尽管比特币(BTC)可以全天候交易,但其蜡烛图每天开盘和收盘,类似于外汇市场。来自TradingView的最新数据显示,周二的蜡烛图在协调世界时(UTC)结束时的价格为106,830美元,创下了历史最高的日收盘价。

这一看涨走势出现在投资者涌入现货交易所交易基金(ETF)之际,债券市场的混乱价格走势表明对包括美国在内的主要经济体的财政健康的担忧加剧。

分析师上周告诉CoinDesk,恶化的财政债务状况可能对BTC和黄金等其他资产有利。

Coinbase比特币溢价指数测量Coinbase Pro(美元对)和Binance(USDT交易对)上比特币价格之间的百分比差异,保持正值,表明美国投资者持续存在买入压力。

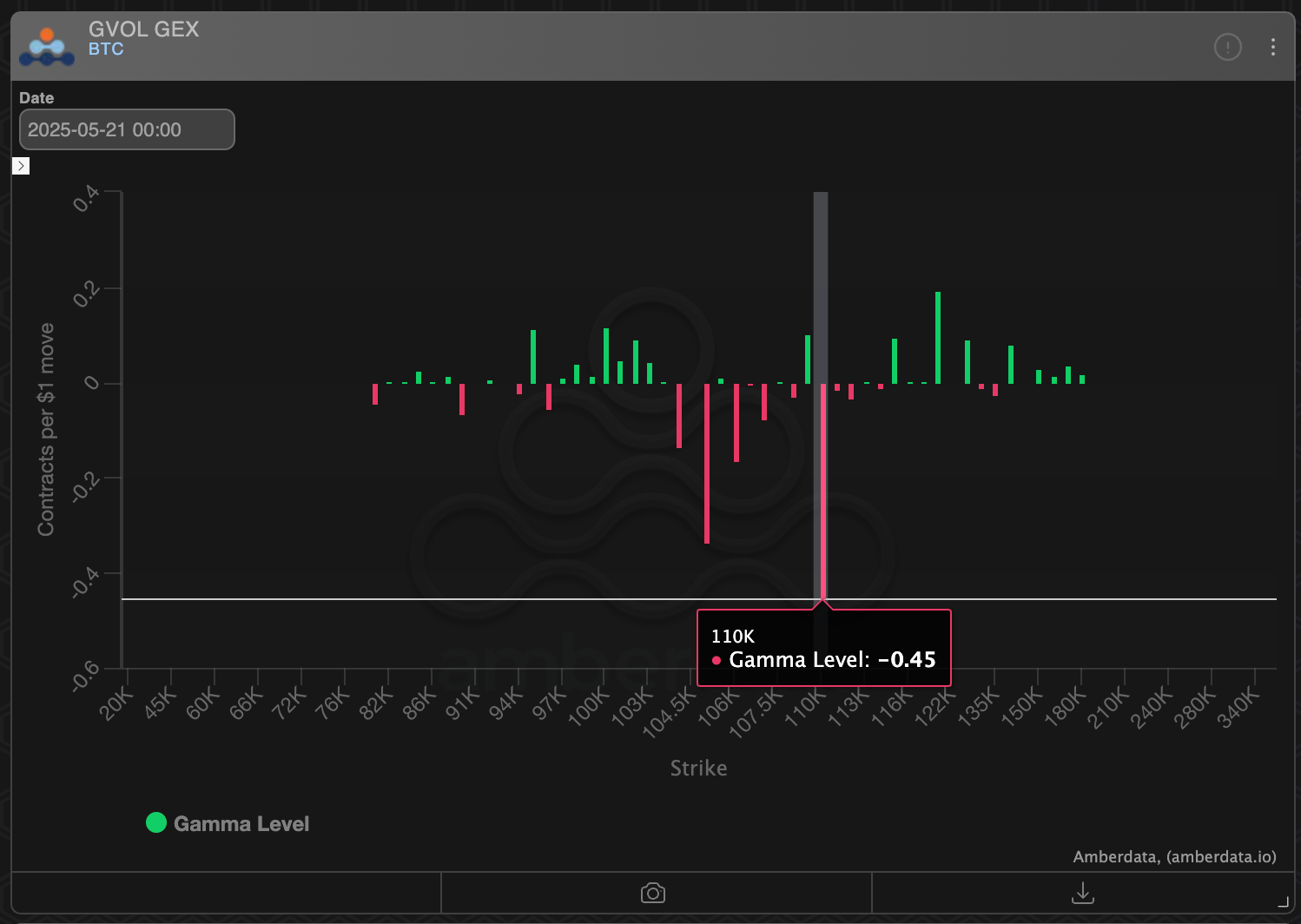

随着上涨趋势的进行,下一关键关注点是110,000美元。来自Deribit的BTC期权市场的数据,由Amberdata跟踪,显示交易商或做市商在110,000美元水平持有大量净"负伽马"敞口。

持有负伽马的交易商通常会在市场方向上进行交易/对冲,以保持其整体市场敞口的德尔塔中性。这反过来又放大了看跌和看涨的走势。

换句话说,若突破110,000美元的潜在突破,反弹可能会加速。过去五年中,期权市场显著增长,交易商对冲增加了波动性的情况屡见不鲜。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。