原创 | Odaily星球日报(@OdailyChina)

作者 | Ethan(@ethanzhang_web3)

6 月11日,美国证券交易委员会(SEC)向拟发行Solana现货ETF的多家机构发出通知,要求其在7天内重新提交修订版S-1文件,重点涉及“实物赎回机制”与“质押条款”的措辞修正。

这一举动被市场视为监管层态度转变的明确信号,也迅速点燃多头情绪,SOL价格随即上扬,短线冲破165美元,单日涨幅一度达5%。

市场情绪快速升温,投资者纷纷押注Solana可能成为继BTC、ETH之后的第三个被主流金融纳入现货 ETF 的加密资。在ETF交易结构逐步明晰、监管信号转暖的背景下,投资者的关注点也从“能否通过”转向“何时通过”与“谁来推出”。

监管动向:从不可想象到逐步接受,Solana进入审查倒计时

当前 SEC的重点不再是“是否允许”Solana 现货 ETF上线,而是“如何合规表达ETF的质押与赎回结构”。要理解此次S-1修订为何意义重大,还需要回顾一下 SEC过往在 ETH 现货 ETF上的表态。

2024年5月24日,以太坊现货ETF 获批,获批的核心原因在于SEC最终放弃了对ETH是否为证券的追问,且ETF结构明确剔除了Staking质押条款。这使得SEC可将其视作“商品型ETF”,纳入传统资产监管逻辑之中。

相比之下,Solana作为高度PoS依赖型链,其Staking机制的合规性一直是争议焦点。而此次SEC要求申请方在S-1文件中明确质押机制细节,被广泛解读为“不再回避Staking”,而是试图在监管框架中纳入PoS逻辑。Staking Rewards数据显示,截至6月12日,Solana的质押率为65.44%,质押收益率为7.56%,是 ETH(3.13%)的两倍多。

更重要的是,SEC还承诺将在 S-1 文件提交后的 30 天内完成审查反馈。这在以往比特币、以太坊现货ETF审查流程中极为少见,也意味着Solana现货ETF的落地窗口已打开,最快可能在7月中旬获批。

审批时间表预测,SOL ETF 最快7月通过

根据外媒 Blockworks 报道,消息人士预计,在完成这些 S-1 文件的更新后,Solana ETF 有望在未来三到五周内就能获得最终批准。

彭博行业研究的James Seyffart 表示,他预计今年就能获得批准,最早可能在 7 月。 Seyffart 在本周的一份报告中写道,“我们认为,SEC 现在可能会比计划更早地专注于处理 Solana 的 19b-4 申请和质押 ETF。发行人和行业参与者可能一直在与 SEC 及其加密货币工作组合作制定规则,但该机构对此类申请做出决定的最终期限要到 10 月。”

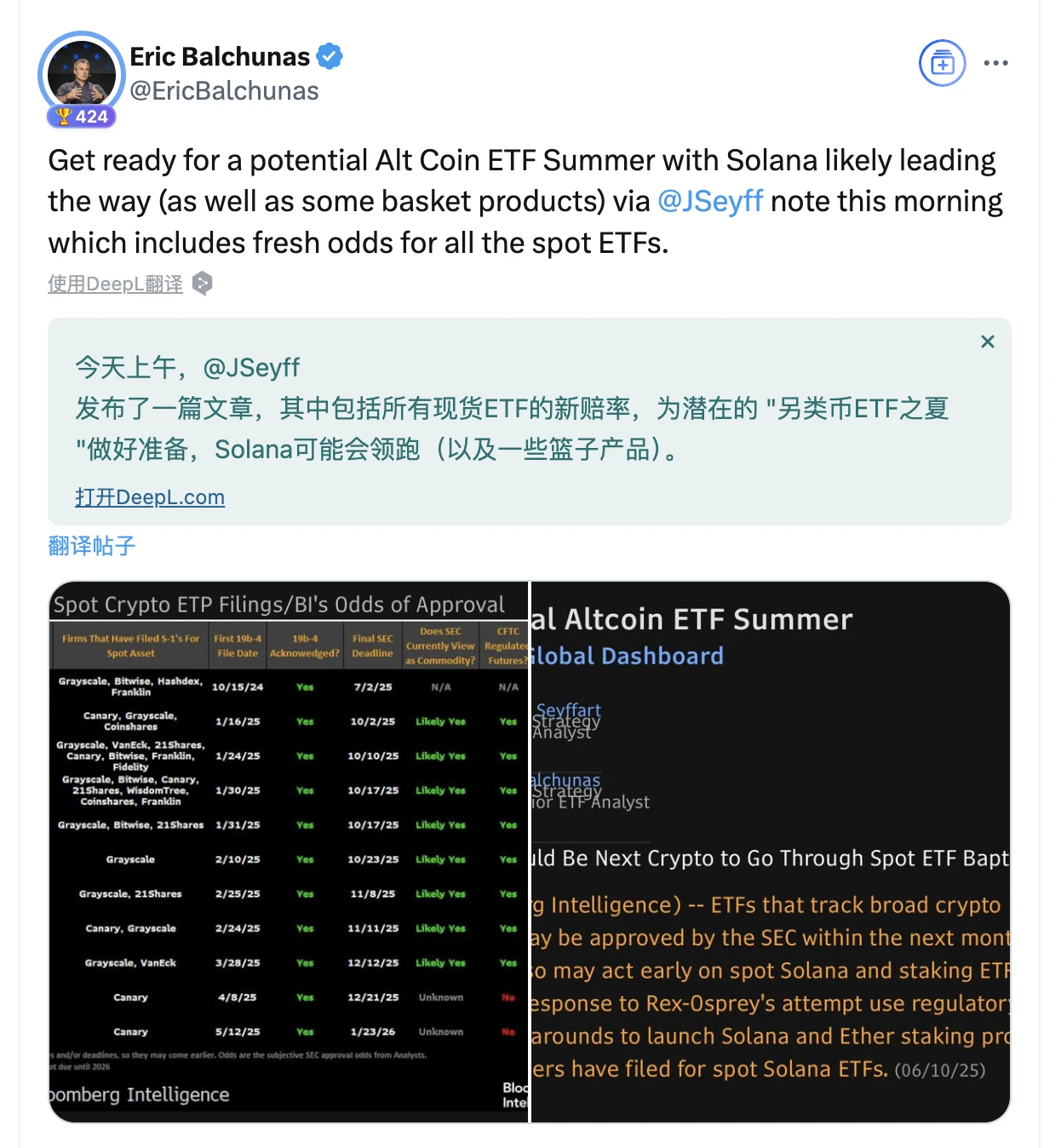

今年 4 月,彭博行业研究分析师 Eric Balchunas 表示,已将 SOL ETF 获批的可能性从 70% 提高到 90%。 他在最新推文中表示:“准备好迎接潜在的山寨币 ETF 夏季吧,Solana 可能会引领潮流(以及一些篮子产品)”。

此外,政治因素也在悄然推动着监管转向:现任美国总统特朗普对加密行业的高调公开支持;美国国会两院相继通过推翻SAB121的决议,从立法层上对加密资产会计政策进行了否定;国会审议中的FIT21法案明确提出对去中心化数字资产豁免证券标准,SOL可能正处于合规门槛之上。

综合来看,Solana现货ETF的审批已从“遥不可及”迈入“路径清晰”的阶段,同时这也意味已经正式进入合规博弈的最后一环。

谁在排队?Solana ETF发行机构全景图

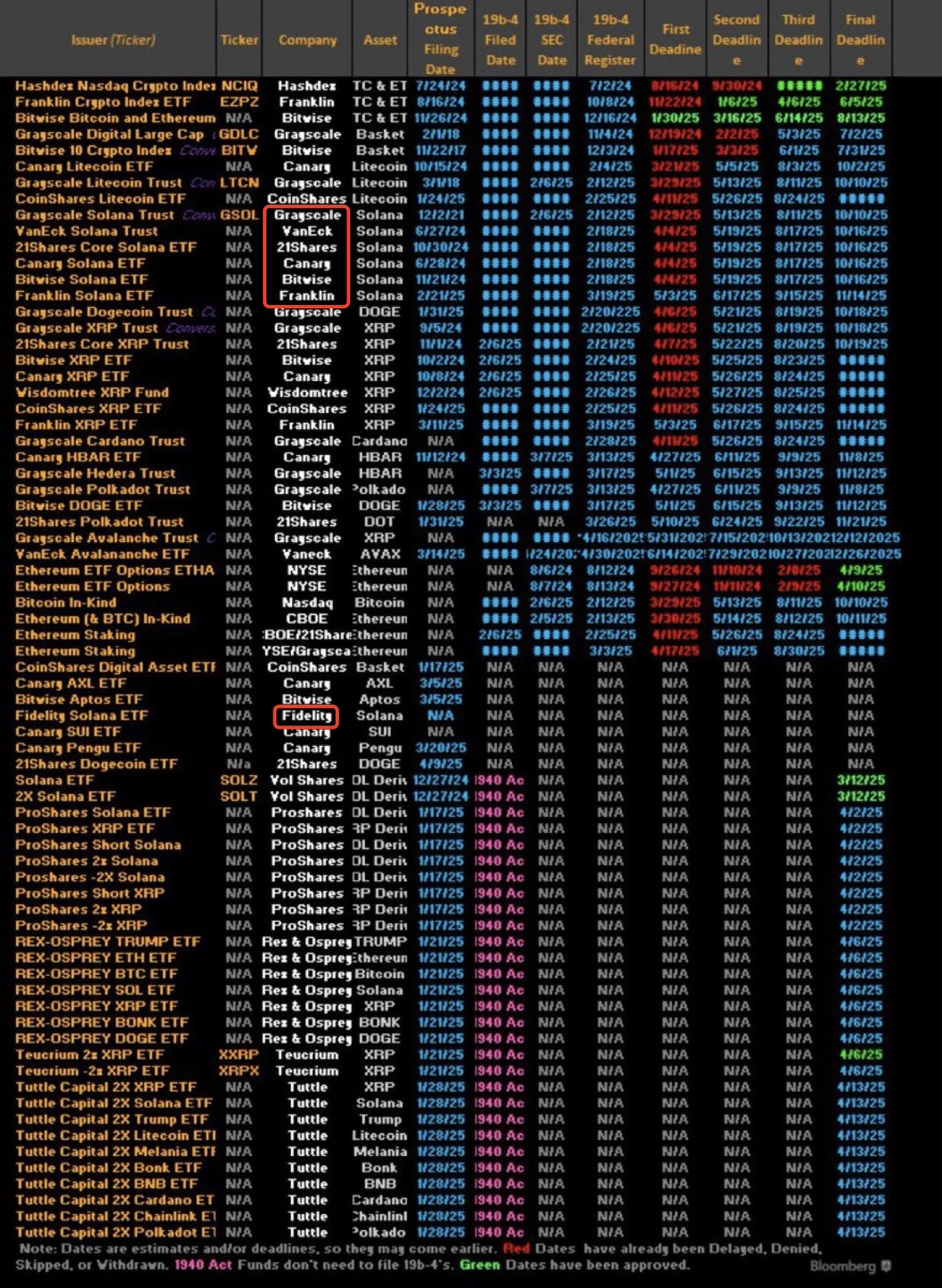

Solana ETF的竞争始于VanEck去年提交的 S-1文件,紧随其后的是21Shares和Bitwise。

目前已经提交Solana ETF申请的机构包括VanEck、21Shares、Grayscale、Bitwise、Canary Capital、Franklin Templeton和Fidelity七家资产管理公司,他们正在等待SEC对其Solana ETF申请的最终决定。其中,由于在BTC和ETH 的现货ETF 上的成功案例,Grayscale 正计划将其现有的 SOL 信托产品也同样复制转换为现货 ETF。

图片来源于@Shibo

ETF通过,SOL能否像BTC一样起飞?

BTC ETF前车之鉴:

参考2023年底到 2024年初的BTC 现货ETF批准前后的市场反应:BTC 在2023年10月在2.7万美元附近起步,在其现货ETF开始交易当日及次日(2024年1月11日至12日)短时内出现 15%下跌,随后累计下跌 21%,然后便开始一路高歌猛进最高触及7.3万美元,涨幅近2.7倍。

然而这样的“美好愿望”在ETH这里却并没有照进现实。自ETH在5月确认现货ETF后,一直到7月23日ETF开放交易,期间 ETH价格反应平缓,涨幅不到 30%。ETF 开放交易后一个月,更是暴跌超过 30%

虽然ETF的通过对于加密货币的长期合法性和机构资金流入具有积极意义,但短期价格表现受到市场预期和“买预期卖事实”心理的影响,所以对于ETH而言,其ETF的通过可能更多地是验证了市场此前的预期,而非带来新的、未被计入价格的刺激。另外一方面原因也在于ETH 的 ETF 是“阉割版”的,没有质押收益机制,同样对用户没有太多的吸引力。

SOL若通过ETF,有多大上行空间?

根据GSR模型推算,若SOL ETF的资金流入为BTC ETF的5%,按市值折算,其涨幅可能达到3.4倍,即从当前160美元上行至500美元,可能冲击400–500美元区间;在更乐观情景下,若资金流入占比达14%,价格可能触及800美元以上。

但值得警惕的是,SOL 的抛压风险。SOL早期投资者成本极低,ETF落地可能成为解锁退出的节点。此外,SOL的供给结构与BTC和ETH 还存在不同:质押占比已超过65%,ETF是否允许将份额质押仍存变数,一旦质押收益未纳入ETF结构,现货ETF中的SOL将因未参与链上回报而吸引力下降。此外,ETF一旦成为主流资金通道,链上DEX与DeFi生态或遭遇流动性迁移风险。

因此,在ETF消息确认前后,市场极可能依旧经历“先炒预期、后兑现”的波动结构,这与BTC ETF开始交易前后的价格周期是极为相似的。

SOL 值得重仓?

从目前公开资料与市场反馈来看,Solana现货ETF有望在未来2到3周内获得正式批准,成为继BTC和ETH之后的又一个“主流入场通道”。

短期内,SOL价格可能进一步受到资金预期驱动,冲击200–300美元区间;中期看,能否重演BTC式的爆发还需关注两个变量:

ETF结构设计能否解决质押问题,真正实现“链上收益+监管透明”双重目标;

链上生态是否能承接新增流量与交易需求,构建稳固的“资金+应用”闭环。

在加密资产迈向合规与主流金融交汇的节点上,Solana ETF不仅是产品,更是公链竞争、PoS共识机制和DeFi应用的集体压力测试。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。