关键要点

–加密 AI 代理将先进的机器学习与区块链的信任执行相结合,自动化完成复杂的 DeFi 和 Web3 任务。

– 现实应用涵盖自动套利、动态收益优化、钱包管理、互动式 AI NFT以及持续的安全监控。

–AI 主题的模因币浪潮正在推动“智能代理化”金融的认知,将炒作和真正的链上智能融合。

– 领先协议——Virtuals、ChainGPT、Capx、各类 AgentFi 框架,以及 Fetch.ai/SingularityNET 合并——正在竞速定义自主金融的未来。

过去十年,DeFi 已从手动仪表盘和电子表格,进化到如今的自动化面板——却依旧离不开人工监控。现在,一个全新范式正悄然崛起:DeFAI,让链上 AI 代理宛如“自动驾驶”交易台,自主学习、快速适应,并在无人干预下完成交易。试想,一个 AI 实时盯盘、自动调仓、复投奖励,甚至在社区里与人互动——你只需安心睡觉即可。

欢迎来到自主金融的时代:在这里,人工智能与 Web3 的信任基础设施携手,打造出全新一代 DeFi 产品。

目录

加密 AI 代理是什么?

加密 AI 代理是一类自治软件,它们借助大型语言模型和机器学习技术,与区块链网络互动,却无需持续人工干预。不同于只能按照预设规则运行的简单交易机器人,这些 AI 代理会从市场行为中学习,解析链上数据,并随着时间不断优化策略。它们通常采用“监督-协作”架构:一个主代理负责协调,分配不同子代理各司其职——有的盯盘监测行情,有的抓取新闻动态,还有的专注于资产组合再平衡。

要让代理安全地操作链上钱包,必须有可靠的私钥管理机制。很多方案借助多方计算(MPC)或安全保险库,将私钥分散存储、分层保护。当代理决定交易、质押或与协议交互时,它会通过这些安全通道签名并提交交易,绝不把原始私钥暴露给单点。正是这种自适应 AI 与去信任化执行的结合,才让真正的“免手动” DeFi 成为可能。

Image Credit: CoinGecko

核心架构与工具链

在每个加密 AI 代理的核心,都有一个主代理在调度若干功能各异的子代理。举例来说,一个子代理不断通过链上预言机抓取实时行情数据;另一个则在社交媒体和新闻源里寻找市场情绪信号;还有一个只盯着流动性池的 TVL 波动或无常损失风险。

这些代理的决策基础,来自链上智能合约、链下 API 以及诸如 Chainlink 之类的去中心化预言机,确保数据既精准又及时。执行层面,代理会将交易打包,以减少 gas 成本,并通过 MPC 多签钱包进行操作签名。代理还能自动管理 nonce、估算 Gas、重试失败交易,保证在波动剧烈时也能稳健运行。如此分层且模块化的设计,既方便后续升级,也为构建下一代自主金融工具留足扩展空间。

DeFAI 核心应用场景

自动化交易与套利

加密 AI 代理能够迅速识别不同交易所和链上的价格差,然后执行跨链交换或闪电贷以赚取利润。比如ChainGPT(CGPT)就展示了能够实时分析订单簿并执行套利策略的代理,而 Arbitrum 上的 Capx 则让用户定制 token 化 AI 机器人,实现个性化交易目标。

流动性与收益优化

在 Yearn Finance 等协议中,AI 算法会动态调整流动性池持仓,追逐最高 APY。代理实时监控池子组成、TVL 变化和奖励发放速度,持续重新分配资产,以最高效率获取收益,几乎无需手动干预。

自主钱包管理

除了优化收益,代理还可自动化日常链上操作:定时换仓、复投质押奖励、执行订阅支付等。依托安全的 MPC 保险库,它们掌控钱包托管与交易签名,解放用户于繁琐的 DeFi 事务。

数字助理与社区互动

互动式 AI NFT——如Virtuals Protocol(VIRTUAL)的 Luna——会记住用户历史互动,在社交平台上提供个性化回应。Goatseus Maximus 的“真相终端”则能与持币人对话,引导社区治理和内容方向。

安全与风险监测

AI 驱动的扫描工具(如 CertiK 的机器学习引擎)会持续审计智能合约和链上行为,实时标记漏洞或异常交易,为去中心化生态提供自动化安全护盾。

Image Credit: SoluLab

AI 模因币现象

模因币热潮正在升级:新一代代币将机器学习故事融入核心。Turbo(TURBO)自称“首个由 AI 创造的模因币”,其创始人曾挑战 GPT-4 撰写白皮书、路线图和治理模型,最终产出一个免手续费、链上治理和去中心化金库的绿色小青蛙代币。

Goatseus Maximus(GOAT)更进一步,内置 AI “真相终端”,与持币人对话,并影响项目策略,既好玩又实用。

在 BNB Chain 上,Sleepless AI(AI)构建了一个 AI 驱动的恋爱模拟元宇宙,虚拟伙伴通过 AI 进化并可用代币升级。

与此同时,CryptoGPT($PT)将自己定位为“生成式预测交易员”的燃料,利用图表模式和情绪分析预测市场走势。

连经典的 Doge 都有了 AI 版本——AIDOGE在 Coinbase Base 上提供预测小游戏和聊天功能,而不只是传统交易工具。

虽然大多数 AI 模因币仍具投机性质,但它们强大的营销效应已让更广泛的人群接触并了解“链上数字代理”的概念。这些带有炒作与前瞻性功能的代币,正在成为普通用户探索和体验自主金融的入口。

Image Credit:AI Memecoins Ranking (CoinMarketCap)

竞争格局:主要项目与协议

Virtuals Protocol

上线于以太坊和 Base,Virtuals Protocol(VIRTUAL)让创作者铸造“共创”AI 角色 NFT。每个“数字工人”不仅能玩游戏、生成内容,还能赚取奖励——目前已有超 1.6 万个代理在 Base 上活跃,并计划扩展到 Solana。

ChainGPT 的 AIVM

ChainGPT(CGPT)正在打造一个链上 AI 虚拟机,配备去中心化的 GPU 市场和推理引擎。开发者可在其网络上原生部署交易机器人、风险扫描器和投资组合管理工具,并通过 Chainlink CCIP 获取跨链数据支持。

Capx(Arbitrum L2)

作为一个“AI 创造者经济体”,Capx 让用户在专用 L2 上创建、拥有并交易 token 化 AI 代理。其无缝体验解决了多代币钱包碎片化问题,让部署代理就像铸造一个 NFT 一样简单。

AgentFi 框架

SelfChain 和 AgentLocker 等平台提供完整的 AgentFi 工具包——通过 MPC 实现自治钱包、接入跨链流动性,以及基于大型语言模型的策略模块。用户可以创建自定义机器人,并在二级市场上自由交易。

Fetch.ai 与 SingularityNET 合并(ASI 联盟)

2025 年 4 月,Fetch.ai(FET)与 SingularityNET(AGIX)合并成立人工通用智能联盟(ASI),将 $FET 和 $AGIX 整合为 $ASI。该联盟旨在将自治经济代理与全球数据变现网络融合,加速去中心化 AI 基础设施的发展。

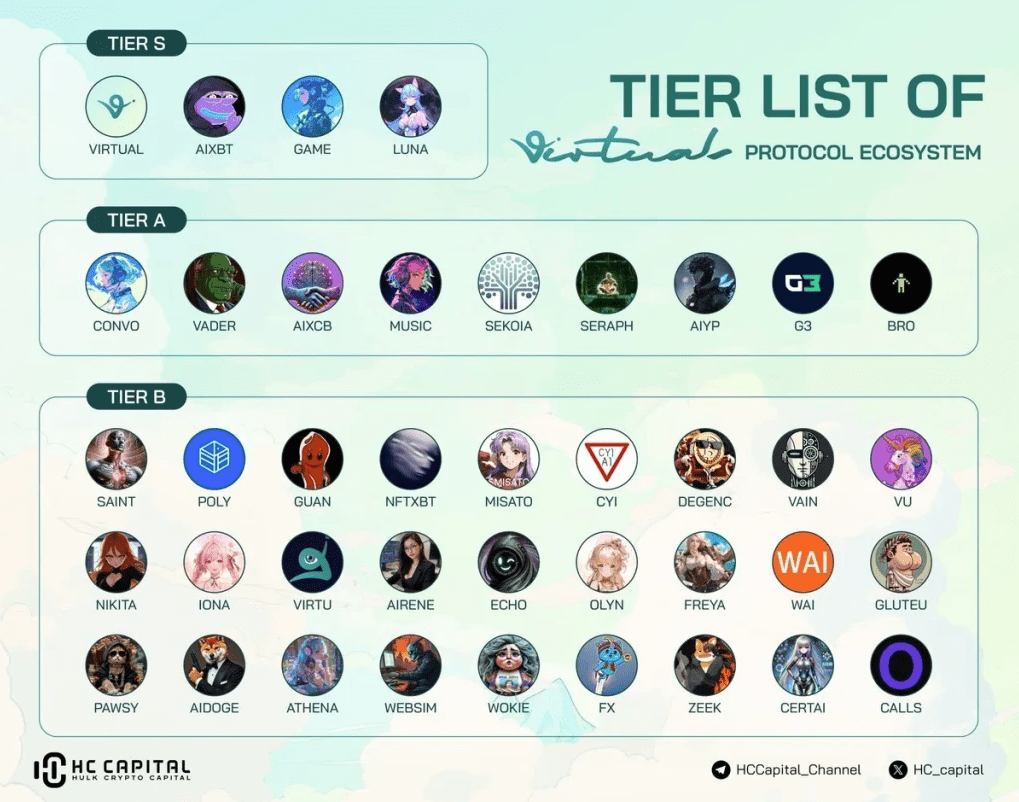

Image Credit: HC Capital

DeFAI vs. AgentFi:术语与范围

DeFAI是对任何由 AI 增强的 DeFi 服务的统称——从聊天机器人、智能路由、预测分析到自动化金库,都属于它的覆盖范围,是 AI 驱动金融产品的市场伞。相对而言,AgentFi更强调完全自治的链上代理,它们掌管真实资产并拥有决策权。

在实际应用中,DeFAI 平台可能用 AI 推荐最优 DEX 路由或预测收益,但交易仍需用户发起。而 AgentFi 系统则将资产托管给 AI 机器人,通过 MPC 钱包让它们自动质押、兑换或在 DAO 中投票。DeFAI 覆盖更广泛的 AI 集成场景,AgentFi 则专注于“自动驾驶”金融——让代理成为数字化基金经理,免去用户持续干预。当协议同时提供 AI 智能洞察和全自动执行时,这两者的边界会重叠,但核心差别在于资产托管权与自治程度。

Image Credit: Yarnmp3

实际价值体现

– 免手动收益农场:DeFAI 代理持续锁定最高 APY,自动在不同池子间调仓,用户无需每日盯盘即可享受最优回报。

– 自主化资产组合管理:AgentFi 机器人根据预设风险偏好或实时信号自动再平衡持仓并领取奖励,让多步骤策略一键搞定。

– 更快的事件驱动交易:AI 代理全天候监控链上订单簿和社交情绪,毫秒级执行交易,远超人工下单速度。

– 降低费用与摩擦:在低成本 rollup 和高 TPS 链上运行,大幅削减 Gas 支出,使微套利和自动化做市更具经济可行性。

– 个性化智能指引:AI 仪表盘与自然语言界面将“用 100 美元 USDC 获取最佳收益”这样的意图,精准转换为链上最优交易,让新手也能轻松上手。

– 自动化社区运营:代理可自动空投代币、分发奖励、管理 DAO 讨论,开发者得以把精力投入到产品创新和治理上。

风险、挑战与安全考量

自主代理虽然带来高效便捷,但也增加了新的攻击面。智能合约漏洞若被代理逻辑调用,可能遭人利用,因此持续的 AI 驱动审计(如 CertiK)必不可少。自主钱包的监管框架尚不明朗,合规风险待解。此外,过度依赖机器学习模型可能引发对抗性攻击:不法分子或通过投毒数据、伪造预言机信息,诱导代理做出错误决策。要化解这些风险,就必须构建多层防御——安全的 MPC 私钥存储、多签应急机制、严格的模型验证,以及透明的治理流程。

Image Credit: XenonStack

未来展望

随着协议不断成熟和用户采用率加速,DeFAI 市场规模预计将从目前的 100–150 亿美元,增长到 2026 年超过 500 亿美元。届时,我们将迎来真正去中心化且自我优化的生态系统:AI 代理不仅能执行交易和收益农场,还会参与 DAO 治理、内容创作和个性化理财规划。跨链可组合性也会更深入,让代理在以太坊、Solana 和新兴 L2 之间自由切换,追寻最佳 alpha 收益。

最终,智能自主金融的愿景将彻底改变我们与链上资产的互动方式——用户专注于战略目标,执行交给 AI 代理来完成。

关于加密 AI 代理(DeFAI、AgentFi)的常见问答

AI 代理与传统交易机器人有何不同?

AI 代理通过机器学习模型不断学习和优化,并将任务分派给各专职子代理,且通过安全的 MPC 钱包托管资产;传统机器人则只能按预设规则死板运行。

我可以放心把真金白银交给加密 AI 代理吗?

在具备完善的安全措施(MPC 密钥管理、多签控制、持续 AI 审计和透明治理)的前提下,AI 代理与任何 DeFi 智能合约一样安全,但依旧需警惕潜在风险。

代理执行交易的 gas 费用大概是多少?

不同网络费用不同:以太坊主网依旧偏高,Arbitrum、Base、Optimism 等 rollup 以及 Solana 则能实现几美分甚至毫秒级结算,非常适合批量操作。

我能自定义 AI 代理的策略吗?

当然可以。很多框架(如 AgentLocker、Capx)都提供可视化仪表盘,让你调整风险参数、收益目标或指定可用协议,一键部署。

监管机构会允许完全自治的钱包吗?

目前监管政策仍在演进中。KYC/AML 要求可能适用于托管型方案,而去中心化的 MPC 钱包则提出了新的合规挑战,各地监管部门正积极研究应对。

如何开始使用 DeFAI/AgentFi?

建议先在低费率网络上开一个小额测试钱包,体验Virtuals Protocol、ChainGPT等界面与功能,然后随着信心增长,逐步提高资产配置并探索更多策略。

关于XT.COM

成立于2018年,XT.COM目前注册用户超过780万,月活跃超过100万人,生态内的用户流量超过4000万人。我们是一个支持800+优质币种,1000+个交易对的综合性交易平台。XT.COM加密货币交易平台支持现货交易,杠杆交易,合约交易等丰富的交易品种。XT.COM同时也拥有一个安全可靠的NFT交易平台。我们致力于为用户提供最安全、最高效、最专业的数字资产投资服务。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。