A month ago, the most discussed topic about the stablecoin issuer Circle on social media was the rumor of "selling for $4 billion to Coinbase or XRP." After Circle released its prospectus in early April, doubts about its declining market share, low gross margin, and single profit channel were rampant in the industry. Investors generally believed that Circle's IPO plan, which was restarted after many years, might struggle to impress the market.

However, the enthusiasm for stablecoins completely exceeded the expectations of crypto practitioners: Circle went public at $31 per share, achieving a valuation of $6.9 billion, with an oversubscription rate as high as 25 times, making it the most watched IPO in the crypto industry in recent years. What caused such a dramatic reversal in market sentiment? Has Circle's fundamentals really improved, or is the market undergoing an "emotional reassessment" of the stablecoin narrative?

Two months, a dramatic reversal in market expectations

Around April this year, when stablecoin issuer Circle restarted its IPO plan, the market's general attitude was cautious, even bearish. Many analysts pointed out that Circle's business faced structural bottlenecks, such as excessive reliance on USDC reserve interest, low gross margins, and insufficient revenue growth momentum.

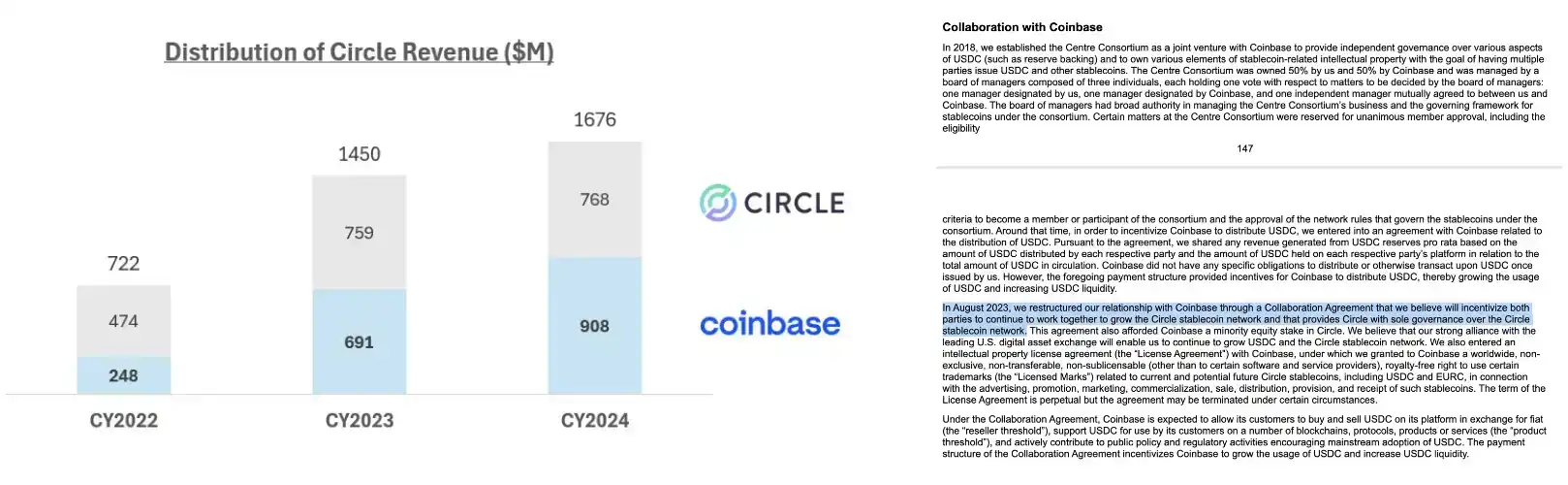

According to Circle's prospectus, its revenue for the fiscal year 2024 is expected to be approximately $1.67 billion, a year-on-year increase of 16%, but net profit is expected to plummet from $267.6 million in 2023 to $155.7 million, a decline of 41.8%. On one hand, the interest income from USDC is a cyclical bonus; once the Federal Reserve enters a rate-cutting cycle, Circle's reserve income will systematically decline. On the other hand, Circle has incurred high costs to promote USDC, especially the 50% distribution cost paid to Coinbase, resulting in extremely low gross margins. Statistics show that Circle's gross margin has rapidly dropped from 62.8% in 2022 to 39.7% in 2024.

Detailed description of the revenue-sharing terms with Coinbase in Circle's prospectus

In short, many investors questioned: Circle's profit model is too singular and fragile, lacking long-term appeal.

At the same time, rumors about Circle's sale were circulating in the market. In May, Cointelegraph reported that crypto giants, including Ripple and Coinbase, had considered acquiring Circle for a valuation of $4 to $5 billion, and the deal was even close at one point. Although Ripple's CEO later personally denied that they "ever sought to acquire Circle," and Circle emphasized that "the company is not for sale," the mere existence of these rumors indicated a lack of confidence in Circle's prospects—when a company is rumored to be willing to sell itself at a price equivalent to market value and far below its previous SPAC valuation (which sought a $9 billion listing in 2022), it inevitably raises questions about its ability to develop independently.

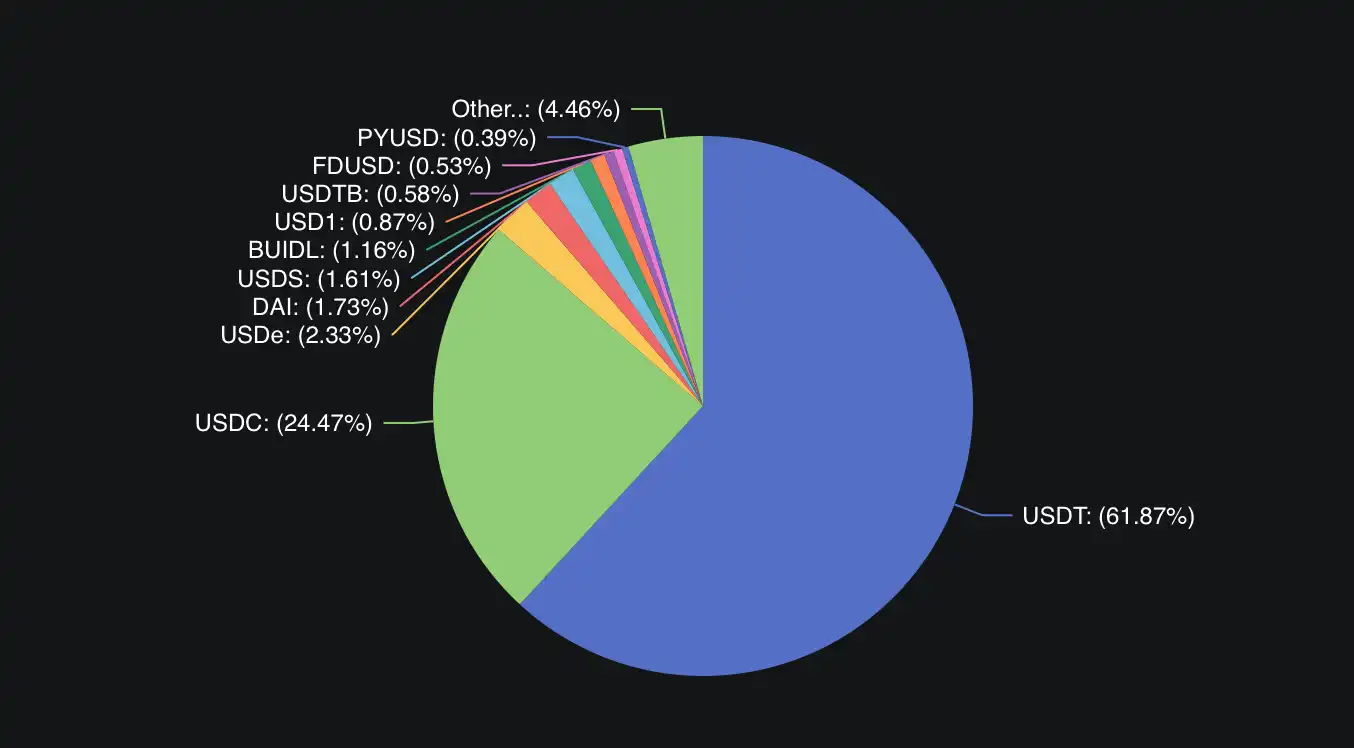

Moreover, the decline in USDC's market share is also a fact. Since the Silicon Valley Bank incident in 2023, USDC's circulation has significantly shrunk from its peak, with market share being squeezed by competitors like USDT. These factors combined made Circle appear unattractive two months ago, and many opinions held a reserved or even bearish attitude towards its IPO prospects, believing that fundraising might face a chill.

However, just two months later, market sentiment underwent a 180-degree reversal. Circle officially launched its IPO pricing in early June, with investor enthusiasm soaring, not only increasing the issuance scale from 24 million shares to over 34 million shares but also raising the issuance price from the originally planned $24 per share to $27, bringing its overall valuation back up to $6.2 billion. Ultimately, Circle completed its issuance at $31 per share, achieving over 25 times oversubscription and raising approximately $1.1 billion.

Such a booming subscription situation swept away the previously gloomy market expectations. Even more noteworthy is that this IPO attracted enthusiastic participation from top institutions: the underwriting lineup was led by Wall Street investment banks such as JPMorgan, Citigroup, and Goldman Sachs, with BlackRock subscribing for about 10% of the shares and Ark Invest planning to subscribe for $150 million. Driven by strong demand, Circle's original plan for early shareholders to cash out significantly also changed: the secondary sale originally arranged in the prospectus accounted for as much as 60% (14.4 million shares, sold by founders and VCs) and has now been cut to 8 million shares, accounting for only 25%. This adjustment indicates that even Circle's internal shareholders chose to sell less and retain more, highlighting the high market enthusiasm.

Has the fundamental situation changed behind the emotional reversal?

In the past two months, the stablecoin sector has welcomed a series of heavyweight regulatory benefits, creating an excellent policy environment for Circle's IPO.

In late May, the U.S. House Financial Services Committee passed the stablecoin regulatory bill known as the "GENIUS Act" with a high vote. This bill aims to establish a clear federal regulatory framework for dollar-pegged stablecoins, meaning that stablecoin issuers are expected to move out of the gray area and enter a new phase of licensed compliance.

For Circle, this is a significant policy benefit—once the legal recognition of stablecoin status is achieved, the market will reassess the compliance and sustainability of its business model. Circle cleverly chose this window to go public, which is seen in the industry as a combined benefit of "regulatory arbitrage + market reassessment," completing compliance endorsement ahead of the formal implementation of the bill and gaining recognition from investors and policymakers through its U.S. stock market listing.

In addition to the U.S., Hong Kong also launched a stablecoin regulatory framework during the same period. On May 30, the Hong Kong government published the "Stablecoin Ordinance" in the Gazette, marking the official enactment of the law. Previously, on May 21, the Hong Kong Legislative Council passed the bill in its third reading, establishing a licensing system for issuers of stablecoins pegged to fiat currencies. This means that Hong Kong will become one of the few jurisdictions globally with clear stablecoin regulatory laws, alongside the U.S. and the EU.

Table of contents of the Hong Kong Stablecoin Ordinance, which was passed in the third reading by the Hong Kong Legislative Council on May 21

This series of new changes in the global regulatory environment has greatly boosted market confidence in the prospects of compliant stablecoins, laying the groundwork for Circle's value reassessment.

The second key driver behind the shift in market sentiment comes from the strong "buying calls" of heavyweight institutional investors. At the end of May, Ark Invest, led by Cathie Wood, expressed its intention to purchase up to $150 million in Circle's IPO, while global asset management giant BlackRock planned to subscribe for about 10% of the issuance. The combined subscription amount from these two institutions accounted for about 30% of the total financing.

Among them, BlackRock's participation is particularly significant for Circle. On one hand, BlackRock began deep cooperation with Circle as early as 2022, with Circle agreeing to have at least 90% of its USDC reserves managed by BlackRock, in exchange for which BlackRock promised not to issue its own stablecoin for four years. This agreement not only strengthened the security and liquidity management of USDC reserves but also brought traditional financial giants' credit endorsement to Circle.

The phenomenon of Wall Street's "big buy" subscriptions reflects a gamble on the prospects of compliant stablecoins and a reassessment of Circle's global expansion capabilities and USDC's dominant position in the ecosystem. Many Wall Street institutional investors have previously kept their distance from pure crypto businesses, but now they can indirectly invest in the expansion expectations of the cryptocurrency market through Circle. The recognition from large institutions also significantly influences the market's attitude towards Circle.

However, regulatory legislation and institutional entry undoubtedly belong to long-term logic: they legitimize the stablecoin industry and open up future growth space, rather than being a momentary hype. But in the short to medium term, the rebound in USDC's market value and the subscription boom do have cyclical emotional components. Since the second quarter of this year, Bitcoin prices have surged, and the entire crypto market has warmed up, allowing the stablecoin sector to continuously create "conceptual momentum," making the explosive demand for Circle's IPO more like a short-term excess demand driven by investors' FOMO psychology.

Currently, the U.S. is still in a high-interest-rate environment, and Circle enjoys considerable interest income. Many institutions, including Circle itself, hope to enjoy this performance bonus before the arrival of rate cuts, which is somewhat a gamble on short-term performance. Once the Federal Reserve enters a rate-cutting phase, the market may reassess Circle's profitability. If Circle's fundamentals are disproven in the future (for example, if USDC growth does not meet expectations or gross margins fail to improve), the current optimistic sentiment may also fade.

In many traditional media comments, stablecoins' "triple attributes of policy endorsement, technological imagination, and industrial landing" align with the market's preference for "storytelling, practical application, and policy encouragement" themes. However, for Circle, behind the hype, its ability to deliver still needs time to be tested.

Is a $7 billion valuation too high or too low?

Circle's IPO pricing corresponds to a valuation of approximately $6.9 billion. As the "first stock of stablecoins," the market seems to have yet to establish a consensus valuation model for it. So, is Circle's nearly $7 billion valuation reasonable?

In 2008, Visa completed its IPO with a financing amount of $17.9 billion, surpassing AT&T's $10.6 billion to become the largest IPO in U.S. history at that time. Circle aims to "replace the Visa payment system," with a projected net profit of $156 million in 2024. Based on a $7 billion valuation, the static price-to-earnings ratio is about 45 times. In contrast, Visa's net profit for the fiscal year 2024 is expected to be around $17 billion, with a market value of nearly $500 billion, resulting in a price-to-earnings ratio of about 30 times.

From a profit model perspective, Visa primarily relies on card transaction fees, using its market monopoly as a moat, with steady revenue growth and extremely high profit margins (gross margins consistently above 70%). In contrast, Circle has faced growth challenges in recent years (with USDC's market share consistently suppressed by USDT, failing to effectively break through the 30% barrier) and gross margin issues (maintaining around 30% in recent years), which have been widely questioned in the industry. Moreover, in terms of profit quality, Visa's profit sources are diverse and stable, while Circle's profits mainly come from reserve interest, making it more susceptible to macro interest rate policies and crypto market cycles, resulting in greater volatility.

Market share of stablecoins, data source: DeFiLlama

In the matter of replacing Visa, perhaps Tether and its USDT have a better chance. In 2024, Tether achieved an extraordinary profit of $14 billion with just 150 employees, averaging a staggering $93 million in value creation per person, leaving Wall Street giants astonished. Simply estimating with a traditional financial company's price-to-earnings ratio of 15 times, Tether's valuation is around $200 billion.

Some publicly priced competitors outside the industry can also serve as a reference dimension. For example, the decentralized synthetic dollar protocol Ethena has a stablecoin, USDe, whose issuance and business model are entirely different from Circle's. It does not rely on fiat currency reserves but is backed by "synthetic dollars" hedged by positions in crypto derivatives and collateral assets, making its revenue capacity directly linked to the investment enthusiasm in the cryptocurrency secondary market. Earlier this year, Ethena's governance token ENA's market cap once approached $4 billion and has stabilized around $2 billion in recent months.

The high valuation multiples given to Circle by the market primarily stem from growth expectations. As a payment giant, Visa experiences slower growth as a mature enterprise, while Circle operates in the rapidly developing stablecoin sector, leading investors to believe that under a "regulatory moat," the competition between Circle and Tether may bring more variables and open up more imaginative space for future profitability.

On the other hand, whether Circle's valuation will inherit the volatility of the crypto market is also a major focus for the market to watch and verify. The valuation fluctuations of "crypto's first stock," Coinbase, illustrate this issue well.

When Coinbase went public in 2021, its market cap once surged to $86 billion, but as the crypto market gradually turned bearish, Coinbase's stock price significantly corrected, nearly dropping below the $10 billion mark. This volatility was again highlighted in the first quarter of 2025, with Coinbase's stock price showing a high correlation with the cryptocurrency market dominated by altcoin trading.

$COIN price trend; Coinbase's listing is widely regarded as a significant marker of the crypto market's transition from bull to bear in 2021; data source: Trading View

In comparison, Circle's $7 billion valuation is merely a fraction of Coinbase's. This reflects the differences in their business models and investor expectations: Coinbase, as an exchange, relies heavily on crypto trading volume for revenue, resulting in significant performance fluctuations with market conditions; whereas Circle, as a stablecoin issuer, derives its income mainly from reserve interest and related service fees, leading investors to believe that its valuation is less affected by the crypto market than by the macro interest rate environment.

It is worth noting that Coinbase currently also earns substantial interest income through USDC reserve revenue sharing (50%), which is directly related to Circle. To some extent, Coinbase's valuation also includes a premium for its USDC business.

Nevertheless, compared to Coinbase's initial price-to-earnings ratio of 300 times at the time of its listing, Circle's current valuation multiple of about 45 times appears much more moderate. The market seems to be valuing Circle according to the logic of a conventional financial services company rather than a tech unicorn, with "somewhat conservative and leaving room" being a major mainstream view on the current $7 billion valuation.

Is the Asian market warming up first?

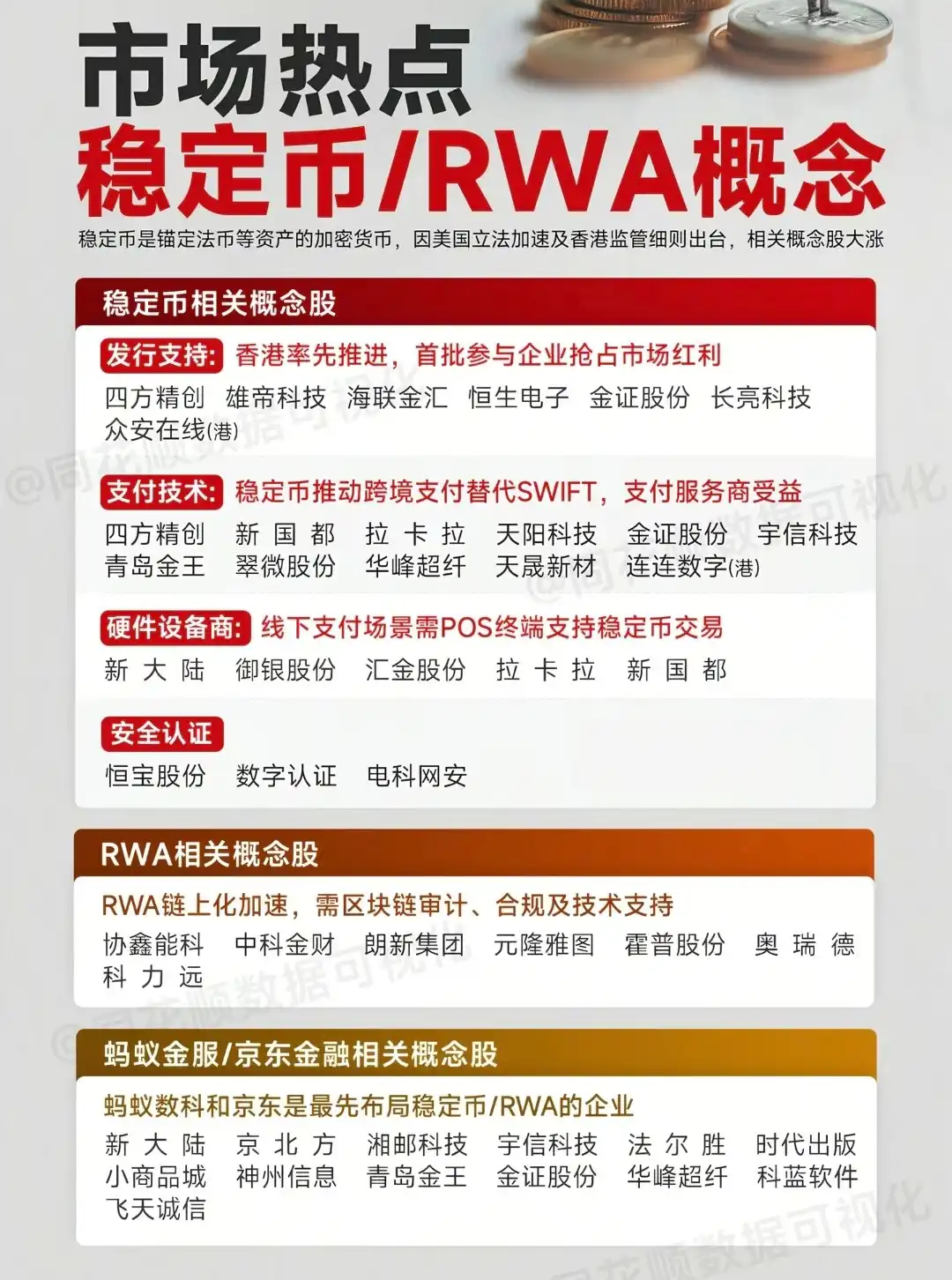

While Circle's IPO is heating up, the Asian capital markets have taken the lead in igniting a "stablecoin concept" craze. Related concept stocks in the Hong Kong and A-share markets have recently experienced explosive growth, with multiple stocks hitting their daily limits or significantly rising, as if stablecoins have suddenly become the new trend in the capital market overnight.

The reason for this is that the stablecoin concept has appeared in the Asian stock market for the first time. The stock market has previously hyped concepts like "blockchain," "web 3.0," and "NFTs," but the stablecoin concept has never been present. In other words, for most people outside the crypto circle, the concept of stablecoins is entirely new.

Coupled with favorable policies, the legislative news of Hong Kong's "Stablecoin Ordinance" in late May prompted the Hong Kong stock market to initiate speculation on stablecoin concepts. In early June, as Circle confirmed its listing date, the Hong Kong and A-share markets experienced a synchronized explosion. From June 2 to 3, more than a dozen stablecoin-themed stocks in the Hong Kong and A-share markets collectively soared, with astonishing gains. It is said that over 20 brokerages issued more than 30 research reports on stablecoins overnight, keeping up with current events to inform everyone about this narrative.

Currently, the most关注的 stablecoin-related concept stocks in the Hong Kong and A-share markets can be divided into two categories: direct participants and indirect beneficiaries.

Direct participant stocks are mainly concentrated in the Hong Kong stock market. These companies have direct equity or business relationships with stablecoin projects, making their benefit logic clear. For example, China Everbright Holdings (00165.HK) strategically invested in Circle in 2016, and the recent IPO will significantly increase Everbright's equity value, causing its stock price to surge, at one point rising over 26% in a single day. Another example is ZhongAn Online (6060.HK), whose affiliated companies are involved in stablecoin issuance and whose bank provides stablecoin custody services, also attracting hot money.

Indirect beneficiary stocks are more prevalent in the A-share market. These companies do not have direct stablecoin businesses, but their products/technologies can be applied to the relevant industrial chain of the stablecoin concept, making the logic more about "possibility." For instance, Cuiwei Co., Ltd. (603123) primarily engages in department store retail but has developed digital RMB payment scenarios, leading the market to associate it with being a "pioneer in future stablecoin offline applications," resulting in consecutive daily limit increases; Yuyin Co., Ltd. (002177) is an ATM and banking equipment manufacturer that has laid out digital currency ATMs in recent years, with its stock price hitting daily limits for four consecutive days; other companies like Sifang Jingchuang (300468) and Xiongdi Technology (300546) have also been speculated upon due to their involvement in digital payments and electronic identity recognition.

Market analysis of stablecoin concept-related stocks; image source: Tonghuashun

As the first compliant stablecoin stock, its IPO carries greater significance in terms of confidence transmission and trend confirmation—conveying the confidence that stablecoins are recognized by the mainstream and confirming the trend of stablecoin compliance and capitalization. In Hong Kong, the global attention brought by Circle's listing may indeed help the local stablecoin sector gain more endorsements and collaboration opportunities, attracting overseas capital into Hong Kong's digital finance sector.

From the general bearish sentiment two months ago to the current oversubscription of 25 times, Circle has experienced a dramatic reversal in market expectations. As a bridge connecting traditional finance and the crypto world, stablecoins are gaining unprecedented attention and reassessment. Circle's story may just be the beginning; with the implementation of the U.S. GENIUS Act and the issuance of stablecoin licenses in Hong Kong, we may see a more mature and rational stablecoin ecosystem. At that time, the market will speak through fundamentals to verify whether this logical shift truly holds water.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。