引言:从极客的玩具到华尔街的新宠,DeFi 是怎么做到的?

在过去的几年里,金融圈有个热词不断被提起——DeFi(去中心化金融)。几年前,当极客们刚刚开始在以太坊上搭建一些稀奇古怪的金融工具时,没人想到这些“小玩具”最终能吸引到华尔街传统金融大佬们的目光。

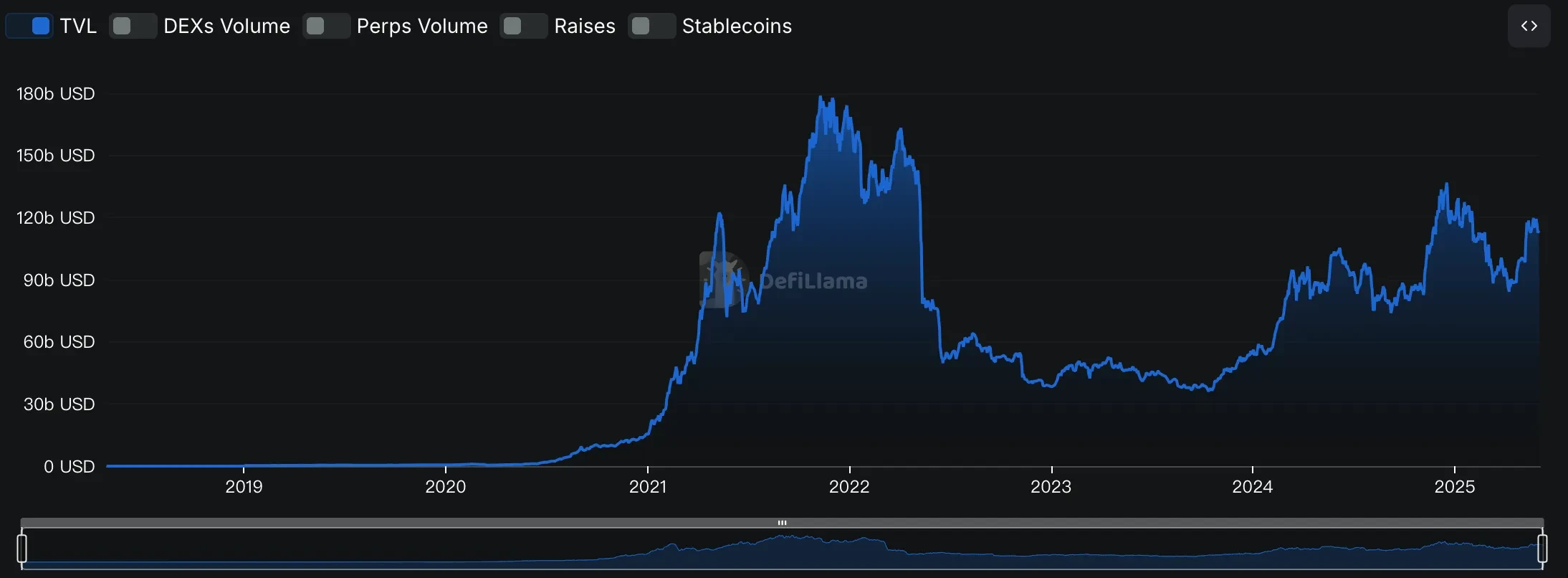

回顾2020到2021年间,DeFi 以让人目瞪口呆的速度迅速崛起。当时,整个市场的锁仓量(TVL)从十几亿美元一路飙升,最高峰时竟达到1780亿美元。像 Uniswap、Aave 这些听起来怪怪名字的协议,一时间成了全球加密界的网红项目。

然而,对于大多数普通投资者来说,DeFi 始终像一座设满陷阱的迷宫。钱包操作让人头疼,智能合约难懂得像火星文,更别提每天还要提心吊胆地防止资产被黑客一锅端了。数据显示,即便 DeFi 如此热门,传统金融市场里的投资机构,真正进场的比例却不足5%。一方面,投资者跃跃欲试;另一方面,却又因为种种门槛而迟迟不敢行动。

但资本的嗅觉永远最敏锐。2021年起,一种专门解决“怎么轻松投资 DeFi”的新工具出现了,这就是去中心化ETF(Decentralized ETF,简称 DeETF)。它融合了传统金融中ETF产品的理念和区块链的透明性,既保留了传统基金的便利性和规范性,又兼顾了DeFi资产的高成长空间。

可以这么理解,DeETF就像是一座桥,一头连着“难以进场”的DeFi新大陆,另一头连着熟悉传统金融产品的广大投资者。传统机构可以继续用他们熟悉的金融账户投资,而区块链爱好者则可以像玩游戏一样,轻松组合自己的投资策略。

那么,DeETF 究竟是如何伴随 DeFi 的成长逐渐崭露头角?它经历了怎样的演变,又如何一步步成为链上资产管理领域的一股新势力?接下来,我们将从DeFi的诞生一路讲起,聊聊这个金融新物种背后的故事。

第一部分:从DeFi到DeETF:链上ETF兴起的发展史

(一)早期探索(2017-2019):那些最初的尝试和埋下的伏笔

如果说DeFi是一次金融革命,那么它的开头一定离不开以太坊。2017到2018年间,以太坊上的几个早期项目,如MakerDAO和Compound,首次向世界展示了去中心化金融的可能性。虽然当时的生态规模还非常有限,但借贷和稳定币等新颖的金融玩法,已经在极客圈中掀起了一股小浪潮。

2018年末到2019年初,Uniswap横空出世,提供了一种前所未见的“自动化做市商(AMM)”模式,让人们不用再被复杂的订单簿折磨,从此“交易”变得轻松许多。从 2017 年到 2018 年,MakerDAO 和 Compound 展示了去中心化贷款和稳定币的可能性。随后,Uniswap 于 2018 年底和 2019 年初推出的自动做市商(AMM)模型大大简化了链上交易。截至 2019 年底,DeFi 的 TVL 已接近 6 亿美元。

与此同时,传统金融的关注也悄然开始。一些敏锐的金融机构悄悄布局区块链技术,然而此时,他们依然被复杂的技术问题困扰,无法真正参与进去。虽然当时没有人明确提出“DeETF”这个概念,但传统资金与DeFi之间急需桥梁这一需求,已在这个阶段初现端倪。

(二)市场爆发与概念成型(2020-2021):DeETF登场的前夜

2020年,一场突如其来的疫情改变了全球经济的走向,也促使大量资金流入加密货币市场。DeFi在这个时期爆发,TVL更是以令人瞠目的速度迅速蹿升,从10亿美元猛增到一年后的1780亿美元。

投资者疯狂涌入,以至于以太坊网络堵得水泄不通,甚至出现了一次交易手续费超过100美元的极端状况。流动性挖矿、收益农场等一系列眼花缭乱的新模式,让市场迅速火热,但同时也暴露了巨大的用户参与门槛。许多普通用户感叹:“玩个DeFi,真比炒股难多了!”

就在这个时候,一些传统金融公司开始敏锐地捕捉到了机会。加拿大上市公司DeFi Technologies Inc.(股票代码:DEFTF)便是典型代表。这家公司原本做着跟加密毫无关系的传统业务,却在2020年果断转型,开始推出跟踪主流DeFi协议(如Uniswap、Aave)的金融产品,用户只需在传统交易所买卖股票般简单,就能参与到DeFi世界。这种产品的出现,也正是“DeETF”概念正式萌芽的标志。

与此同时,去中心化赛道也在悄悄行动。像DeETF.org这样的项目,开始尝试直接用智能合约去中心化地管理ETF组合,但这一时期的尝试还只是初级阶段。

(三)市场洗牌与模式成熟(2022-2023):DeETF正式化

DeFi的火爆并未持续太久。2022年初,Terra崩盘、FTX破产,这一系列黑天鹅事件几乎摧毁了投资者的信心。DeFi市场TVL直接从1780亿美元跌落至400亿美元。

但危机往往伴随着机会。市场的剧烈震荡让人们意识到,DeFi领域迫切需要更加安全、更透明的投资工具,这反而推动了DeETF的发展与成熟。这个时期,“DeETF”不再只是一个概念,而是逐步发展成两种清晰的模式:

传统金融渠道进一步强化:DeFi Technologies等机构趁势扩展产品线,推出更多更稳健的ETP(交易所交易产品),并在传统交易所上市,如加拿大的多伦多证券交易所。这种模式极大降低了散户的参与门槛,也受到传统机构的青睐。

链上去中心化模式兴起:同时期,DeETF.org、Sosovalue等链上平台也正式上线,直接通过智能合约实现资产管理和组合交易。这类平台无需中心化托管,用户自己即可创建、交易、调整投资组合。尤其吸引了加密原生用户和追求绝对透明度的投资者。

这两种模式并行发展,让DeETF赛道逐渐清晰:一方面通过传统金融渠道,另一方面则强调完全去中心化与链上透明。

(四)优势逐渐显现,同时挑战不容忽视

发展到今天,DeETF已逐步展示出自己的独特优势:

易用性强,参与门槛大幅降低:无论是传统模式还是链上模式,都极大地降低了散户投资者的参与门槛。

投资更透明、更灵活:链上模式24小时全天候交易,资产组合随时可调整。

风险控制与投资多元化:投资者可轻松构建多资产组合,降低单一资产波动风险。

但与此同时,挑战也在逐渐显露:

监管环境不确定:美国SEC对加密ETF的监管非常严格,合规成本居高不下。

智能合约安全隐患:2022-2023年间,黑客攻击造成了DeFi协议约14亿美元的损失,让投资者仍存忧虑。

不过,即便存在这些挑战,DeETF依旧被视作未来金融市场的重要创新之一。它让传统投资者与加密市场之间的界限逐渐模糊,资产管理变得更加民主化、智能化。

第二部分:新兴项目崛起,DeETF赛道百花齐放

(一)从单一模式到多元探索:DeETF的新局面

随着DeETF概念逐渐被市场接受,这个新兴领域也在2023年之后进入了一个“百花齐放”的阶段。不同于早期只有单一的ETP(交易所产品)模式,如今,DeETF正沿着两条路径迅速演化:

一条是继续沿用传统金融逻辑,通过正规交易所发行ETP,如 DeFi Technologies,不断丰富DeFi资产类别,让传统投资者可以像买股票一样轻松投资链上资产;

另一条则是更加激进也更贴近加密精神的路径——纯链上、去中心化的DeETF平台。用户不需要经纪账户、不需要KYC,只需一个加密钱包,就能在链上自助创建、交易和管理资产组合。

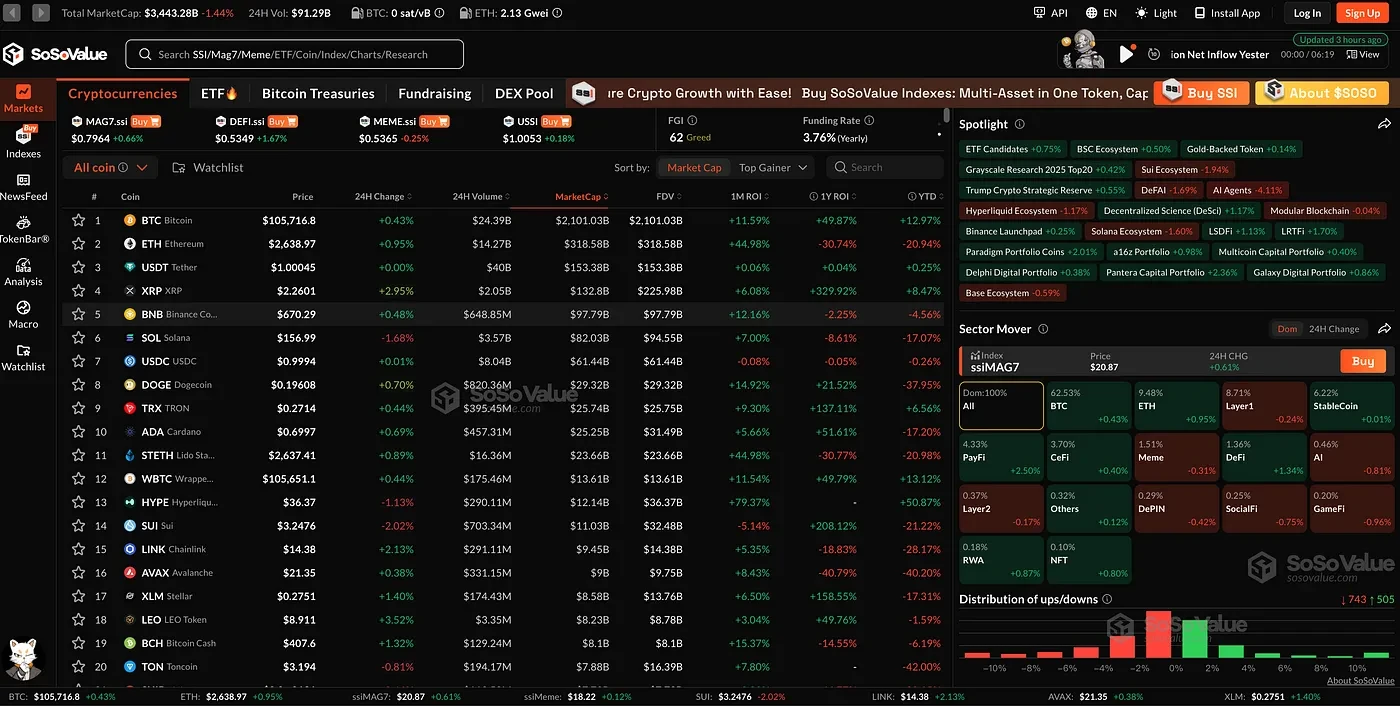

尤其是在过去两年,在链上原生资产组合方向,像 DeETF.org、Sosovalue 等平台成为了先锋探索者。其中 Sosovalue 支持多主题组合策略(如GameFi、蓝筹组合),为用户提供“一键买入+可追踪”的 ETF 产品体验,试图用更轻的方式解决组合管理门槛问题。

而在机构路径方面,除了 DeFi Technologies,也不能忽视 RWA 龙头 Securitize 的影响力。它正在以合规方式将美国私募股权、公司债券、房地产等传统金融资产代币化,并引入一级市场投资者进入链上市场。这种打法虽不直接被称为 DeETF,但其组合式资产托管结构和 KYC机制,已具有 DeETF 的核心特征。

他们提出了“24/7全天候交易、无中介、用户自主组合”的理念,打破了传统ETF受限于交易时间和托管机构的格局。数据显示,截至2024年底,DeETF.org上活跃的链上ETF组合数量已突破1200个,锁仓总价值达到数千万美元级别,成为DeFi原生用户的重要工具。

而在专业化资产管理方向,像 Index Coop 这样的组织也开始将 DeFi资产进行标准化打包,比如推出 DeFi Pulse Index(DPI),为用户提供“开箱即用”的DeFi蓝筹资产组合,降低个体选币风险。

可以说,从2023年起,DeETF已经从单一尝试变成了一个多元竞争的生态系统,不同路线、不同定位的项目正百花齐放。

(二)智能资产组合新趋势:谁在让 DeETF 变得“更好用”?

过去几年,DeETF 赛道经历了从“自己动手自由组合”,到“预设组合一键买入”的阶段性演进。像 DeETF.org 倡导“由用户自选”的组合机制,而 Sosovalue 则更偏向“主题型策略”的产品化路径,比如 GameFi 蓝筹包、L2叙事组合等,这类平台大多面向已有投研基础的用户。

但真正把“组合策略”交给算法自动化处理的,还不多见。

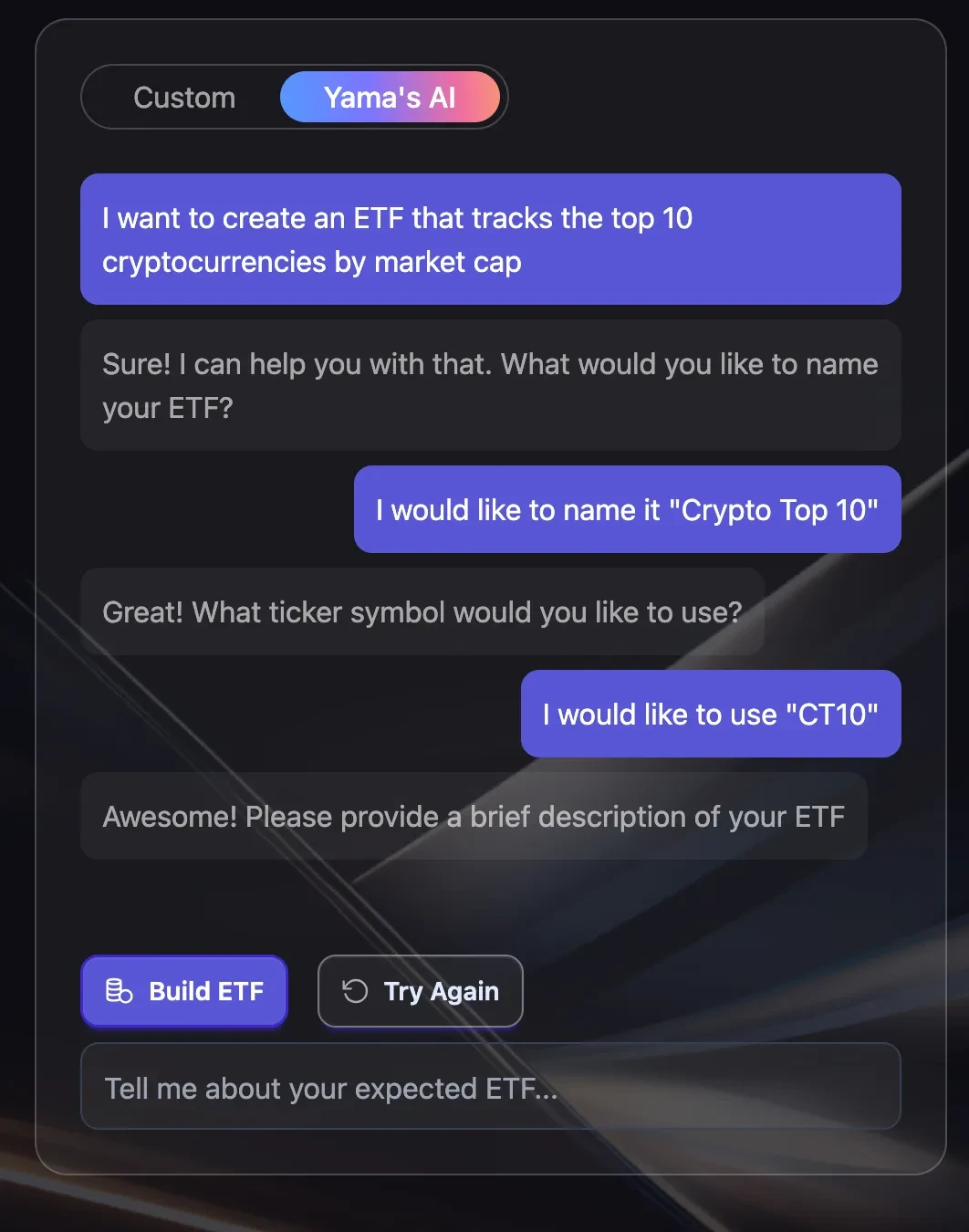

这正是已获得Juchain第一届黑客松比赛的 YAMA(Yamaswap) 切入点:它不是在传统 DeFi 基础上堆叠组合,而是试图让 DeETF 更“智能”。

具体来说,YAMA 并不希望用户承担所有投研压力,而是构建了一个由 AI 驱动的资产配置推荐系统。用户只需输入需求,比如“稳健收益”“关注以太坊生态”“偏好LST资产”,系统便会基于链上历史数据、资产相关性与回测模型,自动生成推荐组合。

与此类似的概念,也曾出现在 TradFi 世界中的 Robo-advisor 智能投顾服务,如 Betterment、Wealthfront,但 YAMA 将其搬到了链上,并在合约级别完成资产管理逻辑。

部署方面,YAMA选择在 Solana 与 Base 上运行,从而大幅降低使用成本。相比以太坊主网动辄数十美元的 GAS 成本,这种架构天然适合更日常化的资产组合交互,尤其是对散户用户而言更友好。

在组合安全性方面,YAMA 的智能合约支持组合成分、权重、动态变化等全部链上公开,用户可以随时追踪策略运行,避免了传统 DeFi 聚合工具的“黑箱式配置”。

而与其他平台不同的是,YAMA 强调用户“自助部署”+“AI组合推荐”的组合式体验 —— 既解决了“不会投”的痛点,也保留了“资产掌控权”的透明与自主管理。

这类产品路径,也许正代表了下一阶段 DeETF 平台从“结构工具”走向“智能投研助手”的方向。

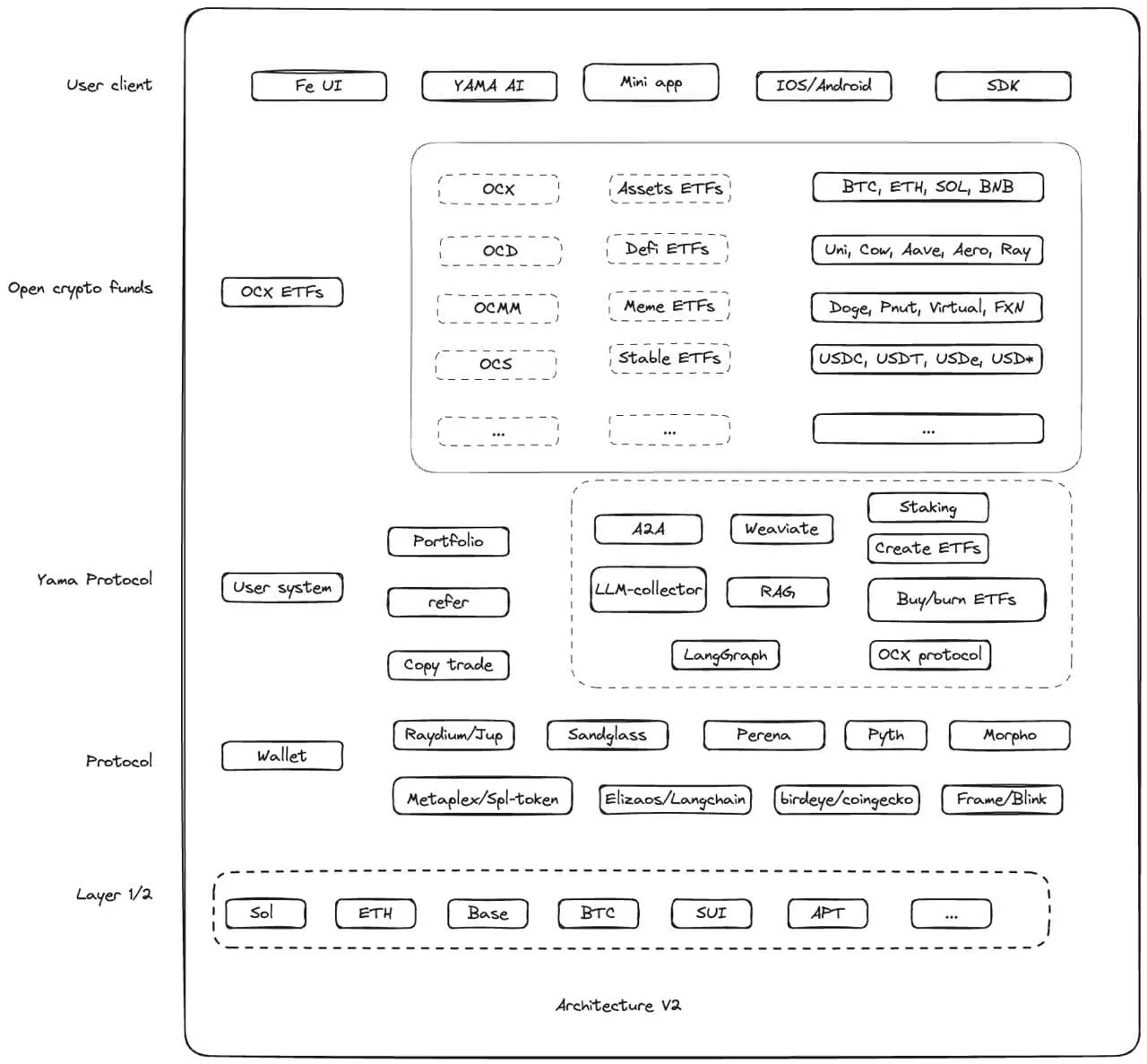

Yamaswap 技术架构

(三)DeETF 赛道,正在形成分叉进化路径

随着加密用户结构从交易为主转向“组合管理”需求,DeETF 赛道逐渐分化为几条不同的发展路线。

比如,DeETF.org 仍强调用户自主配置、自由组合,适合有一定认知基础的用户;Sosovalue 则将资产组合进一步产品化,推出链上主题型 ETF,如“Solana基础建设组合”“Meme生态篮子”等,类似传统基金的风格。Index Coop 等则专注标准指数产品,以长期稳定的市场覆盖为目标。

而传统 DeFi 项目中,DeFi Technologies 与 Securitize 分别面向散户与机构,代表着两种不同的合规化探索路径——后者已成为首批获得 SEC 豁免的 RWA 平台,为链上资产组合合规进程提供了范例。

但从用户交互方式来看,整个赛道开始出现新的趋势转向:更智能、更自动化的资产配置体验。

例如,一些平台开始尝试引入 AI 模型或规则引擎,根据用户目标与链上数据动态生成配置建议,试图降低门槛,提升效率。这类模式也在 DeFi 用户不断扩容、投研需求提升的背景下显现出明显优势。

YAMA 就是这条路径上的代表之一:它在 AI 组合推荐与链上自助部署之间做了结构性整合,同时采用低成本高性能的公链进行部署,使普通用户能在“无需复杂操作”的前提下完成资产配置。

尽管每条路径仍在早期阶段,但越来越多的 DeETF 平台开始从“纯工具”转向“策略服务者”,背后也透露出整个加密资产管理赛道的底层演进逻辑:不只是去中心化,更是去繁化、去专业壁垒化的金融体验。

结语:从趋势到实践:DeETF重塑链上资产管理的未来

过去几年里,加密行业经历了太多次狂热与崩塌。每一次新概念的诞生,都伴随着市场的喧嚣与质疑,DeFi 亦是如此。而DeETF,这个原本小众、边缘的交叉领域,正在悄悄积蓄能量,成为链上金融下一个值得认真对待的分支。

回顾DeFi的发展,能够清晰看到一条主线:

从最初的智能合约试验,到构建开放式交易和借贷协议,再到引发大规模资金流动,DeFi用六七年时间完成了传统金融几十年走过的路。而现在,DeETF作为DeFi的“用户体验升级版”,正在承担起进一步普及和降低门槛的任务。

数据显示,尽管目前DeETF赛道总体体量仍小,但其增长潜力巨大。根据 Precedence Research 的报告,DeFi市场预计将从 2025 年的 323.6 亿美元增长至 2034 年的约 1.558 万亿美元,年复合增长率(CAGR)为 53.8%。这意味着,未来5年,在DeFi的高速发展之下,DeETF不仅会是DeFi生态的一部分,更有可能成为链上资产管理最重要的应用场景之一。

站在今天这个节点上,我们已经能看到不同类型的探索者:

有像DeFi Technologies这样的公司,试图从传统金融切入,发行更合规、更熟悉的加密ETP产品;

有像DeETF.org这样的平台,坚持链上自治,强调自由组合和完全透明;

也有像YAMA这样的新兴力量,不仅延续了去中心化精神,还在此基础上引入了AI辅助组合构建,试图让链上资产管理真正“智能化、个性化”起来。

如果说早期的DeFi解决了“能不能去中心化做金融”的问题,今天的DeETF和类似YAMA这样的项目,正在解决的是“去中心化金融能不能让更多人用得起、用得好”的问题。

未来的链上资产管理,不应该只是少数人的套利工具,而应该成为任何一个普通投资者都能掌握的能力。而DeETF,正是那把钥匙。

从MakerDAO到Uniswap,从DeFi Technologies到YAMA,去中心化金融的每一次进步,背后都是对金融自由、透明与普惠理念的又一次刷新。

而今天,DeETF正在重新定义链上资产管理的方式,而像YAMA这样敢于创新的项目,也正在为这条路注入新的想象力。

故事,还远没有结束。

但未来,正在慢慢成形。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。