A circulating video clip on social media captures the moment Saylor was asked about proof-of-reserves. Given Bitcoin’s open ledger, Strategy—which holds 580,250 BTC—could theoretically verify its holdings, making the exchange all the more compelling. One approach involves publicly sharing the bitcoin address where the funds are held. Since Bitcoin’s blockchain is fully transparent, anyone can view the balance and transaction history associated with that address.

However, this method alone only shows that the funds exist at a given address—it does not, on its own, verify who controls the private keys. To conclusively prove control, the address holder would still need to sign a message or execute a small transaction to a known address, linking identity or intent with the address in question. This requires the private keys.

“The way that the current conventional and published proof of reserves is an insecure proof of reserves,” Saylor said in response to the question. “It actually dilutes the security of an issuer, the custodians, the exchanges and the investors—It is not a good idea— It’s a bad idea. It’s like publishing the address and the bank accounts of all your kids and your phone numbers of all your kids, and then thinking somehow that makes your family better. It doesn’t make your family healthy.”

Saylor added:

So no institutional, brave, or enterprise security analyst would think it’s a good idea to publish all of the wallet addresses such that they can be traced back and forth, and every future transaction can be traced.

He added that if one were to challenge artificial intelligence (AI) with the question of whether exposing wallet addresses might lead to security vulnerabilities, the response would be exhaustive.

According to Saylor, the AI model would generate a sprawling 50-page dissertation detailing the inherent risks, quipping, “It’ll write you a book.” Saylor also emphasized that liabilities are often excluded from such disclosures and maintained that a ‘Big Four’ auditor would likely handle the matter competently.

Saylor said:

If you invest in securities, what you want is an institutional grade proof of assets, and proof of liabilities with them netted out, okay? And the best practice of that, is not to publish the wallet. The best practice of that would be to have a Big Four auditor that does an audit, the checks to make sure that you actually have the bitcoin.

Once the video began making the rounds, the Strategy founder’s remarks were met with noticeable disapproval. One user reposted the video with a pointed caption: “SHOCKING: Saylor cannot and does not want to provide proof of reserves for his bitcoin. Worse. He says proof of reserves is a bad idea. This level of BS is a huge red flag. Check it [out] for yourself.”

The same X account went further, alleging, “His excuse sounds more like he’s buying paper bitcoin, not actual bitcoin.”

“Interesting, so Michael Saylor is refusing to publish on chain proof of BTC reserves,” another person criticized. “How quickly everyone forgets MSTR was found guilty of accounting fraud in 2001.”

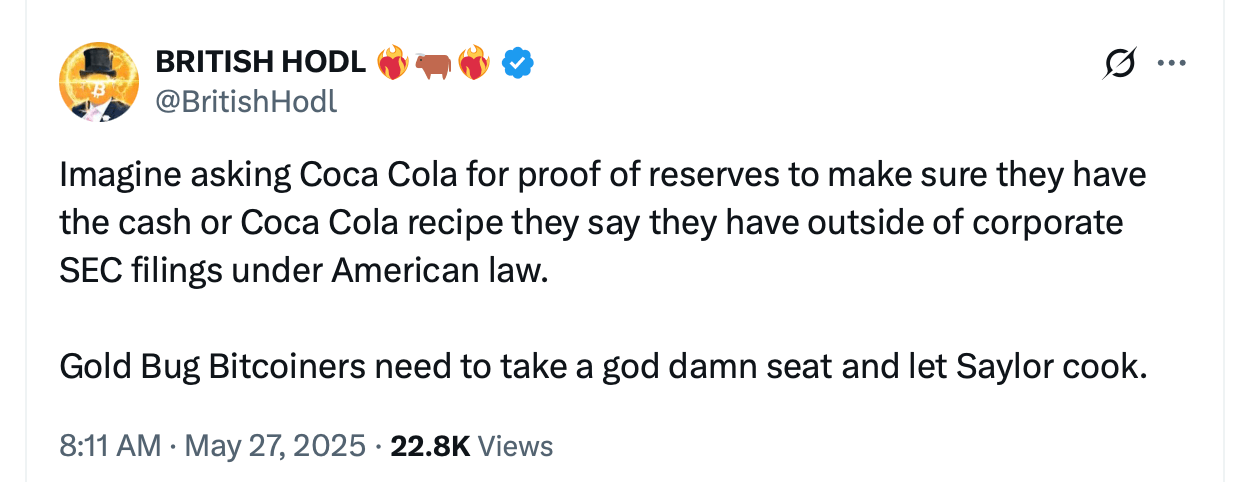

Others stood up for Saylor as one person stated, “I just opened Twitter and saw people criticizing Saylor for not wanting to show proof of reserves. Saylor has been one of the most influential figures in the Bitcoin ecosystem. You honestly have to be clueless to criticize him.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。