Follow the Whales into AAVE, They Made Money, What About You?

The AAVE Craze and Whale Dynamics Spark Heated Discussions

AAVE has once again captured the market's attention.

A whale trading through Wintermute OTC splurged $25 million on AAVE in just four days, accumulating a total of 261,000 tokens at an average cost of only $156.3, currently sitting on an unrealized profit of nearly $30 million.

In addition to AAVE, significant whale activity has also been observed in other cryptocurrencies recently.

| Cryptocurrency & Event | Price Increase | |------------------------|----------------| | November 2021: Bitcoin whale accumulation triggered historical high | 15% | | August 2024: PEPE whale buying caused price surge | 53% | | January 2025: XRP whale accumulation led to price surge | 44% |

These activity data indicate that whales are positioning themselves across multiple assets, leading one to ponder whether simply following whales into purchases guarantees substantial profits.

The answer is quite clear: one must not blindly follow the whales!

Why Shouldn't You Blindly Follow Whales?

Although the trading dynamics of whales are eye-catching, blindly following them often carries significant risks. Whales typically possess information channels, financial strength, and complex strategies that ordinary investors cannot reach.

In 2024, a whale sold 184.4 WBTC (worth $20.4 million) through Wintermute OTC and subsequently purchased $15 million worth of AAVE. This could be a long-term bet on AAVE, or it might simply be for asset portfolio adjustment or arbitrage purposes.

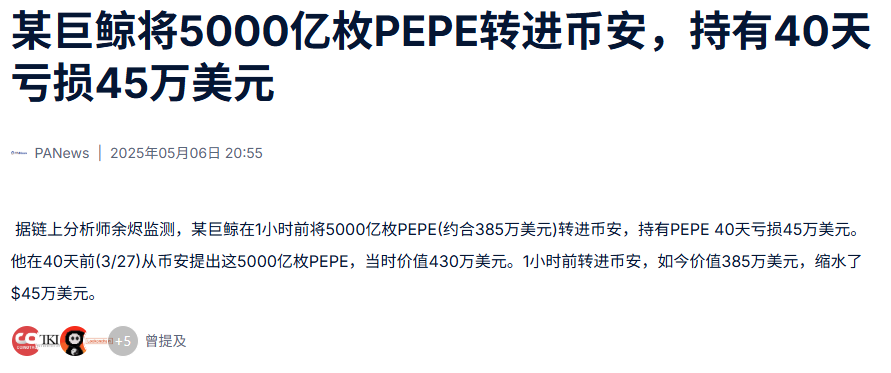

According to on-chain analyst Yu Jin, a whale transferred 50 billion PEPE (approximately $3.85 million) to Binance an hour ago, having held PEPE for 40 days with a loss of $450,000.

Therefore, we should not only look at what whales are buying but also understand why they are buying and the state of the cryptocurrency itself.

Analyzing Whale Intentions from an Objective Perspective

Blindly following whale trading actions can easily lead to emotional traps, overlooking the underlying trading logic. To avoid blind following, ordinary investors can leverage other data analyses to gain insights into the background of whale behaviors.

Understanding whale behavior requires rational dissection across several dimensions. Taking AAVE as an example, we can focus on the following key aspects:

- Indicator Analysis – Chip Distribution

I will analyze using chip distribution as an example. The chip distribution chart reveals the density of AAVE holdings across different price ranges, helping to identify potential accumulation cost zones.

From the chip distribution structure, the current price of AAVE is running above the volume peak (approximately 259.75 USDT), which is the main cost zone for the major players and also a significant support level. A closing price consistently above the chip peak indicates that the downside potential is relatively limited, and market sentiment is leaning bullish. At the same time, we notice that the upper chip distribution is relatively even, with buying and selling forces being relatively balanced, so no significant resistance barriers are likely to form in the short term. Therefore, the overall trend is more inclined towards sideways consolidation or gentle upward movement. Only if the price falls below the chip peak might it trigger a weakening of sentiment, necessitating close attention to the stability of this support level.

If combined with other indicators (such as large transactions, changes in trading volume, wallet activity, etc.), it can better showcase market dynamics and enhance analytical effectiveness.

- Market Behavior Logic

Whale operations are usually not isolated events but are coordinated with specific market nodes or expectations. For example, price fluctuations in AAVE are often related to governance proposals, favorable DeFi policies, or increases in TVL.

For instance, in March 2025, a proposal to allocate 50% of GHO (AAVE's stablecoin) revenue to reward GHO token holders was passed, leading to a price increase of about 13%, reaching a weekly high of $238.74.

Another example is in May 2025, when AAVE announced the successful deployment of its V3 protocol on the Aptos blockchain, marking its first expansion on a non-EVM chain, which caused the price to rise above $260.

By considering these backgrounds, one can better understand why whales are making moves at this time. Additionally, if purchases occur around token unlock windows or buyback announcements, it may also suggest information advantages or early positioning.

How Should Investors Respond?

Combining all the information, it is clear that whales have a relatively optimistic signal towards AAVE. Recent governance proposals and ecological expansions related to AAVE have also reinforced market expectations. From the chip distribution perspective, the current price is running above the main trading density area, showing strong support, and there are no significant signs of selling pressure, indicating a neutral to strong overall trend.

For investors with different risk preferences, differentiated strategies can be adopted:

Aggressive Investors: Light Positioning to Test, Accumulate on Dips

The current AAVE price is above the chip density area, with some technical support, and the downside space is limited while the upside pressure is relatively balanced, making the probability of a significant drop in the short term low, thus providing conditions for tentative accumulation.

- Gradual Accumulation: Can accumulate in batches near the chip peak support level (e.g., 256~258 USDT);

- Position Control: Initial position should be controlled at 20%~30%, leaving room to respond to sudden market movements;

- Breakout Accumulation: If the price breaks above the upper resistance level (e.g., 264~268 USDT) with volume, consider appropriate accumulation to capture further upside potential.

Defensive Investors: Mainly Observing, Waiting for Confirmation Signals

Although the current chip structure leans bullish, the market lacks significant buying pressure from major players, and the market may still maintain a consolidation phase. For risk-averse investors, it is more suitable to wait for clear signals before entering.

- Holder Strategy: If already holding AAVE, continue to hold and observe, suggesting setting a stop-loss level (e.g., below 252 USDT) to control risk;

- Potential Buyer Strategy: If not yet positioned, it is advisable to wait for clearer signals of volume increase or new on-chain capital inflows before considering entry;

- Continuous Monitoring: Pay attention to on-chain capital flows and new whale movements to assess whether there is new capital support driving a market reversal.

While whale behavior certainly holds significant reference value, it does not mean that every action they take is suitable for ordinary investors to replicate. We need to actively monitor more on-chain data and market information to better understand market structure, grasp the rhythm of major players, and identify capital sentiment. Only by integrating all these elements can investors truly "go with the trend" rather than "be constrained by the trend."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。