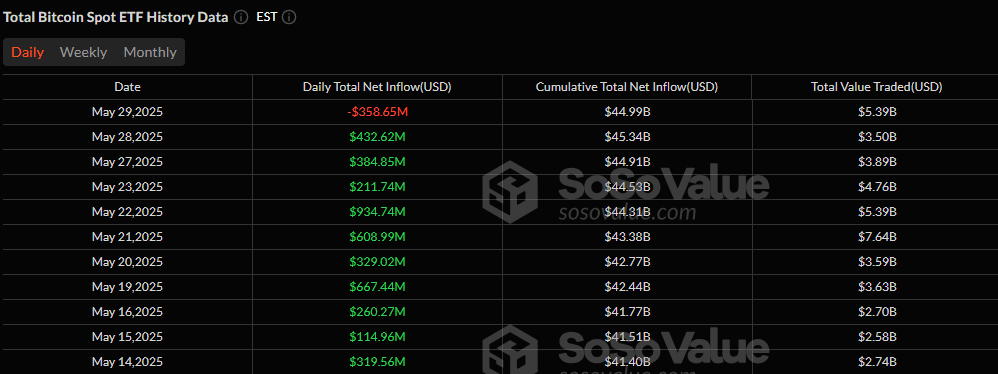

Bitcoin ETFs End 10-Day Inflow Streak as Ether ETFs Push to Day 9 With $92 Million Inflow

After 10 days of relentless inflows, bitcoin exchange-traded funds (ETFs) hit a roadblock. The streak ended with a $358.65 million net outflow, the result of broad exits across eight major funds.

Fidelity’s FBTC led the exodus with a $166.32 million pullback, followed by Grayscale’s GBTC ($107.53 million) and Ark 21Shares’ ARKB ($89.22 million). Additional red prints showed up at Bitwise’s BITB ($70.85 million), Invesco’s BTCO ($20.05 million), Vaneck’s HODL ($11.98 million), Valkyrie’s BRRR ($11.67 million), and Franklin’s EZBC ($6.13 million).

The lone green light came from Blackrock’s IBIT, bringing in $125.09 million. Despite the heavy outflows, trading activity hit a significant $5.39 billion, with net assets slightly dipping to $128.13 billion.

Source: Sosovalue

In contrast, ether ETFs extended their inflow momentum to a 9th consecutive day, securing $91.93 million. The lion’s share came from Blackrock’s ETHA ($50.45 million) and Fidelity’s FETH ($38.31 million), supported by Bitwise’s ETHW ($4.55 million) and Grayscale’s Ether Mini Trust ($3.24 million).

A minor $4.62 million outflow was logged by Grayscale’s ETHE, but it barely dented the day’s net gains. Ether ETF trading volumes reached $552.39 million, with total net assets climbing to $9.63 billion.

Despite bitcoin ETFs cooling off, institutional appetite for crypto exposure, especially in ether products, remains firm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。