James Wynn, the Hyperliquid trader who had at one time a billion-dollar notional position, has become an outsized victim of bitcoin's BTC cooling sentiment.

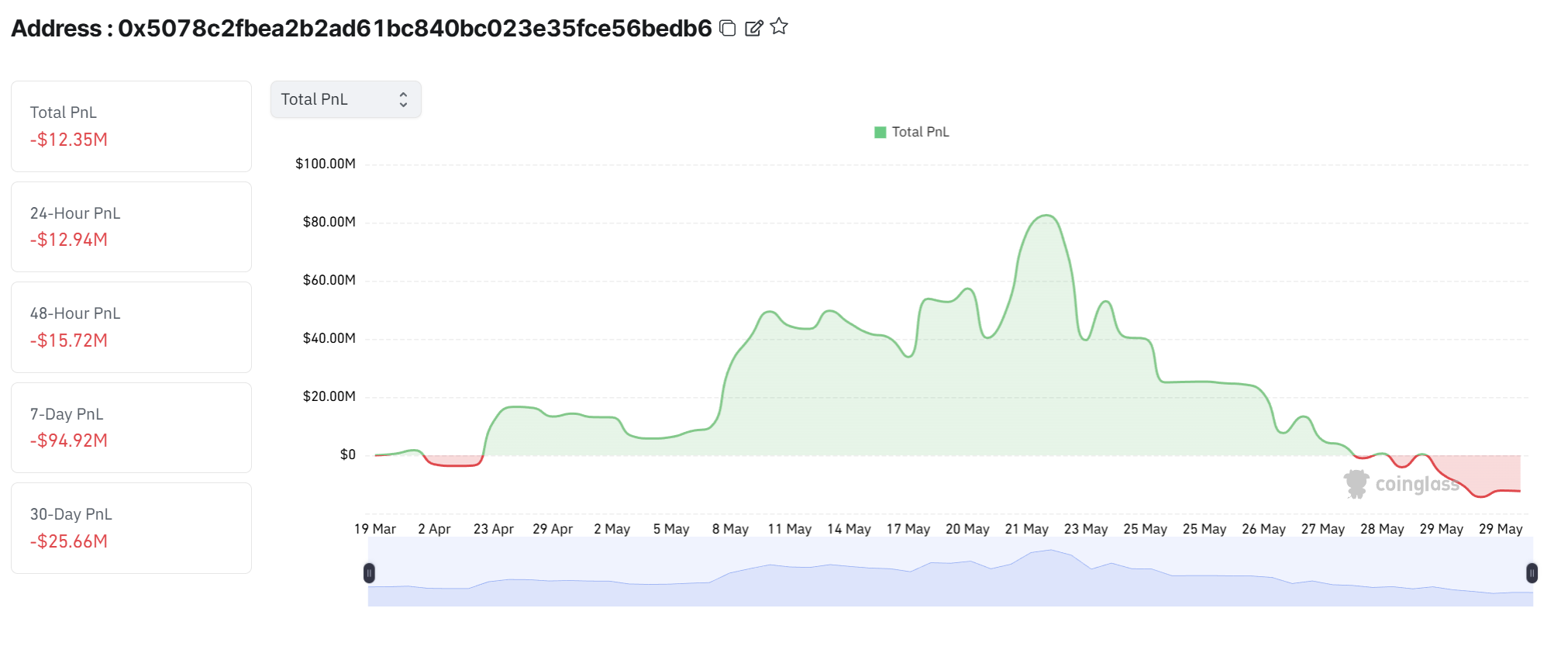

Wynn's current highly leveraged BTC position, which he appears to be struggling to maintain, spiralled into a loss of nearly $100 million over the last week.

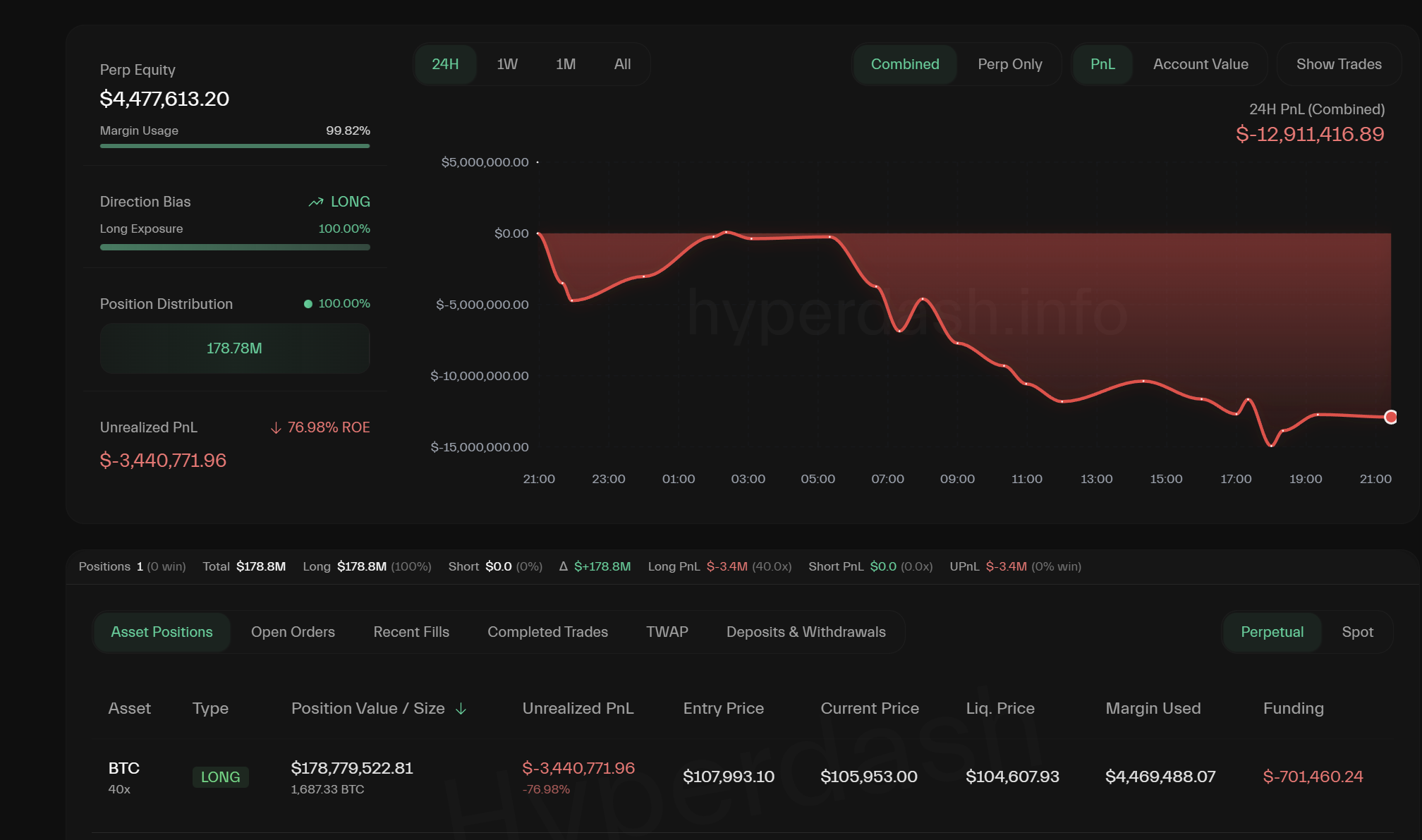

Data from Hyperdash shows that Wynn's margin usage is nearing 100%, which would result in a total liquidation of his position, though Wynn recently made a deposit of $376,000 to bolster his defenses.

The trader, known for making aggressive bets under the pseudonym "moonpig," currently holds a long position of approximately 1,690 BTC, valued at roughly $178.78 million.

On-chain data shows that Wynn's 40x leveraged BTC bets now carry an unrealized loss of approximately $3.5 million, representing a negative return of 77%.

But with BTC trading near $106,000, just slightly above Wynn’s liquidation price of around $104,607, any further decline in the asset’s price could trigger automatic forced sales.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。