Federal Reserve Policy Trapped in "Stagflation Dilemma," Is Opportunity Brewing in the Crypto Market?

Event Overview: The Federal Reserve is Observing, and the Market is Watching

The minutes from the Federal Reserve's meeting have been released, revealing a sense of caution. Officials are worried about persistently high inflation while also fearing a rise in unemployment. The Trump administration has begun raising tariffs again, causing concerns in the market about continued price increases and unrelieved inflationary pressures. The unemployment rate is also somewhat troubling, with expectations that it may exceed normal levels by the end of 2025, indicating a weak labor market.

Investor reactions indicate a bet that the Federal Reserve may cut interest rates 1-2 times within 2025. However, the Federal Reserve has yet to take action, maintaining a wait-and-see attitude, stating that more data is needed before making decisions. Therefore, everyone is focused on the upcoming meetings, waiting for clear signals.

To Cut or Not to Cut? Keep an Eye on Liquidity Changes

With the Federal Reserve remaining inactive, the crypto market must hold its breath for news.

If interest rates are indeed cut 1-2 times in 2025, there will be more funds in the market. What does this mean? High-risk assets like Bitcoin and Ethereum may gain traction. With more money, people are more willing to take risks. But if the Federal Reserve does not budge and continues to maintain high interest rates, liquidity will tighten, leading to less activity in the crypto market, especially for volatile altcoins, which will face greater pressure.

What should investors focus on?

Pay close attention to the data. The three key indicators—CPI, price levels, and non-farm employment—are all essential.

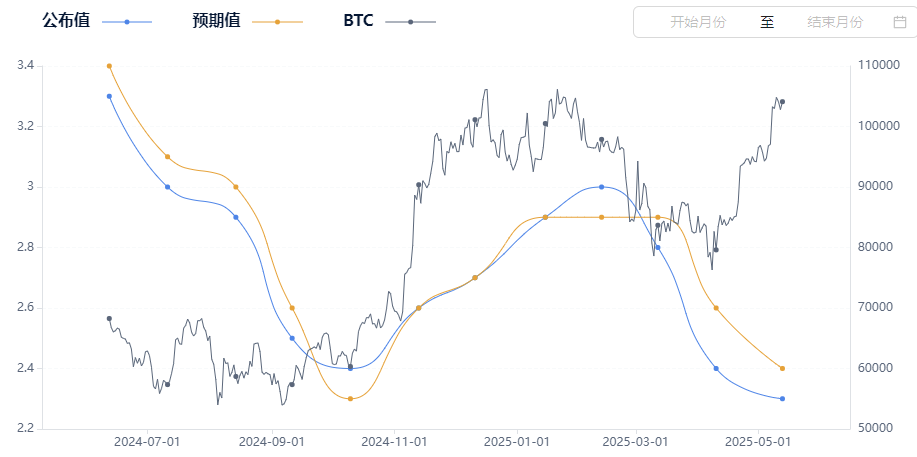

(CPI Change Chart)

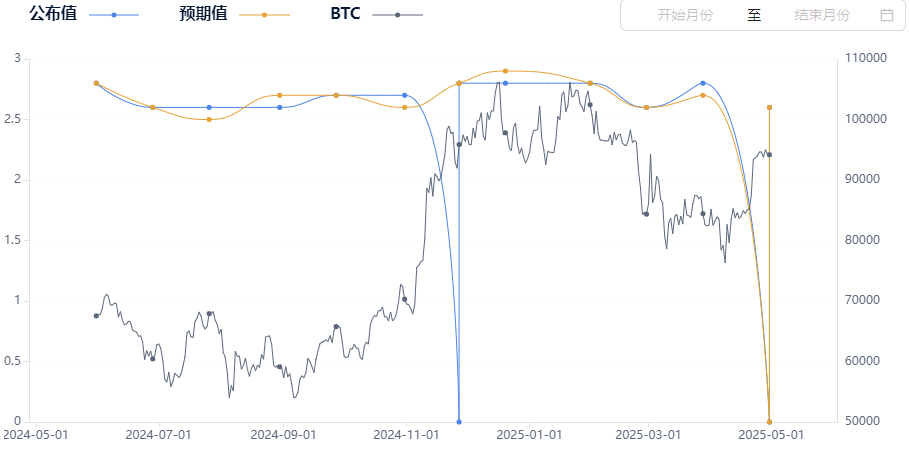

(PCE Price Change)

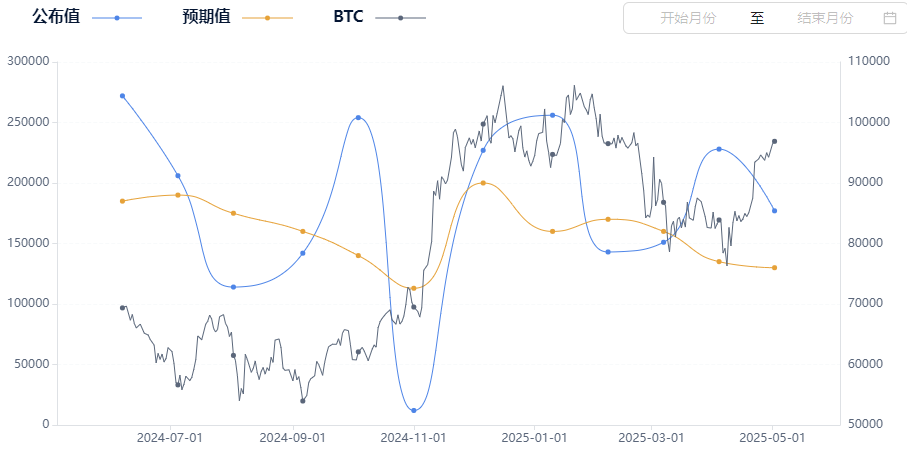

(Non-Farm Employment Numbers)

- If inflation cools and prices drop, expectations for interest rate cuts may heat up, potentially providing short-term opportunities for BTC and ETH.

- If inflation remains high, be wary of capital outflows.

Platforms provide trends for these key indicators and comparisons with BTC trends; observing and comparing these trends will clarify the macro situation significantly.

Inflation is Here, Is BTC Really a Safe Haven? Are Altcoins and DeFi Projects Too Fragile?

High tariffs are pushing up prices, and the Federal Reserve may maintain high interest rates to control inflation, resulting in a stronger dollar. In the short term, Bitcoin may be suppressed because it does not earn interest like the dollar. However, if market confidence in fiat currency wavers, Bitcoin's long-term value remains promising.

At the same time, DeFi and altcoins are even more sensitive—if interest rates are cut, stablecoin liquidity will be ample, allowing DeFi projects and related tokens to rise; but if policies tighten and liquidity becomes scarce, the prices of DeFi and altcoins will fluctuate greatly, increasing risk.

What should investors do?

- Continue to monitor the relationship between the dollar index (DXY) and Bitcoin. Typically, when the dollar rises, Bitcoin falls; when the dollar falls, Bitcoin rises.

- Pay attention to the trading volume of altcoins and the buzz on social media platforms; hot opportunities often hide here.

Directly view the 1-hour hot word cloud; the latest trends are summarized here!

Short-Term Trading or Long-Term Holding?

In fact, whenever the Federal Reserve speaks, the crypto market behaves like a roller coaster. In the short term, with expectations of interest rate cuts, BTC and ETH prices may surge. Conversely, if hawkish signals appear, the market will immediately correct.

In the long term, Federal Reserve policy determines institutional investor attitudes. When a rate-cutting cycle begins, institutional funds are more willing to enter the market, leading to a more mature market; when interest rates are high, institutions tend to wait and the market is primarily driven by retail investors, resulting in greater volatility.

What should investors do?

- Short-Term: Use technical indicators (RSI, MACD) to catch price rhythms, entering the market when it tends to overheat and exiting quickly when it becomes too hot. A warning system is quite important in this regard!

- Long-Term: Monitor institutional movements, such as changes in holdings by Grayscale and MicroStrategy. Keep an eye on the Ethereum Layer 2 ecosystem to see if market structure upgrades are occurring.

The Federal Reserve is cautious about inflation and unemployment rates, with expectations for interest rate cuts coexisting with risks. For the crypto market, it is essential to respond flexibly, closely monitor various policies and macroeconomic data, capture short-term fluctuations, and pay attention to institutional funds and market structure in the long term. This is the way to steadily grasp the potential of the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。