Tech billionaire Elon Musk confirmed on Wednesday (May 28) via his social platform X that he will soon conclude his role as a special government employee under the Trump administration. The White House also confirmed later that evening that Musk's departure process is underway.

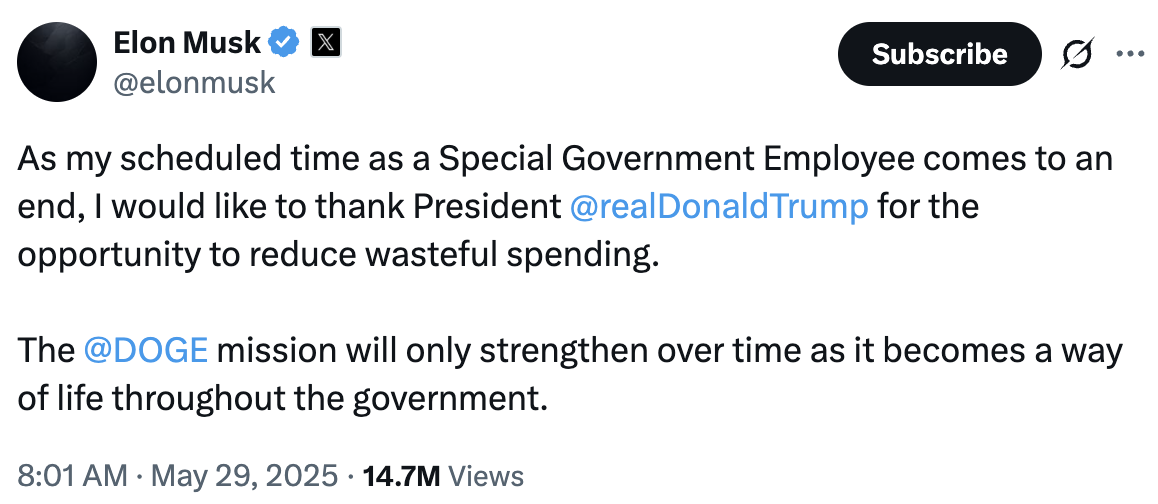

In his statement, Musk expressed gratitude to President Trump for the opportunity to participate in government affairs, particularly in the effort to cut wasteful spending. He emphasized that the “Department of Government Efficiency” (DOGE) that he led will continue pushing forward with relevant reforms.

“As my tenure as a special government employee nears its end, I want to thank President Trump for giving me this opportunity to cut wasteful spending. The mission of DOGE will continue to strengthen over time and eventually become a new normal for government operations.”

According to a source familiar with the matter, Musk made the decision without formally informing Trump in advance. The move was finalized at a senior staff level, executed quickly and quietly—signaling the end of the tech tycoon’s brief stint in government, despite once declaring himself Trump's “#1 fan.”

Musk served as a special advisor for 130 days. His temporary appointment was set to expire around May 30. During that time, he was granted rare administrative authority to lead reform projects through DOGE, aimed at cutting redundancies, reducing expenses, and promoting efficient governance. Although the position lacked electoral legitimacy, Musk had repeatedly defended his role as a “necessary attempt at systemic optimization.”

With his exit imminent, there’s widespread speculation about whether Musk will continue to engage in politics in other forms, or shift his full attention back to his business empire.

Behind the Exit: Political Setbacks and Internal ConflictsMusk’s departure didn’t come out of the blue—he had been signaling his exit for weeks. Earlier this week, he harshly criticized Trump’s budget proposal, calling it “too bloated,” and expressed dissatisfaction with the government’s response to DOGE-led reform efforts. He also pointed out that Trump’s flagship tax reform was costly and counterproductive to the goal of government efficiency.

In an interview with The Washington Post, Musk said bluntly: “The state of the federal bureaucracy is worse than I imagined. I thought there would be some issues, but trying to push for improvements in Washington is like swimming upstream.”

He added that within the White House, DOGE was often used as a “scapegoat,” blamed when other policy initiatives failed.

In addition, last month’s Supreme Court judicial race in Wisconsin ended with Democratic-backed liberal judge Susan Crawford winning—meaning the $25 million Musk had invested in Republican candidate Brad Schimel’s campaign essentially went to waste.

Musk also had tense relationships with several Cabinet members. Policy disagreements frequently led to clashes—such as when White House trade advisor Peter Navarro opposed Musk’s proposal for U.S.-EU “zero tariffs,” prompting Musk to mock him as a “moron.”

Last year, Musk spent nearly $300 million supporting Trump and other Republican candidates. But earlier this month, while attending an economic forum in Qatar, he admitted he would significantly reduce future political donations—“I think I’ve done enough.”

When Musk Was in Office, Dogecoin SoaredDOGE, sharing the same acronym as Dogecoin, caused a frenzy in the crypto community when Musk took office.

Looking back at past data: in November last year, when Trump announced the creation of DOGE, Dogecoin’s price surged by 20% in a single day. In January, when Musk’s appointment was confirmed, the coin’s value jumped around 10% in just 24 hours, triggering investor speculation that Dogecoin might hit the $1 mark.

At the time, the market widely believed Dogecoin was receiving a temporary “policy imagination boost” due to the acronym’s official adoption and Musk’s political aura. On platform X, the topic “$DOGE” skyrocketed, even reaching global trending status.

What’s more, Musk mentioned “DOGE” several times during his tenure—though referring to the department, not the coin. Yet the crypto community “chose to interpret” it bullishly, fueling speculative sentiment. Influencers hyped the idea that “Dogecoin is being semi-officially recognized by the government,” drawing in short-term capital.

However, the rally didn’t last. As tensions between Musk and the administration became public, Dogecoin prices quickly fell back. It’s now trading around $0.022—essentially returning to pre-appointment levels.

Musk Leaves Office, Crypto Buzz Cools? Dogecoin May Lose Its “Policy Fantasy” BoostIn the 12 hours following Musk’s resignation announcement on May 28, Dogecoin’s price remained relatively stable, fluctuating between $0.224 and $0.227. While there hasn’t been a large-scale selloff, market sentiment has clearly begun to soften.

Analysts believe part of Dogecoin’s previous valuation premium stemmed from the dual narrative of “policy fantasy” and Musk’s influence. With Musk exiting the White House, the symbolic value of his “official status” diminishes, and Dogecoin loses a key storytelling hook—potentially weakening its speculative momentum in the short term.

It’s worth noting, though, that Musk, despite lacking an official role, remains the most prominent “unofficial ambassador” in Dogecoin’s history. His posts on X still carry market-moving weight. Some in the market even believe Musk, now free from official constraints, might continue discussing crypto topics—and could resume openly endorsing Dogecoin.

That said, compared to the early meme-hype days, today’s crypto market is less reactive to celebrity influence. Dogecoin’s future will likely depend more on fundamentals like development progress and payment use cases, rather than any one individual’s tweets.

Back to Business: Musk Goes All In Amid Corporate TurmoilLeaving the Trump administration doesn’t mean Musk can now “take it easy”—from Tesla to SpaceX, from X to xAI, every front is under pressure, and business challenges are piling up.

Tesla’s sales are plummeting; Cybertruck seems to be heading toward “epic failure” territory; social platform X suffered a major outage over the weekend, prompting Musk to admit it “urgently needs operational overhaul”; just two weeks ago, xAI’s Grok AI model briefly went viral for spouting far-right conspiracy theories about “white genocide”; and on Tuesday night, the latest multi-billion-dollar SpaceX Starship launch ended in failure when the rocket lost control and disintegrated over the Indian Ocean.

Tesla is the only publicly traded company among Musk’s ventures. With shrinking European market share and slumping core model sales, the company’s growth narrative faces unprecedented strain. Musk will need to refocus on product strategy and rebuild consumer trust to turn things around.

Musk claims he has “resumed working around the clock,” and while this kind of performative “grind culture” draws criticism, given the crisis across his empire and the pressure of single-handedly running several troubled companies, this full-throttle attitude may be necessary.

Now, Musk is trying to pick up the pieces—and the market is watching closely to see whether he can stabilize the fundamentals and get his companies back on track.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。