原文编译:雷建平

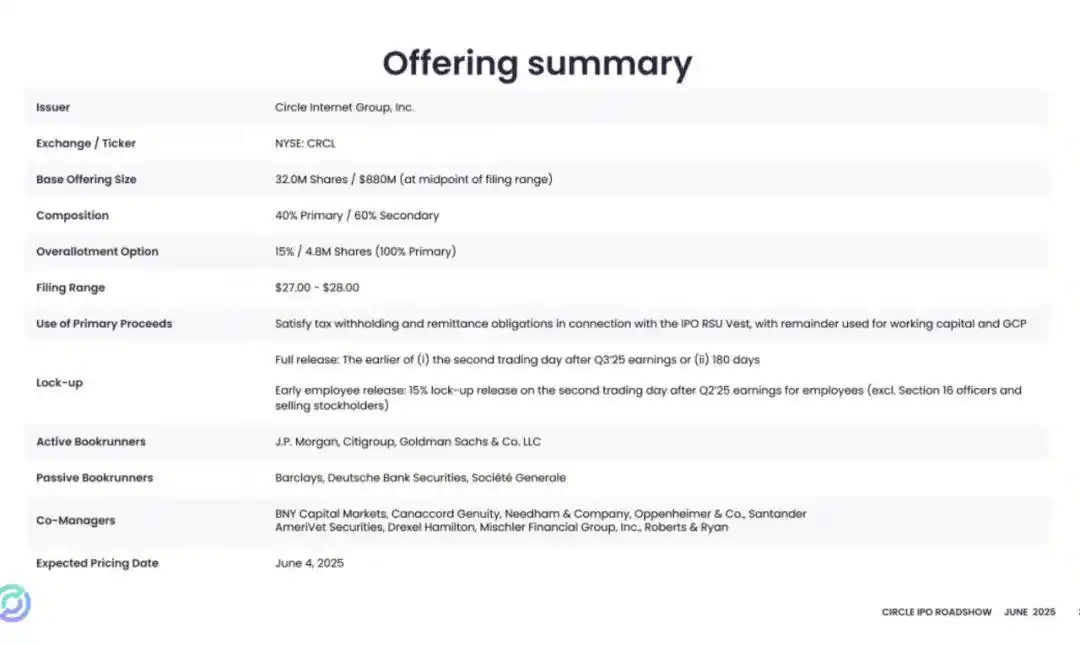

USDC 稳定币发行商 Circle(股票代码为:「CRCL」)日前开启招股,准备本周在纽交所上市。Circle 发行区间为 27 美元到 28 美元,发行 3200 万股,最高募资 8.96 亿美元。其中,Circle 公司发行 1280 万股,最高获 3.58 亿美元;现有股东出售 1920 万股,套现 5.38 亿美元。

ARK Investment Management, LLC 及其关联实体已表示有意以首次公开发行价格认购本次发行中最多 1.5 亿美元的 A 类普通股,认购条款与本次发行的其他购买者相同。Circle 目标估值已从 56.5 亿美元上调至 72 亿美元。Circle 首席执行官 Jeremy Allaire 表示,「对于 Circle 来说,成为纽约证券交易平台的上市公司是我们希望以最大透明度和问责制运营的延续。」

曾拟曲线上市:公司作价 90 亿美元

Circle 冲刺纽交所

Circle 创立于 2013 年波士顿,拥有一款提供法定货币转账服务的产品 Circle Pay,也被称作「美国支付宝」。Circle 与 Coinbase 曾有合作,2018 年双方成立 Centre Consortium,创建 USDC。

2023 年 8 月,Centre Consortium 联盟解散,Circle 从 Coinbase 收购了 Centre Consortium 剩余的 50% 股权,总对价为 2.099 亿美元,以约 840 万股按公允价值计量的普通股形式收购,Coinbase 获 Circle 的股权。

Centre 收购完成后,成为 Circle 的间接全资合并子公司,Circle 完全控制了 USDC 生态系统。2023 年 12 月,Circle 解散了 Centre,其净资产分配给本公司的另一家全资子公司。Circle 曾在 2016 年 6 月宣布获 6000 万美元 D 轮融资,由 C 轮的领投方 IDG 资本继续领投。Breyer 资本和 General Catalyst Partners 也继续参与投资。

Circle 的 D 轮融资也吸引到数位中国战略投资者,包括百度、中金甲子、光大控股、万向和宜信,及两位重要个人投资者的支持:前 IBM 董事长兼 CEO Sam Palmisano 和 SilverLake 的联合创始合伙人 Glenn Hutchins。

2018 年 5 月,Circle 宣布完成 1.1 亿美元的 E 轮融资,由比特大陆领投。IDG 资本作为两家公司的共同投资方以及 Circle 的 C、D 两轮连续领投方在此轮继续跟进,跟投方还包括 Breyer Capital、Accel 等老股东和新加入的 Blockchain Capital 和 Tusk Ventures。2021 年 5 月 31 日,Circle 宣布募资 4.4 亿美元,此轮融资参与者包括数字货币集团、富达管理和研究公司以及加密货币交易平台 FTX。

Circle 曾在 2022 年通过一家特殊目的收购公司上市的交易中,估值为 90 亿美元。该交易于 2022 年 12 月结束。当时,Jeremy Allaire 还表示,他对拟议的交易「超时」感到失望,但公司仍打算上市。

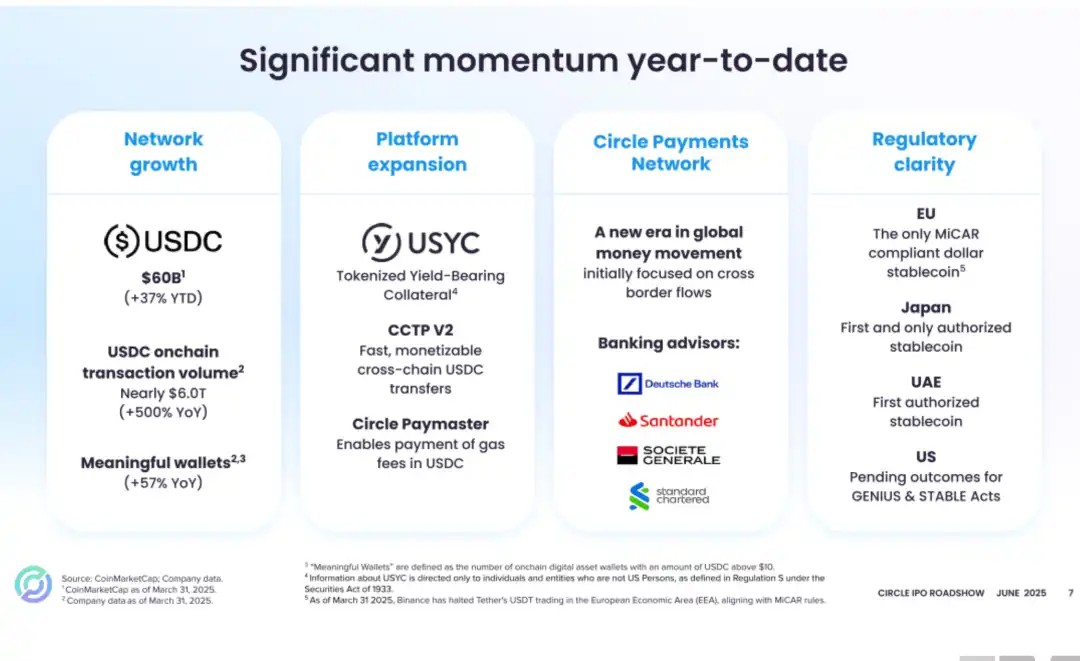

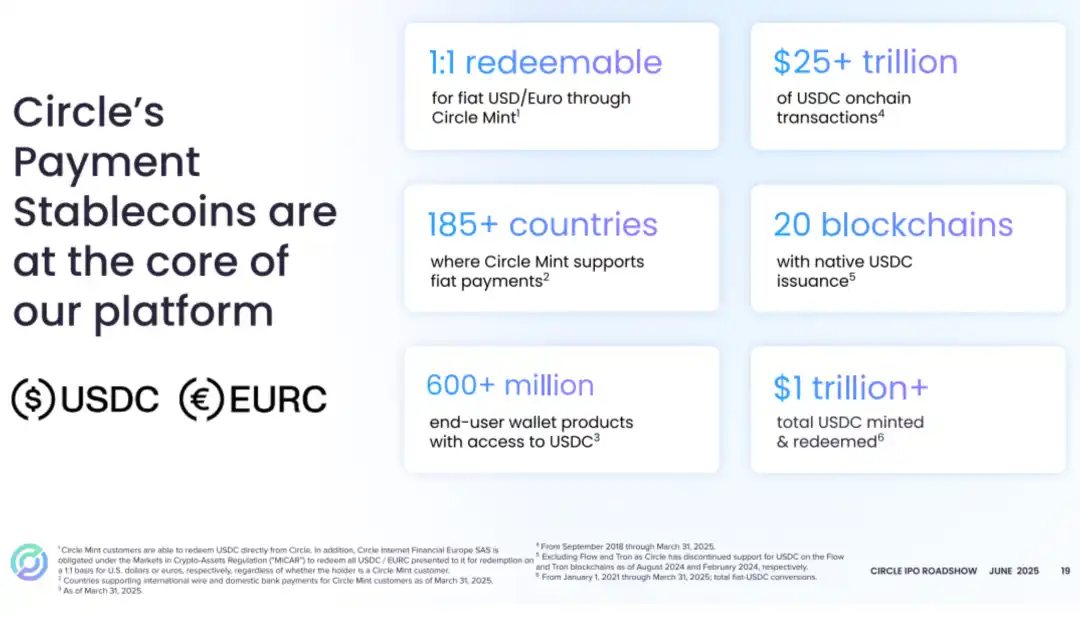

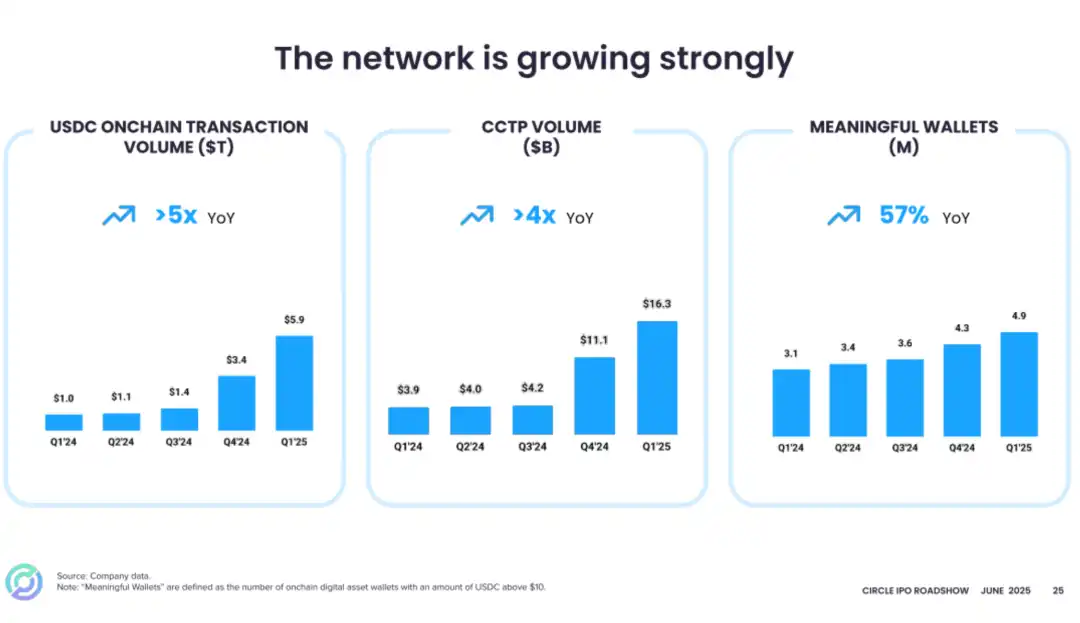

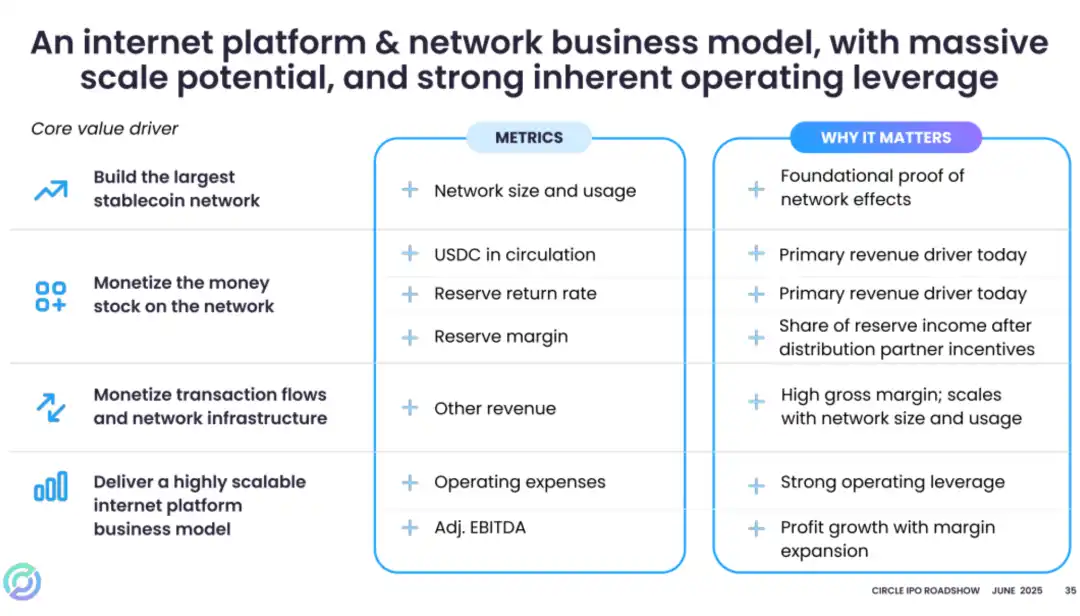

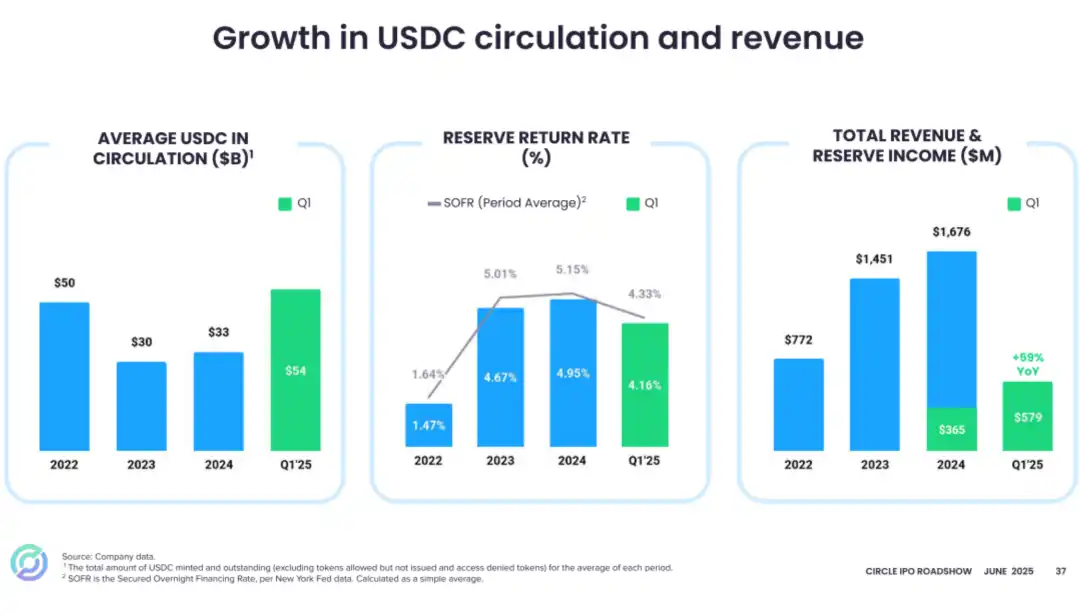

年营收 16.76 亿美元

截至 2025 年 3 月 31 日,Circle 持有的 USDC 价值为 599.76 亿美元,平均 USDC 价值为 541.36 亿美元。招股书显示,Circle 在 2022 年、2023 年、2024 年营收分别为 7.72 亿美元、14.5 亿美元、16.76 亿美元;运营利润分别为-3812 万美元、2.69 亿美元、1.67 亿美元。

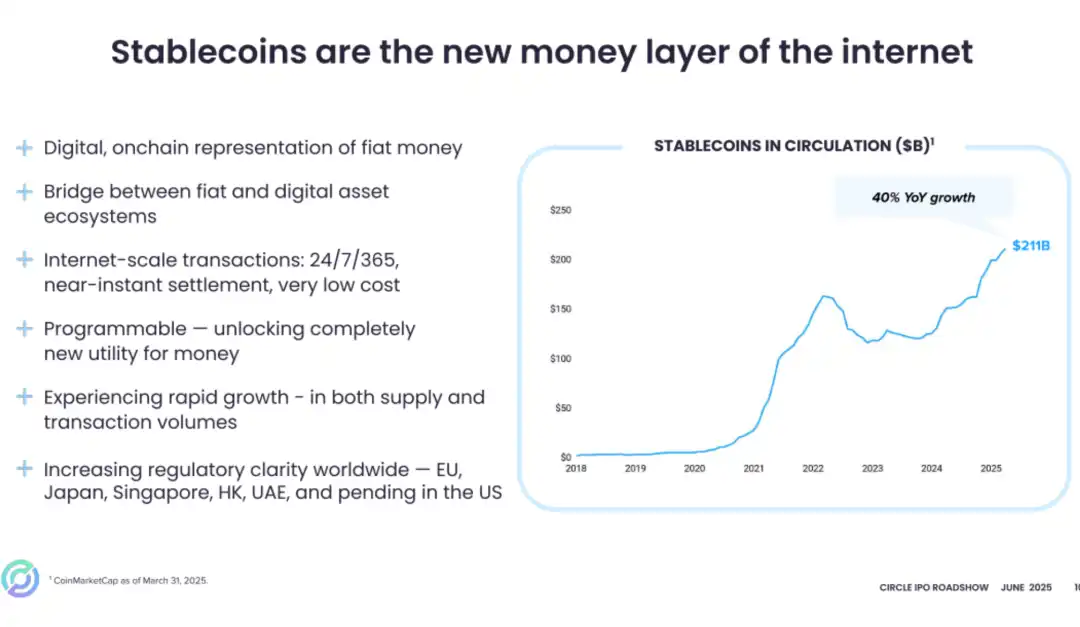

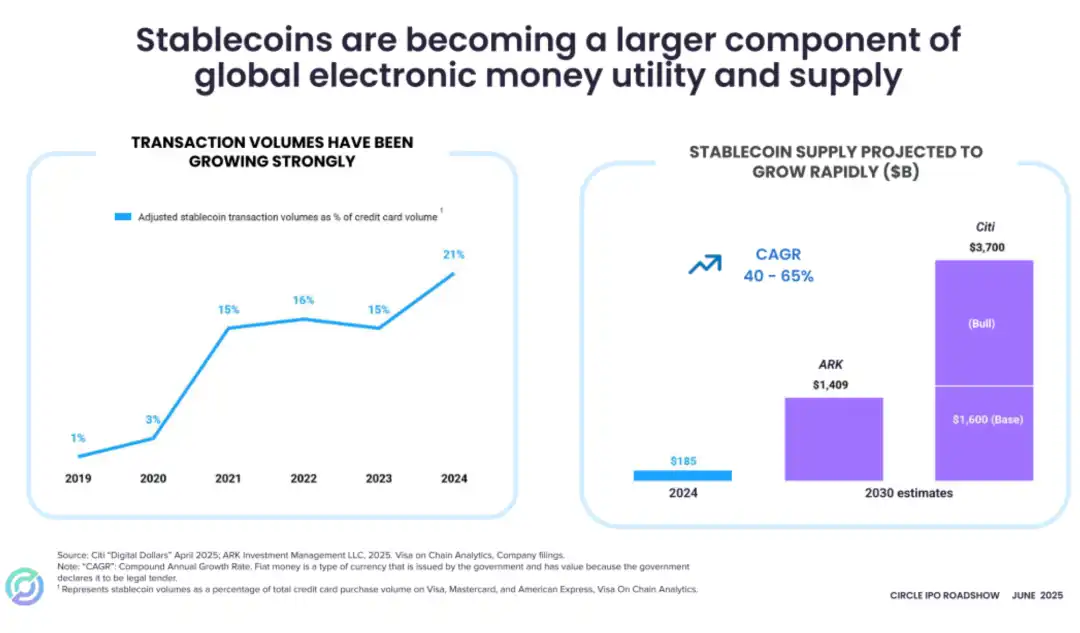

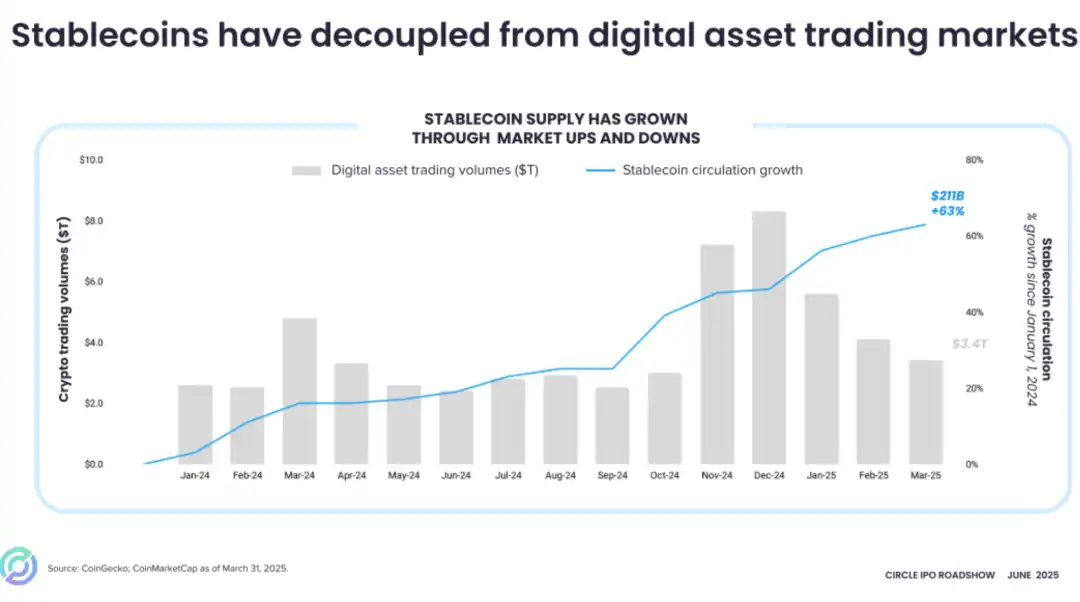

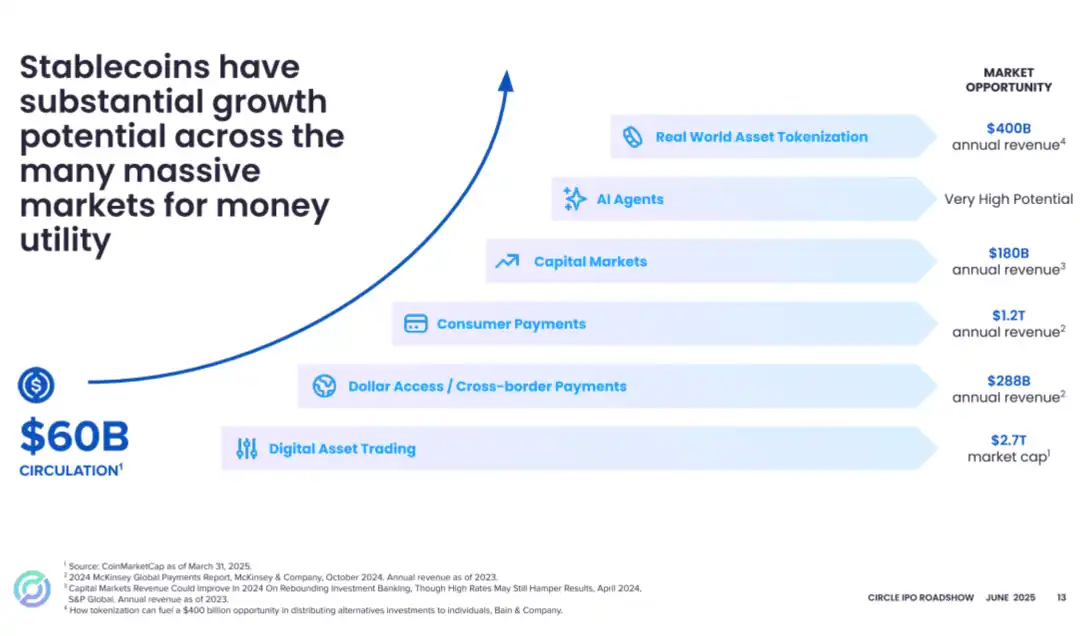

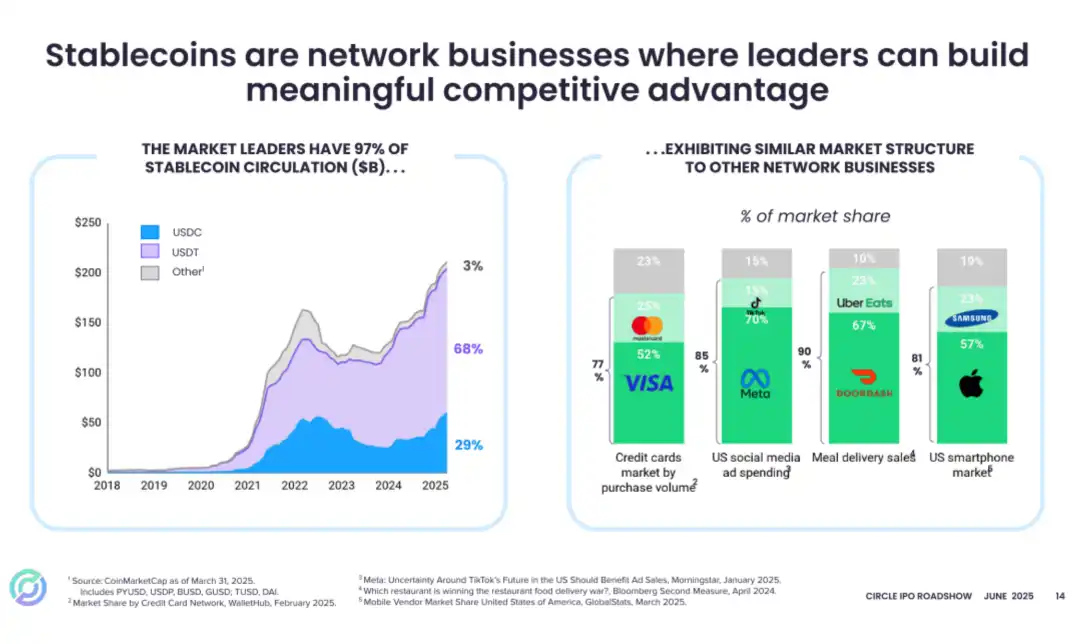

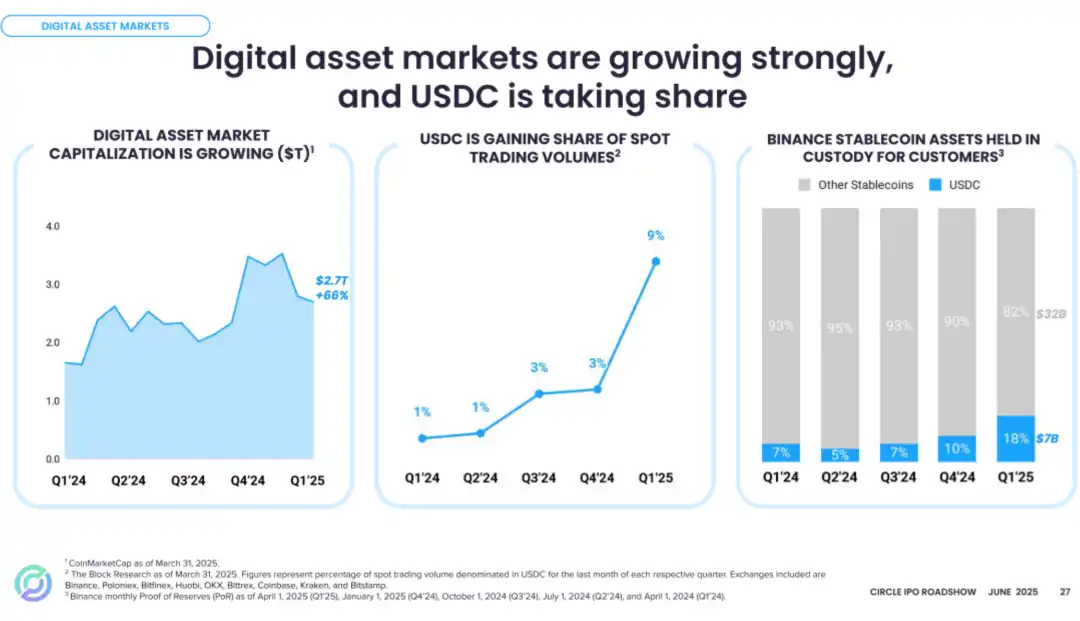

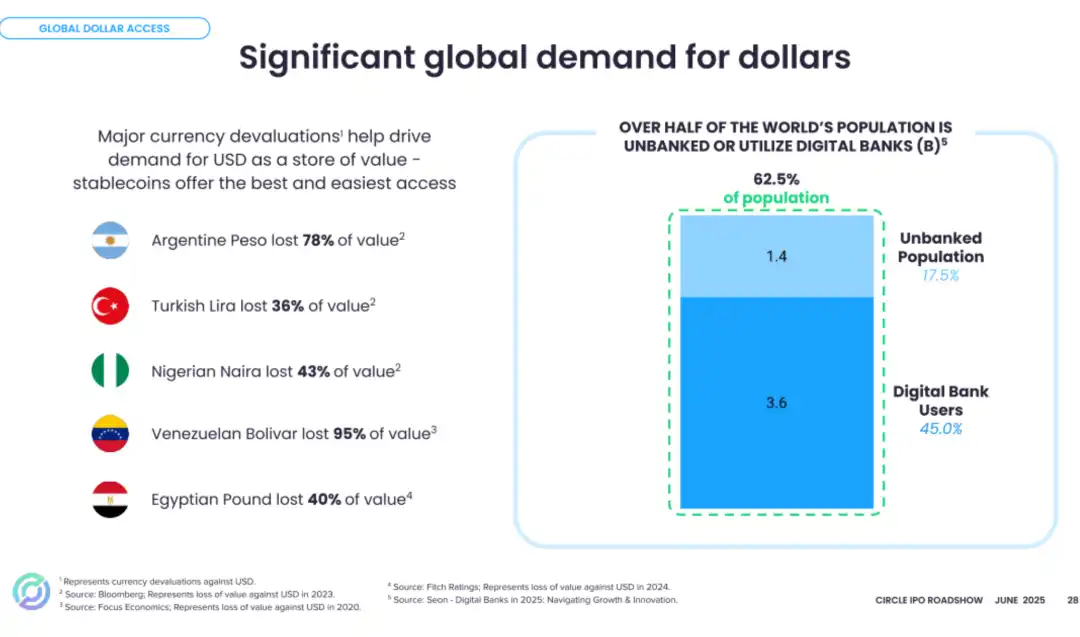

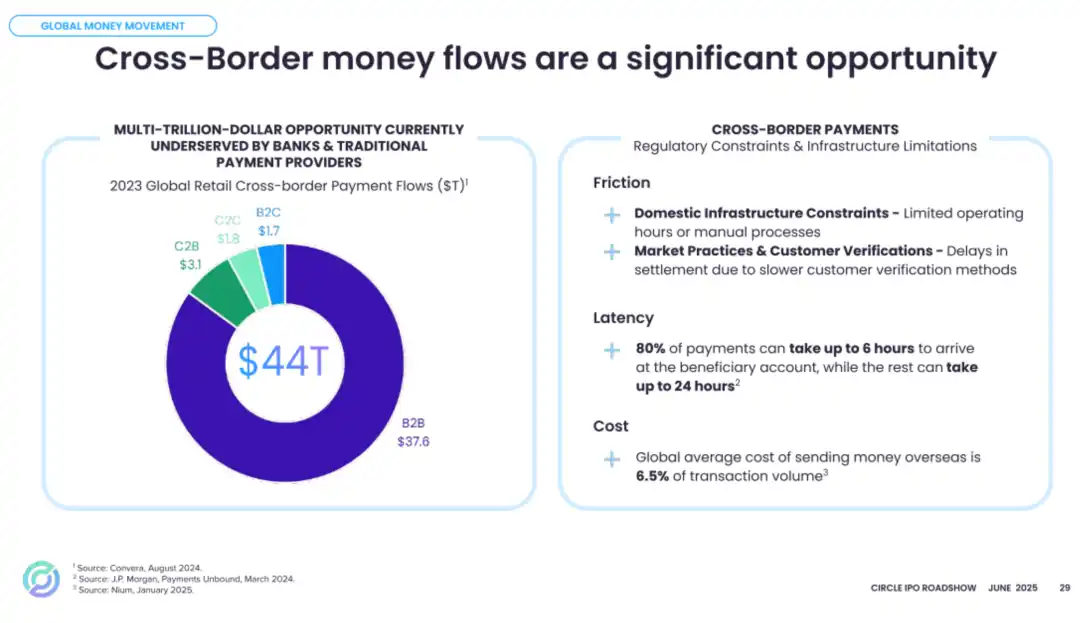

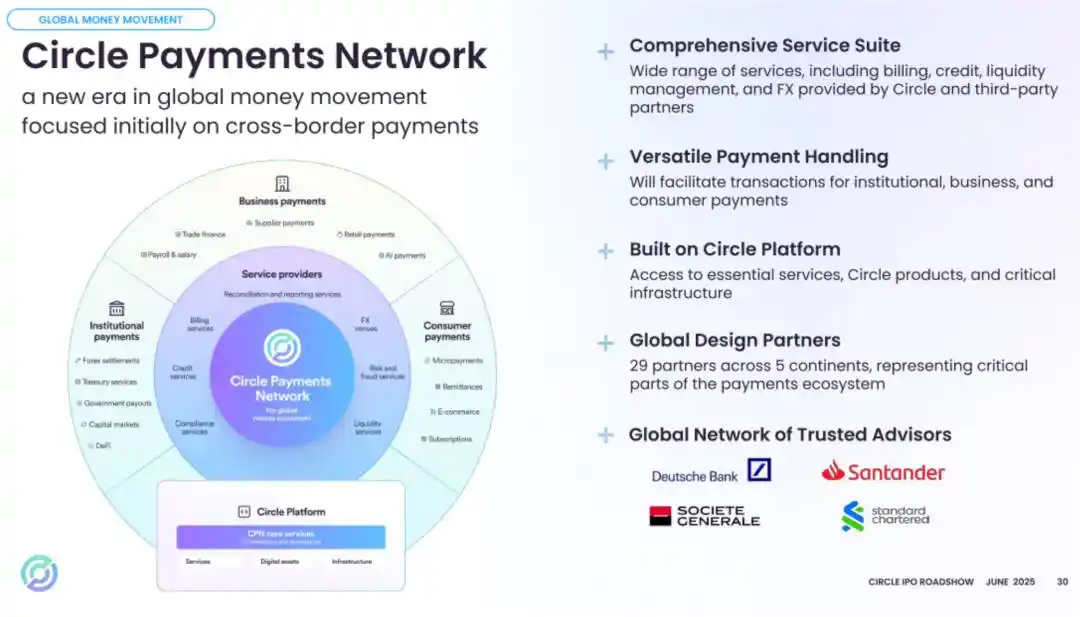

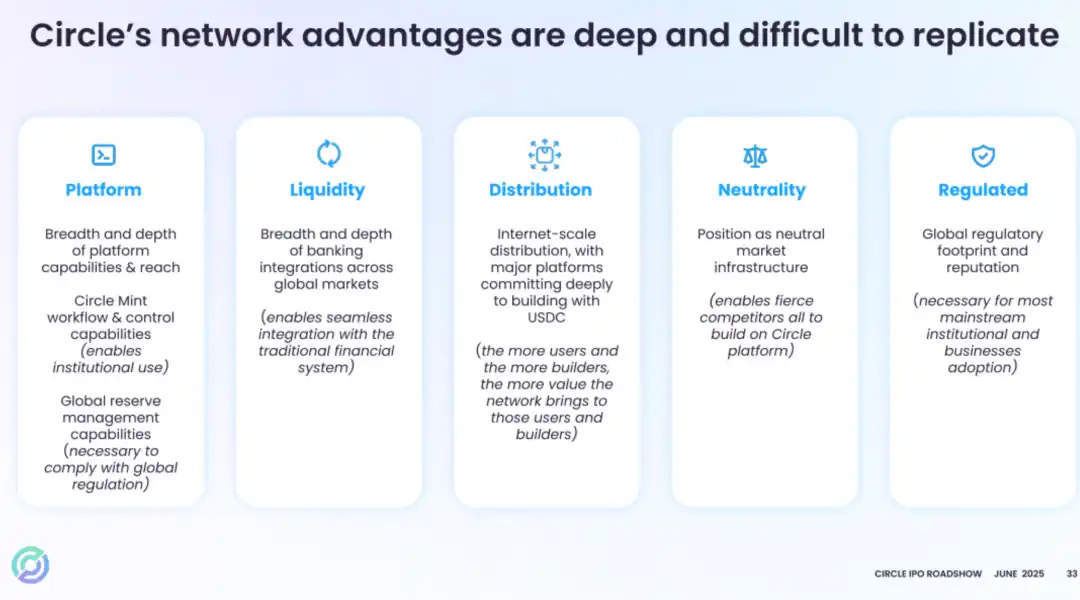

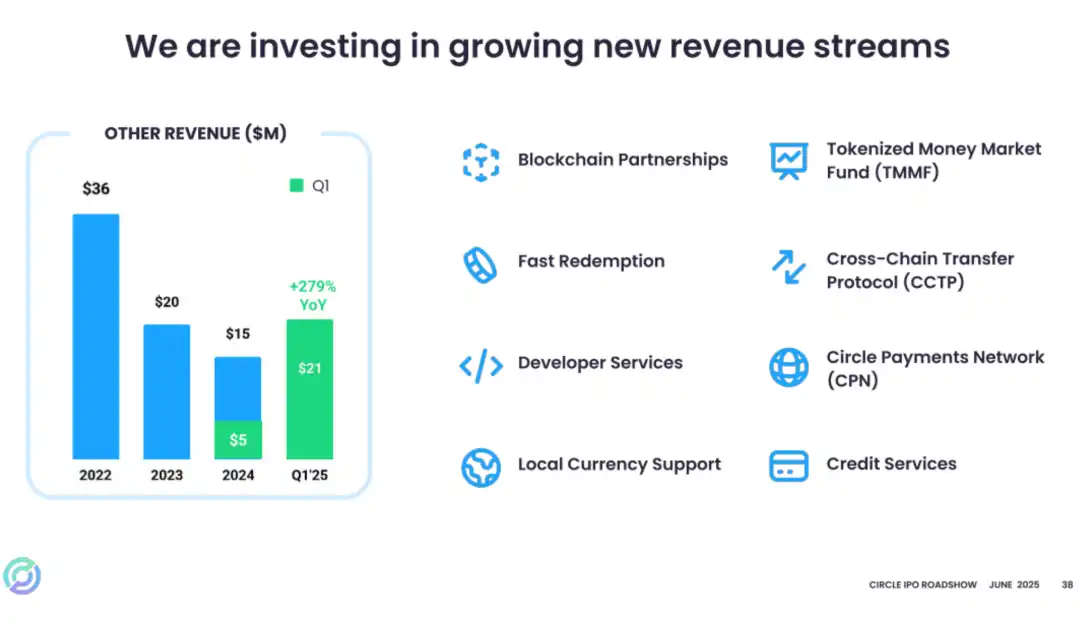

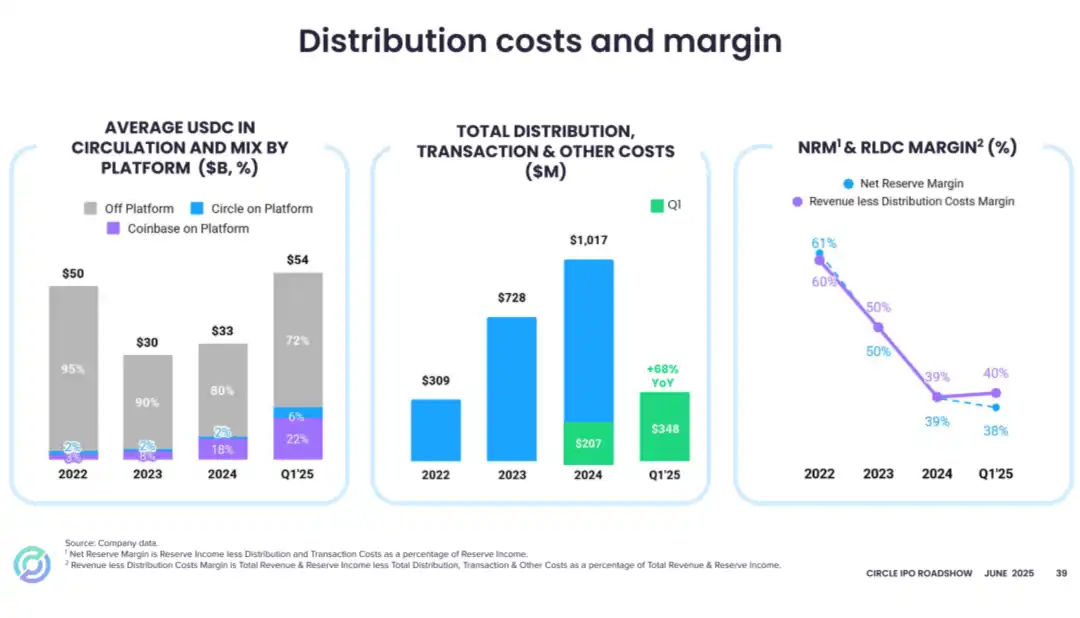

Circle 的商业模式简单:公司发行与美元 1:1 锚定的 USDC 稳定币,将用户存入的 600 亿美元投资于短期美国国债,赚取无风险收益。Circle 主要投资于美国国债和现金,2024 年产生了约 16 亿美元的利息收入(「储备收入」),占 Circle 总收入的 99%。

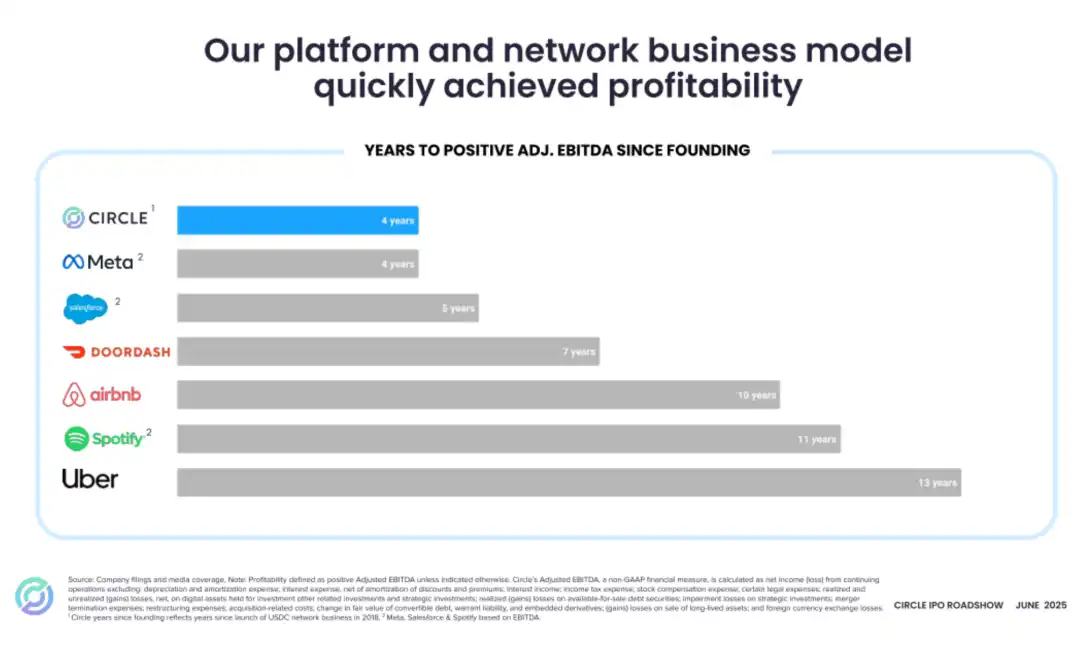

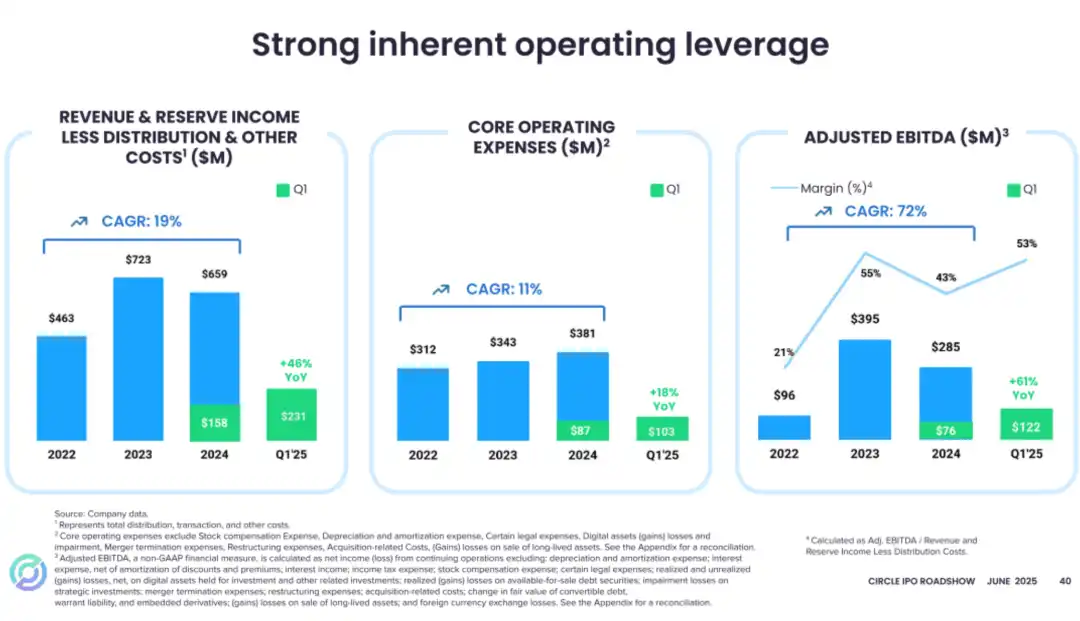

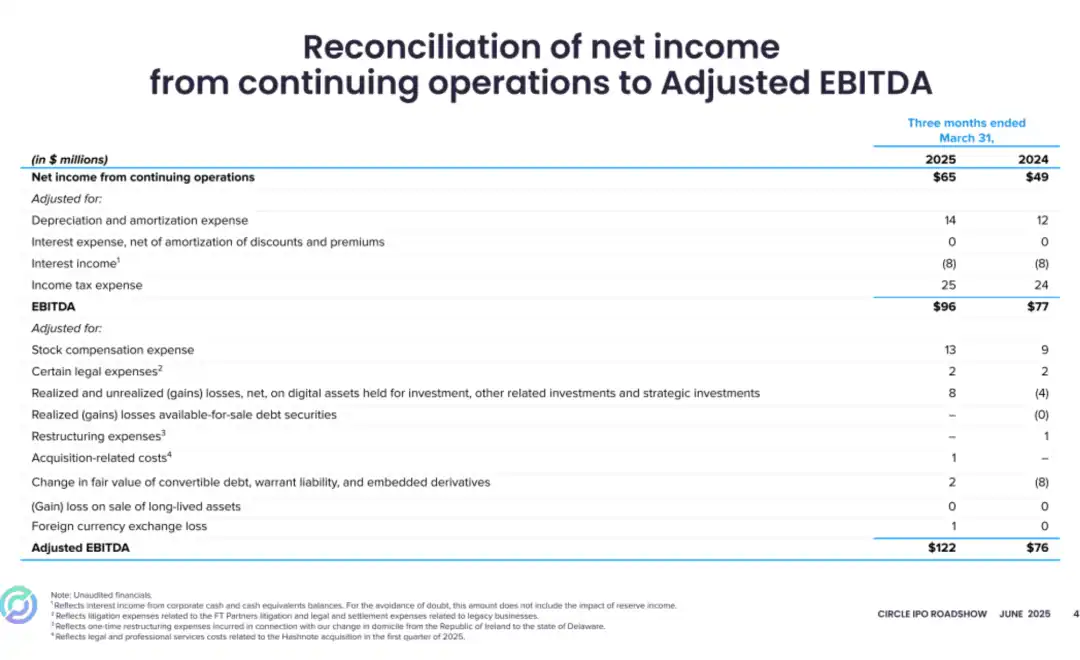

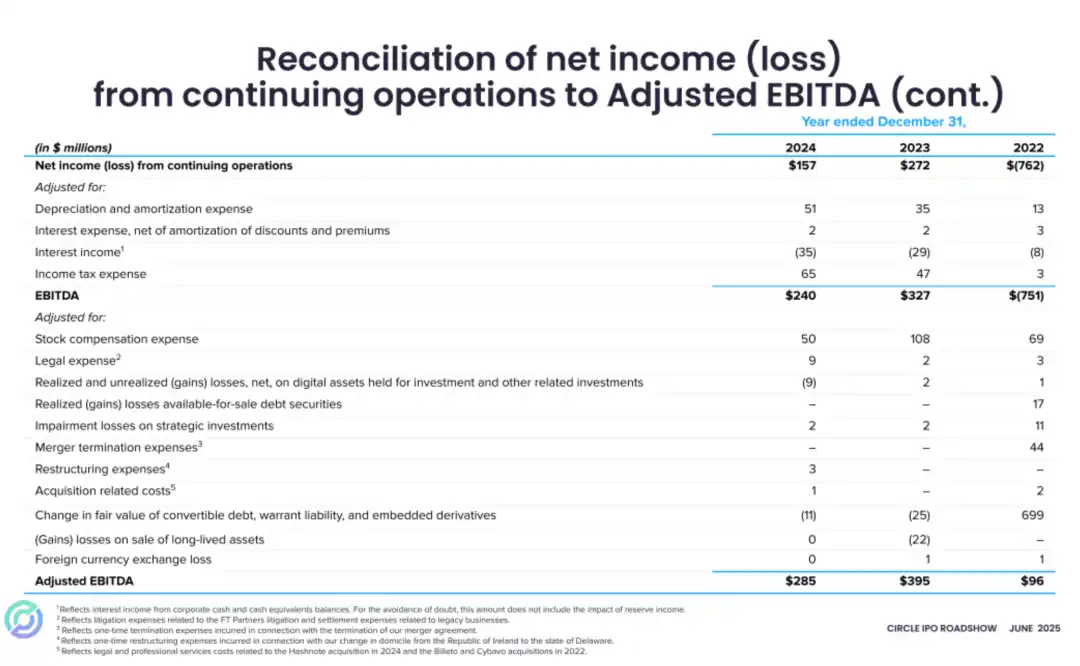

Circle 在 2022 年、2023 年、2024 年来自持续运营的净利分别为-7.6 亿美元、2.71 亿美元、1.57 亿美元。Circle 在 2022 年、2023 年、2024 年 Adjusted EBITDA 分别为 9600 万美元、3.95 亿美元、2.85 亿美元。Circle 在 2025 年第一季营收 5.79 亿美元,较上年同期的 3.65 亿美元增长 58.6%;

Circle 在 2025 年第一季分销和交易成本较 2024 年同期增加 1.446 亿美元,增幅 71.3%,主要原因是支付给 Coinbase 的分销成本增加 1.018 亿美元,这归因于储备收入及其平台余额的增加,以及与新的战略分销合作伙伴关系相关的其他分销成本增加 4,250 万美元。

Circle 在 2025 年第一季来自持续运营利润为 9294 万美元,较上年同期的 5232 万美元增长 77.6%;持续运营的净利 6479 万美元,较上年同期的 4863 万美元增长 33.2%。Circle 在 2022 年、2023 年、2024 年 Adjusted EBITDA 分别为 9628 万美元、3.95 亿美元、2.85 亿美元;2025 年第一季度 Adjusted EBITDA 为 1.22 亿美元,上年同期为 7626 万美元。

IDG 资本与 Accel 是股东

Circle 董事局主席、CEO 为 Jeremy Allaire,CFO 为 Jeremy Fox-Geen,总裁为 Heath Tarbert。IPO 前,Jeremy Allaire 持有 77.1% 的 B 类股,有 23.1% 的投票权;Nikhil Chandhok 有 1% 的 A 类股;Accel 持有 6.9% 的 A 类股,有 4.8% 的投票权;Breyer 持有 9% 的 A 类股,有 6.3% 的投票权;

General Catalyst 持有 12.8% 的 A 类股,有 8.9% 的投票权;P. Sean Neville 持有 22.9% 的 B 类股,有 6.9% 的投票权。IDG Capital 持有 12.6% 的 A 类股,有 8.8% 的投票权;Oak Investment 持有 7.5% 的 A 类股,有 5.3% 的投票权;FMR 持有 7.2% 的 A 类股,有 5.1% 的投票权;Elisabeth Carpenter 持有 2.8% 的 A 类股,有 2% 的投票权。

IPO 后,Jeremy Allaire 持有 78.9% 的 B 类股,有 23.7% 的投票权;P. Sean Neville 持有 21.1% 的 B 类股,有 6.3% 的投票权。Accel 持有 5.4% 的 A 类股,有 3.8% 的投票权;Breyer 持有 6.7% 的 A 类股,有 4.7% 的投票权;General Catalyst 持有 10% 的 A 类股,有 7% 的投票权。

IDG Capital 持有 10.4% 的 A 类股,有 7.3% 的投票权;Oak Investment 持有 5.9% 的 A 类股,有 4.1% 的投票权;FMR 持有 6.7% 的 A 类股,有 4.7% 的投票权;Elisabeth Carpenter 持有 2.1% 的 A 类股,有 1.5% 的投票权。

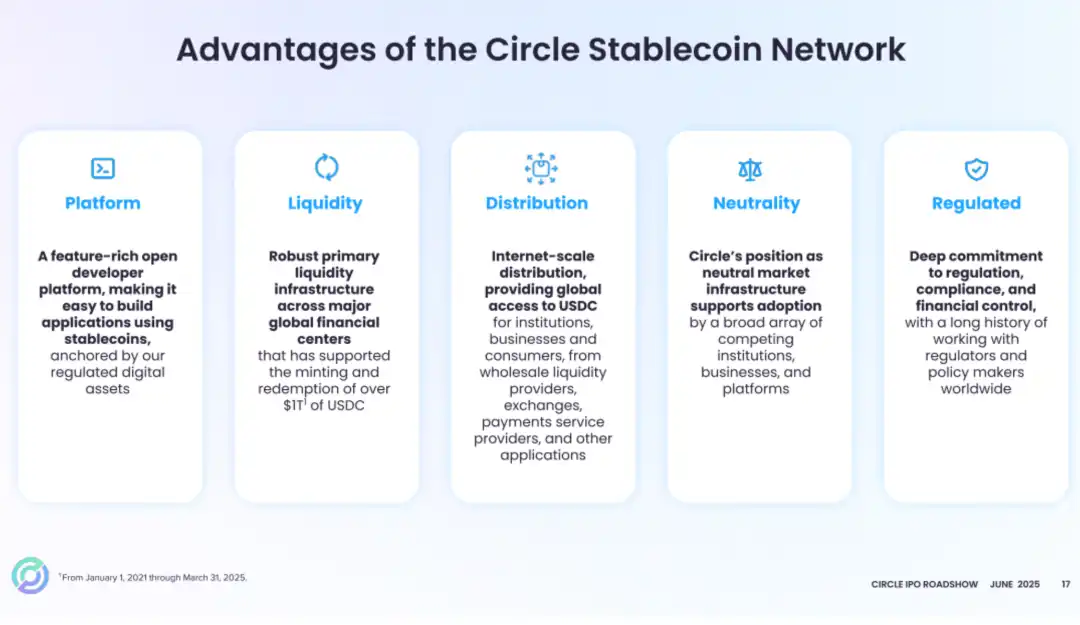

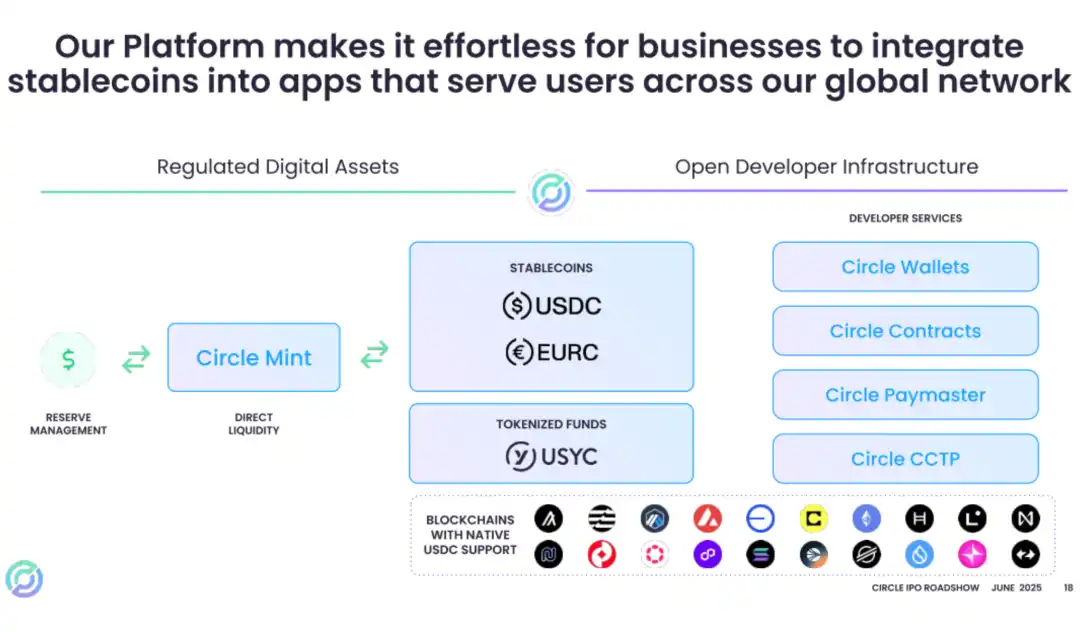

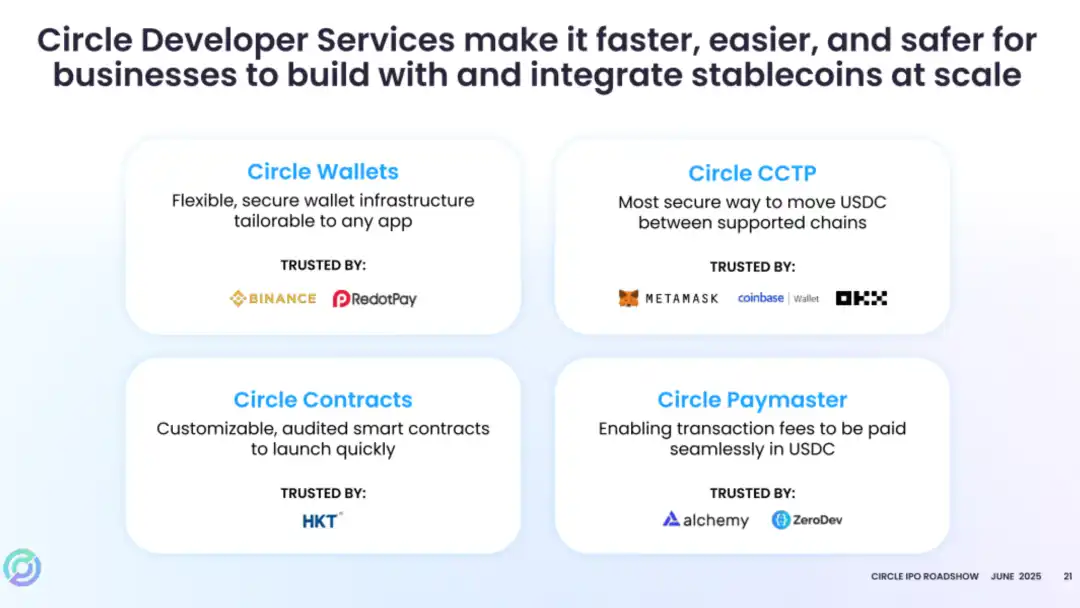

以下是 Circle 路演 PPT:

Circle 路演 PPT 内容

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。