宏观解读:美国参议院昨日以66:32的跨党派投票结果通过《GENIUS法案》程序性表决,接下来将在参议院进入辩论和修正环节,这一事件或将成为加密市场发展的分水岭。法案首次为稳定币建立联邦监管框架,市场分析将其重要性置于比特币现货ETF获批之上,认为这标志着"华尔街与加密行业的联姻"。值得关注的是,16名民主党议员跨越党派藩篱的支持,折射出美国政界对加密资产战略价值的重新评估。监管框架的确立不仅为机构资金入场扫清障碍,更可能引发以太坊、Solana等主流公链及Uniswap、Aave等DeFi协议的估值重构——相较于比特币这类"数字黄金"资产,合规明确性对应用层项目的价值释放更具催化作用。

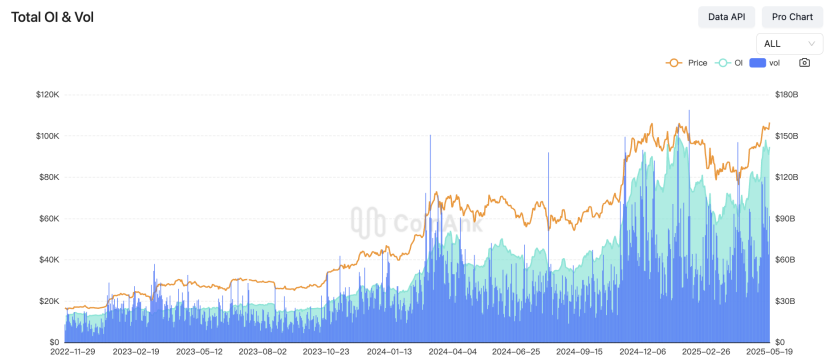

市场结构层面正经历深刻转型。监测数据显示,比特币未平仓合约达720亿美元历史峰值,但永续合约资金费率仍接近零值,显示本轮上涨主要由现货买盘驱动。这种"低杠杆化"特征与2021年周期形成鲜明对比,意味着市场基础更为健康。链上数据佐证了这种转变:统计显示当前99%的比特币持有者处于浮盈状态,但UTXO盈亏比30日移动平均线突破200阈值,暗示市场已消耗大部分"轻松上涨"动能。后续突破需要更强劲的资本流入或重大基本面刺激,单纯依靠存量资金博弈难以维持陡峭上涨曲线。

机构行为成为影响短期走势的关键变量。比特币在冲击11万美元关口时遭遇阻力,Strategy与Metaplanet等上市公司的持续买入构成当前价格核心支撑。日本企业Metaplanet作为亚洲市场风向标,其股价月内158%的涨幅与持续增持比特币形成共振效应。值得警惕的是,这类机构可能扮演"边际买家"角色——当它们的资产负债表配置接近饱和时,市场或面临流动性真空。纳斯达克上市公司Kindly MD与比特币原生企业Nakamoto Holdings的合并案例,则揭示出传统行业通过资本运作切入加密赛道的创新路径,这种"变相ETF"模式可能催生更多跨市场套利机会。

宏观经济层面呈现复杂博弈格局。美联储官员戴利"政策处于良好状态"的表态,暂时平息了市场对激进加息的担忧,但美国经济滞胀风险与地缘政治冲突仍在推高避险需求。特朗普推动的减税法案遇阻事件,暴露出美国财政政策的不确定性,这种宏观波动性客观上强化了比特币的避险叙事。从资本流动角度看,10年期美债收益率攀升至4.5%高位背景下,比特币仍能保持价格韧性,证实了其逐渐脱离风险资产阵营、向独立资产类别演进的市场认知。

展望后市,监管突破带来的制度红利与机构配置需求形成长期利好,但技术指标显示的短期超买压力不容忽视。对于普通投资者而言,需重点关注两个维度:其一是《GENIUS法案》最终版本对稳定币发行储备、跨链交易等条款的具体规定,这些细节将决定DeFi生态的合规化空间;其二是上市公司财报披露的比特币持仓变化,微观层面的机构操作策略可能成为价格波动的放大器。历史经验表明,当市场完成从投机驱动向价值存储的功能转换时,往往伴随剧烈波动与认知重构——比特币能否突破周期魔咒,或许取决于其在这场博弈中展现出的抗脆弱性。

BTC数据分析:

CoinAnk数据显示,2025年5月21日,比特币合约持仓规模攀升至720亿美元的历史性高位,但永续合约资金费率仍维持接近中性水平,显示多空博弈趋于平衡。当前市场中近99%的比特币地址处于盈利状态,但UTXO盈亏比指标的30日移动均线突破200临界值,表明市场已消化前期快速上涨的推动力,进入动能转换阶段。

从市场结构来看,期货未平仓量的激增往往与价格波动性放大相关联,历史数据显示当该指标突破前高时,常伴随大规模清算风险。尽管当前机构参与度持续提升(如CME占比超30%),且现货ETF资金流入支撑市场信心,但永续合约资金费率未能同步走强,暗示杠杆投机热度有所收敛。值得注意的是,UTXO盈亏比突破阈值与2024年牛市周期中的预警信号相似,反映短期获利盘积累可能触发抛压。综合而言,市场或进入震荡整理阶段,需警惕高持仓量下的双向剧烈波动,但中长期看,机构资本流入与减半周期的供需关系仍为比特币提供基本面支撑。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。