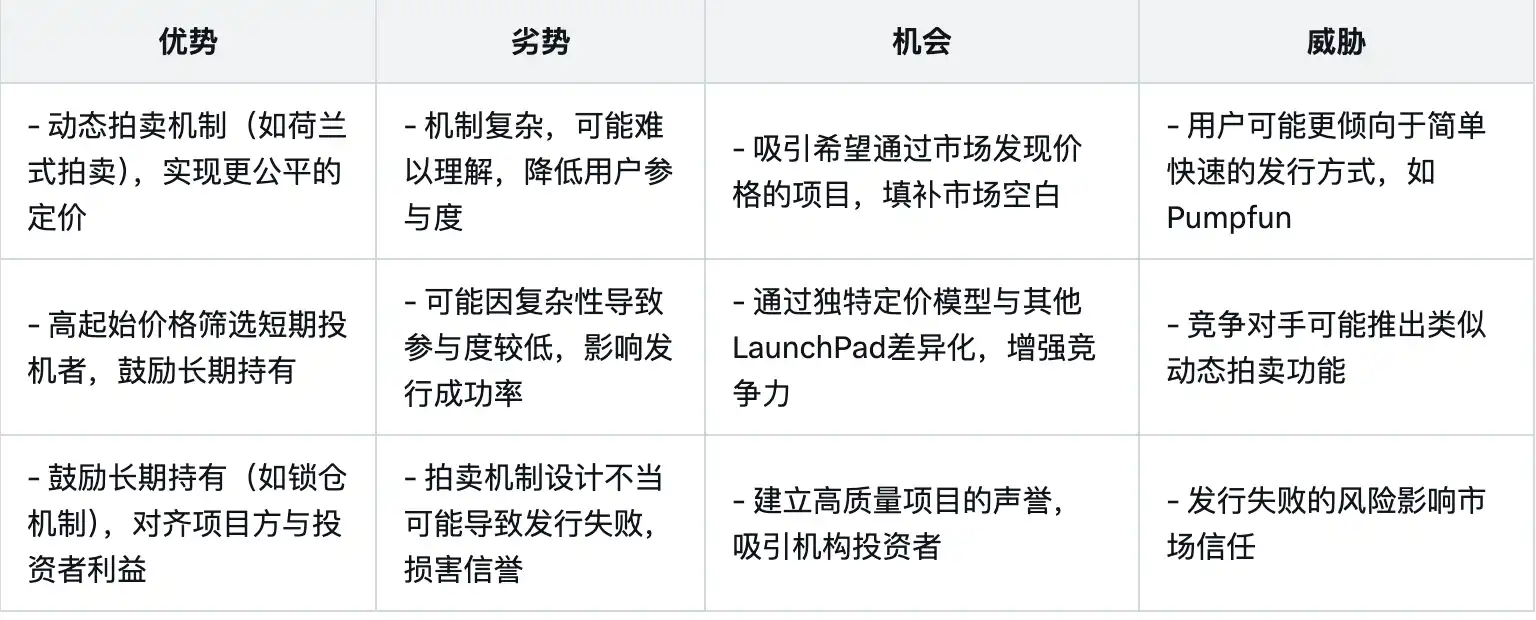

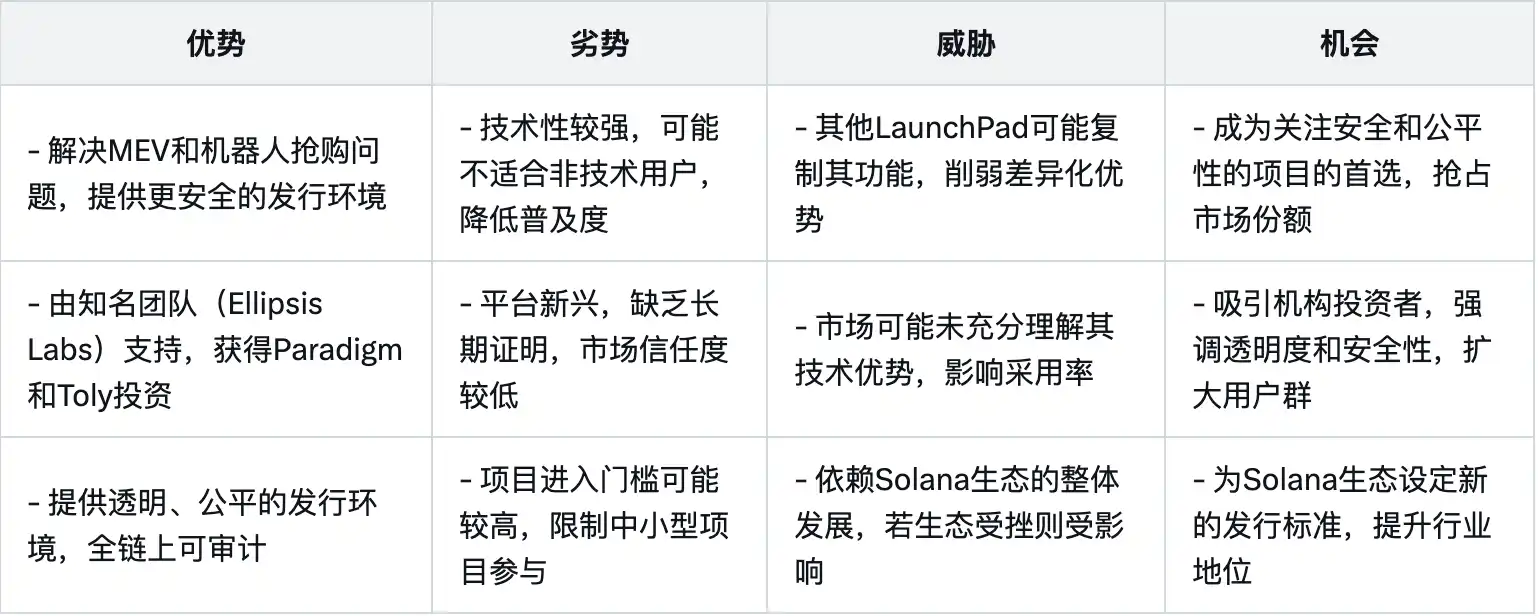

Since Pumpfun became a phenomenon-level product, the impression of players entering the market after it has shifted from ICO/IDO platforms like Coinlist to various "meme-like" launchers. From the initial various ".fun" clones to the public chain launchpad wars, and then to the emergence of the SocialFi/AI + Launchpad paradigm, the current popularity of Solana's ICM (Internet Capital Markets) concept, along with the involvement of Silicon Valley tech companies and VCs, has further intensified the competition in this "battle."

Even though the Memecoin market has not seen numerical growth, new projects on Launchpad continue to emerge one after another. This is because, with the shift in the "asset issuance" model, Launchpad now carries not only "meme culture" but also a broader market beyond the "ICO era" blockchain projects.

Meme Market Index, Source: SoSoValue

"Value Investment" to "Price Investment"

For blockchain projects, the hottest financing model outside of traditional financing methods and structures like IDO and ICO is currently Launchpad. More and more project teams are becoming accustomed to this model, which is "lighter" and more suitable for blockchain project teams compared to traditional models. According to CryptoRank's monthly public sale data for IDO/ICO, the proportion of this fundraising model in the market has gradually decreased.

The left image shows the number and total amount of IDOs/ICOs from 2009 to present, while the right image shows the financing amount data for Crypto from 2009 to present.

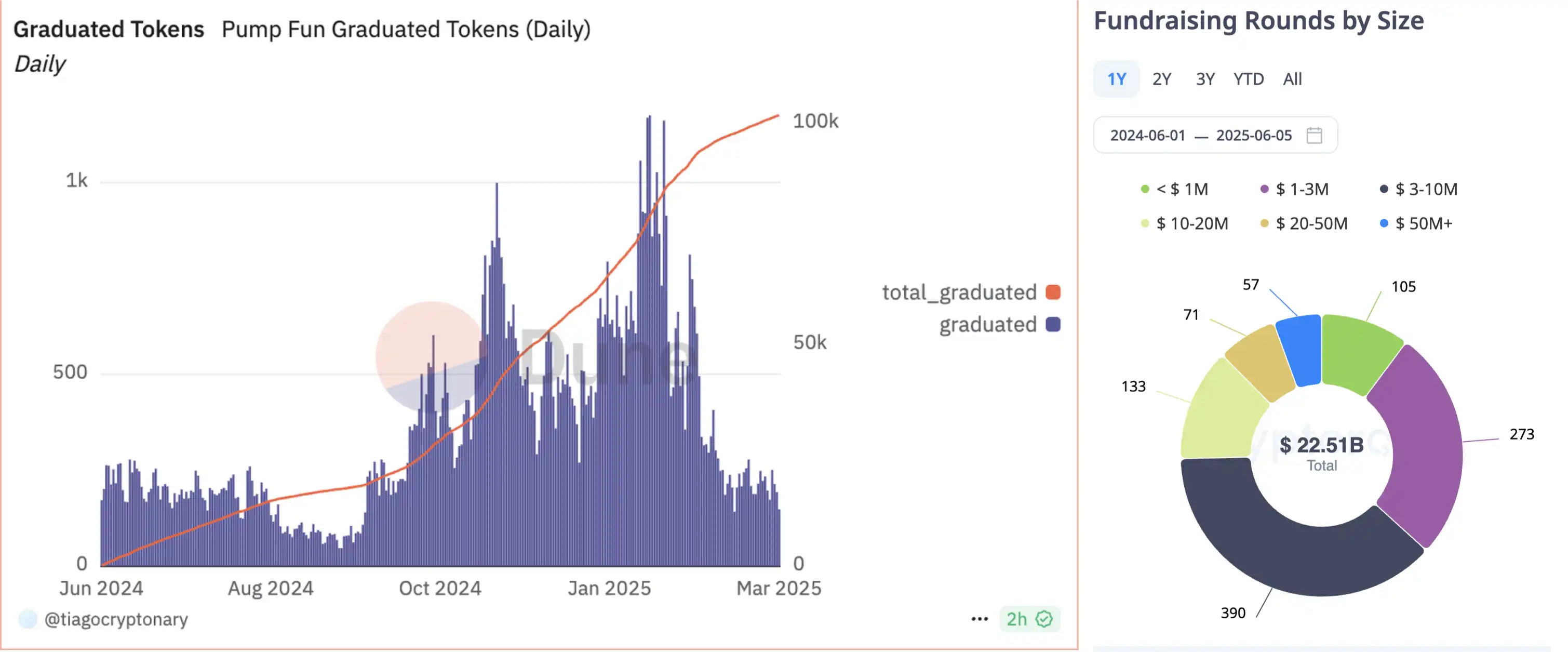

Taking PumpFun's data as an example, since 2024, it has "graduated" a total of 100,000 tokens. With a graduation threshold of approximately 80 SOL (the average price of SOL from March last year to May this year is $177.87), PumpFun has raised at least about $140 million in its "internal market," accounting for 6.3% of the total financing amount of $22.5 billion from last year to now, including private seed rounds.

Although public data comparisons cannot fully cover the situation, and the fundraising and investment amounts in the internal market cannot be compared, the trend of "ICM" is gradually becoming evident, with more and more malicious funds willing to seek investment opportunities in Launchpad.

The left image shows the total number of graduated tokens from Pumpfun since last year, while the right image shows the distribution of total financing amounts from March last year to now. Source: DefiLlama, CryptoRank

What Strategy Are New Launchpads Using?

VC Endorsement + Anti-RUG Mechanism — Cooking.City

Cooking City is a Launchpad co-invested by Jump Crypto, CMT Digital, Bitscale Capital, Mirana Ventures, and EVG with a total investment of $7 million. Cooking.City aims to reshape the token issuance mechanism, proposing a new on-chain issuance model that is sustainable, incentivized, and community-centered.

The new model proposed by Cooking.City includes value redistribution "redistributing most platform fees to developers and users," a confidence pool mechanism "token issuers must deposit a certain amount of funds in the smart contract in advance," and a social-based value distribution system "introducing a referral commission system, redistributing fees within the ecosystem, with most fees used for community referrals and trading rewards, a portion returned to token issuers, and the rest invested in the platform's long-term development."

During the beta testing phase, users will receive an invitation code and a "profit and loss card" for their wallet address after linking their wallet, along with the new version of Galxe's "Yap" tasks, making the user experience feel like the "Old School" cold start model of previous cycle projects.

In the cryptocurrency market, where tokens frequently "drop to zero" upon launch, this protocol attempts to rebuild the trust foundation between project teams and investors through a dual-drive mechanism of "fund staking + market validation."

Specifically, when developers create a token, they must inject at least 10 SOL as "faith funds" and set a price floor for the token. This fund will be locked immediately until the project passes market validation.

If the token meets the platform's set trading volume, active holding addresses, and other "graduation standards" within 5 days, all staked SOL will be injected into a dynamic liquidity pool (DLMM) at the preset price, creating a rigid protective net on decentralized exchanges. If the token fails to meet the "graduation standards" within 5 days, the staked funds will be fully refunded to the developers, but the token will permanently lose its price protection qualification.

At the same time, to ensure the effective operation of the mechanism, the protocol adds multiple layers of insurance. If the liquidity pool funds are exhausted within 5 days, the protective net is automatically lifted; if there are remaining funds, they will be refunded to the developers. The tokens obtained by developers are subject to a mandatory lock-up for 30 days, preventing them from dumping and cashing out through the Streamflow protocol. The advantage of this mechanism is that it allows developers to "set a flag" with their funds, incentivizing them to seriously promote project development while providing traders with a certain degree of price floor protection, reducing the risk of being "smashed through the floor," and using "graduation status" and "activation protection" to assess whether a token is reliable, thus lowering the risk of stepping on landmines.

However, many platforms that previously used similar mechanisms to protect prices have perished for two main reasons: either they could not continuously create attention-grabbing tokens, or they failed to find a suitable sinking market. This type of mechanism may not be as attractive to "serious" project teams compared to ecosystems like Virtual and Believe, while the barriers are too high for "whales" and popular concepts. How to maintain market continuity after the mandatory lock-up ends may be the key to this project's success.

Long Faith-Based Issuance Mechanism

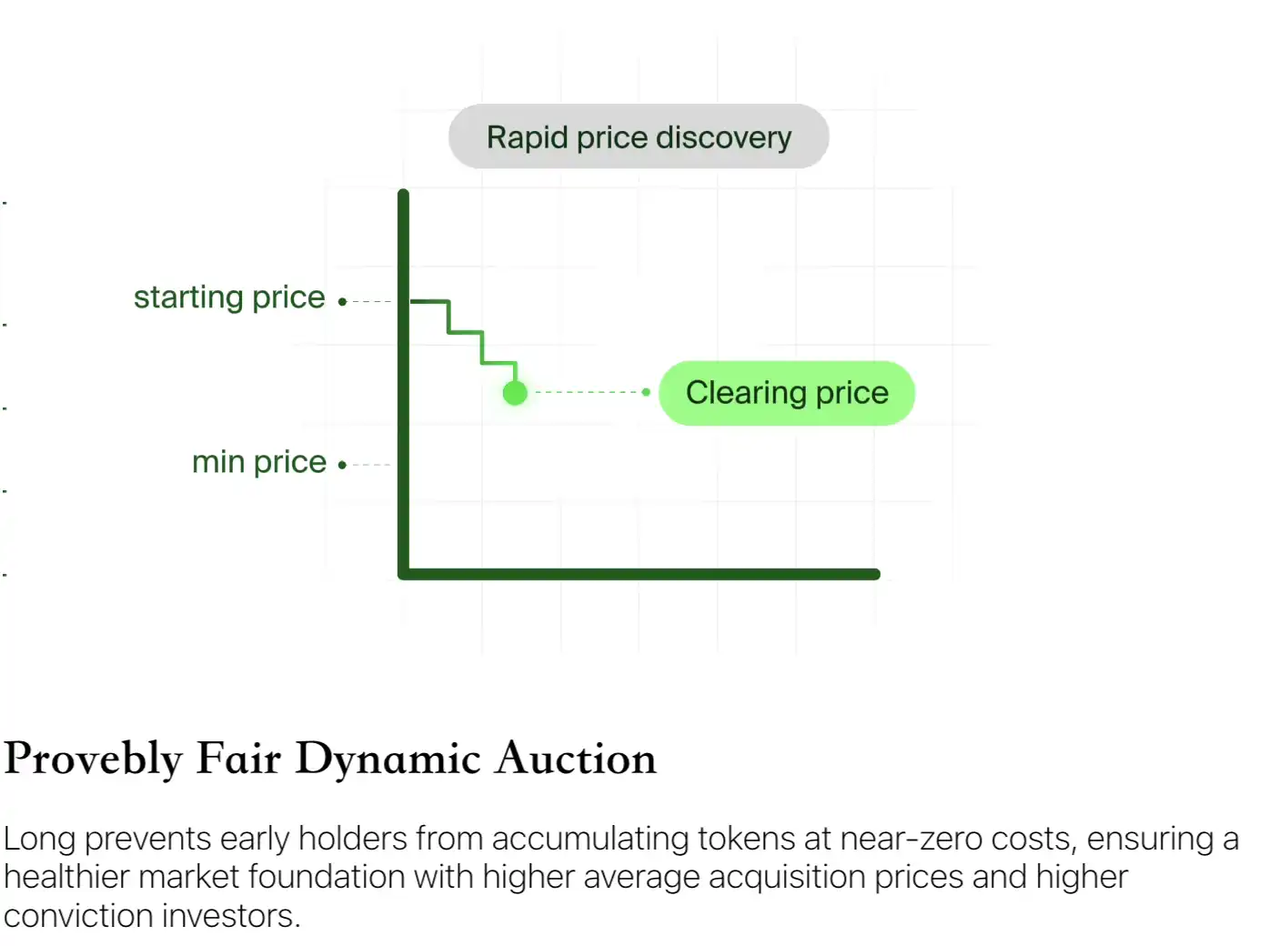

The Long platform introduces a new primitive called "dynamic auction," strongly aligning the incentives between project teams, early supporters, and long-term holders. Unlike traditional rush-buying mechanisms, Long avoids early buyers hoarding at low prices through a higher starting price and an automatic auction system, creating a healthier market foundation and filtering out truly committed users.

Specifically, in stark contrast to traditional platforms that pursue "low-price rush buying," Long requires tokens to start at an astonishing premium—initial pricing can be as high as 30-4000 times that of conventional platforms. This design acts as a "permissionless financing channel," naturally filtering out short-term speculators and only attracting high-cognition, high-faith participants.

Additionally, paired with a slow-paced Dutch auction measured in hours, it ensures that every participant has ample time to assess the project's value. The Dutch auction mechanism is a price-decreasing auction model, in contrast to the traditional "highest bidder wins" English auction. Its core logic is to stimulate demand through price reduction until the market's true acceptance price is found. On the Long platform, each round of token sales starts at a high price, which then gradually decreases through an automatic Dutch auction mechanism until market demand and price reach equilibrium. Therefore, the first real transaction price may fall anywhere between the high starting price and the preset minimum price.

Moreover, to address the rampant issue of bot sniping in the industry, the Long platform has deployed a sophisticated triple defense system. This includes an inverted penalty mechanism, where the earlier the purchase, the higher the price, compressing arbitrage profits; a time-based price lock, where each trading window only refreshes the quote for the first transaction in each time period, and after each update, the price is rebalanced through liquidity reconstruction, making MEV attack costs increase tenfold; and a value protection wall, where each sale sets a global minimum price, adding a certain protective liquidity buffer to ensure participants can always exit at a level not lower than the average issuance price; if sales do not meet expectations, the system will automatically refund.

At the same time, the platform dismantles the monopoly of whales through mechanisms such as "dividing the token supply into multiple rounds of auctions, with strict limits on the quantity for each round," and "large buy orders automatically triggering price increases for the current period." It also binds the long-term interests of project teams by mandating them to set transparent on-chain unlocking plans, ensuring that reserved tokens do not exceed 10%.

In short, Long is a brand new platform based on "faith-based issuance," replacing rush buying with auctions, substituting speculation with transparency, and aligning long-term interests through mechanisms. Here, those who truly believe in the project can enter fairly, enjoying a more stable market starting point and a longer-term return space.

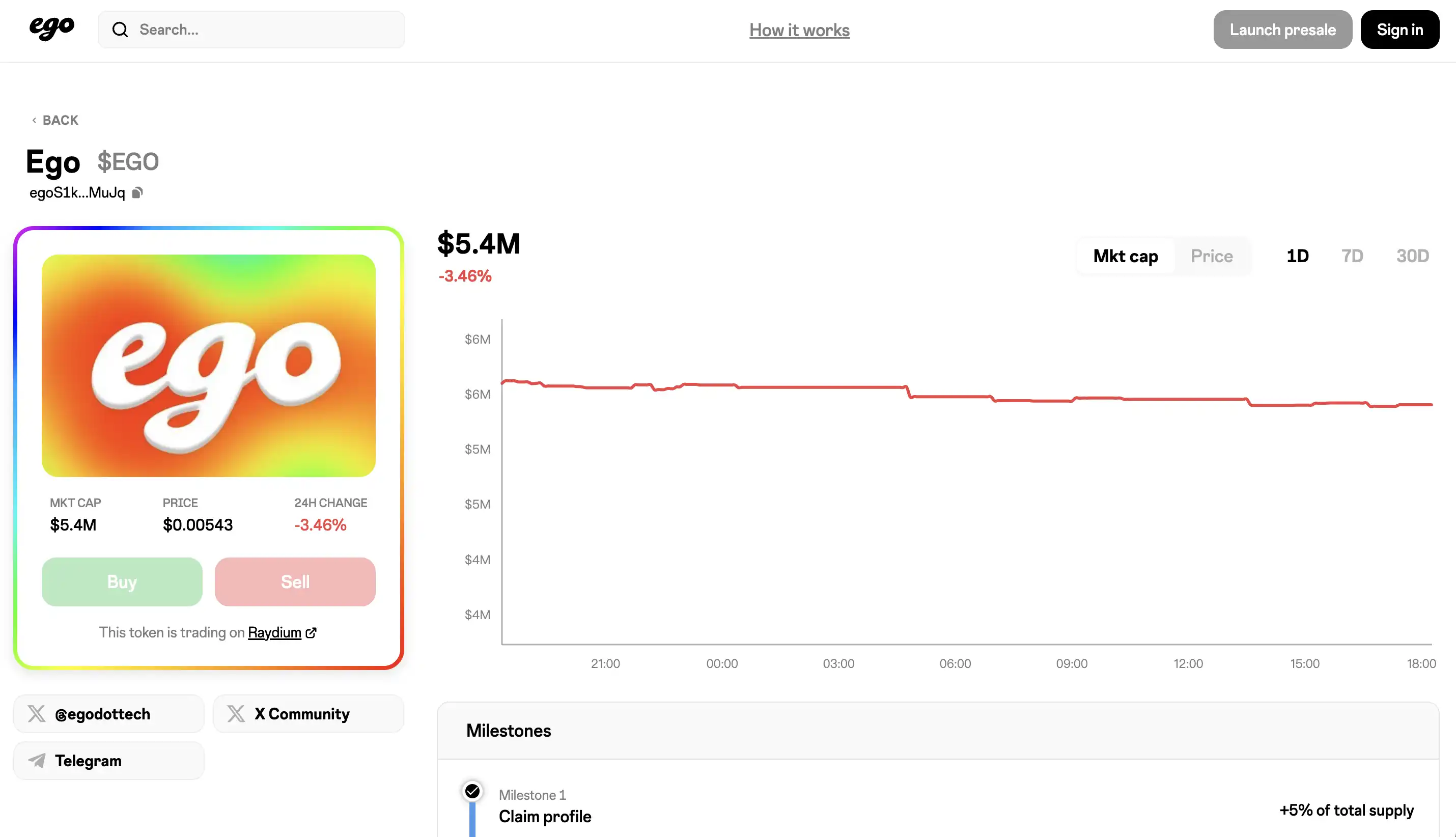

A New Paradigm of Social Identity Assetization — Ego

Ego is a social asset issuance platform within the Solana ecosystem, adhering to the principle of "one address, one person, one Token." Each Ego Token represents a unique personal profile and can only be linked to one social account (such as Twitter). The initial distribution is completed through a public and fair presale mechanism to eliminate front-running, monopolization, and pre-mining.

Each Ego Token presale lasts for 4 hours, during which users can participate by depositing SOL to purchase the token shares corresponding to that Profile. The presale opens for 25% of the total token supply, and all participants buy at the same price, with no first-mover advantage or slippage exploitation. There is a minimum subscription threshold of 60 SOL; if this amount is not reached, the presale automatically fails, and all funds are returned.

After a successful presale, the system will use the raised SOL along with 25% of the token supply to inject into the Raydium liquidity pool, forming the first trading market. The total token distribution allocates 25% to presale participants, 25% for Raydium's initial liquidity, and 50% reserved for the corresponding social account owner and future incentive distribution.

Anyone can initiate an Ego token presale for a specific X account. After a successful presale, the account owner can claim the token by binding their account or logging in to verify their identity. Upon successful verification, the profile owner will receive 50% of the total token amount as a reserved share, which must be gradually unlocked by completing subsequent tasks and achievements to incentivize their continued participation in the platform ecosystem. Additionally, after the token goes live, the profile owner will also receive 50% of the transaction fee sharing to bind their long-term value.

At the same time, to prevent project teams or account owners from "cutting the grass," the profile owner must undergo a public 7-day announcement period before claiming the earned tokens, ensuring transparency and allowing the community to be informed in advance. If the community discovers unreasonable behavior during this period, they can intervene in a timely manner to avoid sudden sell pressure.

This concept has appeared several times before, and such launchers that use personal influence on social media to "issue tokens" generally prohibit others from initiating presales for a specific X account. However, this platform allows anyone to initiate a "token presale," and with the account holder owning 50% of the share, this mechanism creates a significantly unbalanced structure for token holders, making it difficult for participants to obtain guarantees.

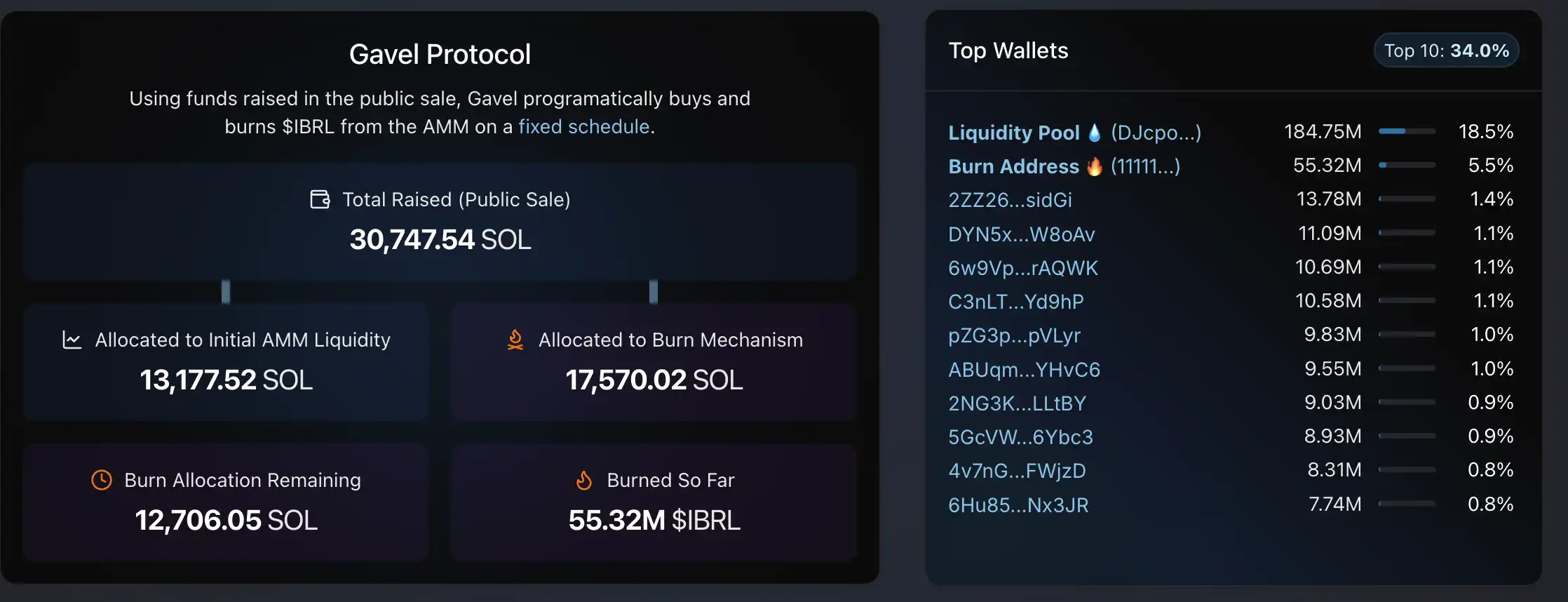

Mev+Launchpad — Gavel A Unique "Tax" Launch Model

Gavel is an on-chain token issuance and liquidity guidance platform that aims to fully move the token issuance process on-chain to avoid high fees from centralized exchanges. It also achieves on-chain price discovery to prevent users from encountering harmful MEV attacks.

Currently, many project teams face a dilemma when issuing tokens: on one hand, choosing to list on centralized exchanges often means paying listing and liquidity fees of up to 10% of the total token supply, with a non-transparent process. On the other hand, while on-chain issuance has lower fees, it is susceptible to front-runners and MEV bot attacks, leading to value loss.

Gavel provides a fair, transparent, and efficient on-chain fundraising and token distribution mechanism, combined with secure and controllable liquidity management, achieving complete auditability and transparency throughout the token's lifecycle. Many tokens on Solana currently use Bonding Curve issuance, where the initial price is extremely low, and as buying volume increases, the price rises. The starting price is usually artificially set and does not represent the true market value of the token.

This leads to bot racing—whoever can buy faster can acquire tokens at a very low price and then sell them at a high price to ordinary users. This is akin to Taylor Swift concert tickets initially selling for $200 but being snatched up by scalpers and resold for $1000. The negative impact of sniping includes reduced actual funds raised by the project team (due to bot arbitrage) and worse token prices for ordinary users.

Most AMMs cannot withstand MEV attacks, while Gavel employs a defensive AMM mechanism that retains the bilateral liquidity of traditional AMMs while preventing sandwich trading. Gavel's core mechanism includes initial public fundraising, raising funds through various models and providing initial liquidity for tokens, ensuring that the fundraising price aligns with the AMM's opening price to eliminate arbitrage.

After fundraising ends, the remaining tokens and part of the raised SOL will be injected into the defensive AMM, achieving price transparency and uniformity, preventing front-running and sandwich attacks. Additionally, Gavel adopts a temporary liquidity design, gradually withdrawing AMM liquidity as trading activity increases, automatically retracting liquidity positions and burning tokens to avoid permanent asset loss from traditional lock-ups.

Currently, the only token launched on the platform is IBRL, which is a demonstration token for Gavel purely showcasing the protocol's operational process. The total token supply is 1 billion, of which 700 million will be distributed through a 24-hour public fundraising. Participants deposit SOL within a fixed time, ultimately receiving token allocations based on their proportion of the total amount— for example, contributing 1% of the total amount would yield 7 million IBRL × 1% = 700,000 IBRL.

This method is fair with no front-running and does not set an investment cap. The downside is that users cannot know the final price when depositing, but the AMM will start based on the fundraising price, facilitating subsequent exits. After fundraising ends, the remaining 300 million IBRL and 3/7 of the raised SOL will be injected into Gavel's AMM. For instance, if the total fundraising amount is 700 SOL, then 300 million IBRL and 300 SOL will be injected into the AMM, while the remaining 400 SOL will be reserved for future burn.

The liquidity portion will begin to be gradually withdrawn after 7 days, at a rate of 0.01% (1bp) for every 2000 blocks (Slots). After withdrawal, SOL will be exchanged for IBRL and burned. Meanwhile, the remaining SOL inventory will also use 0.01% of funds to purchase and burn IBRL for every 1000 blocks. The entire process is executed automatically on-chain without any permission, driven by Crank.

Gavel is a full-process on-chain platform designed for Solana projects, providing fair fundraising, controllable liquidity, and transparent price discovery, eliminating front-running and sandwich trading risks, avoiding high fees from centralized exchanges, and achieving automated management of token issuance and liquidity. It has currently received support from many Solana groups, but for most project teams, providing liquidity as market makers requires higher "technical costs" and "capital costs."

A Crowded Track: Who Will Solve the Liquidity Problem?

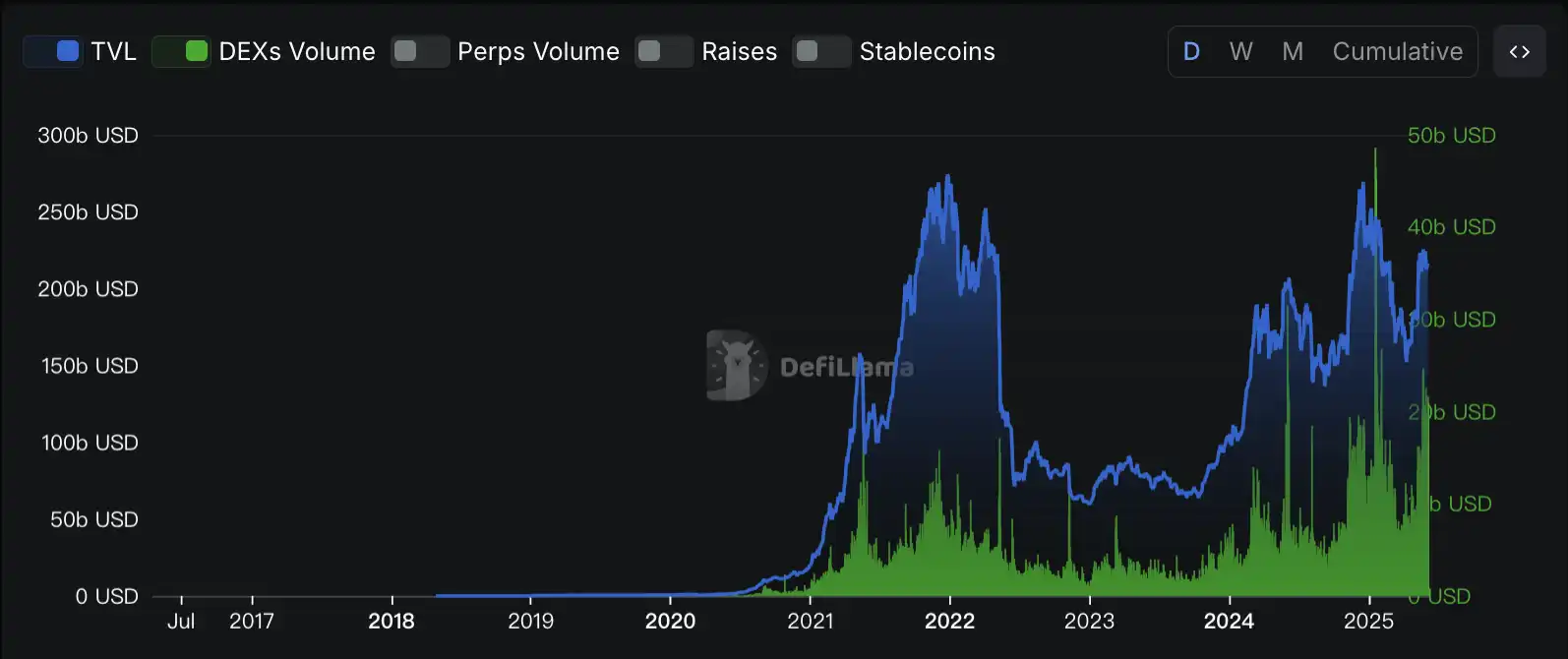

From the data perspective, although the current trading volume of DEX is four times that of the same period last year and ten times that of the same period two years ago, the total TVL has not increased proportionally, growing only 20% compared to the same period last year and 250% compared to two years ago. The reasons for this may include a shift in the market's "trading mainstream" tendency, with the survival cycle of tokens becoming shorter and more "P small generals" emerging, leading to an apparent "inflated" trading volume. Additionally, the slowing growth of on-chain trading may be related to the market gradually becoming "mainstream and compliant," with no more "killer applications/narratives" on-chain to attract external growth. Regardless of the reasons, the current market faces a lack of incremental markets.

Crypto DEX Protocol TVL and DEX Trading Volume Chart, Source: Defillama

In the absence of incremental markets, however, more and more Launchpads are emerging. Currently, the only active ones on the Solana chain are Believe, also invested by AllianceDAO, and BONK, supported by the early Solana OG community, along with Virtuals "far away" on the Base chain. Most Launchpads do not last beyond one month.

In addition to the Meme craze it brings to Solana and the entire Crypto market, and the market's "OG" sentiment towards it, the product itself, which aligns with the modernist architect Ludwig Mies van der Rohe's concept of "Less is more," is core. As a Launchpad, the only necessary function is to issue tokens. The anchoring effect combined with path dependence, along with the continuous "DEGEN" driven feedback loop, allows Pumpfun to thrive among launchers.

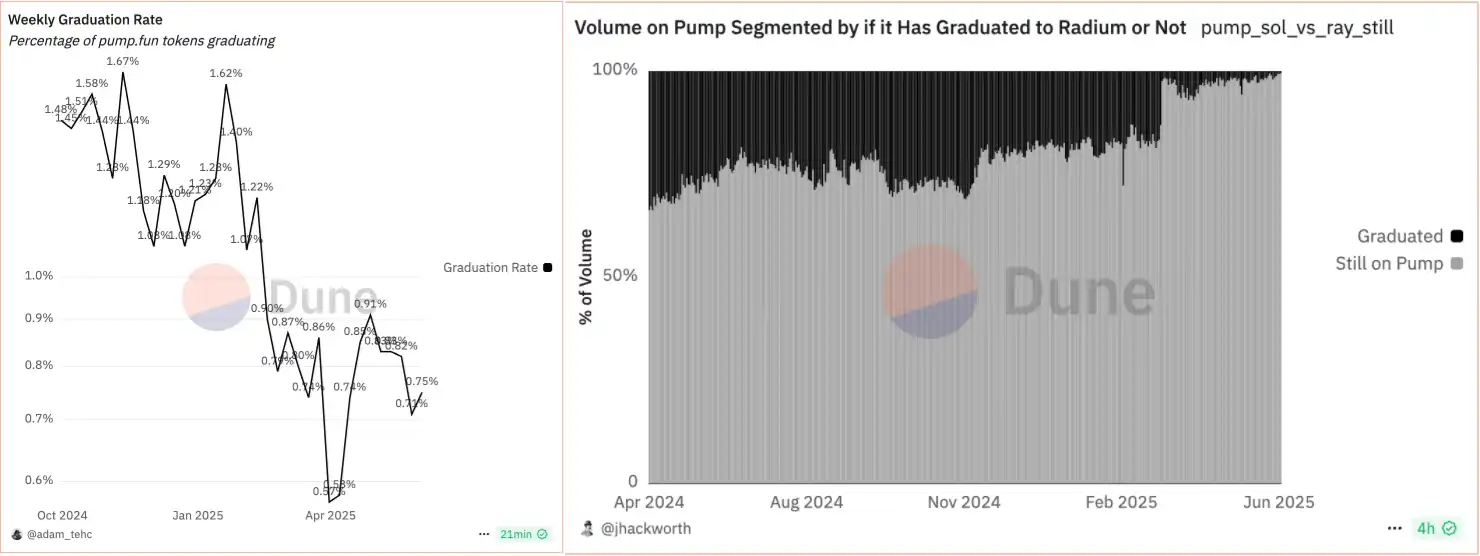

From the data perspective, the "graduation rate" of Pumpfun's tokens compared to the internal market has dropped sharply from an initial average of over 20% to a low point after U.S. President Trump launched his own Memecoin. The number of failed "graduated" junk Memecoins has increased, and the graduation rate has significantly declined, reaching a low of 0.57% in March. This means that for every 1,000 Pumpfun tokens, only about 5.5 can graduate, while the undergraduate admission rate at Harvard University, one of the world's top universities in 2024, is around 5%. In a sense, the competition to "graduate" from the internal market is even tougher than that of Harvard.

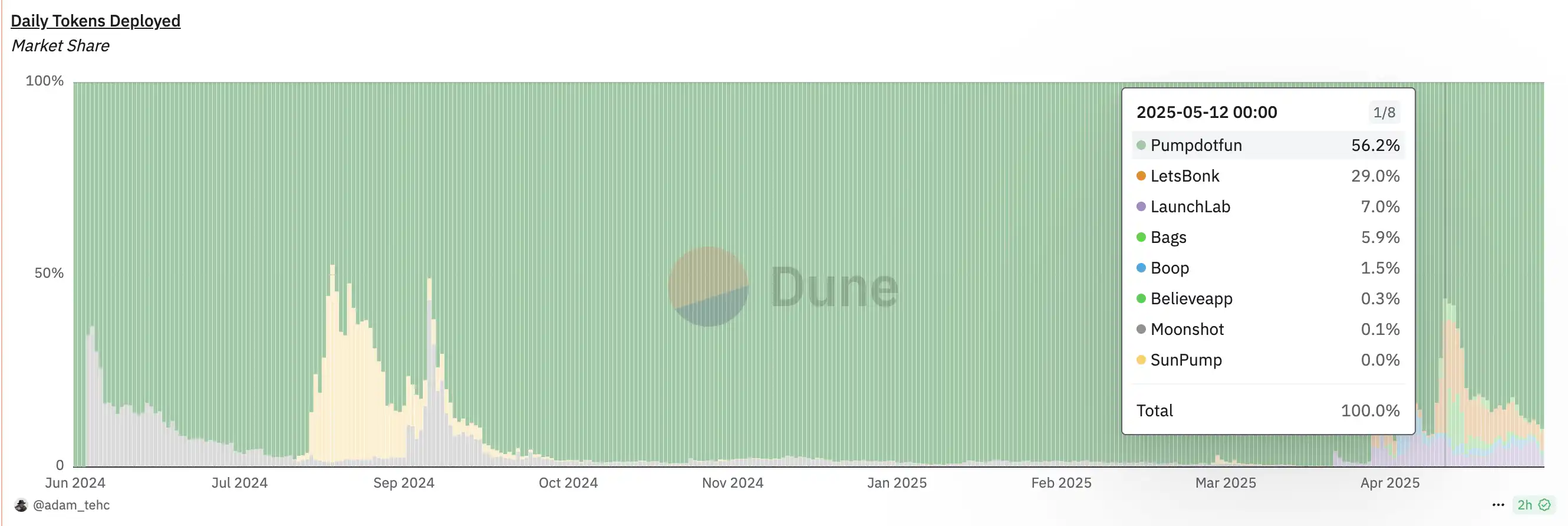

The left chart shows the trend of Pumpfun's graduation rate, while the right chart shows the ratio of Pumpfun's internal market to graduated tokens. Source: DUNE

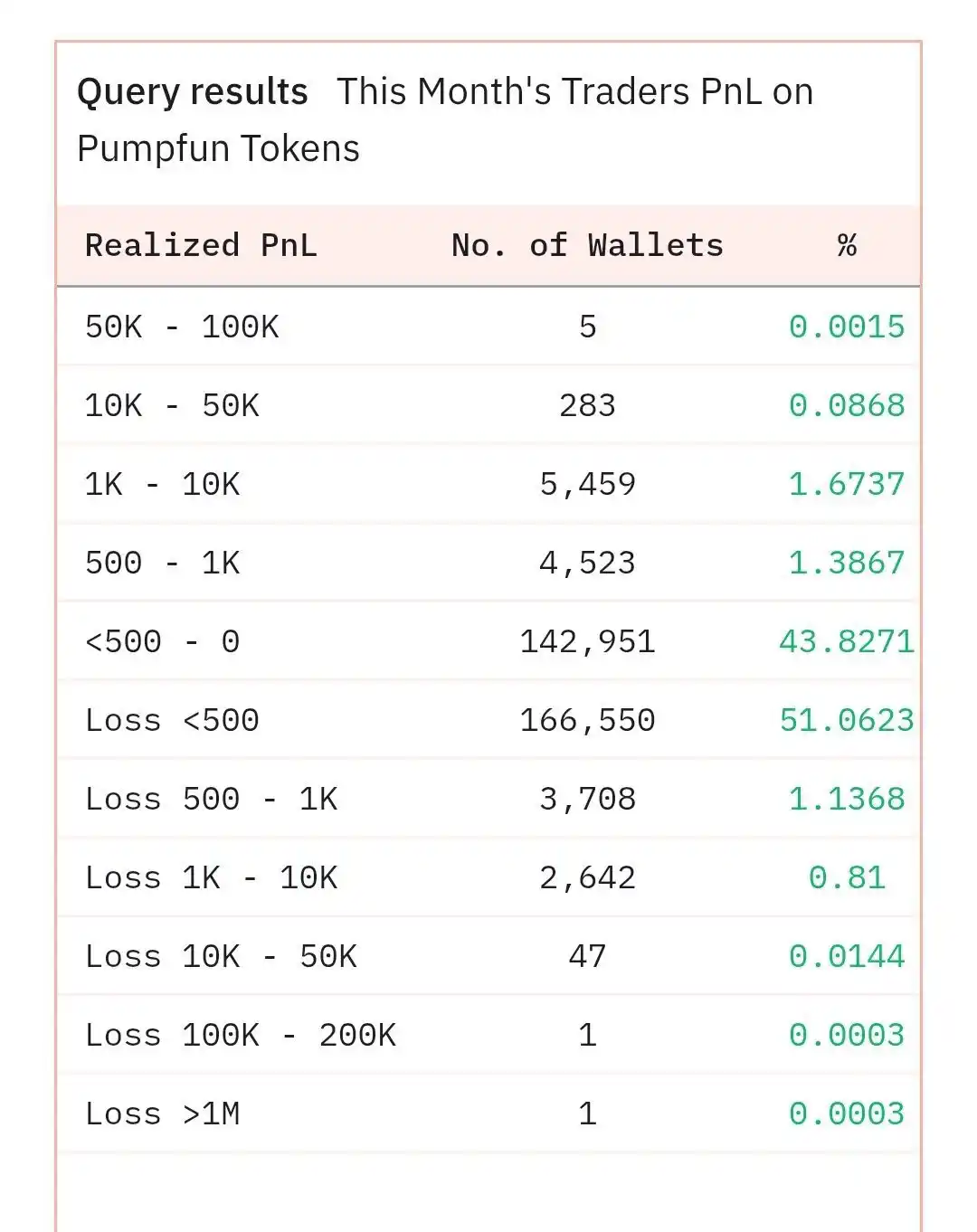

The competition to make money on Pumpfun is equally fierce, with only 1.76% of addresses in the market this month earning over $1,000 on Pumpfun. As the market experiences "aesthetic fatigue" from an increasing number of junk Memecoins, fewer people are able to make money.

Additionally, project teams have continuously sold SOL for transaction fees, earning $700 million, and there are even recent reports that Pumpfun will raise $1 billion at a valuation of $4 billion. Both the Solana ecosystem and retail investors in the market are lamenting, accusing it of "draining the market's liquidity."

Notable KOL 0xTodd tweeted on X expressing his dislike for Pumpfun and jokingly commented on the financing situation, stating, "In the past year, Pump has picked the pockets of on-chain Degens, picked the pockets of Binance and Coinbase, picked the pockets of the Solana Foundation, and the only ones left unpicked are the tier-one institutions and traditional institutions."

There are many differing opinions in the market. Another well-known KOL Crypto Skanda believes that SOLANA Maxis criticizing PumpFun is an act of forgetting their roots. He outlined how Pumpfun has "saved" Solana and added, "If you are truly a SOLANA Maxi, you better hope Pump succeeds. Because from a value investment perspective, its PE RATIO is only about 5, making it a genuine value investment target. From an ecological perspective, Pump is actually the largest Consumer App on the entire network. If such a thing can't make it into the top 50 by market cap, you better clear out and short SOL."

Regardless of whether PumpFun's financing is successful, the "token issuance wave" it has sparked has led to a new understanding of asset issuance forms in the market. This is also a reflection of the ideological changes brought about by the current trends in AI Vibe Coding, meme culture, Degen culture, and other cultural movements.

When ideas can become assets, and attention turns into liquidity, the rules of money flow have quietly changed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。