This week, BTC fell back after breaking through $110,000, with short-term fluctuations dominating the market; the ETH/BTC exchange rate rebounded slightly, with $2,700 becoming a short-term resistance level for ETH; Grayscale launched an AI asset sector, including tokens such as VIRTUAL, KAITO, and AIXBT; the Trump Media Technology Group announced a plan to establish a Bitcoin treasury worth approximately $2.5 billion; the supply of SOL on CEX dropped to 27.01 million, nearing the lowest point in October 2022; Gate Launchpool launched ELDE, with a total prize pool of 1,000,000 ELDE.

Summary

Market Interpretation

Market Commentary

Popular Concepts

This week, Bitcoin has been fluctuating in a high range, with altcoins showing mixed performance and no significant collective rise. According to Coingecko data, sectors such as AI Agents, DID, and DeFi outperformed the market average, rising approximately 9.7%, 8.7%, and 5.7% respectively over the past week. The commonality among these three sectors is that their technological or narrative developments are highly popular, all belonging to recent hot tracks.

AI Agents

AI Agents are becoming a key innovative driving force in the cryptocurrency market. They optimize market participants' decision-making and operational efficiency through intelligent algorithms, data analysis, and automated trading. AI Agents can be used for market prediction, risk management, arbitrage opportunity identification, and even drive the automated governance of decentralized finance (DeFi) protocols. Their high-speed execution and data processing capabilities give them a competitive advantage in highly volatile markets, attracting widespread attention from institutional and retail investors. — Over the past 7 days, this sector has risen by 9.7%, with JAM, ARBUS, and JOS performing particularly well.

DID

The DID (Decentralized Identity) sector is an important part of the Web3 ecosystem, aiming to achieve user control over identity data and privacy protection through blockchain technology. DID projects use distributed ledgers to provide users with verifiable digital identities, replacing traditional centralized identity management, and are widely applied in DeFi, NFTs, the metaverse, and cross-chain interactions. Through mechanisms such as cryptographic technology and zero-knowledge proofs, they ensure the security and anonymity of identity verification, promoting data sovereignty and the proliferation of decentralized applications. — Over the past 7 days, this sector has risen by 8.7%, with BYB, WCT, and LGX performing particularly well.

DeFi

The DeFi sector is a core area of the cryptocurrency market, providing financial services without intermediaries through blockchain technology and smart contracts. DeFi reshapes traditional finance, covering lending, trading, derivatives, stablecoins, and yield farming, emphasizing transparency, accessibility, and decentralization. Protocols like Uniswap, Aave, and MakerDAO attract global users through automation and community governance, promoting financial inclusion. The high yield potential and innovative characteristics of DeFi make it a market hotspot, but it also comes with risks such as smart contract vulnerabilities and high volatility. — Over the past 7 days, this sector has risen by 5.7%, with ZBCN, TRB, and SYRUP performing particularly well.

Focus of the Week

Grayscale launches AI asset sector, including VIRTUAL, KAITO, AIXBT, etc.

On May 28, 2025, Grayscale announced the launch of the AI cryptocurrency industry sector as its sixth sector, including 20 assets with a total market capitalization of approximately $20 billion, accounting for 0.67% of the cryptocurrency market, making it the smallest sub-sector. The financial sector has a market capitalization of $519 billion, ranking third. The AI sector integrates tokens that originally belonged to other sectors, with unchanged index standards. Grayscale believes the AI sector is small, reflecting that the projects are in the early stages.

Grayscale's newly established AI cryptocurrency sector focuses on 20 assets, and although the $20 billion market capitalization is small, it highlights the potential for the integration of AI and blockchain. The sector's size only accounts for 0.67%, reflecting the early characteristics of AI projects, with significant growth potential but also high risks. By integrating existing tokens rather than adding new ones, it shows a cautious strategy to avoid market bubbles. Compared to the financial sector's $519 billion, the AI sector is still in its infancy, and short-term speculative enthusiasm may drive prices up, but long-term value needs to be supported by technological implementation. Grayscale's move may lead investment trends, but caution is needed regarding the volatility of early-stage projects and regulatory uncertainties, and investors should assess carefully.

Ondo Finance launches on-chain securities trading platform, supporting public securities trading on Solana

On May 23, according to SolanaFloor, Ondo Finance announced the launch of the "Ondo Global Markets" platform, which will support on-chain trading of public securities (including stocks) on the Solana blockchain. As competition intensifies for traditional financial markets to migrate to blockchain, the platform plans to deeply integrate with the Solana DeFi ecosystem.

Solana has become the preferred blockchain for RWA tokenization due to its high performance and low costs. In 2025, BlackRock's BUIDL fund migrated from Ethereum to Solana, highlighting the maturity of its institutional-grade infrastructure. Ondo GM's choice of Solana reflects the industry's preference for high-throughput blockchains, especially in the securities market where real-time trading is required.

Supporting securities trading is a significant advancement for Ondo Finance in the RWA tokenization field, providing investors with a low-cost, high-transparency investment channel. The platform utilizes instruction tokenization to retain traditional market liquidity while enhancing on-chain composability through API and DeFi integration, which is expected to attract more attention and participation from developers, investors, and traditional financial institutions in the future.

Trump Media Technology Group announces a plan to establish a Bitcoin treasury worth approximately $2.5 billion

According to Bloomberg, the Trump Media Technology Group announced on May 27 that it has signed subscription agreements with about 50 institutional investors for a total of approximately $2.5 billion in private financing. This financing includes about $1.5 billion in common stock and $1 billion in zero-coupon convertible senior secured bonds, with the raised funds intended to create a Bitcoin treasury, expected to be completed around May 29.

This move by the Trump Media Technology Group emulates MicroStrategy, aiming to transform the company into a "Bitcoin-backed enterprise," relying on Bitcoin appreciation to reshape its valuation. At the same time, the plan aligns with its Truth Social platform ecosystem and echoes Trump's concepts of "financial freedom" and "America First," politically reinforcing his image as the "cryptocurrency president" and accelerating the politicization of crypto assets.

In the short term, this news has boosted Bitcoin prices and cryptocurrency concept stocks, and may encourage more companies (especially politically connected ones) to follow suit in purchasing Bitcoin. However, TMTG's actions pose significant risks: its weak fundamentals (severe losses, low revenue) could lead to a sharp decline in stock prices due to massive financing diluting shareholder equity; the volatility of Bitcoin prices poses a huge threat to its finances; at the same time, the plan deepens the crypto industry's reliance on political resources, raising concerns about interest transfer and regulatory issues. The long-term success or failure depends on Bitcoin's trends, TMTG's operational capabilities, and U.S. crypto policies.

Highlight Data

SUI native DEX protocol Momentum's cumulative trading volume exceeds $3 billion

Since its launch on March 27, 2025, the SUI on-chain native DEX protocol Momentum has seen its cumulative trading volume exceed $3 billion, setting a historical high for the protocol.

Momentum adopts a unique ve(3,3) token economic model, creating a "flywheel effect" through incentive alignment (liquidity providers receive 100% of emissions, traders enjoy low slippage), driving rapid increases in trading volume. The $3 billion trading volume confirms the efficiency of this model within the Sui ecosystem. Previously, Momentum managed over $500 million in TVL through a multi-signature asset management solution, and the further breakthrough in DEX trading volume solidifies its role as the "liquidity engine" of the Sui ecosystem, attracting more protocol integrations and collaborations.

The explosion of Momentum is a reflection of the accelerated flywheel effect in the Sui ecosystem, validating the synergistic efficiency of its economic model and technical infrastructure, and providing core momentum for Sui to attract institutional capital and compete for a leading position among public chains. Recently, Sui has obtained the Dubai VARA license and collaborated with Franklin Templeton on RWA, combined with Momentum's data breakthrough, further strengthening capital confidence. The market has bet on SUI breaking through $4 (with bullish options positions increasing by 320% week-on-week), with valuation models pointing to a potential space of $20 billion.

The supply of SOL on CEX drops to 27.01 million, nearing the lowest point in October 2022

Glassnode data shows that from early March this year to now, the balance of SOL on centralized exchanges has dropped from 37.22 million to 27.01 million, a decrease of 27.4%, nearing the lowest point in October 2022.

Recently, SOL has shown a clear trend of decentralization, with the number of tokens held on centralized exchanges continuously decreasing, indicating that users are increasingly willing to transfer tokens on-chain or hold them long-term. This alleviation of supply-side pressure provides support for price rebounds. Although it surged to around $300 at the beginning of the year and then experienced a significant correction, dropping to a low of $95, as the overall market sentiment has warmed, SOL's price has gradually recovered, currently returning to above $170. From on-chain data and price performance, SOL's recent trend shows signs of a phase of bottoming out, and with steady ecological development, Solana is expected to continue to play a leading role among mainstream public chains in the next round of market movements.

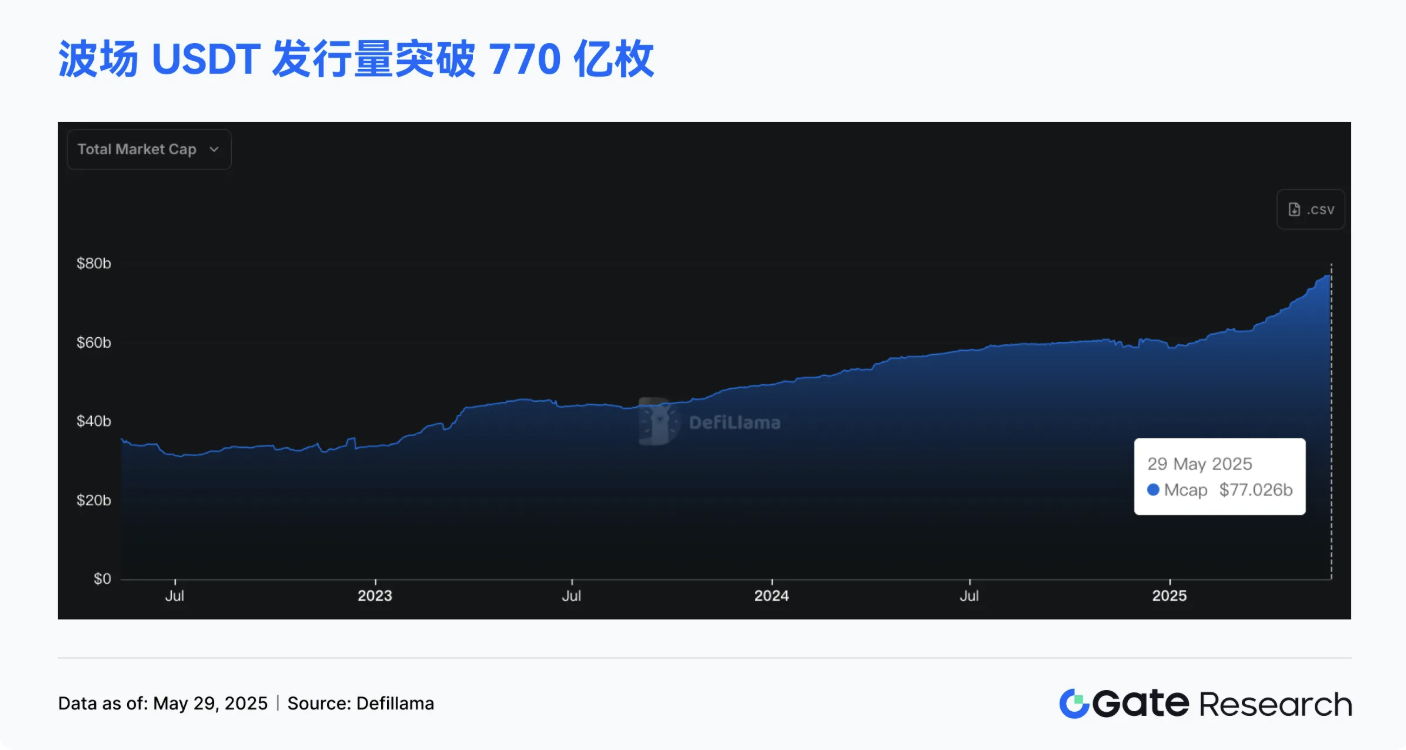

TRON's USDT issuance exceeds 77 billion, surpassing Ethereum to become the largest USDT issuing blockchain

As of May 29, the total market capitalization of stablecoins has surpassed $245 billion. Behind the rapid growth of stablecoins is a battlefield of competition among various public chains. As one of the main forms of asset accumulation, stablecoins are not only indicators of asset flow changes but also important measures of public chains' market recognition.

The supply of USDT on TRON has grown from $48.8 billion in 2024 to $77 billion by May 2025. The reasons for this include TRON's low fees and high transaction speeds, making it the preferred network for a large volume of USDT transactions, particularly favored by retail users and emerging markets. Additionally, the close collaboration between TRON founder Justin Sun and the Trump family has provided more possibilities for the future of TRON's stablecoin. In May, Zack Witkoff, co-founder of the Trump family project WLFI, stated that the USD stablecoin issued by WLFI will also be natively issued on the TRON chain.

As the native token of the TRON chain, TRX has shown relatively strong price performance over the past few years, consistently maintaining a position within the top 10 by market capitalization. Since 2024, TRX has accumulated a rise of over 150%, performing relatively well among Layer 1 public chains.

Related: MetaMask wallet plugin officially integrates with the Solana network | Cantor Fitzgerald launches a $2 billion Bitcoin collateral loan program

Original article: “Grayscale launches AI asset sector | Trump Media Group invests $2.5 billion to build Bitcoin treasury”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。