According to Glassnode researchers Cryptovizart and Ukuria OC, this breakout signals accelerating investor engagement across exchanges, derivatives, and exchange-traded funds (ETFs), though the $120,000 zone may trigger intensified selling pressure.

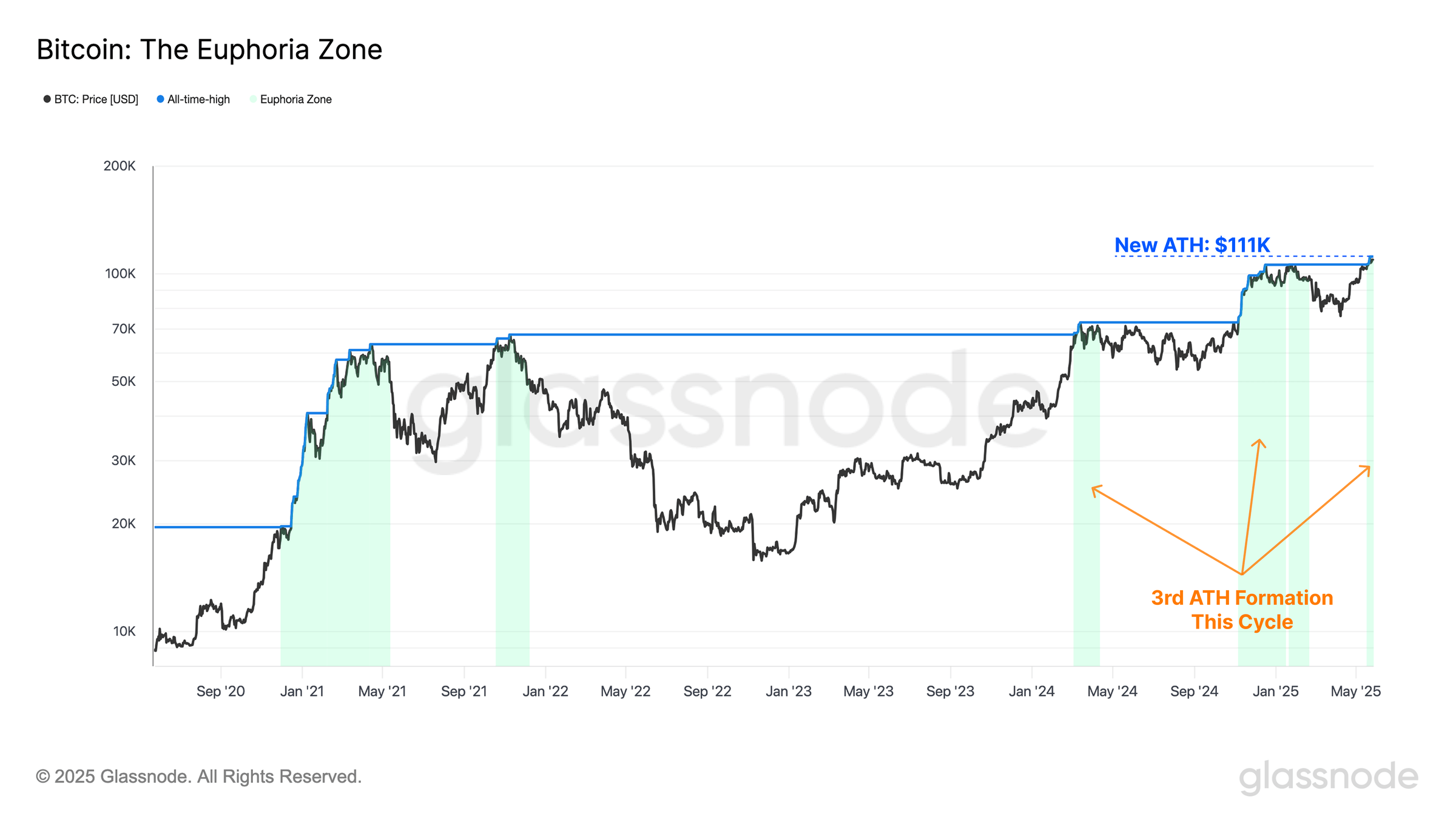

Glassnode’s latest “Heating Up” report details how bitcoin’s rally drove unrealized profits to “euphoric phase” levels, with the Relative Unrealized Profit metric exceeding its +2σ band. Despite this, profit-taking remains below historical extremes, with just 14.4% of days seeing higher realized profits, the firm noted.

Cryptovizart’s and Ukuria OC’s analysis emphasized that current spending behavior is “overwhelmingly profit-driven,” as coins deposited to exchanges realized average gains of $9,300—12× larger than losses.

Exchange activity surged significantly, Glassnode observed. Centralized platforms now handle 33% of bitcoin’s onchain volume, a notable spike aligned with price discovery. The researchers tied this to heightened trading demand, evidenced by $4B–$8B daily exchange inflows/outflows.

Derivatives markets mirrored the fervor, Glassnode reported. Futures open interest soared 51% to $55.6B since April, while options hit a $46.2B ATH. The report further highlighted this reflects “a maturing investor base” using sophisticated strategies.

Spot ETF inflows exceeded $300M daily, sustaining buy-side pressure since late April. Glassnode credited this institutional and retail demand as a “meaningful tailwind” for recent ATH breaks. Technically, bitcoin trades above key momentum indicators (111DMA: $91.8K; 200DMA: $94.3K; STH cost-basis: $95.9K).

However, Glassnode’s MVRV Ratio places the price between +0.5σ ($100.2K) and +1σ ($119.4K)—a zone historically linked to overheating. The researchers warned that the $120,000 level, aligning with STH cost-basis +0.5σ, may accelerate sell-side pressure.

Glassnode concluded that while accumulation and leverage trends indicate bullish momentum, consensus behavior near psychological resistance like $120K warrants caution, echoing prior cycle patterns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。