在的投资者和资金来源。尤其是在风险投资和加密货币投资活跃的地区,如美国或东南亚,项目更容易获得资金支持,推动其快速发展。

(五)产业集群效应

不同的国家和地区因为技术和政策等先天优势,聚集成了不同的产业集群,形成了区域性的供应链,为当地的 Web3 企业提供不同的基础支撑。

(六)风险分散

在多个国家开展业务可以将风险分散,避免因单一市场的经济、政治或监管变化而对项目造成重大影响,从而提升项目的抗风险能力。

合规与风险隔离

Web3 企业在选择出海目的地时,必须优先考虑当地的监管框架,以确保合法合规运营。

(一)各国家与地区的合规政策

香港:

香港自 2023 年起实施虚拟资产服务提供商(VASP)牌照制度,要求所有虚拟资产交易平台(VATP)获得香港证监会(SFC)的许可。截至 2025 年 1 月,SFC 已向 PantherTrade 和 YAX 等平台颁发运营牌照,总计 7 家自 2024 年中以来获得许可。自 2020 年以来,香港已正式许可 10 家交易所,包括 2024 年 12 月的 4 家,显示其对虚拟资产行业的谨慎开放态度。牌照要求包括严格的 KYC 流程、资产保障和网络安全措施,旨在保护投资者并防范洗钱风险。

新加坡:

新加坡金融管理局(MAS)通过监管沙盒(Regulatory Sandbox)允许金融科技公司在受控环境下测试创新产品,为企业提供监管支持。Coinbase 在新加坡的合规布局显示其对监管友好的适应:2022 年获得 MAS 的初步批准(In-Principle Approval),2023 年进一步获得全牌照(Major Payment Institution License)。这表明新加坡已成为 Web3 企业的亚太枢纽,Coinbase 将其亚太机构业务设于此,显示其对当地监管环境的信心。

其他地区:欧洲、亚太和北美:

欧盟的《加密资产市场法规》(MiCA)于 2024 年底生效,统一了加密资产的监管标准。MiCA 要求加密资产服务提供商注册并遵守透明度、流动性和消费者保护标准。

在亚太地区,日本要求虚拟资产服务提供商获得金融服务管理局(FSA)许可,澳大利亚则需注册为数字货币兑换服务提供商,受澳大利亚交易报告和分析中心(AUSTRAC)监管。北美方面,美国 SEC 对加密资产监管较为严格,如币安、Coinbase 曾面临诉讼,但仍在积极与监管机构沟通,寻求明确框架。

(二)风险隔离

风险隔离机制是 Web3 项目在跨境运营中构建合规框架的重要组成部分。其核心目标是通过企业架构的合理设计,确保不同业务板块或地区的风险不会相互传染,从而保护企业的整体稳定性和持续运营能力。在全球化的 Web3 行业中,由于不同司法管辖区的监管政策、法律环境和市场风险差异显著,风险隔离机制尤为关键。

比如在不同国家或地区设立独立的子公司,每个子公司作为独立法律实体,负责特定市场的业务运营。能够将法律、财务和运营风险限制在特定实体内,避免风险扩散至整个企业集团。各实体独立运营,互不干扰,即使某一地区面临监管变化或 法律挑战,其他实体仍可正常运作。这种设计不仅提升了企业的抗风险能力,还便于根据特定市场的需求调整策略。

将核心资产(如技术专利、知识产权、品牌等)置于特定的控股公司或信托结构中,以保护其免受运营实体的风险影响。例如,企业可以将核心资产注册在英属维尔京群岛(BVI)或开曼群岛的控股公司中,而将高风险的运营业务置于其他地区的子公司中。即使运营实体面临诉讼或财务困境,核心资产仍能得到保护,从而保障企业的长期发展。

通过合同和协议明确各实体之间的权利与义务,确保风险在法律层面得到有效隔离。比如企业可以通过服务协议、许可协议或资金往来协议,清晰划分各实体之间的业务边界和责任范围。这种方式不仅降低了风险传递的可能性,还为企业在全球合规运营提供了灵活性和透明度。

通过合理的建立企业架构隔离机制,Web3 企业能够在面对不同市场的监管要求和风险挑战时,灵活应对,确保核心业务和资产的安全,同时维持全球运营的稳定性。

中国企业出海主要目的地

(一)香港

香港作为国际金融中心,拥有成熟的金融基础设施和健全的法律体系,为 Web3 公司提供了稳定的运营环境。并且相比其他地区,香港对 Web3 项目的监管较为宽松,便于初创公司快速开展业务。尤其是近年来香港政府积极推动区块链技术的发展,通过政策激励和支持措施,为 Web3 公司创造了良好的发展条件。

(二)新加坡

新加坡是亚洲领先的金融科技枢纽,拥有先进的科技生态系统,吸引了大量 Web3 相关企业。并且新加坡政府对区块链和 Web3 技术持开放态度,并制定了清晰的监管政策,帮助公司在合规的前提下快速发展。新加坡的税收制度相对优惠,为 Web3 公司降低了运营成本,增强了吸引力。

(三)BVI(英属维尔京群岛)

BVI 以其快速、简单的公司注册流程和较低的注册费用著称,适合 Web3 初创公司快速设立。BVI 提供严格的隐私保护政策,保障公司和股东信息的安全,非常适合注重隐私的 Web3 项目。当地法律体系灵活,且提供显著的税收优惠,是离岸注册的理想选择。

出海架构的构造

全球合规布局的底层逻辑是通过建立不同实体,构建区域化合规框架,通过持股或实质性控制,充分发挥各地区的独特优势。这种方式使得离岸公司不再仅仅是「逃避监管」或「税务洼地」的代名词,而是通过合理筹划,成为企业构建全球化合规体系、优化资金与资源调配的「战略枢纽」。企业可以根据不同发展阶段的需求,灵活构建单实体架构、多实体架构、平行架构等多层次、多生态的企业战略体系,以适应不同场景和阶段的诉求。

(一)架构适用性

在架构的适用性方面,不同的企业架构设计能够满足企业在不同发展阶段和业务需求下的目标。

(1)单实体架构

单实体架构适合希望快速验证商业模式、专注于单一市场的初创企业或小型公司。

这种架构结构简单,管理成本低,便于快速启动和运营。例如,一家初创公司在新加坡注册一个单一实体,可以迅速进入市场并享受当地的税收优惠政策,同时避免复杂的跨国管理负担。

但是随着企业规模扩大和业务复杂化,单层架构的不足逐渐显现。它可能无法满足全球市场的合规要求,例如不同地区的监管标准差异,也难以实现资源的高效调配和风险的有效隔离。当企业需要同时进入多个市场时,单一实体可能面临税务、法律或运营上的瓶颈。

(2)多实体架构

多实体架构适用于业务线较长、板块复杂、股权结构多样的企业。

通过在不同司法管辖区设立子公司或关联公司,多实体架构能够实现风险隔离、税务优化和市场适配。例如,一家科技公司在欧盟设立子公司以符合 GDPR(通用数据保护条例)要求,同时在开曼群岛设立控股公司以优化全球税务结构。这种架构通过分散实体,将法律和财务风险控制在特定区域,同时提升企业在全球范围内的运营灵活性。它支持企业在不同市场间的资源调配,并通过区域化合规框架增强全球竞争力。

适合已经进入扩张阶段、需要应对多国监管环境和多元化业务需求的企业。例如,某些头部交易所在东南亚、欧洲和北美分别设立子公司,并推出不同版本的 App,以适应当地消费者习惯和法律要求。

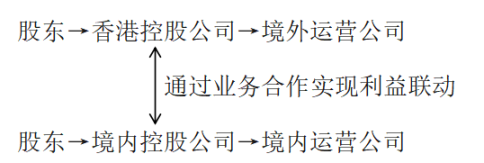

(3)平行架构

平行架构是另一种更复杂的设计,一般是对多个多实体架构直接进行股权或业务的组合,特别适用于需要独立运营多个业务板块的企业。

平行架构通过设立多个独立实体,确保各业务板块在法律和财务上互不干扰。例如,一家集团可能同时运营制造业、零售业和金融服务,通过平行架构为每个板块设立独立的法人实体,避免某一板块的风险波及其他业务。但是通过股权控制或者业务结合,使得各个板块之间还会有紧密的联系和协同效应。一家 Web3 公司可以在不同地区独立运营技术开发和业务推广,既满足本地合规需求,又优化全球资源配置。

这种设计不仅提升了管理的清晰度,还能在全球合规布局中实现更高的灵活性和稳定性,更适应拥有多元化业务的企业。

(二)架构优势分析

(1)单实体架构

单实体架构的特点在于,企业可以充分利用所选司法管辖区的政策和监管优势,实现快速合规与运营。不同地区的监管环境为企业提供了独特的机遇。

比如企业看重融资或科技集群效应,可以新加坡作为注册地。新加坡的融资法律监管相对宽松,尤其在资本市场和金融创新方面较为开放。这为 Web3 企业提供了灵活的融资渠道,有助于快速筹集资金并推动项目发展。并且新加坡政府积极鼓励高新科技企业的发展,为企业提供了多项政策支持和资金激励。企业可以借助这些政策,降低研发成本并加速技术创新。

如果企业对税收和股东隐私更为注重,则可以以 BVI 作为企业注册地。BVI 以其严格的隐私保护政策著称,特别适合注重信息安全和股东权益保护的 Web3 企业。企业在此注册可享受高度的商业机密保护,同时受益于简化的监管要求和低税率环境。

(2)多实体架构

案例:中国→新加坡→境内公司

多实体架构的特点在于其能够将不同地区的监管优势有机结合,通过在全球范围内设立子公司或关联公司,实现合规与运营的优化。

比如设立 BVI 控股公司,控股香港金融公司,再由香港公司控股境内运营公司。BVI 公司具有低税率和隐私保护性的优势,香港控股公司享受香港的金融便利和税收优惠,运营公司在中国境内中心享受科研相关的补助政策和科技产业优势,优化全球控股结构并保护核心资产。

通过多实体架构,企业不仅能够在不同市场间灵活调配资源,还能将法律和财务风险控制在特定区域,确保企业在全球范围内的合规运营。

(3)平行架构

例如:

平行架构的监管特点在于其高度的灵活性和风险隔离能力,特别适用于集团化、业务多元化、股权需求复杂化的企业。

比如通过设立多个独立实体,平行架构确保各业务板块在法律和财务上互不干扰,避免某一板块的监管风险波及其他业务。一家 Web3 企业可能在不同地区独立运营技术开发和业务推广,既满足本地合规需求,又优化全球资源配置。

尽管各实体独立运营,但通过股权控制或业务结合,各板块之间仍能实现紧密的联系和协同效应。一家跨国公司在新加坡设立技术研发中心,在香港设立 Web3 服务公司,两者通过股权或者业务往来进行合作,共同推动技术创新与市场拓展。

平行架构不仅提升了企业在全球合规布局中的灵活性和稳定性,还为企业在复杂监管环境下实现可持续发展提供了坚实基础。

架构税务优势

在如何选择架构实体的注册地点时,需要及时了解各地监管政策,技术和降本增效的需求,以及当地服务商与合规服务的深度合作,尤其是需要注意各地区的税务区别和优惠协定。

(一)单实体架构

单实体架构是指企业通过单一境外子公司直接进行海外投资或运营,适用于业务集中、规模较小或目标市场单一的企业。

优点:结构简单,管理、控制都很方便。

缺点:可能会面临比较高的税负,而且缺乏风险隔离机制。

1.香港:前 200 万利润税率 8.25%,50 多国免双重征税 buff 加持

优势:企业所得税(利得税)8.25%-16.5%(首 200 万港元利润减半征收),无资本利得税、增值税,与 50 多国签订税收协定,外汇自由兑换,上市融资便利;

2.新加坡:17% 税率,双边税收协定网络覆盖广

优势:企业所得税 17%,首三年免税优惠,与 100+ 国建立双边税收协议,利于跨境避税;

3.BVI:零税天堂,保密性强

优势:0 企业所得税、0 增值税、0 资本利得税,公司注册流程极简,股东信息保密性强;

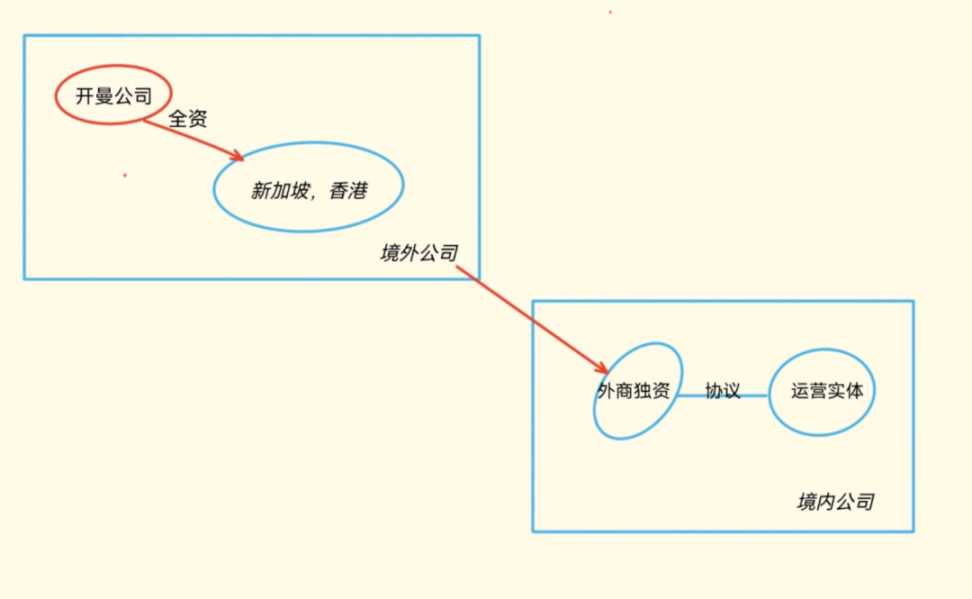

( 二 ) 多实体架构

采用多实体架构,可以更有效地进行税收筹划。境内企业通过在一些低税率的国家或地区(通常是香港、新加坡、BVI 或开曼)设立一个或多个中间控股公司在目标投资国进行投资。利用离岸公司低税率和保密性的优势,降低企业的整体税负,同时能够保护企业信息,分散母公司风险,也为未来的股权重组、出售或上市融资提供了便利。

优点:可以利用各国税收优惠政策,降低投资成本,还能支持全球化布局。

缺点:管理复杂,税务合规成本也会上升。

1.顶层:高度保密 + 低税率 + 资本自由流通

-

注册地:开曼群岛,英属维尔京群岛(BVI)等离岸金融中心

-

实现功能:股东及受益人信息受法律保护,规避单一市场风险(分散地缘政治冲击)。

2.运营层:衔接顶层投资者与底层运营实体 + 提升投资回报率 + 利润预留

-

注册地选择:香港 / 新加坡(贸易合规)、爱尔兰 / 荷兰(欧盟市场)、迪拜(中东市场)

-

实现功能:与目标投资过签署避免双重征税协定(DTT)提升整体投资回报率。

3.实际运营公司:业务落地 + 直接 / 间接控股

-

注册地选择:目标市场本地公司

-

实现功能:落地生产、市场营销、本地化服务,满足属地化经营要求,根据经营项目选择注册地。

案例:跨境电商

架构设计:

-

控股层:BVI 公司(保密性)+ 香港公司(融资与供应链统筹)

-

运营层:香港公司(离岸贸易免税)+ 迪拜公司(中东仓储物流)

-

实体层:中国内地工厂(出口退税)+ 巴西子公司(本地化销售)

通过 BVI 公司控股香港公司再投资运实体层,由境外控股公司通过层层架构以 VIE 协议方式实现对运营实体公司的控制。

BVI 公司作为顶层控股,香港向 BVI 分红免征预提税,未来股权转让免征资本利得税,保护创始人隐私。

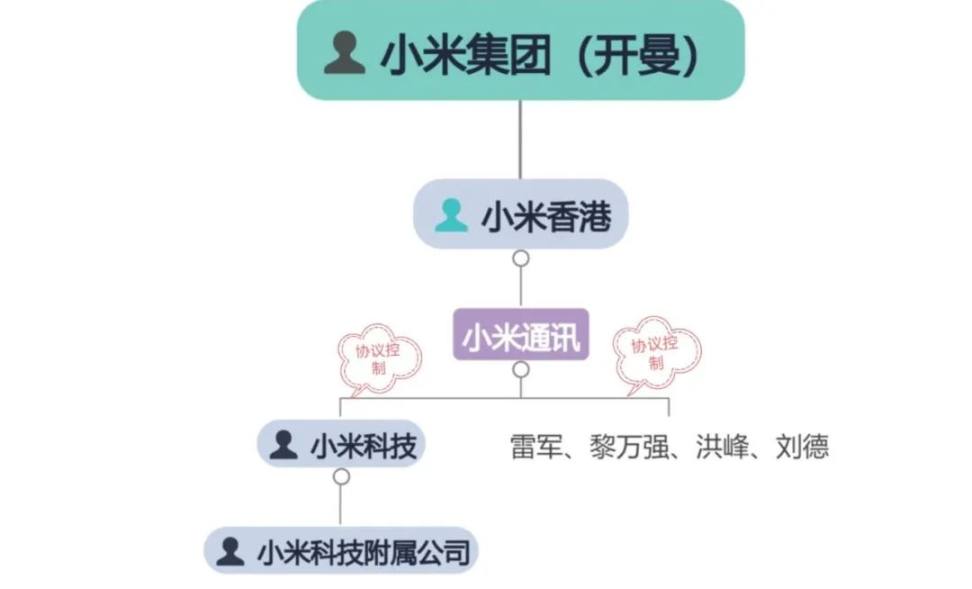

案例:小米集团

架构设计:

-

控股层:小米集团(开曼)

-

运营层:小米香港(全球采购 + 利润留存)

-

实体层:小米通讯(直面消费者)、小米科技以及小米科技附属公司

通过小米集团(开曼)控股小米香港公司再投资小米通讯等实体层。小米通讯与小米科技及其工商登记的股东签署协议控制法律文件,通过 VIE 协议控制小米科技并间接控制小米科技附属公司。

总结

在全球化的背景下,Web3 项目出海已成为中国企业突破国内监管限制、开拓海外市场的关键策略。通过出海,企业不仅能够有效规避合规风险,还能抓住国际市场机遇、吸引优质资源并实现风险分散。例如香港、新加坡和 BVI 等地因其宽松的监管环境、税收优惠政策以及完善的基础设施,成为 Web3 企业的理想目的地。

在架构设计上,企业可根据自身规模与目标,灵活选择单实体、多实体或平行架构,以确保合规性并隔离潜在风险。同时,借助各地政策优势,企业可通过多实体架构优化资金流动,显著降低税务负担。

展望未来,随着 Web3 项目的全球化发展,企业正从单一架构转向混合架构,以实现风险隔离、资金流转、战略协同和税务筹划。通过在不同司法管辖区设立多个实体,企业能够有效隔离市场风险并确保合规,同时利用离岸公司和控股结构优化资金流动、降低税务负担,并整合全球资源提升创新能力和市场竞争力,利用全球化布为区块链技术带来的新机遇。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。