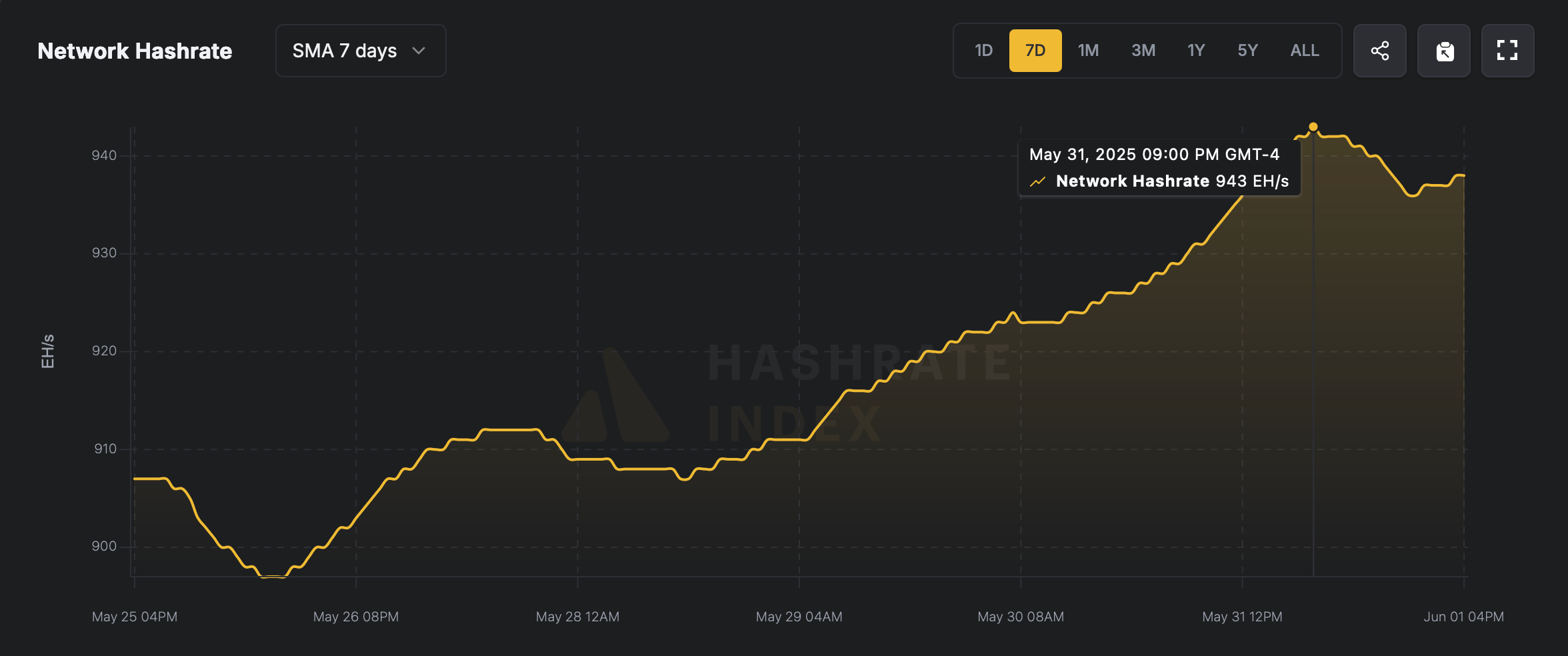

Bitcoin’s global hashrate has reached a fresh pinnacle, with data reflecting a high of 943 EH/s based on the rolling seven-day simple moving average (SMA). This milestone was achieved on May 31, arriving just 22 days after the previous high of 929 EH/s, marking a 14 EH/s increase above the former peak in computational power.

Source: hashrateindex.com

Moreover, this milestone stands just 57 exahash shy of breaching the 1 zettahash per second (ZH/s) threshold. That’s an immense torrent of computational effort. Although the hashrate dipped slightly by June 1, it remains formidable—clocking in at an astounding 934 quintillion hashes per second committed to the Bitcoin blockchain as I type this at 5:02 p.m. Eastern time on Sunday.

In the past, some have argued that this positions the network as the most powerful computational system on Earth, yet drawing direct comparisons with supercomputers is inherently complex. Bitcoin‘s hashing relies on integer-based operations, while supercomputers are measured in floating-point operations per second (FLOPS), a fundamentally different metric.

Even so, prior rough estimates have proposed that Bitcoin’s hashrate may execute significantly more operations per second than the world’s best machines like El Capitan, which boasts 1.742 exaflops—but again, any such parallel comparison is inherently imperfect given the dissimilar tasks involved. It’s akin to weighing poetry against mathematics—two realms with no common metric.

However, Bitcoin’s computational force is globally dispersed, operating without pause—24 hours a day, seven days a week. While disruptions or hardware shutdowns can temporarily reduce the network’s processing capacity, that hasn’t been the case in 2025; instead, miners have steadily contributed even more hashing power to the system.

The most recent uptick arrives amid a 7.93% decline in revenue per petahash since May 29. At that time, the projected earnings for 1 petahash per second (PH/s) of hashing capacity stood at $56.99; today, that figure has slid to $52.47. As the Bitcoin network edges closer to the zettahash frontier, the unrelenting expansion of its computational footprint hints at both miner confidence and technological ambition.

While profitability metrics may fluctuate, the steady climb in processing power suggests a deeper narrative—one where efficiency keeps getting better and better as the days progress. Despite operational efficiency, miners are navigating very thin margins and remain dependent on higher bitcoin prices to recover the earnings seen before the fourth halving event in April of last year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。