继MCP等概念之后,Web2领域的互联网资本市场(Internet Capital Market, 简称ICM)概念也被引入Web3。ICM是一种去中心化的融资方式,资金无需风投或中介,直接流向开发者。开发者发布想法,用户用代币参与,项目受欢迎则代币升值,不被认可则自然消亡。ICM打破了众筹、融资和投机的界限,让资本流动更直接、更自由。

在ICM叙事中,抢先跑出的项目是Believe。Believe作为此次ICM概念下的代表项目,其平台币$LAUNCHCOIN日内涨幅超500%,市值曾突破3亿美元。在Believe平台,用户可实现发帖即发币,对创作者的创意理念进行投资。代币创作者和早期参与用户都能获得更多的激励,Believe也获得了Solana基金会的扶持。与此同时,Believe在经历短期爆发式热度后,整个生态却在短期内降温,项目也引发了社区的质疑与争议。下文,我们一探究竟。

Believe日交易费用,在Solana新发行平台中排名第一

Believe在5月23日对原有的发币模式进行了优化, X账号@launchcoin 发帖即发币的方式将暂停。目前平台会采取开放式上线机制,允许开发者通过官网即时提交并发布项目,无需官方审核。与此同时,为防范“抽水”和缺乏实际产品的项目,平台将阻止此类开发者获取平台费用,并依据社区反馈初步筛选,未来将引入产品内部的强制机制。同时,官方对部分项目实行Verified标签认证,代表项目方已与平台沟通并展现诚信,但不构成背书或担保。

Believe也是Solana的链上新晋发行平台之一,但据Dune数据显示,目前Solana链上代币发行依然集中在Pump.fun,Pump.fun所发行的MemeCoin占Solana整个公链的90%以上。

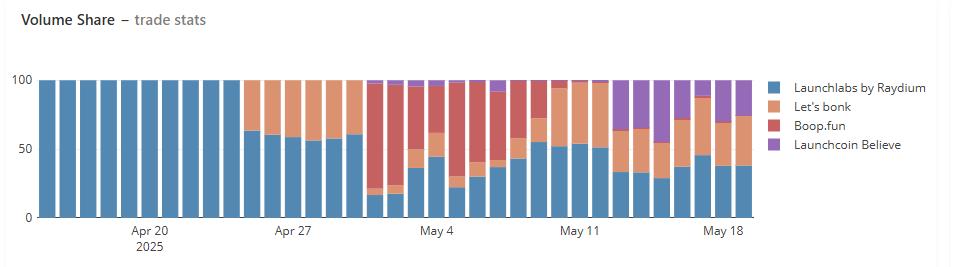

但在Solana链上新的发行平台中,出现了一些其他的面孔。在这些新的发行平台中,根据市值占比,目前占比最多的是Raydium新的发行平台 LaunchLabs占38.1%,其次是Let's bonk占比36%,此后是Believe占比25.8%以及Boop.fun占比1%。

图1 Source:analytics.topledge

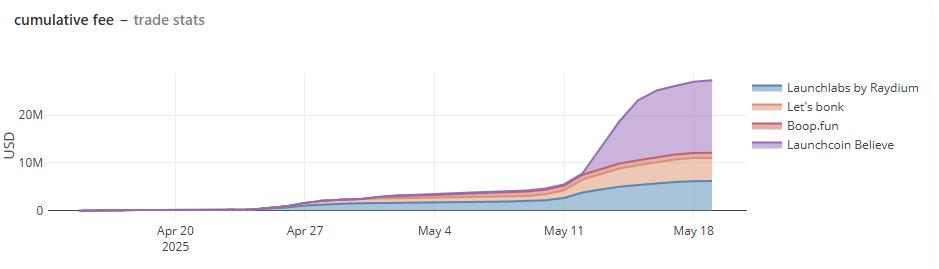

同时,在新的发行平台的累计交易费用中,Believe占据第一,日累计交易费用近1,500万美元。这和Believe设置的交易费用机制息息相关,也是Believe的痛点之一,下文我们将进行详细的解读。

图2 Source:analytics.topledge

Believe三大痛点引发信任危机,缺乏造福效应难以带动增长飞轮

在Believe平台,创作者须通过绑定曲线(bonding curve)机制发行代币。这意味着创作者需要创建一个代币,并通过绑定曲线启动交易。当代币市值达到一定标准时,代币将“毕业”进入更深度的流动性池。这些机制之下,也隐含了Believe平台的一些痛点。

1.高额交易费

Believe 平台在所有交易中强制收取 2% 的手续费,其中 1% 分配给创作者、0.1% 奖励 Scout(早期代币推广者)、0.9% 归平台所有。这个费率远高于主流发射平台(约1%-1.5%),且用户在买卖两个方向都需缴纳,实际负担高达 4%。更重要的是,这种模式在代币价格波动剧烈的情况下极易蚕食用户收益,抑制了短线交易行为的活跃度。大量社区用户质疑平台是否将手续费作为主要盈利来源,而非真正推动创作者与社群共赢。

2.代币创作者收入不明

虽然平台称创作者可获得交易1%的分成,但多位用户在链上交易额达到数十万美元后,实际收益却低得出奇。甚至有创作者曝光自己完成 45 万美元交易量仅获得 50 美元收入,远低于合理预期。与此同时,平台缺乏公开透明的结算文档或链上可查合约,进一步削弱了用户的信任。

3.缺乏造福效应

Believe的代币创作者很多都是来自Web2,本身对于Web3的理念并不熟悉。因此,项目普遍存在代币和产品严重偏离的现象,甚至更有项目直接是无产品的。同时,Believe也被质疑存在内幕交易,新代币开盘狙击手较多,很多项目买入和发币都是在同一秒同一个block完成的,对于参与的散户投资者而言,毫无造福效应。

Believe生态现状不容乐观,市值超千万美元的项目仅五个

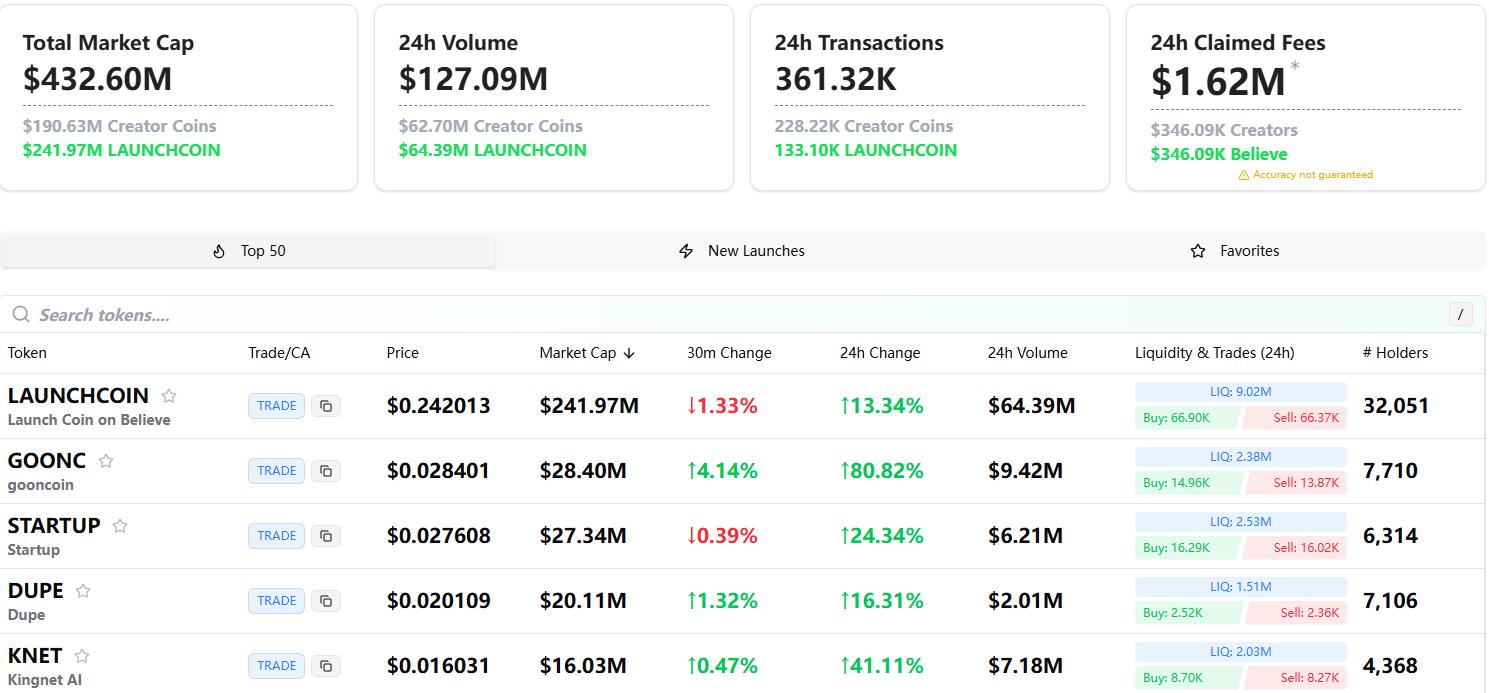

Believe在短期的ICM叙事概念之后,整体生态热度已逐渐在下降。据believescreener数据显示,目前平台总市值约为4.33亿美元,其中平台币$LAUNCHCOIN市值约为2.42亿美元,占总市值的56.2%。除此之外,整个生态中市值超1,000万的项目仅有五个。

图3 Source:believescreener

这些现状表明Believe在优质创意落地、构建可持续经济模型方面仍存在挑战。当前生态更多反映出投机参与主导下的脆弱结构,若无法在产品逻辑、社区激励和流量机制之间找到更稳固的平衡,Believe 可能难以支撑起项目的长期愿景。

小结

Believe主打ICM叙事,成为该领域的抢跑者。目前看Believe并未稳住其市场份额,官方对于项目现存的一些回复并未从根源上解决问题,发币机制的优化也需要经过市场的考验。但从Believe现象所衍生的思考却值得我们关注。

从Web2的概念引入Web3看,在概念引入初期依然有资金和流量去追逐,但中长期看大多数都是一波热度。无论是AI Agent引入MCP或是Lanuchpad引入ICM,都存在无法维持项目长久运营的情况。或许,更深度一点思考,Web2领域的概念本身就已经非常成熟,引入Web3的概念是否是炒作需求?或是只有等Web3有大范围的实际应用后,从Web2引入一些机制才更有具体的意义?当前阶段,投资者更应客观看待这种嫁接引入的概念。

尽管Believe存在诸多问题,但也侧面反映出市场对Launchpad创新机制的真实需求。从Believe到此前的boop.fun,这些案例都表明,Launchpad平台若想持续发展,必须回归公平性、透明性以及社区用户利益的核心诉求。以Virtuals Protocol为例,其正是通过持续优化用户系统,才能在一轮又一轮的叙事潮中脱颖而出、稳步前行。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。